Slow Networks and Extra Fees Hamper Sales in Cashless Market

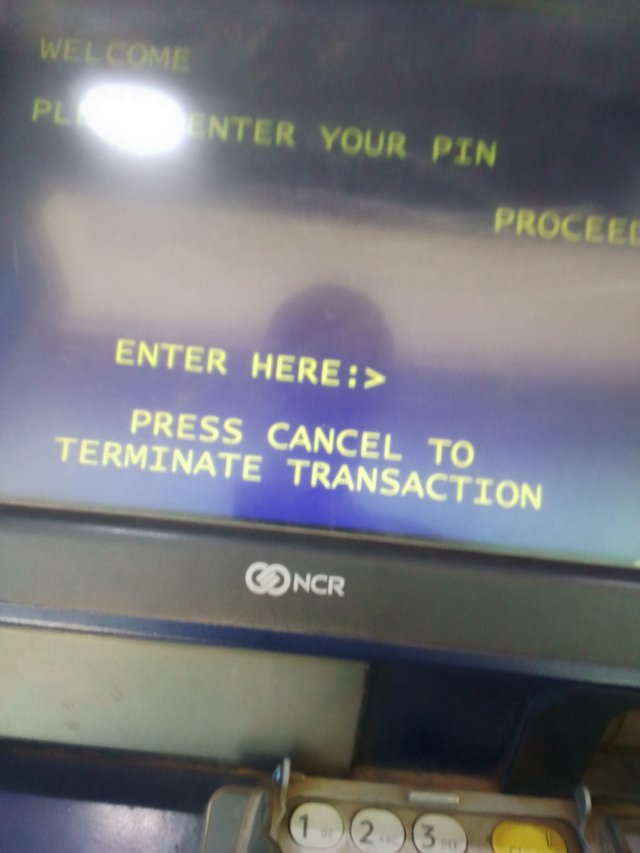

Today was an interesting day at the market. I had to transfer money from my bank to purchase goods, but the network was slow and it took me over an hour to complete the transfer.

Slow bank network due to the current new Naira policy

To make matters worse, the store seller even had to take a screenshot of the transfer before releasing my goods. After this frustrating experience, I had the chance to listen to the story of the store owner.

The story of how he used to sell Aya tiger but now he owns a big warehouse in the market. The entrance to the warehouse

Trailer offloading goods inside the warehouse

Goods owners waiting for wheelbarrow pusher to help carry their good's

However, my day wasn't all bad. I visited some stores and was disappointed to learn that due to a shortage of cash, some store owners were even asking for extra fees on top of the price of the goods purchased.

To quench my hunger, I treated myself to some delicious pineapple, orange, a doughnut, and a malt.

This just shows how important it is for everyone to have access to basic financial services.

Overall, today was a mix of good and bad experiences at the market. Despite the challenges, I am grateful for the opportunity to meet new people, try new foods, and learn more about the community.

My day at the market was a reminder of the importance of access to financial services and the challenges that come with it.

The slow network and the need to screenshot a transfer before receiving goods highlight the need for more efficient and secure financial systems.

The extra fee charged by some store owners shows the importance of financial literacy and the need for consumers to be aware of their rights.

Finally, the bike man's response about not having an account emphasizes the importance of financial inclusion and the need for everyone to have access to basic financial services.

In a world where financial technology is constantly evolving, it's vital for everyone to have access to the tools and resources needed to participate in the modern economy.

By working together, we can create a more inclusive and equitable financial system for all.

The implementation of a cashless policy has caused some challenges for traders in the market. While it may seem convenient for consumers who don't have to carry physical cash, it has resulted in slow sales for some traders.

The slow network and the need for extra verification steps, such as screenshotting transfers, have made transactions longer and more complicated. This can be particularly challenging for small traders who may not have the resources or technical know-how to navigate these issues.

Additionally, many traders in the market may not have access to digital financial services or may not be comfortable using them. This can limit their ability to accept electronic payments from customers and slow down their sales.

This can also lead to a divide between those who are able to participate in the modern economy and those who are not, creating further challenges for financial inclusion.

Therefore, it's important to address these challenges in order for the cashless policy to truly benefit everyone.

This could include providing education and training for traders on how to use digital financial services, improving the network infrastructure, and ensuring that all transactions are secure and transparent.

By addressing these challenges, the cashless policy has the potential to increase efficiency, reduce fraud, and make financial transactions more accessible for everyone.