Steem inflation observations for 2024/Q3

As the third quarter of 2024 winds down, it's time to take another look at the Steem blockchain's inflation. For previous quarters, see 2023/Q3, 2023/Q4, 2024/Q1, and 2024/Q2.

Looking forward

- Note that these forward looking projections are influenced by many factors that cannot be predicted, so these graphs are speculative. Other factors include (but are not limited to): token burning, missed blocks by witnesses, the price of STEEM, and rule/parameter changes by witnesses.

1. Projected Daily STEEM production is now off by about 1/2% from it's November, 2023 peak of 89,933.

| Date | Block # | Inflation Rate | Supply | New Steem Per Day |

|---|---|---|---|---|

| 2024-10-06 13:53:19.192068 | 89250000 | 0.062100 | 525735697 | 89447 |

| 2024-10-15 06:13:19.192068 | 89500000 | 0.062000 | 526512095 | 89434 |

| 2024-10-23 22:33:19.192068 | 89750000 | 0.061900 | 527288386 | 89422 |

| 2024-11-01 14:53:19.192068 | 90000000 | 0.061800 | 528064565 | 89409 |

| 2024-11-10 07:13:19.192068 | 90250000 | 0.061700 | 528840629 | 89395 |

| 2024-11-18 23:33:19.192068 | 90500000 | 0.061600 | 529616574 | 89381 |

| 2024-11-27 15:53:19.192068 | 90750000 | 0.061500 | 530392396 | 89367 |

| 2024-12-06 08:13:19.192068 | 91000000 | 0.061400 | 531168092 | 89352 |

| 2024-12-15 00:33:19.192068 | 91250000 | 0.061300 | 531943656 | 89337 |

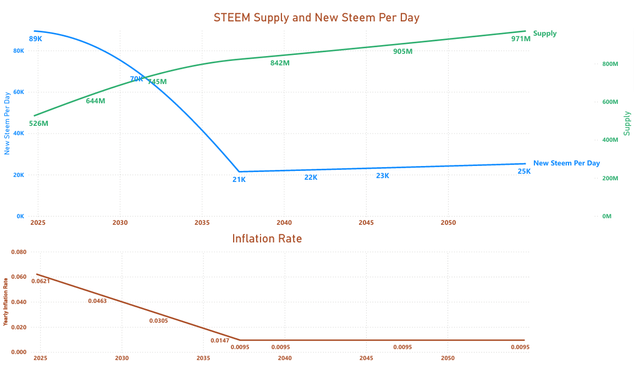

The projected STEEM per day is currently near 89,447 and expected to decline below 89,337 by the end of the quarter. The corresponding value 1 year ago was near 89,903. With the existing economic rules, this number is projected to decline until 2037, bottoming out around 22,000 and remaining below current levels for decades or centuries.

The price of STEEM has been below the SBD print threshold for the entire quarter, so - barring rule or parameter changes by the witnesses - this represents an upper limit on the daily production. If the price of STEEM crosses above the SBD print threshold, we'd expect this value to decline faster.

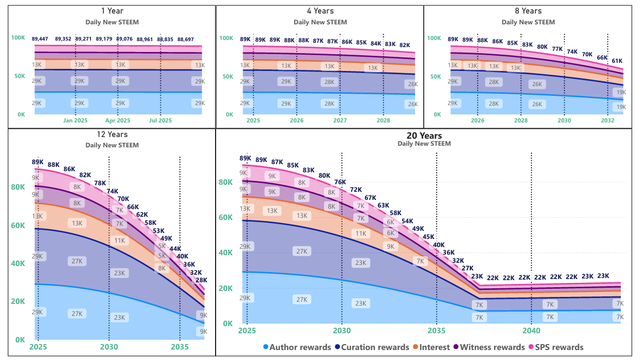

2. Here are the daily inflation projections for 1, 4, 8, 12, and 20 years.

Slowly, then suddenly.

3. And here are the projected values for inflation rates, virtual supply, and new STEEM per day

As before, more than half of the STEEM that is projected to exist in 30 years already exists today (roughly 54%).

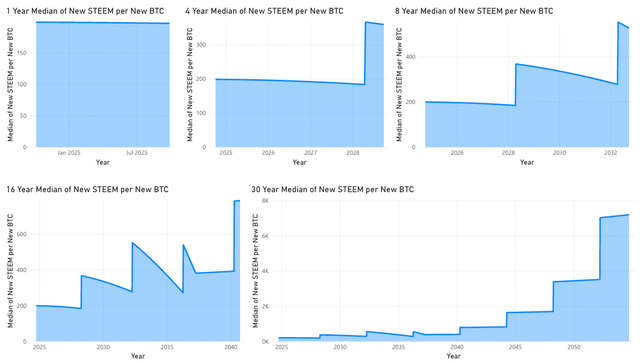

4. New STEEM per day vs. New BTC per day

For the next 13 years, STEEM's daily production schedule is at the closest to Bitcoin's as any phase of STEEM's lifecycle. From 2016 until last year, Steem's daily production was growing while Bitcoin's shrank. That will be the case again after 2037. Between now and 2037, Bitcoin and STEEM are both shrinking (though Bitcoin is still shrinking faster).

In the rear view mirror

- The following graphs show what has happened in past months.

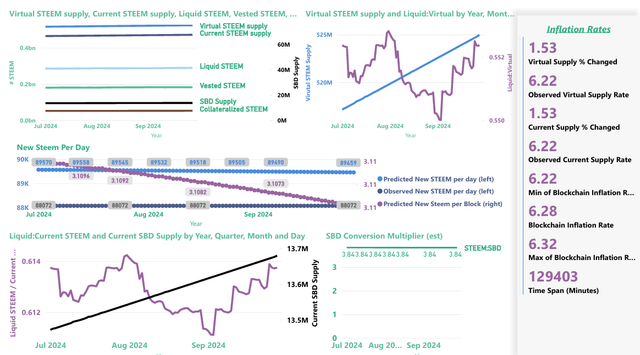

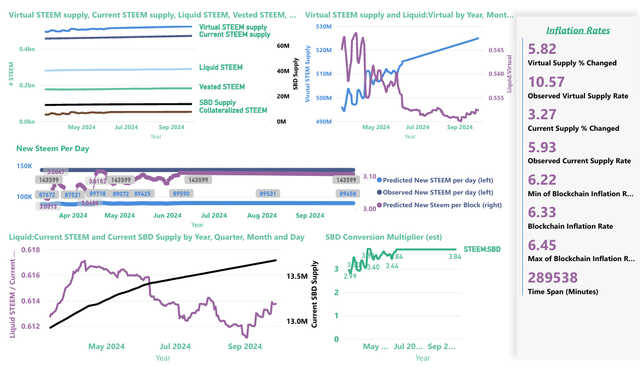

5. Single quarter summary graph

These visualizations cover the last 90 days

I lost about an hour troubleshooting this one because I didn't believe the numbers. They're correct, though. Basically, this is the first time that I've seen the observed inflation rate that was as high as the current inflation rate. With token burning, that seemed implausible until I finally remembered that the blockchain inflation rate changes as time passes, so I was making a bad comparison. I updated the metrics cards on the right to show min/median/max values for the blockchain inflation rate so that will be less confusing in the future.

This quarter, the blockchain inflation rate ranged between 6.32% and 6.22% and the observed inflation rate was 6.22%. Because the price of STEEM was below the SBD print threshold for the entire quarter, the current inflation rate and the virtual inflation rate would be expected to be the same - and they were.

Overall, burning and other factors reduced growth by about 1,400 STEEM per day, or 1 1/2%.

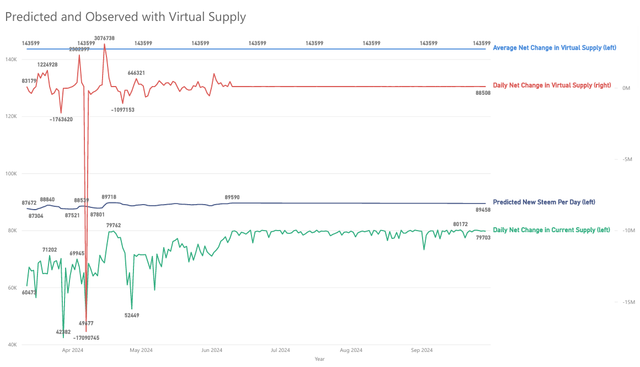

6. All available data

Using all available data from steemdb.io, the start date is March 12, 2024. Here's what we see.

- The blockchain's inflation rate dropped from 6.45% to 6.22%.

- The observed current supply inflation rate (STEEM supply) was 5.93%, which is below the blockchain inflation rate due to burning and other factors.

- The virtual supply rate (STEEM + SBD debt) was at 10.57% because a falling price of STEEM drives the inflation rate up whenever STEEM is above the SBD print threshold. (Likewise, a rising price of STEEM would drive inflation down)

- Daily STEEM production increased from 87,672 to 89,718 when the STEEM price was above the SBD print threshold (and falling), then declined to 89,548 when the STEEM price stayed below the threshold.

- The average daily growth in virtual supply was 143,599 STEEM per day, well above the number of newly issued tokens. Again, this was due to price declines until STEEM's price fell below the SBD print threshold.

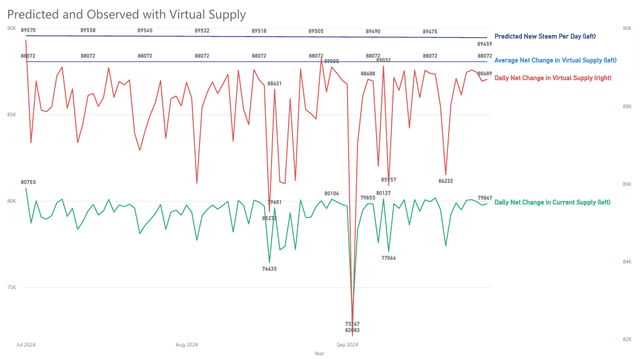

7. Zooming in on daily supply changes in Q2

- Reminder that the daily change for the virtual supply (red) is a different magnitude than the others, so that's graphed against the right-hand axis. Don't try to compare the red line with the other ones.

8. Zooming in on daily supply changes for all available data

- Reminder that the daily change for the virtual supply (red) is a different magnitude than the others, so that's graphed against the right-hand axis. Don't try to compare the red line with the other ones.

- Note how the virtual supply changes that were visible in the quarterly graph are smoothed to invisibility because they are dwarfed by changes caused by STEEM price movements in the previous quarter. It's thousands in the quarterly graph vs. millions in the longer term graph.

9. Wrapping up

As always, I warn that these calculations represent my best understanding of the topic, but there is no authoritative documentation and they could be mistaken.

In summary, with STEEM's price consistently below the SBD print threshold, we saw low volatility for the quarter. The blockchain inflation rate dropped smoothly from 6.32% to 6.22%, and the 6.22% rate was matched by observed growth for current and virtual supplies.

Going back and looking at all available data reinforces the observation from previous months that when Steem's price is above the SBD print threshold, the price-driven movement overwhelms token burning and other factors as the dominant influence on the virtual supply, and therefore on the rate of token issuance.

In short, if we want to reduce the STEEM supply, raising the price of STEEM (and keeping it there) would be a much more efficient way to do it then by burning tokens.

Thank you for your time and attention.

As a general rule, I up-vote comments that demonstrate "proof of reading".

Steve Palmer is an IT professional with three decades of professional experience in data communications and information systems. He holds a bachelor's degree in mathematics, a master's degree in computer science, and a master's degree in information systems and technology management. He has been awarded 3 US patents.

Pixabay license, source

Reminder

Visit the /promoted page and #burnsteem25 to support the inflation-fighters who are helping to enable decentralized regulation of Steem token supply growth.

There was talk about using DAO funds to buy Steem. Is that going to happen or did the idea evaporate again?

It is still being worked on. But the progress is not yet such that a proposal can be made.

Just like in any other economic system, it is time to recognise that crypto and blockchain do not work any differently than the ‘real’ economy.

In the traditional economy companies sometimes do stock buy backs - which can be functionally the same as burning (depending on how it's organized), so burning also makes sense in some contexts. But yeah, there's no substitute for enhancing the value of the product/service.

Personally, I think it would be better to raise the price of STEEM and maintain that price than to burn tokens to reduce the supply of STEEM.

In this case, burning tokens is something we (Steemians) can decide internally and pursue. However, whether STEEM is traded at a high price and maintained at that price is something that is determined by the actions of external market participants.

I think we need to pool our wisdom to make STEEM attractive to external market participants and trade it at a high price (i.e., increase the value of STEEM).

Thank you for the great analysis.

The information you gave is really imagine , and thank you for up voting in my previous post , and also thank you for your support

Upvoted. Thank You for sending some of your rewards to @null. It will make Steem stronger.