GDXJ Sell Off is a Blessing in Disguise for Gold Specualtors

I. The Bond Market Loses Confidence in the Fed

After the Fed hiked rates and highlighted their balance sheet unwinding plans last week, bond yields further dropped. This means there is a significant lack of confidence in the economy and doubt in the Fed by bond investors.

Why does this matter?

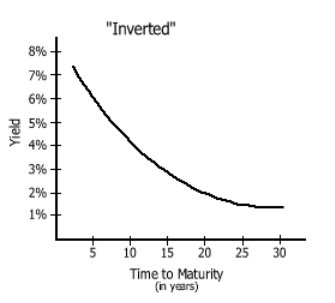

Because bond investors are predicting a recession, so they buy bonds which pushes yields down. But the Fed is claiming that everything is going swell, so they are hiking rates. This is causing the yield curve to start inverting.

And since 1956 the last 9 time yields inverted, a recession followed. . .

Yield inversion is when short term rates, such as the overnight lending rate i.e. Fed funds rate, are higher than longer term rates, such as the 10 year bond. Economic and market sentiment is poor when this occurs. Bond investors would rather own long term bonds since they expect deflation and slow growth. Most importantly, the market believes that the higher short term rates won’t last long since Fed doctrine calls to slash rates during a recession, attempting to stimulate economic growth.

The divergence between bond investors and the Fed is signaling a dangerous outlook.

This is critical to understand. . .

Even after the Fed raised rates for the second time this year and notified the public of their Quantitative Tightening (QT), treasury yields actually fell. Not only that, but they have been falling since the end of March.

This tells us that the bond market doesn’t believe the Fed. . .

Bond investors are expecting deflation and slower growth, contrary to the Feds jawboning of rising inflation and higher growth. And I believe the bond market.

Not only is the bond market telling, but the price of gold is signaling problems ahead for the Fed. . .

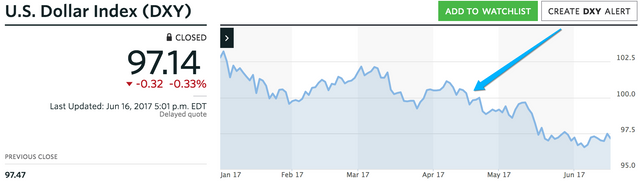

Gold has held up extremely well against a tightening Fed, slower growth, and a multi-year high dollar. The price of gold has bounced around the $1,250 range consistently. All while the dollar has been losing steam since hitting a near decade high in January.

The only asset class that is believing the Fed’s “economic recovery” pipe dream is the stock market. And stock investors are always the last to realize what is brewing under the economy.

Thats why stock markets collapse so suddenly. . .

… but remember the bond market takes a longer-term view of what’s going on. I think people are taking a longer-term view on our economy, our economy growth, and where they think policy’s going – said Gary Cohn, Former Goldman Sachs President and Trump Economic Adviser, in an interview with Jim Cramer.

Gold and bond investors are diverging from the euphoric stock investors and the Fed. They are taking the longer-term view that rates will go back down to zero.

Maybe even lower. . .

I wrote a detailed piece of the recent dismal data thats going unnoticed by many. I find the data compelling enough that the U.S. consumption based economy is imploding. The year-over-year growth has collapsed for auto, real-estate, and commercial industrial loans. This tells us that debt fueled consumption is slowing dramatically.

And the inverting yield curves back that up. . .

II. Gold Mining ETF’s Recent Crash is Actually a Gift in Disguise

April saw a huge crash in gold mining shares, for no apparent reason. Gold has held up well and the USD has declined.

What caused this divergence between the mining indexes and the actual price of gold?

It was the April 12th announcement that the GDXJ was to be rebalanced.

GLD (orange) vs. GDX (blue) vs. GDXJ (red) – Note the significant divergence since mid-April (white box)

By May 4th, the GDX was down -17% against the GLD. And the GDXJ faired much worse, down almost -26% against the GLD. . .

Contrary to what many think, this was a bullish sign. The GDXJ has endured a problem that was caused by its own success. . .

An abundance of capital has flowed into the GDXJ from bullish investors. And they haven’t been able to place it all within the mandated sphere of stocks it can invest in. Index funds cannot own a certain over a certain amount of a company’s shares without triggering takeover regulations.

Demand has been overwhelming enough that it has run into the danger of owning too much blocks of mining company shares.

And it has already hit the threshold for many companies. . .

“This is the curse of success,” said Sameer Samana, a St. Louis-based global quantitative strategist at Wells Fargo Investment Institute, which oversees $1.8 trillion. “They’re starting to run into issues of how much they own in certain names, how many names qualify for the index and they’re running into issues of how big the fund has gotten.” – wrote Bloomberg

Observe how ugly that drop was, and still relatively is. Interestingly enough this was during a time that the gold price has kept steady.

The last time the GDXJ was battered like this (end of December 2016), it rallied back quickly and fiercely.

This has opened up incredible opportunities for investors. None of these gold mining stocks had any fundamental problems which caused their prices to collapse. It was all from forced selling by an index fund. Therefore these prices are artificially low.

Paradoxically though, the short-term weakness created by the GDXJ rebalance may actually represent a buying opportunity for canny investors, since all this downward pressure has very little to do with fundamentals – wrote Alastair Ford of ProactiveInvestors.

Chances are, since this rebalancing talk started in April, that the market has already priced all this in.

Thus anymore downside is shallow.

III. Always Seize the Opportunity

These type of special situations are what offer prudent investors asymmetric, low risk-high reward, gains.

As the yield curve begins to invert and bond markets lose confidence in the Fed, a recession becomes imminent as history shows. The U.S. Dollar is also losing momentum, even as the Fed hikes. The USD Index is down more than 5% since beginning of the year. Since the end of April the dollar has been progressively declining.

Fed will reverse their tightening once the economy slides into recession. They will, in fact, begin ample easing and stimulus. And gold will soar as they do whatever they can to get inflation back.

A GDXJ rebalancing is the situation investors must take advantage of. High quality companies can be purchased at a discount from being sold off in a quick liquidation.

Wouldn’t it be great to go to Abercrombie & Fitch and take advantage of a huge sale they’re having, simply because they are being forced to liquidate clothes to rebalance their inventory? It doesn’t mean there is anything wrong with the clothes. Simply a spacing issue.

This is exactly whats going on with the GDXJ stocks. Nothing wrong with the companies fundamentals or assets. Just an ETF spacing issue.

Make sure to do research and have the best gold stocks for when the tide turns.

Reposted from my blog

https://lonewolf.liberty.me