Interest rates; something strange is going on?

The recent headlines indicate that something is brewing; central bankers are not buying the inflation line the Fed seems to be pushing

Central Banks Take It Easy to Give Global Growth a Second Look

Sweden’s central bank just can’t get enough inflation.

ECB leaves interest rates unchanged

New Zealand's central bank happy to wait as inflation lags growth

Asian Central Banks Unlikely to Follow Fed Rate Hike

Now Bank of England might be joining the pack, and Japan continues to indicate that they will continue doing nothing for the foreseeable future. Two things are at play here; the economic recovery as we alluded well back in 2012 is illusory. Hot money has fueled it; cut the money supply, and this house of cards will collapse. Secondly, technology (and AI) is pushing prices lower, so the normally inflationary effects of pumping so much money into the world’s economic system are being nullified. Hey, why do you think Gold is trading in the 1300 ranges and not north of $2000, and it’s the same reason Oil is trading well of its highs. If inflation were an issue, Gold would be soaring.

It’s possible that technology will continue to mute the effects of this insane central bank policy for years to come. In fact, AI and robots are replacing jobs at a very fast clip, and deflationary forces could continue to outpace inflationary forces. Time will tell, but so far most of the world’s central bankers are avoiding raising rates, and that’s very telling. So why is the US diverging?

Longer term Trumps Tax cuts will have a very positive effect, but there is a very good chance that the companies will use the money saved to buyback stocks rather than hire more people. While unemployment numbers are low; these numbers don’t paint an accurate picture:

• The BLS does not count the number of individuals that have stopped looking for a job; this paints a false picture as there are a lot of individuals that have stopped looking for a job

• Many of the jobs created are either low paying jobs or part-time jobs or seasonal jobs.

Logically speaking the US should not be raising rates at such a rapid clip.

The only reason we can think of is that the Fed is planning on a long-term attack, as they want to maintain the impression that the US dollar is still the strongest currency in the world when they re-embark on a rate lowering program. Why is this important? The US is the world’s largest debtor, and foreigners are not going to be interested in purchasing boatloads of US debt if the US is devaluing its currency at the same rate as the rest of the world. The U.S is never going to pay this debt back; to be able to print boatloads of money the illusion that the US dollar is the strongest currency out there must be maintained at all costs; this could be the reason for the rate hikes. We are still in full blown out currency war, and the idea is to reach the bottom last.

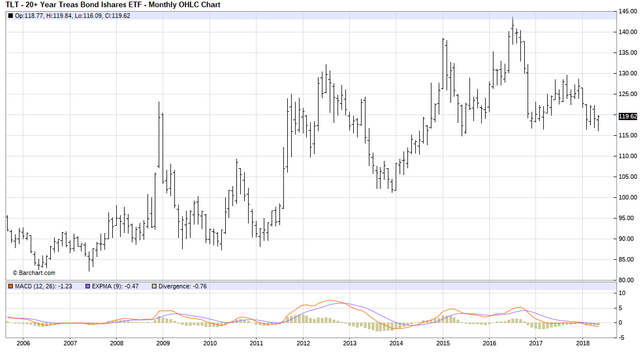

Looking at the monthly chart of TLT, the MACD’s averted the almost certain bearish crossover last month, and the higher dollar could suddenly push the Feds to tone down their rhetoric in the same manner BOE was forced to play down the almost certain rate hike they were broadcasting for months. Markets in general (like many stocks) are exhibiting a pattern of trading in the extreme to insanely overbought ranges for an extended period; note that TLT has never traded in the insanely overbought ranges and more importantly it has not traded in the extremely overbought ranges for an extended period.

Courtesy of Tactical Investor