What is Dollar-Cost Averaging? Millenials get on Board!

What is Dollar-Cost Averaging? Millenials get on Board!

Dollar-cost averaging is the capability that allows you to invest over time what you can afford. You invest a set amount of money each month. Let’s say you have $50 available to invest monthly, you can buy $50 worth of stock on a set day of the month.

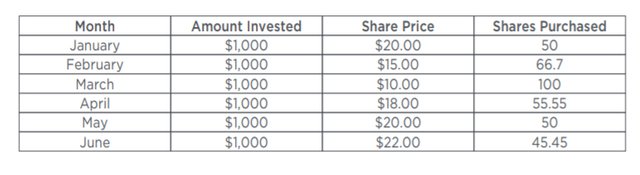

This Chart gives you an idea.

Here is another example.

Over time, your consistent investment will build up. You can usually buy partial shares, so your entire investment (minus any fees charged) goes toward building your portfolio. Your investment amount remains steady, but the number of shares you purchase changes depending on stock price. So, if you have $50 buying shares at $25 a piece one month, you receive two shares. However, if shares drop in price to $12.50, you will receive four shares. (I know that is drastic, but just used to explain the example).

Your investment purchases more shares when the market is down, and when the market is up your investment purchases fewer shares. The theory is that over the years your investment averages out so that you are paying an “average” amount for your stocks.

Back in the day, brokers would automatically deduct a specified amount of money from your bank account each month, and then use that money to automatically purchase shares of your preferred investment. Of course after broker’s fees you are not putting the full amount into the stock.

This is so much easier to do nowadays due to technology and phone apps. You can simply do it from the palm of your hand, with such apps as Robinhood.

How Dollar-Cost Averaging Helps You

One great thing about dollar-cost averaging is that it allows you get started investing with a relatively small amount of money. You can add more to your investment dollars as it comes available to you..

Another great thing about automated dollar-cost averaging is that you are always building your portfolio. Each month you know that your portfolio size is growing. With time, the longer you invest consistently, your portfolio will grow to a substantial size.

One downside to dollar-cost averaging, when you use an automatic investment plan, the number of shares you buy is determined by the price on a set day of the month, you might miss out on a chance to scoop up an extra share or two depending on the share price that day.

Overall the impact of missed buying opportunities is offset by the benefits of regular investing. When possible keep extra funds available for buying extra shares when opportunities come about and you have the time to watch the market a bit more closely for those buying opportunities .

Start your stock portfolio now with the Robinhood App.

Click on the link and you will get a free stock to start up your portfolio after opening an account.

http://bit.ly/freestockrobinhoodapp

This is not to be considered as investment advice. For information only. When doing any type of investing you should do your own due diligence and research before putting money into any investment vehicle.