This is why silver is a smart buy....

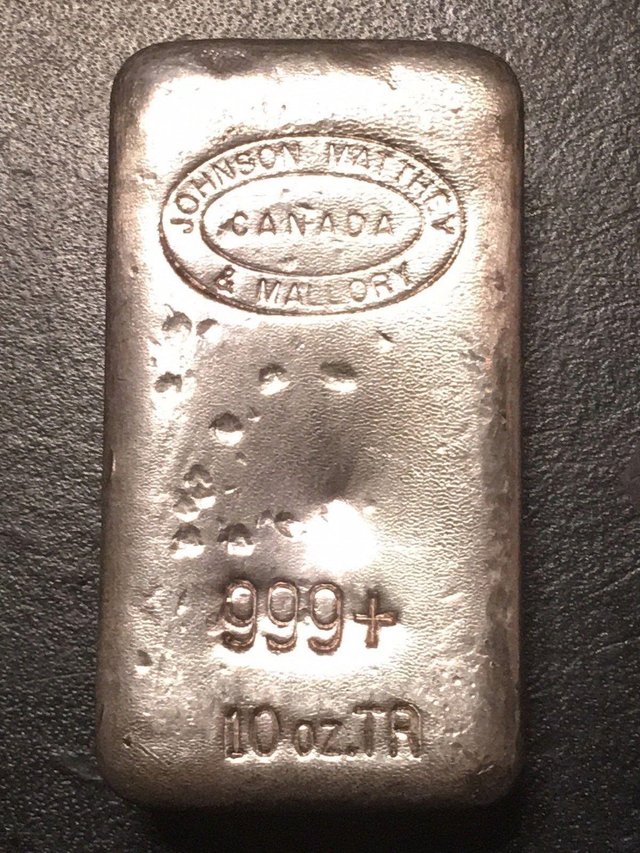

Physical silver is a hard asset. Of all the investments you own, how many can you hold in your hand? Only physical silver and gold, and those paper EFT’s don’t count. And it can be as private and confidential as you want. Physical silver is also a tangible hedge against all forms of hacking and cybercrimes. And it preserves your wealth against inflation.

Silver is a very small market in fact, that a little money moving into or out of the industry can impact the price to a much greater degree than other assets (including gold). This greater volatility means that in bear markets, silver falls more than gold. But in bull markets, silver will soar much further and faster than gold. Proof: when both gold and silver started the bull market from 2008-2011 where both metals hit their all time highs. Golds price increased by 166%, where as silvers price increased by 448%. Which one sounds better to you?

Silver supply is falling and falling quickly. There are currently only three countries that hold stockpiles of this metal. They are Mexico, India and the United States. Mining efficiency and production is at an all time low. It is taking much more effort and money to extract this metal out of the earth.

Industrial use of silver is growing every day. With technology today’s almost all high end electronics use it, from solar panels to cell phones. Plus it has a very high demand in the medical field because of its bacteria killing antibodies.

Global demand for silver is growing. Virtually all major government mints have seen record levels of sales (except for the US) with most already operating at peak production. Surging demand is nowhere more evident than China and India. These two massive markets have long histories of cultural affinity toward precious metals.

Silver is also cheap to buy compared to gold. Currently you can purchase 80 ounces of silver for the price one ounce of gold. Silver makes s good gift as well, what other hard asset would you like to give to someone.

The gold to silver ratio is so inflated currently that silver not gold is the smart investment.

Silver has long-term use as money. A scan of monetary history shows that silver has been used in more coinage throughout the world then gold.

No counterparty risk. If you hold physical silver, you don’t need another party to make good on a contract or promise. This is not the case with stocks or bonds or virtually any other investment.

Hope that you enjoyed the content. Please upvote, resteem, comment and follow....

Thank you

Very interesting read thanks for sharing

Thanks Dixie. Anytime

Good article. Thanks for sharing

Thanks Cajun. How’s the pouring coming along?

Waiting on the bar mold. Postal service is so slow. lol

Thats sucks. They sure do...👎

Nice write up and some good points. It's hard to invest in anything else with all that is going for silver.

Thank you. No doubt. Thanks for the view🍺

@silverd510 on a percentage basis in my opinion will outperform Gold to the UP Side once things get really active.............

I agree with you 100%, that’s why I’m buying silver....😀

I agree with you. Silver is the name of the game. Well written article.

You have received an upvote from STAX. Thanks for being a member of the #steemsilvergold community and opting in (if you wish to be removed please follow the link). Please continue to support each other in this great community. To learn more about the #steemsilvergold community and STAX, check this out.

@silverd510 Great post! All music to my ears...👍