Stock Market Crash?

Will the Stock Market crash?

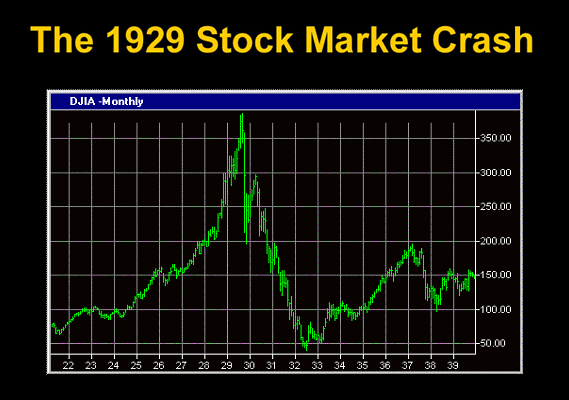

As we all can see the S & P 500 has risen quite strongly the last years. Many are now starting to question the rise. Some voices say this rise is mainly due to central bank printing of money. They also call it a "bubble". And looking at the chart the argument clearly comes to mind.

But what if this is not a bubble. What if this is only a rise due to strong credit expansion? Sometimes you have to look at the picture from the other side of the coin. Surerly many investors bid up assets when there is plenty of credit around.

Let us take a look at the p/e ratios. Click on the link below and choose "all years". The result will show that the current p/e of 25 is nowhere near the value of 46.5 just before the dotcom bubble popped in 2000. Compared to the value of 122 in May 2009 when the banking crisis was at its worst makes the value even smaller.

http://www.macrotrends.net/2577/sp-500-pe-ratio-price-to-earnings-chart

So what is going on here? Are not the centralbanks colluding and trying to frame us all into eternal bondage and slavery? What with all this talk about gold and silver? Are we all being royally done for?

The p/e ratio indicates that even though the dow has risen, the earnings has risen also. So is there really a bubble and why?

Please comment in the section below.

If you like this article, then please vote for it or resteem it, so that others can enjoy it too. Thank you!