You are viewing a single comment's thread from:

RE: Proposal of how to stabilize SBD

It sounds good except for one small issue...what happens when the price of the collateral goes down so much that there isn't enough to cover the value of the pegged asset?

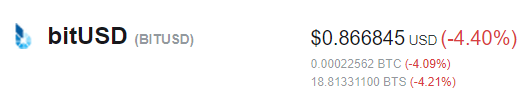

This actually happened recently with BitUSD on Bitshares (which has a similar mechanism). There the outstanding BitUSD loans were liquidated and the asset no longer held the peg.

SBD already has a similar way of handeling this (the "haircut rule").

The smart contract that underpins the Dai token hasn't been tested by the market the same way that BitUSD or SBD have. I am not so sure that with the current market conditions of STEEM it would make much of a difference.

I concur with this.

But how is it that DAI managed to stay stable even after a 90% drop on the price of steem and bitUSD couldn't? what is the difference? Is it just the amount of staking people did? Or are there deeper issues?

Maker apparently has some more feautures that shields Dai:

https://www.reddit.com/r/MakerDAO/comments/7ldc0g/dai_versus_bitusd/

https://www.reddit.com/r/MakerDAO/comments/8cqfl7/weakness_of_makerdaobitusd_mechanism/