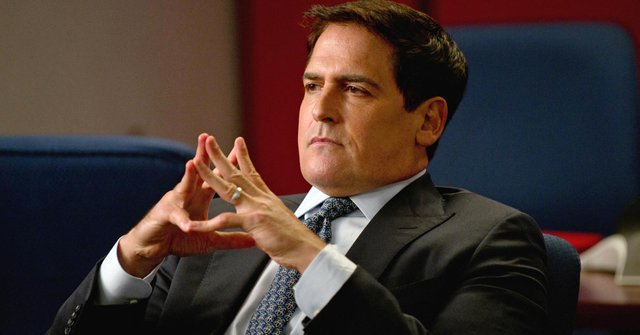

Why Billionaire Mark Cuban Says Saving Money Is A Bad Idea

Why Billionaire Mark Cuban Says Saving Money Is A Bad Idea

I was watching a video interview on youtube yesterday, with Tai Lopez and Mark Cuban. Mark Cuban is one of my heroes. We both live in the same part of Dallas as well. I hope one day I run into him, and get a chance to CLOSE him. Anyways, during the interview Mark said “The best time to invest in yourself is when you’re young and have nothing to lose”

Cuban went on to talk about how saving money is not the best use of money. He quickly spoke about low bank return rates, risk and exposure in the stock market, as well as how easy it is to lose a 401k. With energy prices on the downward slope, you can expect more and more people starting to lose big in the stock market.

Mark gave a quick economical plan for anyone looking to break away from the 9 to 5 and live life on their own terms. He said “save 6 months worth of living expenses” but really that’s all you need. I couldn’t agree with him more. There’s no need to save all your money.

Matter of fact, saving money is a bad idea.

Yeah, I said it, and I’m well aware it’s contrary to everything you’ve been told by the scarcity minded people you’ve been surrounded with your entire life. You know, the friends and family members with stable jobs and a fixed income. The people who’ve never even attempted to do what you want to do.

Saving money is not the best use of your money. Case in point, when you hear Forbes or whatever, talk about the richest people on the planet, they don’t base it on how much cash they have in their personal account. They base it on the amount of assets, cash flow and profit each person has. Cash saved is useless, cash invested is priceless.

Money has to move in order to make more money.

The best time to take a risk is when you are young and you have nothing to lose. #entrepreneur

One of the biggest problems people with money have, is finding a solid place to put their money to work for them. If you have cash sitting around, it’s not making you much of a return. Smart people know that you have to invest in order to keep growing. Money grows stale just sitting around.

Most of us don’t have time to learn the stock market, how real estate works or how to invest in privately funded deals. Investing could turn out to be a whole new time suck in our life, it’s easier just to give our cash to the bank or let some 401k manager take it out of our checks. Not me, I don’t trust them!

I learned early on to invest in what I know. When I was young I invested in guns and drugs. When I got into mortgages I invested into real estate (still do) and now that I run an online business I invest in online programs. Every time that I’ve entered an industry, job or market, I’ve found a way to invest in myself.

Saved money goes stale

I was listening to the 12 Month Millionaire Program by Russell Brunson and he had this guy Vincent, on there. Vincent made over $100MM in cash during 2002, selling dick pills in direct mail. You know, the little ads in the back of nudie and muscle magazines that offer male enhancement.

So this Vincent guy, great interview by the way, gets in this jam and the state prosecution office seizes $48 million in cash. Yes, $48 million. It was pretty much all in his personal name. He hadn’t invested any of it into anything other than advertising. He admitted on the interview that he had no idea how to plan for protection against lawsuit, taxes or ultimately the Federal government.

Obviously this is an extreme case, and Vincent and Mark Cuban both have more money than you and I, but it’s a reality check of what happens with saved cash. It really does you no good to save up a lot of cash. If you’re an entrepreneur like me, you’ll get lazy if you save up too much money. Most of us have to stay hungry in order to keep on the hunt.

Invest in what you know

As I was saying earlier, I’ve always invested in what I know. More times that not, it was an investment in myself. Still, to this day, I invest in knowledge, then take action to get a return based on my efforts and results. When I buy real estate, I know I can sell it. When I invest in a program or software, I know I can do the work to get my money back. Then I take that money and make more money with it.

I’ve been flipping my cash for years. It drives my book keepers and CPAs crazy, but my lawyer likes the paperwork! Every time I pull my cash out of one deal, I’ve already got another deal lined up. I keep 12 months of reserves in my account at all times. I have ZERO credit card debt and I’m fluid. Meaning I can move in and out of any investment with ease.

When I was in federal prison, I met a guy who wanted to sell cars when he got out. The guy worked for a leasing place and worked up to desk manager. He bought the lease trades for cash off the dealer or sometimes the client beforehand. After a period of 2 years he had his own lot and 30 tote the note cars out at all times. He flips cars the same way he used to flip keys.

Saving money is lazy

It’s easy to put back 10 – 20% of your income each month. It’s not easy to invest 10 – 20% of your income and have to do some sort of work to get it back, in hopes of gaining interest. Saving money takes sacrifice but no effort. Investing money takes knowledge, and constant searching for opportunities.

Hardcore Closer @hardcorecloser