An in depth analysis of the economics within cryptocurrencies: Cryptocurrency vs Precious metals.

There aren't that many people that particularly fancies the idea of cryptocurrencies - let alone embrace it as a huge advancement in our technology.

But I think otherwise. I'm going to challenge the common misconception that fiat currency(invested in a bank or government bonds) is a safe haven, as well as the notion that precious metals, i.e. gold and silver are the only safe assets that you can invest yourself into, as well as the misconception that precious metals would serve as the most efficient monetary unit of account.

Functions of good money - cryptocurrency compared to others.

| Function | Fiat currency(e.g. USD) | Precious metals(Commodity money) | Cryptocurrencies |

|---|---|---|---|

| Portable | Yes | Not really | Yes |

| Durable | Yes | Not really | Yes |

| Divisible | Yes | Not really | Yes |

| Fungible | Yes | Not really | Yes |

| Long term store of value | No | Yes | Yes |

| Decentralized | No | Yes | Yes |

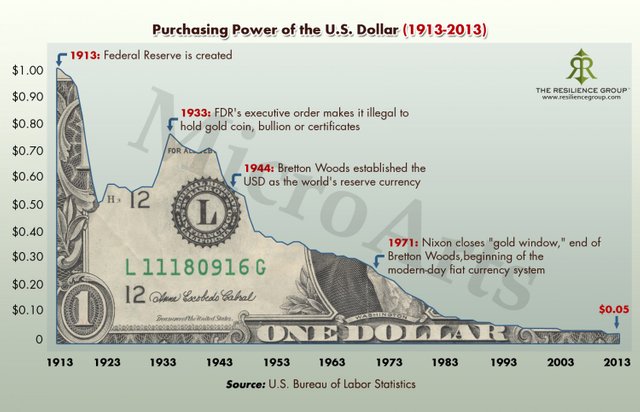

As you can see, fiat currency fulfills everything but the most important function - store of value. The dollar simply does not retain its value, because it is created solely by one single entity, the Fed. I'm going to compare cryptocurrencies to precious metals because fiat currencies are obviously not "money", rather "currency".

With precious metals, or commodity money however, you start to see something a bit more interesting. Technically, they are fungible, durable, portable, and divisible. So why am I saying "Not really"?

1. Divisibility

If you were conducting business with someone, and you decide to pay him in gold, say for $1 USD. That's 1/50 gram of gold. Is that really possible? Is there any way that you can divide your ounce bar into 1/50 gram pieces? Not really.

However, with cryptocurrencies they can carry as much decimal places as the community fancies.

2. Fungibility

Furthermore, are pieces of gold or silver really interchangeable/fungible? Not really, because the purity of each piece varies, as well as the weight. Is it really practical to weigh each gold piece by hand, when you are dealing thousands of them?

If you were dealing with someone with 10 million dollars, all in gold, if the purity of the gold was 0.9996 instead of 0.9999, that would be a $4,000 loss for you. And that difference can't be examined easily, even if you do examine it, you would be paying hefty amounts of fees.

With cryptocurrencies, each unit is worth the exact same as another unit. There is no such thing as purity, and thus making it way easier to transact on a day to day basis.

3. Portability

How hard would it be to carry 10 million dollars of gold, let alone silver? Just hiring arm guarded vans will cost you a fortune. So there is really little portability in the transport of mass amounts of precious metals. But with cryptocurrencies, you can literally carry a USB stick, or even remember a passphrase to own the cryptocurrency. And with a globalizing world, I believe that cryptocurrencies will be the future. Like who goes to the bank to transfer their dollars now? We all do it online. But cryptocurrencies make that process smoother.

4. Durability

Gold and silver is easily sweated off coins. And especially after years of circulation, a coin can lose as much as 5-10% of its precious metal content, and still being accepted. But with cryptocurrencies, there is no problem with durability.

5. Store of value and decentralization

What gives money value is how well it can achieve its function. Its intrinsic value is simply how well it can serve as money. Take for example, gold. Gold has value although it has no real industrial uses(less than 10% is used in industry). Cryptocurrencies can't be used in anything - but is a perfect method of payment, and therefore has intrinsic value.

Obviously, fiat currencies do not qualify as a store of value, as the Federal Reserve abuses its power to create currency as much as they would like to. I believe that only a decentralized, independent medium of exchange can be considered a good store of value. Gold is decentralized, and no one can just "print" gold. Also most cryptocurrencies have a disinflationary model, which makes it a great investment.

I guess we can call cryptocurrencies the "digital gold". It has all the functions of precious metals as a currency, but better.

Which cryptocurrency is going to reign?

There are three main contenders in my opinion: Bitcoin, Bitshares and Steem.

Bitcoin however, has scalability issues. The community is divided over this. Steem can pretty much achieve what Bitshares can achieve, except that it has more uses and functions. However, Bitshares offer a range of Smart Assets, while Steem only offers Steemdollars.

Obviously, this can be changed. Steem might issue silver ounces, or gold ounces, to incorporate people's trust in gold and silver with the convenience of cryptocurrencies.

It really depends on which cryptocurrency can market itself to the general public before the others, and make their GUI understandable to the average Joe. Steem is the closest so far.

Conclusion

Overall, cryptocurrencies are a more convenient and practical way of making business. It also provides a good store of value, because of its decentralized economic model.

I don't hate precious metals. I used to be and still am a silver investor, just to a lesser degree now though. I hate fiat currency, which is why I embrace decentralized payment systems, whether it is physical gold or silver, or cryptocurrencies.

I agree with Mike Maloney(search him up on youtube, he's got some great vids) and a lot of his points. I believe that blindly investing in any asset that is apparently a safe haven, such as silver and gold, is outright stupidity. Although Mike Maloney invests a large percentage of his portfolio into precious metals, he is only doing so because it is a good time to do so.

In fact gold in the long term, if you bought at the wrong time gave you negative returns in terms of purchasing power, instead of giving you interest. In fact, you would have to incur a loss on your investment, if you purchased gold in 1560 and sold it in 1960. 400 years and a loss on your investment - you probably are a bit baffled, since you could have gotten so much more in interest alone!

Timing of an investment is just as important as the choice of investment - or even more so. Right now, it's the perfect opportunity to get into cryptocurrencies. Adoption rates, although rising, has not yet boomed. The value of Steem, although stable at less than 2 dollars, is a steal at this price.

Buy the rumor, sell the news. Right now, 99/100 people have no clue what cryptocurrencies are. In 5 years, I believe that figure is going to be reduce to 50/100. And that would mean 50x more people using cryptocurrencies, 50x more cryptocurrency market caps and 50x more cryptocurrency value.

I hope I have convinced you with my points that cryptocurrencies are the future of money. And I do hope that you are holding some Steempower yourself - just for what the future might hold for all of us.

Steem will definitely become a serious competitor to Bitcoin. We are 5th and the coins above us are a joke. Ethereum can't offer basic security, and Ripple is too centralized. We can easily outpace them.

Good post

Cryptocurrency future of money and that future starts today :)

Nice article. No reason one can't invest in both gold/silver and cryptocurrencies. Both have their merits. Gold and silver, afterall, have been around 5000 years. And it's not really about the fiat price of gold. Gold holds its purchasing power. It's insurance against our central bankers.

As an economist, I don't understand your relation between cryptos and metals. Gold and bitcoin have been negatively correlated the last 12 months. It is a weak negative correlation, not strong. But still a negative one.

Good summary. Cryptocurrency does have all the advantages of fiat plus the important advantage of being produced by fixed rules rather than by a "discretionary system." It's taking some time to catch on, but it has caught on. The next step is mainstreaming.

I would like to see BitShares as more and more developing specialized financial centre/bank (mighty financial instrument) as it was intended from the very begining and Steem as a social net with wide and inovative ways of use and maybe distributed market like https://steemit.com/steemit/@highlite/steemswap-like-craigslist-for-steem(which is still needed)using both SMD and Bitshares Smartcoins.

Remember mobile wallet exists for Smartcoins https://steemit.com/crypto-news/@kencode/ann-smartcoins-wallet-v1-0-5-released-multiple-currencies-loyalty-points-3sec-transactions-44-languages-overdraft-protection

IMO it would be undesirable if Steem someway kills BitShares despite the fact that multiple of users writes, makes photos or videos more likely than trading bonds or currencies.