DRutter's Divergence - 2019 update!

In 2013, I spotted an anomaly in the silver bullion demand data I was analyzing. I started updating my YouTube audience regularly as the trend became more pronounced. Before long, other analysts were following the pattern, dubbed "DRutter's Divergence", including BrotherJohnF, SGTReport, and David Morgan. My coverage of the widening divergence was noticed and expanded upon by the world's top experts in precious metals and monetary theory, including Mike Maloney.

I'm often asked to update my analysis of this phenomenon. I've been very ill for 3 years, but I'm getting my life and health back on track, so this is a great time to look at new data and get back into the graphs.

What is the Drutter Divergence?

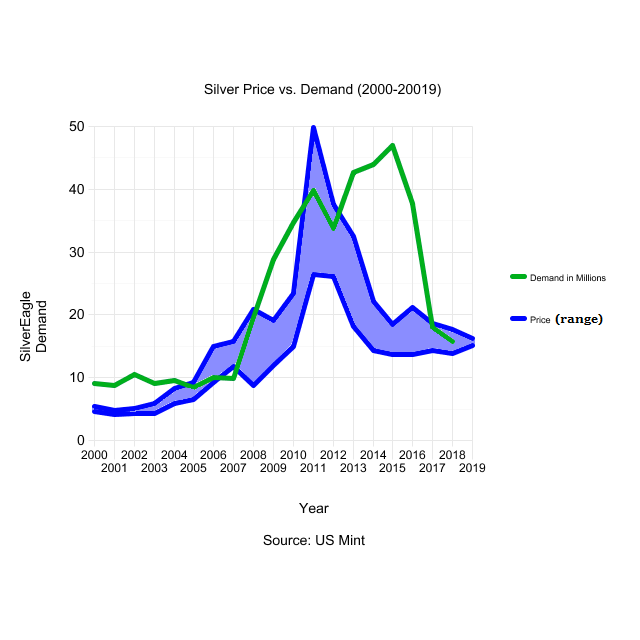

The US Mint produces the most well-known (and minted) silver bullion item in the world - the US Silver Eagle. When looking at physical demand for silver bullion, for simplicity I look primarily at the Silver Eagle sales data, available on their website. (A closer look at sales data for the Canadian Silver Maple - published quarterly - and many other coins minted around the world, gives similar results.)

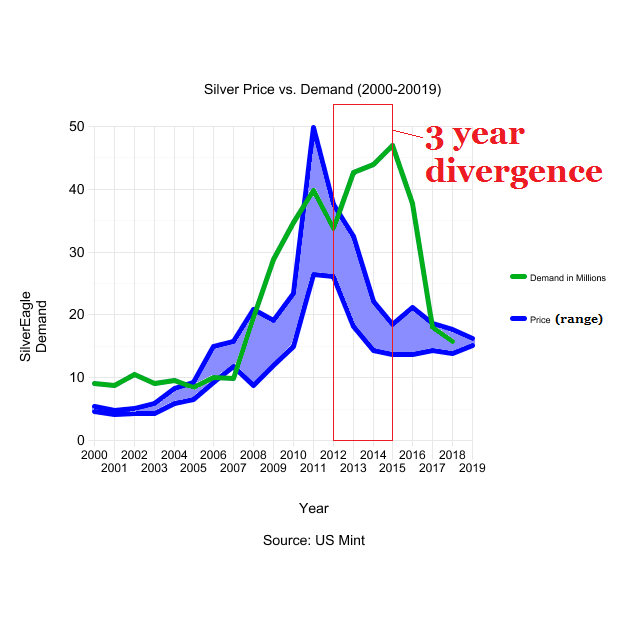

The divergence is a large unexplained gap between silver bullion demand and its price, beginning January 2013 and ending June 2016.

For years, I noticed as demand for bullion rose with the price. The price finally retreated after a long bull run in 2012, and demand similarly cooled. But in early 2013, physical demand surged again, despite crashing prices! By mid-year, the precious metals world was hearing about this unprecedented and unexpected divergence.

As I noted in May 2016, demand for bullion was so high, only about 1 in 10 American Silver Eagles can be minted with American silver! About 90% of American bullion is actually from Mexico and Australia!

For a video summary of the divergence, from my last upload on the topic, click here.

New Data

After crashing for no known reason in mid-2016, silver bullion demand has remained low, with the price.

In a way, things are back to how they were in 2007 - before the bull market. Nowadays, both price and demand are low.

Looking back, we see the divergence between demand and price existed from early 2013 to mid 2016.

I reported on the silver bullion shortages many times since 2009, most recently in late 2015:

The latest data from the US Mint website shows demand is starting to go back up. So far in 2019, they've sold 25% more bullion than they did in all of January-February of last year. It's not up to levels seen during the divergence, but the stackers are back!

Why did price and demand diverge so dramatically in 2013, causing turmoil in bullion and currency markets, and bullion shortages across the world?

What ended it so suddenly halfway through 2016?

Despite the well-known undeniable fact that gold and silver prices are heavily manipulated by the big banks and financial elites, silver's price is up 15% from the low in November, and demand is up too.

I'm going to be watching the data closely. Stay tuned here for developments as they happen. (This is not financial, relationship, or cooking advice.)

Stack on! Steem on!

DRutter

Keep the great info coming and stack ‘em high!

😜👍

So cool that your analysis got noticed and even have a phenomenon named after you. 😎

I do find that divergence as well as the 2016 crash strange. How much do you think market manipulation plays into it? Have you found any evidence of that?

The electronic price of gold and silver (and other monetary metals) are decided by a few elite bankers, and have nothing to do with the forces of supply and demand anymore. They select what price they want the chart to show, and they make billions with insider trading, but the real prize is keeping PMs looking dull (and keeping the almighty dollar looking beautiful). Their fiat system is a fraud and they're propping it up in such a way that anyone paying attention can confirm it with a quick google search. Manipulation was the subject of conjecture for decades but finally was confirmed in and around 2015 when the Supreme court found the banking elites responsible for fixing PM prices, Libor (the value of dollars and interest rates), the bond market, and the rest of the financial system. Nobody went to jail. Just fines, paid in dollars they stole.

It's right out in the open, but there's no revolt. 100 or even 50 years ago there would be instant revolution if the people found that out.

GATA's sole purpose was to uncover and prove gold manipulation. They worked at it for decades. Anyone paying attention back then knew, but since the courts have come out and declared the banks and elites guilty, there's really no excuse.

Does that manipulation affect demand? You can bet your ass it does! As I've shown, humans buy when prices go up, and stop buying when prices go down. Humans are stupid, don't worry about it, heh. The point is, the elites know this, and set the price to whatever will cause demand for physical metal to drop. When they fuck up, we get shortages in the physical market - there was no silver to be purchased in Vancouver for months at a time, several times over the past 10 years. People were paying high premiums just to get their hands on physical silver asap. Spot was say $30, and they were paying $40+ for silver Maples. Even then, many had to wait, or have connections.

Is there any wait for cash, ever? Any shortage? Why not? (Unpack that if you haven't before.)

Getting famous that way was fun, yeah. Not that I aim to be famous - could easily have done that a few times now, but always passed it up. I fly under the radar to some degree. I'd been flirting (intellectually) with Mike Maloney for a few years. I was online friends with his cameraman, Dan. Some of my conversations about PMs and the way the world works, with Dan, found their way into Mike's ears and mind. I can hear myself in well-known productions like Hidden Secrets of Money.

I've had my 15 minutes of fame before, too. In 2000 or so I was heavily into Magic the Gathering (yes, the 'MTG' of MTGox.com, the infamous early bitcoin exchange that got hacked, sending the price briefly to 1 cent). I got into chatting about it on forums. People would post rumoured cards from upcoming sets, and the forum got large because many players want to know what's coming out soon. I rose to the top as the guy who could spot fakes better than anyone else. The site (MTGNews.com) got very large and I was known by the nerd kingdom across the planet. At some point, leakers started to come to me with insider info, and I'd post it if I thought it was real, or wasn't sure. I rose to top admin on the forums. The company that makes Magic (Hazbro) began to get upset at my success in sifting out the fake rumours from the real. They had started their own blogging website to talk about their upcoming Magic releases, and wanted to be the only ones talking about rumoured new cards and sets. So they filed a lawsuit against me for violating their intellectual rights, and so on. I found out about it online, before the documents came to my door a few days later. It really messed up my marriage life. My ex was very upset I had brought legal danger to her life with my online activities. We had a sick newborn who needed surgery at the time, so stress was pretty high. Supporters began petitions online, to have the charges dropped, saying if anything my actions promoted the product and encouraged excitement about new releases, and did no harm to the brand. There were protests and boycotts across Europe, Australia, and North America. People were angry that Hasbro was going after the beloved and trusted rancored_elf. They had no real legal case, but had millions with which to bury me. A probono lawyer stepped up to defend me and got me off with, well, I can't tell you. But that should tell you. I signed things, promises were made, threats were set in place, and that's the end. I faded from the Magic community, lost my business rancoredelf.com, and I have literally hundreds of thousands of Magic cards filling up my apartment. With no way to sell them anymore, I may have to just surrender them at a local shop for pennies on the dollar.

But that's one of the other times (so far) I've been recognized worldwide. You'd think I was trying, but I'm not. It just happens when you're me and do the things I do, I guess.

I do remember the Libor scandle but don't remember hearing about anyone doing any time for it. We need to make like Iceland and jail all the crony bankers!

I used to do swing stock trading all the time and made some decent profits but stopped trading in 2012 for the most part because things were getting too crazy. I mostly used chart technical indicators on Price overlaying Volume, MA and Williams %R (over 14 day period).

Sounds like you have had at least 30 min of fame (haha sounds like infamy) with MTG and WoC. I have some co-workers that are super into MTG. I will have to ask them about those early days and see if they know anything about it. I never really got into it personally. I did however used to have some core set cards that I remember selling at a comic book store. Those are worth quite a bit these days from what I see. Another lost opportunity for me. You might want to hold onto yours. Who knows.

Very sorry to hear about the struggles that caused with your wife and newborn. That sounds like a pretty frantic situation let alone a large company with deep pockets threatening litigation against you. I am glad you got it worked out. Your life is starting to sound crazier than mine... and that is saying something haha!

Hahaha buddy! I suppose some parts have been, yeah.

But I've found that each unique (no matter how hard) situation I faced made me different, and in a lot of cases, better. They say what doesn't kill you makes you stronger. I'm not saying I've had it hard. Many have had it far worse. But yes, I've been through the fire a few times now. I'm lucky - I'm still alive to continue the story, but plenty others had their story end right there. I see myself as a survivor, not that I want recognition (at all), but internally. I made it, where others didn't. Maybe it was luck, I'm not trying to claim I did it all without help from others or luck. But one way or another, I'm here. Each wound that healed up, changed me for the better. I'm not who I would have been otherwise, I see that and admit that. I'm not better in every way than the person I would have been, but also not worse in every way either. There are pros and cons to the me I am, compared to the me I would have been if things were easier.

So yeah, being me has been hard. But being everyone else has been pretty hard for them, too, and I'm not saying otherwise! It's just my way of overcoming, and healing. I look at myself and wish I hadn't had to go through so much suffering. I see the ones who didn't make it and I'm glad I'm not them. The only alternatives are to hope for a simple and easy life, or go through the fire and hope you're the one who survives. I'm the one who survived. I'm fucked up and some things about me aren't what they might have been otherwise, but I'm here, I have dreams, and I can still strive to achieve them. That's amazing and I'm so thankful for it.

Maybe I'll hear a little about some of the things you've been through, if the right time and place for it comes up. :)

Well said! I agree you are who you are today because of the fire and experiences that you have gone through. You got the right attitude as well!

Oh yes, I have plenty of things that I have been through. They will come out in due time so you will for sure hear about them. It's never a dull day around me haha :)

Love SILVER and Everyone Else should Too..........

I miss BJF

He was smart but I personally couldn't handle his religious stuff.