Why Invest in Gold and Silver?

Source

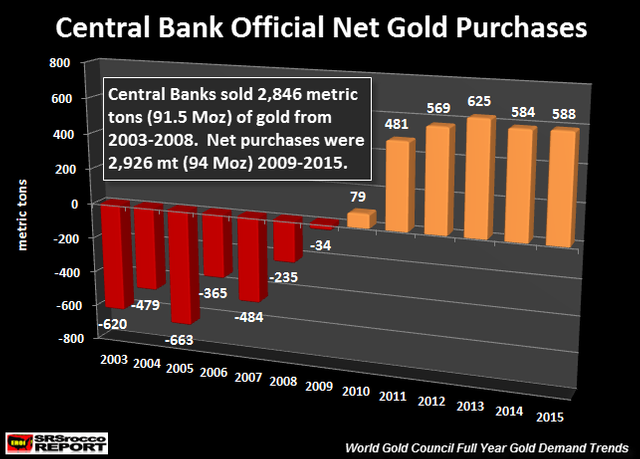

“It’s a barbarous relic and it has no yield.” You say? Well you’re right but if that was the only truth to it then why are Central Banks around the world holding Gold. Even buying more of it? These guys are supposed to be the bankers bankers, the elite of the financial world. They are buying Gold and if you practise the age old wisdom of “Watch what we do, Not what we say” then you’d know not to listen to bankers claims of Gold being a “Barbarous Relic” and instead pay close attention to the fact they are still buying it.

Source

Gold has been at the center of the financial world through much of human history. The paper notes we pass around and call “Money” were once redeemable for Gold or Silver not so long ago. The famous British Pound was called that because it was once the equivalent value of one Pound (by weight) of Sterling Silver (92.5% Purity Silver). The fact that the modern British Pound has nowhere near the value of a Pound (by weight) of Sterling Silver should be a clue as to the reason why the wise ones might prefer to save in Sterling Silver rather than paper British Pounds. Yes, you guessed it – INFLATION.

Source 1 2

Which would you prefer : 10 British Pounds or 4.53kg of 92.5% Silver?

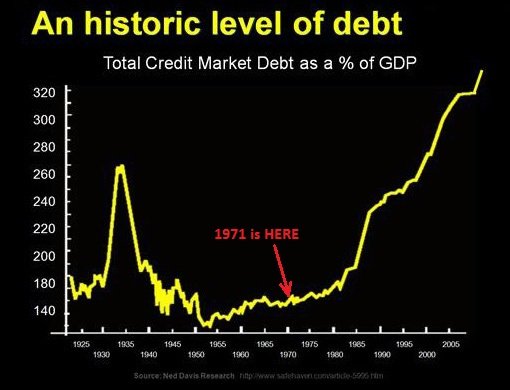

In 1971, the US Dollar was famously unhinged from the Gold standard and since then paper money has been backed by nothing except government promises. In truth, modern paper money is backed by the Taxpayer and it is now commonly accepted that we have a 2-3% Inflation Target per year! What we have seen over the last 46 odd years is an unprecedented monetary experiment that has allowed governments around the world to print money and rack up debts in the name of getting politicians re-elected.

Source

Gold and Silver in todays world still has value and while bankers and investment advisors might reluctantly acknowledge that these precious metals are an effective hedge against inflation, they are also a hedge against badly behaving governments. If you’re like me you can see plenty of badly behaving governments around the world today, so it’s a good time to wise up.

Source

Investing in Gold and Silver is not so much about Wealth Creation as it is about Wealth Preservation. If you’re here on Steemit you know about Cryptos which is an excellent innovation to invest in for Wealth Creation. But when the inevitable downturn or the next financial crisis occurs, wouldn’t it be prudent to focus at least a little bit on Wealth Preservation too?

https://www.gold.org

https://www.veteranstoday.com

https://www.mypivots.com

http://www.muthead.com

https://agoodhuman.wordpress.com

http://www.azquotes.com

http://news.goldseek.com

Given Gold's (and Silver's) long history, the idea that Bitcoin is taking the title of "a store of value" is laughable.

Mate, I could not agree more. I love my cryptos and Bitcoin will always have a special place in the history book but you can not have a "Store of Value" that is as volatile as Bitcoin.

this

liquid not paper is what real tangible metals should be considered. Wealth preservation will always win in the long run versus so called wealth creation. I will go in crypto, once they mine precious metals, that aren't mined in the future, but already above ground level and accounted for. that will be the game changer.

Great solid advice there my friend, but how many are listening. As it always goes they will want it when it's to late, but you have done everything to help, the ball is in their court, cheers mate.

"Gold is money, everything else is credit"....J P Morgan

Well, maybe people aren't listening but it's all on the blockchain now so my message is out there :)

I recently purchased some silver with steem. Im using a small portion of gains in crypto to purchase silver. What a good way to hedge against fiat, governments, and even crypto. Silver and gold are never going anywhere.

Smart move. Absolutely it is a great hedge against all those things. Not quite as glamorous as Cryptos at the moment though so still undervalued I reckon.

This is an excellent post. It correctly describes precious metals as wealth preservation. It highlights where the big money bankers are putting their money, which is of course in Precious Metals.

Thanks @goldkey it means a lot coming from a devout gold bug such as yourself.

Great insightful post! I am a pawn broker/gemologist. Gold and silver still definitely holds value, just like your cryptocurrency and watching the market you would do the same when you buy gold or silver. Always take a look at your change too if you have any 1964 or before coins they are 90% silver. Good post!

Very interesting. Do you plan to write about your gemology? I've heard there is still some coinage in circulation containing silver and have been meaning to research into that so I can look out for it.

@buggedout I absolutelyplan on writing about gemology, I also know quite a bit on coins. Some people don’t even know what they have. There are some wonderful coin books out there too! My favorite coins are mercury dimes :)

It's also the most undervalued asset, in relation to bonds, stocks, real estate and crypto's. Even more so silver.

Since I have observed several of your posts, what do you think about Gold money? is an online wallet with a backup in gold reserves, do you see it feasible?

Honestly, I haven't had a close look at it. But if it relies on a centralised reserve of gold to redeem from then I would consider that an organisational risk, like Tether.

If so, then yes it's feasible as long as the organisation behind it is trustworthy and submits to audits etc.

I think I might do a post on this but I still see no reason to invest in gold and silver - they generally go up with inflation. Conversely, money/bonds and stock generally have higher returns than inflation. If you held stocks or a bank account in 1900, since the interest rate has been above inflation for the whole of the 20th century and dividends have been higher, you'd be much better off than if you held gold. Fiat currency and stocks are backed by real goods and service whilst gold is a shiny metal. Sure if you want an asset that just goes up with inflation, I suppose it's useful?

"..the interest rate has been above inflation for the whole of the 20th century..." was it?

What about the 21st century? We are now 17 years old into it and we've have negative real interest rates in a large part of the world since the GFC. What worked for investors last century may not work this century is all I'm saying ;)

That's true - but many bonds and stocks have yields higher than inflation. I see no reason why gold prices will rise above inflation - it's use doesn't increase. Yes, there has been a slowdown in technological growth in the 21st century and the rapid increase of technology in the 20th century will likely never be repeated. But hopefully interest rates will eventually rise (yield curve is pretty dim tho) and productivity growth will improve (and therefore stocks as a whole).

"...there has been a slowdown in technological growth in the 21st century..." Have you heard of blockchain technology? Or Artificial Intelligence? Even the internet has had more impact on society in the 21st even though it first arrived in the 20th century. We are just getting started here and the rate of technological advancement is only getting faster. I can already hear the screams from the Luddites who want it all to slow down!

Why do you think technological advancement is getting faster? Productivity growth is down in developed countries. The innovations you mention have less effect (or at least currently do) than things like refrigeration, antibotics, central heating, flight, phone, computing. In terms of happiness, the 21st century hasn't really had any technological advancements (bar medical ones) which improve happiness (unlike central heating or refrigeration which markedly improved living standards) - see https://en.wikipedia.org/wiki/Easterlin_paradox. Do you think that productivity growth will soon increase in the future suddenly despite the trend down?

"Happiness Economics" sounds a bit like lefty pseudo-science to me so you'll have to forgive me for not buying into that.

Productivity is down in developed nations due to globalisation and the shifting of production into the developing or 3rd world. It has been going on for decades now and it is the reason for stagnation in the living wage in the West. Look at global productivity rather than a subset of it and you should see a better trend.

Plus, we are suffering from the increased "Financialisation" of our economies which is not helping productivity OR wages in the developed world. We've actually had anaemic growth since the GFC and have never truly recovered.

Calling something "lefty pseudo-science" isn't an argument - they use logical reasoning and support it with empirical data. For sure, developing countries productivity growth is much higher. But globalisation should bring increasing productivity - more options for trade. Not sure about financialisation although I'd lean towards agreeing with you. This guy puts the technology point quite well - https://www.amazon.co.uk/Summary-Rise-Fall-American-Growth/dp/1683780485/ref=sr_1_1?s=books&ie=UTF8&qid=1515180995&sr=1-1&keywords=rise+and+fall+of+american+growth

But intuitively, early twentieth century had incredible changes compare the 21st century invention of a smartphone with the invention of phones and telecommunication. Before the phone, people lived in a world confined to their village or town.News spread very slowly. A smartphone is an improvement over a phone, but it's not a completely different uphaul of society (obviously quite hard to define what an "uphaul of society" is though!).

Negative interest rates are mad though, you would expect house price increases and massive stock price increases so that dividend yields, rents and interest rates are in line (adjusted for risk). Yet you don't... My theory is that only really the government can issue debt efficiently, and we've have a recent turn towards austerity. In addition, the private sector is highly indebted (although obviously an economy as a whole can't be in debt as for every borrower there is a lender).

"My theory is that only really the government can issue debt efficiently..." Ok, you've lost me here.

The government and central bankers are manipulating the money supply and interest rates. We need less of this, not more.

What I mean is that only the government can borrow at the risk-free rate. Out of interest why do we need less of this? I think as a whole (although it's obviously not perfect), central bank policy helped the financial crisis not turn into a 1930s prolonged depression. Remember in an economy, your spending is my income, and my income is your spending so if everyone tries to simultaneously save, everyone is worse off. This is a classic collective action problem - what is in everyone's private best interest isn't in the interest of the community. Having a government step in with fiscal policy solves this situation.

being an Indian we prefer investing in gold, more than anything. Simple reasons you could hold and store. You can take money out of gold anytime at the market rate and the metal is always in Demand :)

Yes. I have heard some news about the war on cash in India and then something about gold restrictions too. Isn't there some new taxes or import duties or something?

yeah there is high import duty, but still stocking gold is a common practice + people pay bribes in gold. In fact at the time of demonetisation people exchanged old notes for gold at double the price :)

For that we cannot trust our future to them, but sadly they are the people who usually write it, and have more time and means to be prepared.