How the Steem pyramid scheme really works

I'm intentionally not calling it a Ponzi. People would then cling to the conventional definition of a Ponzi scheme and come up with arguments like "but you can get rewarded without investing anything, so it's not a Ponzi". However, we'll get to that argument as well.

Current distribution of wealth

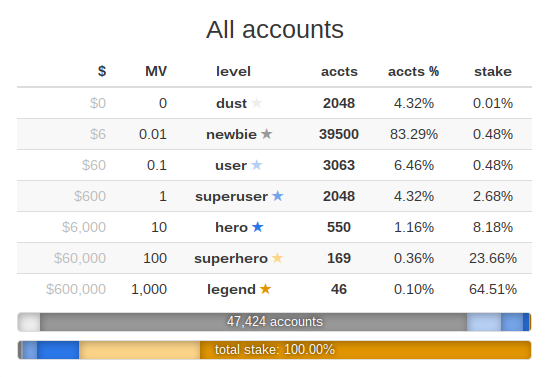

Out of over 47000 accounts, 46 accounts hold 64.51% of Steem Power. That's a very unequal distribution of wealth, but doesn't necessarily make it a scam in itself. Let's see what does.

Continuous generation of wealth

For every 1 unit of wealth generated as a reward (author, curation, witness, etc), 9 units of wealth are generated and distributed to Steem Power holders.

So while indeed, users do get rewarded without investing anything, for every dollar you see distributed on the website, 9 dollars are given to the already wealthy behind the scenes.

To help that sink in, let's divide the userbase between the top46 wealthy and the rest of users and see how much each group is rewarded with each generated token.

Of every token, 90% goes to Steem Power holders. The top46 users hold 64.51% of the Steem Power. So their share of each generated token is is 0.9*0.6451 = 0.58059, that is, over 58%.

Even if none of the curation, author, comment, witness, etc rewards were fed back to the top46 wealthy, they will still receive 58% of every generated token. In practice, it's obviously more, as they also receive a high portion of these mentioned rewards in addition to the 58% they get for doing nothing.

The coverup

10% of every generated token is divided between the rest of the users, mostly proportional to the...will of the "Steem rich". That's what you see in the interface as rewards. This is pretty much just a tiny bit of the newly generated tokens, distributed as a bait to lure more users into investing and cover up the true pyramid of Steem.

So while you could reason that 10% of the generated tokens is backed by the value of "community and content authoring" (if you accept that that a makeup tutorial has a market value of thousands of dollars), 90% of the generated wealth is backed by nothing but the money new investors are expected to bring in.

And bringing in new investors they try. Why do you think most author rewards go to influental people lately? People with serious follower bases on various social media platforms. Yes, you guessed it, to make them bring in more investors.

Summary

So, we've seen that very few people - devs and early birds - hold most of the "Steem wealth" (top of the pyramid).

We've estabilished that the top wealthy users receive most of the newly generated wealth without contributing any kind of value. In order to cash out these tokens, they must convince new users to invest in the platform.

The only difference to a pyramid scheme is, 10% of the generated tokens are distributed as a show to lure in new investors.

So my advice: If you want, try and take what you can of this 10% and cash out as soon as possible, but under no circumstances invest anything to enter the pyramid - it will collapse sooner than you think.

Normally I wouldn't take the time to refute such nonsense, but since others may be lead astray if I don't, I'll do it.

First, the issuance of new Steem by the blockchain is not a "continuous generation of wealth". Rather, it's a DILUTION of wealth. When a stock does a 2 for 1 stock split, no new wealth is created. Yes, there are twice as many shares than before in existence but, all else being equal, each share is worth half as much after the split. So, overall wealthy hasn't changed at all.

In the case of Steem, the split isn't 2 for 1, it's only 1.9 for one. The other .1 goes to reward authors, curators, miners, etc. In this way the system actually steals from the rich (who experience inflation of 10% per year) and gives to the...worthy.

The Steem token has use value independent of speculative demand. Each token confers its owner with influence within the Steem network. That influence is useful for the same reason that video game tokens or powers are useful. Because they are useful, they have value independent of speculation. Speculation can increase their value beyond the use component, but the same is true with any commodity and always has been.

I'm going to have to downvote this post, not because you express an unpopular opinion, but because it contains objectively false information that could mislead the less informed.

It's a continuous generation of tokens. But the steem/vests ratio is also continuously incremented. So SP holders will not experience the dilution/inflation from the generation of tokens, yet do not produce any value to back this increase of wealth. This is the 'generated wealth' that must be offset by getting an increasing number of investors on board, who actually pay for this without knowing it.

And this is the system behind 90% of the tokens. Yes, the other 10%, you could say is backed by the value of community and content creation. But that money is not magically generated either, it's also from the investors without them knowing.

So the bottom line is, steem promises profit to new investors, existing stake holders and to content creators. Who the hell would be paying for it if not new investors that arrive later to the party?

I can't even tell if you seriously believe what you're saying or just helping cover it up. But i guess the downvote to hide my post should be telling.

Two questions:

Needless to say, only those at the top profit (and some random users who managed to grab some of the 10% bait at no cost along the way).

Almost totally false... it's only indirect in the same way that people who watch TV aren't directly paying for the content they view. The upvote structure organically encourages what content is desired. If a whale likes content about gardening and upvotes it, you can damn well bet that within a weeks worth of time, we're going to have a lot of selfie photos of people planting their first tomatoes.

emphasis mine... it will not plummet. Were it not for the power up mechanism, I would agree with you. Since it exists and we can know at any point in time precisely how much steem will be powered down in little more than one weeks time, we can know what's coming. Accepting your premise, we're in a constant race condition to the bottom... unless there are new market entrants.

That doesn't happen overnight.

For the reasons above, I think this is a simplification at best.

Yeah, TV is an ok analogy I guess. It's indirect compared to directly purchasing a show on the creator's website. It's indirect compared to other ways of micropayment, be it direct donation to the author, flattr, patreon, whatever.

What's even worse is, investors are not informed upfront that, in fact, a portion of their investment is going to be donated to content creators, and they will only get that money back if more new investors join the platform.

About your second point, I agree, the pyramid may fall in slow motion. It largely depends on how those at the top of the pyramid decide to cash out - as they hold the vast majority of tokens. They may slowly sell over the years, or power down and accumulate the tokens for a while then suddenly dump to the market.

Either way, we're arguing time frames here - the mechanics stay the same.

Can't continue extending the thread so a followup to your last message:

So who do you propose act as the arbiter of when someone is 'well informed' enough to invest? Would you argue for a 'platform literacy test' before purchasing Steem from the platform?

Precisely my point. I contend that the vast majority have and will remain vested in the platform.

They must necessarily.

What would be the 'rational actor' mentality that defines behaving in this way? Why would you effectively strangle your golden goose after it lays enough eggs to 'cash out'?

We're arguing both time frames AND mechanics. I wholly disagree that your analysis calculates for the content creation variable OR the variable of 'more perfect information' available to know precisely how much liquid Steem could be sold at any point in time +7.01 days.

I definitely appreciate the dialogue... thank you for the civility.

Everyone should decide for themselves. But the information required to make a decision should be clear and accessible. Steem's mechanics are convoluted, the whitepaper is long and obfuscated and the only message they are pushing is along the lines of "everyone gets free money for everything", as if the platform was some magic money generating machine.

People are incentivized to lock down their investment for 2 years without being informed that they are actually paying earlier investors and content creators, and new investors with ever greater investments are required in the future if they ever want to see their money again. It only takes one sentence to provide this information, yet it is nowhere to be found.

It may even be so for a while. But eventually every investor will want to cash out their investment and their return on it, which must be covered by an increasing number of people lured into investing. But then again, the largest stake holders are powering down as we speak.

When they can't convince any more people to invest, the money stops flowing in and the market price starts going down. If at that point the top stake holders have enough accumulated liquid tokens, they might be better off dumping it all at once and let the market burn before the demand and price drop further.

If the top stake holders continue accumulating liquid tokens, that information will become increasingly meaningless. And even if they don't, that variable is only part of the story. In a scheme like this, in order to decide whether it's worth investing, you would have to know how much more money people are willing to invest in the next 2 years. Which in turn, among other things depends on how succesful steem is at marketing.

My point is, that information alone doesn't get you much.

To me, the mechanics and the outcome seem clear. The time frame I'm not sure about. But one thing is certain: the longer it goes on, the more people will lose their money to the ones at the top of the pyramid.

Power goes to those who invest

That includes code and the rest

Unlike conventional businesses with their shares

Steem provides investment to anyone who dares

You get this for doing nothing at all

Yet you get more for standing tall

Yet still there are those who complain

Unfairness they will seek to explain

They are getting something where there is usually nothing at all

And still they'll talk daily about how steem should fall

The graphs of the distribution look like a schism

Yet in reality they are just anti-socialism

If steemit is such a scheme

then surely you'd prefer facebook it would seem

For there traditional as it is

Zuckerman gives you none of what is his

Great job with the poem! I do not agree with the contents though :) Please allow me to respond in prose.

Sure, Steem provides investment opportunity in the form that is known as a pyramid scheme. If you invest early enough, the stake holders manage to get enough new investors on board and you cash out early enough, you may even make a profit.

Yeah, the chart depicts capitalism very well. That's exactly why I believe in communism, specifically anarcho-communism.

And no, facebook is not any better either (I'm not a user). It scams users out of their data, privacy and freedom while steem scams investors out of their money. Both are harmful and disgusting in their own way :/

Upvoting this because I think this discussion should be had openly and honestly, not because I agree. It is good to have this conversation even from just a devil's advocate point of view. If you're willing to respond to this post and refute it, that means it's made coherently enough that you think some people will be convinced, it is not something that should be buried.

Hey yo! What it be? Saw your twitlink

I hope stats needs to be fixed little more.

top 1 account holds 61% of steem.

top 2~top 46 accounts hold only 3% of steem.

So I think that top 1 and top 2~top 46 account needs to be thought separately.

That just makes things even worse... So ~55% of the generated tokens go directly to the founders at the top of the pyramid.

I took the chart as is from https://steemd.com/distribution , and it shocked me so much already that I didn't dig any deeper.

The bottomline here is that Steem price is supported only by traders/speculators and people investing into it. Creators and curators generate their own SP so they don't really need to power up (I would say power down is more logical).

Do these people have 10-20k in Facebook shares? I really like Steemit but this is an unproven platform in the world of crypto. Many things can and will go wrong. A lot of newcomers into this world are for a rude awakening (scammers are already running amok as usual in the crypto community for example).

This side of the story needs to be heard and it is shame that downvotes have been placed upon it (that may silence this view). I found out about this post from Tone Vays on Twitter: https://twitter.com/Tone_LLT/status/761975587451928576 I would like to hear more about the role Steem Dollars play into this and now that they are trading in the 80cents range if you think that is a sign of things coming apart. Thanks for taking the time to present this. My latest post is here (I mention some bearish aspects of Steem/Steemit):

https://steemit.com/steemit/@bitcoinmeister/a-bullish-bitcoin-sign-and-some-bearish-steem-thoughts

Disclaimer: I am just a bot trying to be helpful.

Congratulations @orly! You have received a personal award!

Click on the badge to view your own Board of Honor on SteemitBoard.

For more information about this award, click here

Congratulations @orly! You have received a personal award!

Click on the badge to view your Board of Honor.

Do not miss the last post from @steemitboard:

SteemitBoard World Cup Contest - Quarter Finals - Day 1

Participate in the SteemitBoard World Cup Contest!

Collect World Cup badges and win free SBD

Support the Gold Sponsors of the contest: @good-karma and @lukestokes

Congratulations @orly! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!