Société Générale Publishes Math Implying A 70% Crash If Bond Yields Hit 5%

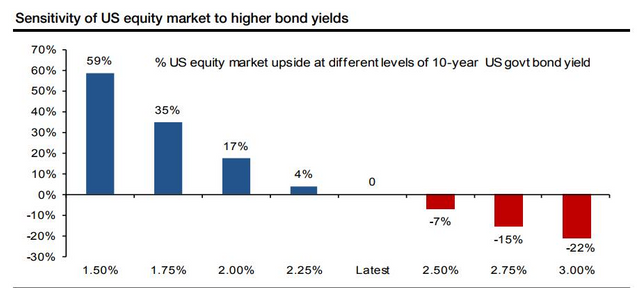

The following chart is taken from Société Générale's research into the sensitivity of US equities to a higher interest rate environment. Specifically, with respect to the rate on US government treasuries.

So just take that on board for a moment.... the implication here is that equity markets are nowhere near ready for interest rate normalisation and, on the contrary, are very sensitive to this.

As interest rates rise, yields are rising. In fact the flagship US 10 Year Treasury yield recently broke a long-term downward channel - exceeding the 3% mark.

According to the Société Générale paper, a 3% bond yield correlates to a possible 22% crash.

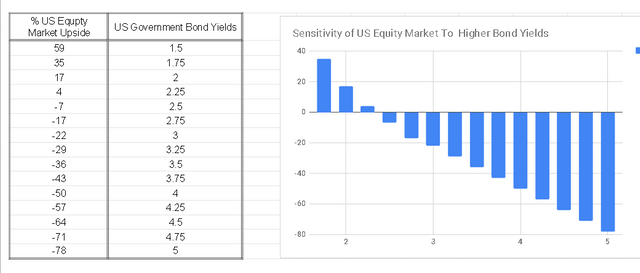

What's interesting about their paper is that the severity of an equity crash increases by 7% for every unit of 0.25% gained by rising bond yields.

We can thus extrapolate upwards from there.

And thus a 5% bond yield equates to a possible 78% correction in the US equity markets.

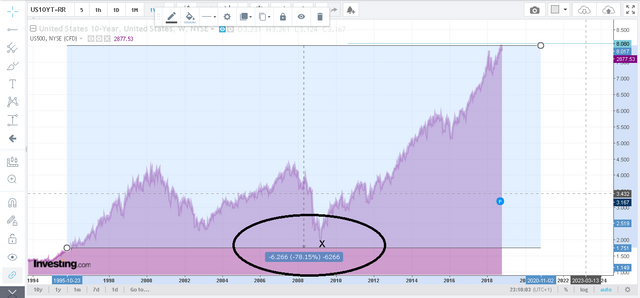

Even more interestingly, a 78% collapse would seem to take us right back to the traditional support point of the S&P500

Coincidence? Decide for yourself.

However we can use this as a guide for how to prep shorts against US equities.

For instance, by using the applicable 10 Year Treasury rate at any given time, we can judge how deep we should expect a possible correction to be.

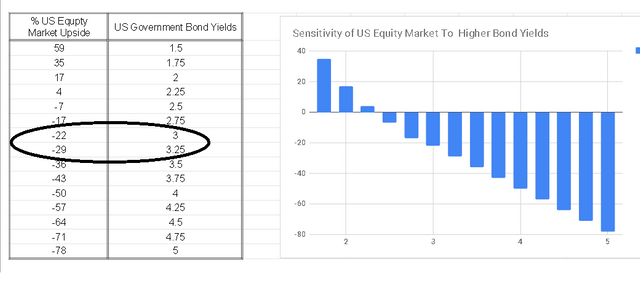

As we're at roughly 3.1% as of today, then if there was a serious stock collapse, then this would translate to around a 20-30% writedown in prices according to the math here.

And of course the writedown severity rises in line with bond yields on the Flagship 10y Treasury (which of course means the rest of the market is rising with it).

Now interestingly, a recent forecast by JP Morgan head honcho, Jaime Dimon, says that he would not be surprised to see a 5% treasury yield in the near future.

So factor all this in, and make your own mind up on where we're going with the bond market, and in turn the downside present in the US equity market.

Congratulations @intellivestor! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board of Honor

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard:

This is a one-time notice from SCHOOL OF MINNOWS, a free value added service on steem.

Getting started on steem can be super hard on these social platforms 😪 but luckily there is some communities that help support the little guy 😊, you might like school of minnows, we join forces with lots of other small accounts to help each other grow!

Finally a good curation trail that helps its users achieve rapid growth, its fun on a bun! check it out. https://plug.sh/somlanding/