From $250 to $360 million: Vijay Kedia's Stock Market Success Story

Imagine starting with just $250 USD and turning it into ₹3,000 crores (about $360 million USD)! That’s exactly what Vijay Kedia achieved in the stock market. His journey from humble beginnings to becoming a multimillionaire is nothing short of remarkable. Born into a working-class family in Kolkata, Vijay faced numerous challenges early on, but his determination and smart investing transformed his life.

Part 1: Vijay Kedia’s Early Years

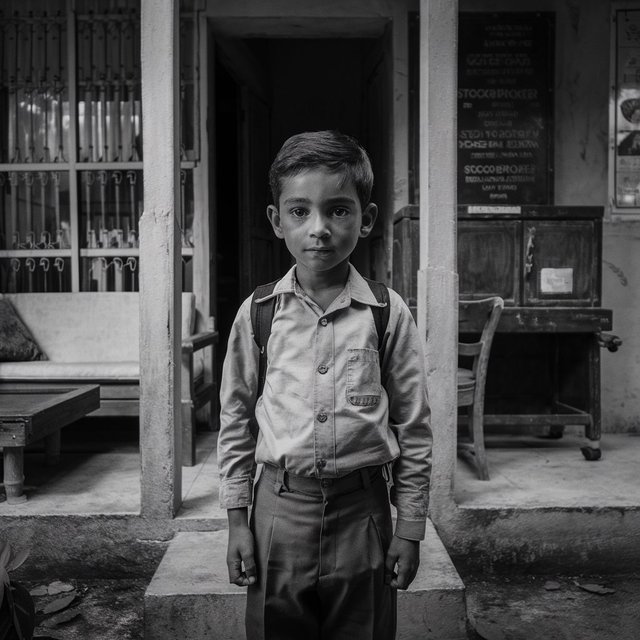

Vijay Kedia grew up in a middle-class family in Kolkata. His dad worked as a stockbroker, which introduced Vijay to finance early on. Sadly, when Vijay was in tenth grade, his dad passed away, causing the family to face financial struggles. This loss forced Vijay to leave school and start working to support his family, putting his dreams of higher education on hold.

Despite these tough times, Vijay managed to graduate while his family continued to face hardship, living in cramped conditions. This period of struggle marked the beginning of Vijay's journey into the stock market, a field that would soon become both his challenge and his opportunity.

Part 2: Starting Out in the Stock Market

In the early days of stock trading in India, Vijay saw a chance to make a mark. He started trading with high hopes and saw some initial success, which led him to believe he had it all figured out. However, the stock market's ups and downs quickly turned his profits into losses. At one point, he had to sell his mother’s jewelry to cover his losses, highlighting the risks of speculative trading.

During these difficult times, including supporting his new family and managing daily expenses, Vijay took on various jobs to make ends meet. Despite the challenges, his passion for the stock market remained strong, setting the stage for future successes.

Part 3: Moving to Mumbai

Seeing Mumbai as the heart of India’s financial world, Vijay moved there to find better opportunities. Initially, he faced obstacles getting into the Bombay Stock Exchange (BSE), but persistence paid off, and he secured a position through a friend.

The move was tough, with a challenging commute and the financial strain of settling in a new city. However, Vijay's efforts bore fruit when he made a significant investment in Punjab Wafers in 1992, which led to great returns. This success allowed him to invest in ICICI shares, which also performed well. Despite market crashes that led him to shift focus from trading to long-term investing, these early successes laid a strong foundation for his future.

Part 4: The Comeback and Success

Vijay’s journey took a major turn when he spent 16 months in Germany on a project, returning to Mumbai with depleted funds. This period of reflection helped him closely observe market trends. In the early 2000s, he capitalized on the stock market’s recovery, making smart investments in companies like Atul Auto, Adjustics, and Sirasa Sanitaryware, which yielded impressive returns.

By 2009, Vijay’s success allowed him to make significant purchases, including a milk company and Tigar Nurseries. These buys were more than just business moves; they represented personal milestones, showing his rise from financial struggle to success.

Part 5: Vijay Kedia’s Investment Strategy

Vijay Kedia’s investment approach is shaped by his early failures and later successes. His strategy includes:

Long-Term Investment: Kedia emphasizes patience and suggests avoiding short-term trading for quick gains. Instead, he advocates for investing in strong companies for the long haul.

Research and Knowledge: He stresses the importance of thorough research and understanding market fundamentals for successful investing.

Courage and Patience: Kedia believes in having the courage to invest in down markets and the patience to hold investments through market fluctuations.

Avoiding Trading Pitfalls: He warns against the risks of speculative trading and advises a cautious approach.

Part 6: Vijay Kedia’s Market Philosophy

Kedia’s market philosophy is built on three key principles:

Knowledge: A deep understanding of markets and stocks is crucial for informed investing.

Courage: Investing in solid stocks during market lows can lead to significant long-term gains.

Patience: Holding onto investments through market ups and downs is vital for realizing their full potential.

He also believes that stock market gains should not be relied upon for everyday expenses but should be seen as a way to build long-term wealth.

Conclusion: Lessons from Vijay Kedia’s Journey

Vijay Kedia’s rise from financial struggle to becoming a successful investor teaches valuable lessons. His story highlights the importance of perseverance, strategic investing, and continuous learning. Kedia’s success is not just a matter of luck but the result of deep knowledge, seizing opportunities with courage, and practicing patience.

His journey offers a valuable guide for navigating the complexities of the stock market and achieving significant wealth. Vijay Kedia’s story is not just about financial success but also a testament to how resilience and determination can lead to extraordinary accomplishments.

Check out My other works on Vocal Media page