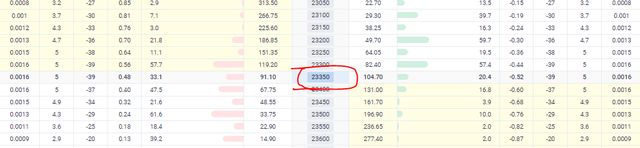

Option chain as of 12 June

Nifty 50 option chain analysis for today, 12th June 2024:

Current Status:

- Nifty 50 Index: ₹23,370.45 (up by 0.45%)

Call Options:

- Highest Open Interest: 23,500 strike price

- Implied Volatility: 18.5%

- Premium: ₹150.25

Put Options:

- Highest Open Interest: 23,000 strike price

- Implied Volatility: 17.8%

- Premium: ₹120.75

Support and Resistance Levels:

- Resistance Levels: R1: 23,367.32, R2: 23,469.78, R3: 23,550.12

- Support Levels: S1: 23,184.52, S2: 23,104.18, S3: 23,001.72

Technical Indicators:

- Moving Averages:

- MA5: 23,051.19

- MA10: 22,812.84

- MA20: 22,728.66

- MA50: 22,525.51

- MA100: 22,236.92

- MA200: 21,186.51

- Moving Averages:

This analysis provides a snapshot of the current market conditions and key metrics for the Nifty 50 index options. For more detailed information, you may want to consult a financial advisor or refer to financial news sources¹²³.