What is an NFT? What you MUST know about this?

While the cryptocurrency community remains fascinated by DeFi, our attention should not miss the growing popularity of NFT (non-fungible token). Some say that the NFT boom has just started, others that it will start in a moment. So if you are late for bitcoin, ethereum or DeFi - perhaps it is the NFT that is worth looking for your chance. We invite you to a short overview of the specifics of NFT and the platforms on which they can be traded.

What is "fungibility"?

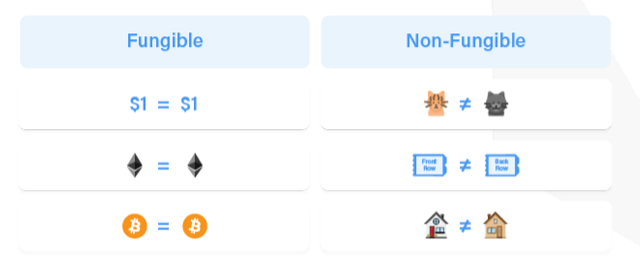

Before we delve into the intricacies of NFT, it's worth taking a look at the difference between "convertible" and "non-convertible". The basic feature of an "exchangeable" (exchangeable) item or token is that no matter what it is used for and what its goals are, it is possible to exchange one for another without the risk of losing specific identifying features. To put it simply - a "fresh" PLN 20 banknote taken from an ATM is worth exactly the same as the old, crumpled "twenty" that we have hidden in our home piggy bank. The same is with bitcoin. 1 BTC equals 1 BTC. For the sake of simplicity in the definition scheme, I omit the issue time and issues related to the effects of inflation here.

On the other hand, we have things that are non-interchangeable, that is, they are not interchangeable with each other because they have unique, distinguishing properties. It is thanks to these properties that they can radically differ from each other, despite the fact that they "look" similar.

Examples? There are indeed a lot of them. There are many examples of non-interchangeable items in the real world, such as images, concert tickets, and so on. While the two images may look alike, they may be - to put it mildly - an entirely different level of rarity. Likewise, front row tickets to a concert by a popular rock band are much more valuable than a back row ticket.

What is NFT?

NFT is an extremely powerful type of token that allows you to flexibly represent non-exchangeable assets on a blockchain. The main properties of non-exchangeable tokens are:

Uniqueness:

Non-exchangeable tokens contain information in their code that describes the properties of each token, which in turn distinguish one NFT from another. For example, a digital art work may contain encoded information (in single pixels), while tokenized in-game items may contain details that allow the game client to understand what item the player has (as well as their attributes).

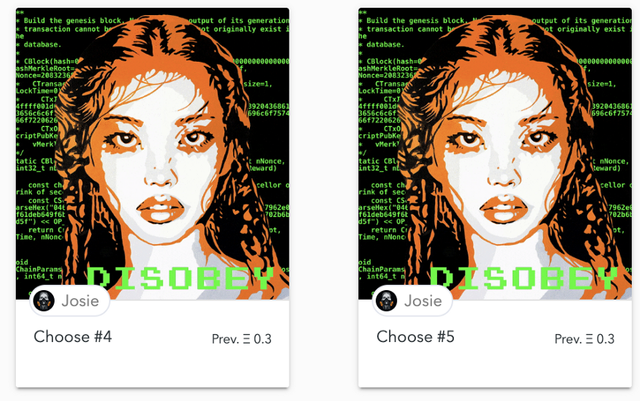

I can have two of the same digital art pieces, but each one will be completely unique. The example below shows two NFTs from crypto artist Josie. Her two songs, "Choose" # 4 and "Choose" # 5, may look the same but are completely unique to the blockchain:

Traceability

Each NFT has its own transaction record on the blockchain. We know exactly when it was created and when it changed hands. Thanks to this solution, each individual NFT can be easily identified in terms of authenticity. Fakes in this case are impossible. The basis for NFT verification is blockchain - a technology that in the NFT model becomes crucial for both creators and potential buyers.

Rarity

In order for non-exchangeable tokens to be attractive to buyers, they should be relatively rare. This feature ensures that the assets remain in demand

in the long run - supply will not exceed demand.

Indivisibility

NFTs generally cannot be traded as fractions of a whole. Just as you cannot buy half a concert ticket or sell half a trading card, non-redeemable tokens cannot be divided into smaller "denominations".

Programmability

Like all traditional digital assets and tokens on which smart contracts are based, NFTs are fully programmable. In other words, NFTs combine the best of decentralized blockchain technology with assets that are not interchangeable with each other. Unlike regular digital assets that are

issued and regulated by centralized entities, and which can be taken from us at any time, the ownership in the context of the NFT seems unquestionable and indisputable.

2018–2019 - the NFT explosion

2018 and 2019 saw tremendous growth in the NFT ecosystem. Currently, there are over 100 projects in this space, and even more are underway. NFT markets are booming, led by Sorare and SuperRare. Trading volumes are modest compared to the actual cryptocurrency market, albeit growing at a rapid pace. Deploying the NFT ecosystem just got easier as Web3 wallets like Metamask continue to improve. Dapper Labs also recently introduced the Dapper wallet that does not require gas payments. In addition, there are now websites such as nonfungible.com and nftcryptonews.com that delve into NFT market indicators, guides to key indicators as well as provide general information about the sector.

How NFT work or what is Ethereum Token Standard (ERC-20)

The Ethereum blockchain supports different technical standards for the different types of tokens on its network to allow individual interactions to function properly. "ERC" stands for "Ethereum Request for Comment". The most popular standard is ERC20, which has rules that allow tokens to interact with each other as expected. This standard framework is extremely helpful for developers when they create tokens that need to interact with other tokens or applications in Ethereum.

While ERC20 tokens work well for many functions in Ethereum, they are not the best for creating unique tokens. It was for this purpose that the ERC721 was invented. While similar in many ways to ERC20, ERC721 was specifically created as a technical standard for non-redeemable tokens in the Ethereum blockchain. The main difference between the two standards is that ERC721 tracks the ownership and movements of individual tokens within a block, which enables the chain to recognize non-exchangeable tokens. The first project to use the new NFT technical standard was CryptoKitties.

The most popular projects in NFT

Now that the brief historical outline is behind us, it is worth realizing the wide range of NFTs currently presented by this market. Here are the most interesting of them:

Collectables

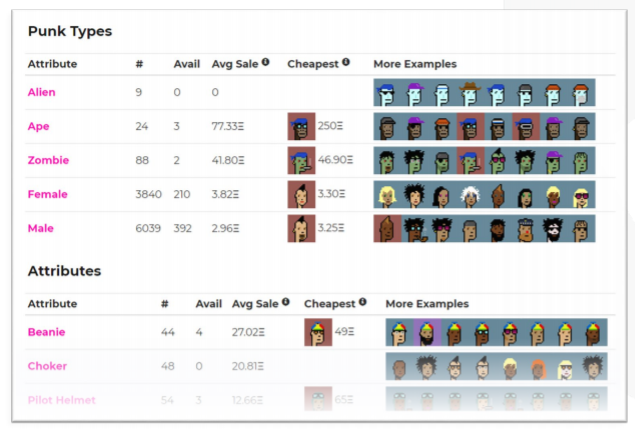

CryptoPunks: collectible characters that were algorithmically generated, created by Larva Labs.

Avastars: Users can create and collect avatars

Meme: farming tokens that can be used to claim Limited Edition collectible NFTs

Gaming

Axie Infinity: Collect, breed Axies and send them into battle

CryptoKitties: Buy, breed and collect unique digital cats

Sorare: a soccer game where users can collect, trade and issue player cards

Virtual world

Decentraland: Ethereum-based virtual world where users can trade virtual real estate

Cryptovoxels: Buy land in this virtual world, build shops, art galleries, organize events

Domains

Ethereum Name Service: register .eth domains

Unstoppable Domains: blockchain domain registration platform for your cryptocurrency wallets

Marketplaces

SuperRare: the digital art market

Rarible: the marketplace for digital collectibles.

OpenSea: P2P marketplace for all NFTs

DeFi

Aavegotchi: trade avatars with the support of interest-bearing tokens representing loans on the DeFi Aave lending platform

NFTfi: Use NFT as collateral for a loan

NFT | Obstacles to Mass Adoption

There is no doubt that NFT tokens are an extremely powerful tool. They carry an extremely credible promise for future applications. They are highly flexible instruments and appeal to the innate human desire to possess rare and unique items. The use cases are endless, only the developers' imagination may be limited in this regard.

However, despite this potential, it's hard to deny that the NFTs are still remarkably niche. Even in November 2020, NonFungible estimated that the number of active addresses belonging to active NFT Dapps users is about 70,000. Although this number has more than tripled since 2018 and has doubled since the beginning of the year, tens of thousands are still a drop in the ocean of tens of millions of users cryptocurrencies around the world.

So how do you explain the fact that NFT adoption is still relatively low for a technology that seems so promising?

Inaccessibility:

The most popular uses of NFT are collectibles, graphics and gaming. While the market for this type of asset should naturally be very large, the fact is that the availability of NFTs is mainly limited to relatively seasoned cryptocurrency users who know how to operate in the industry using decentralized applications. In other words, not all collectors, art lovers, or gamers are digital.

Technology:

The technology behind NFT is only a few years old. It has been operating in its present form for a relatively short period of time. The understanding of how these resources work is still very low, leading in many cases to questioning the security and authenticity of tokens. This, in turn, likely means that current users of NFT technology still fall into what can be successfully termed "early adopters".

Transaction fees:

As NFTs currently operate mainly on the Ethereum blockchain, the creation and execution of NFT transactions can be highly dependent on the level of network activity on the platform. During the DeFi boom in September 2020, when Uniswap launched its token and encouraged yield farming, the gas price hit a staggering 1000 gwei.

Difficulty relating to the real world:

Even though NFTs can represent assets in the real world, it can be difficult to guarantee NFT holders ownership of the asset in real estate. For example, to what extent can a user be sure that an NFT supposedly linked to real-world assets ultimately guarantees ownership of a physical item?

To clarify this issue, NFT would have to issue companies from the "real world" or even cooperate with companies from the cryptocurrency sector.

Thanks for reading. What is your opinion about NFT?