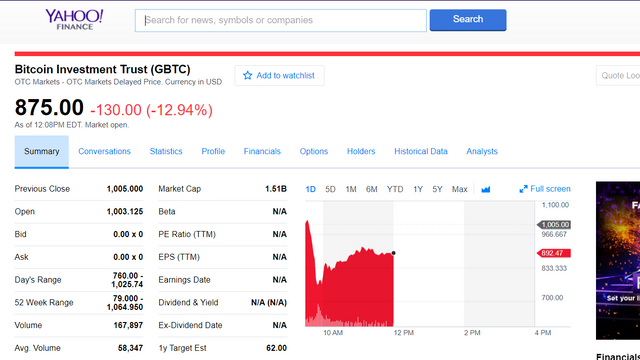

Do not buy GBTC

Buying GBTC at current prices is a recipe for disaster.

GBTC is a Bitcoin Investment Trust traded on the OTC markets in the U.S.

On first glance that sounds like a great way to gain exposure to the cryptocurrency industry via more traditional investment vehicles.

One doesn't have to go through Coinbase, Poloniex, Bittrex, or any one of the large number of exchanges out there that seem to get hacked or have security issues almost weekly.

Sounds great on the surface, but what is GBTC?

GBTC is a Bitcoin investment trust, created in 2015, it was the first publicly traded investment vehicle of it's kind.

It buys and holds Bitcoins giving investors the option of buying the fund instead of the buying the underlying asset directly.

It is one of the few legitimate options like this out there.

Since it is a trust, purchases and sales can only happen 1 time per day, at the close. Not at market prices during the day like a stock.

That is where an ETF hoped to find it's niche, but that is a story for another day.

What is the problem?

The problem with buying GBTC has nothing to do with it's underlying fundamentals, but instead, the problem lies solely with its price.

Currently GBTC has 174,174 Bitcoins, which equates to roughly an $836 Million dollar valuation.

That is a problem when the current market cap of GBTC is roughly $1.5 Billion USD.

That means that GBTC is currently trading for roughly 2X it's current asset value.

There are likely many reasons for this, but the big take away should be that GBTC is trading at an unsustainable valuation currently.

What does this mean?

This means that Bitcoin would need to double in price to catch up to GBTC's current price.

The more likely scenario will be that when the popularity around Bitcoin dies down or when more similar investment vehicles come to market the price will drift back towards it's actual net asset value.

Which would be roughly a 50% haircut from current levels.

That means that anyone buying GBTC currently is buying an asset that is trading for 2X its market value.

Nothing good can come of that investment strategy...

Stay informed my friends.

Sources:

Image Sources:

https://depositphotos.com/16792605/stock-photo-warning-sign.html

http://raamsjablonen-halloween.vindhier.com/

Follow me: @jrcornel

Thanks a bunch for the heads-up! This is going to be valuable help to many.

I guess, from here, it would be very resourceful for us all to become more aware of ways to ramp up onto the cryto-currency train. Do you have any quick and fairly easy solutions to that. For example, if someone has $10K, how can they move it from fiat to Steem for instance?

Thanks again for your quality work and precision, it is appreciated. Namaste :)

Come to Woldwide bittrex pump group

The power of the bittrex forces is strong

you can get good results

this place is real.

Earn 500% ~ 1500% weekly !!!!!

Join Telegram channels http://telegram.me/DvaPump

세계인구를 모아 비트렉스 사이트 대상으로 펌핑작업 하고있습니다.

우리의 세력힘은 정말 강합니다.

그렇기때문에 당신은 좋은 결과가 올수밖에없습니다.

발빠르게 움직이면 보다더 많이 수익 얻을수있습니다.

못믿으시나요? 참여 안하셔도되니 관망만 해보세요^^

법적 규제가 심해지기전에 참여하시어 많이벌고가세요~

텔레그램 설치하고 들어오세요. http://telegram.me/DvaPump

Thanks for the tip. Namaste ;)

Great post, I agree we should stay away from GBTC. I would rather invest directly in Bitcoin and have ownership of it instead of investing in a trust.

http://www.FlippyCoin.com is the #1 Cryptocurrency Exchange!

I recommend to stay with Crypto Currencies with the Highest Volume, that prevents Wales from pumping or dumping the price. Compare Crypto Volume here: https://coinmarketcap.com/

Look at BTC, everyday is a new record high and if you have some spare BTC you can earn 28% interest on Bitbond. Check out my Listing here: https://www.bitbond.com/listings/4CE0AZF7BH/?a=4BYBSNF4FN

thank you for the warning

Also, what happens if the Coin ETF is approved in the US? GBTC would crash hard short term. regards

Yep, I think so as well. A 50% haircut is likely in the cards for this one in the near future...

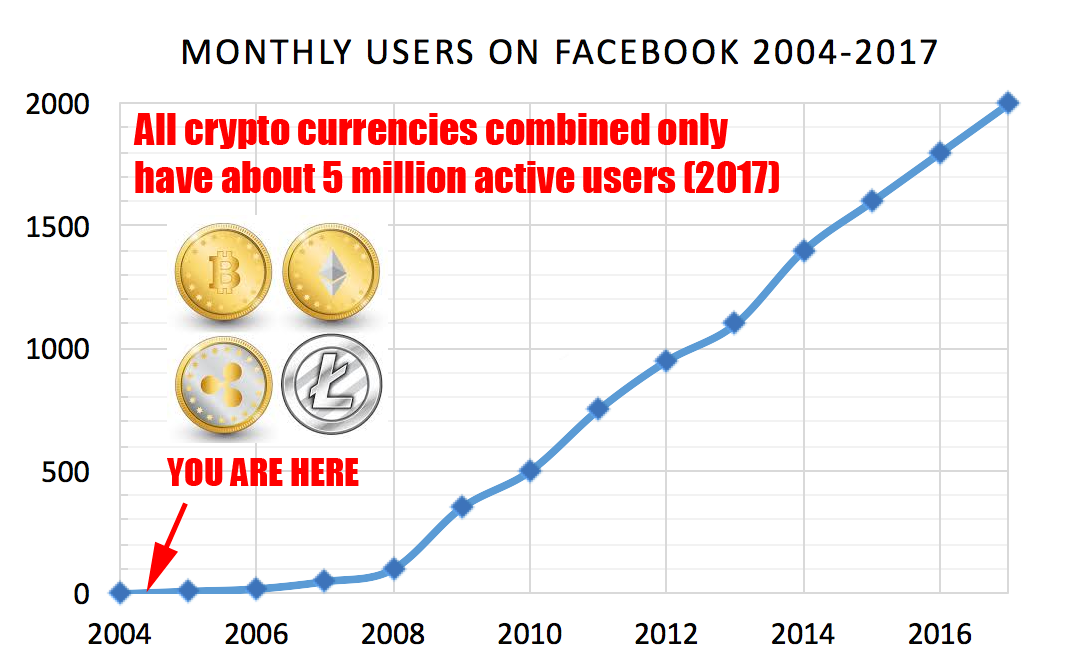

Still, for people with a strong hand, thinking of the long term, it still is a good option as long as they don't panic sell in the next drop. This is why I say so:

https://steemit.com/bitcoin/@cryptoeagle/cryptocurrency-wallet-users-vs-facebook-users-where-are-we-now-making-the-case-for-the-million-dollar-coin

Thank you very much for this great post, it was informative and really interesting.

I was not aware that such big price differences were even possible in the free market. I always assumed that margin trading bots would close those inefficiencies within fractions of a second.

Is there any information out there why this find is so extremely overvalued? Is it because "old-school" traders don't understand crypto? I hardly believe that, it is not that difficult xD.

Maybe it has to do with the way the fund is only traded in market close, but I still can't wrap my mind around how this would change anything. If someone can help me understand this, feel free to comment.

Thanks for sharing your thoughts in the GBTC investment danger...your analysis is very good as it makes no mathematical sense to invest in an asset that is highly over valued. Thanks for sending out the warnings.

Yes. I think for most it is easier to buy this trust (and possibly safer in their eyes) then to go out and create a coinbase account etc, and buy the asset directly. I can't wait till there is an ETF for this stuff...

Good point, I agree with you.

GBTC is the first steps to the BIT (Bitcoin Investment Trust) ETF, currently with filling for NASDAQ. OTC markets have less liquidity and participants than a main Stock Exchange. There are administration fees. The high demand by the limited players on the OTC market pushes the prices to a premium. When it becomes an ETF this will get balanced by ETF creations and cancellations (redemptions) for and with the underlying asset, Bitcoin. If you are an investor that need to got through a regulated market, or a regulated asset manager this is one of the few options. Rule for the pricing is determined transparently in the prospectus and there is a voluntary agreement from investors to buy/sell at this prices.

Yes and when these others become available, I would imagine the premium will be sucked right out of it. That is kind of my point in all of this. At this stage I would say the premium is much more likely to decrease from these levels going forward than it is to increase...

Good advice. I hold the following: BTC, ETH, LTC, DASH, MONERO, SBD, STEEM, gold, silver, lead, cash, no debts, BTSC, BITCF (woopsie daisy on them!), THMG, KNTNF, SING, GOHE and a regional bond fund (job matches 1 percent contribution fully), a few 529s (regularly rolled out with penalty for stacking).....thoughts on all that? I don't trust anyone but myself to manage it, but it eats up a lot of time. And most 457/529/401 etc are just scams like the pyramid scheme crap everyone tries to peddle.

Looks good, just be careful with any of the OTC crypto related stocks. As you can see with BITCF, they are mostly just trying to make a quick buck off the hype around Bitcoin etc.

Aye, aye! Thank you kindly!

I think BTC going to 5000$, may be tomorrow?It great opportunity don't lose it, on bitmex you can trade bitcoin contract features a high leverage of up to 100x.Users who have signed up with my affiliate link will receive a 10% fee discount, -0.025% (Maker) 0.075% (Taker).

https://www.bitmex.com/register/HJfZyC

It simple, try it now!

Awesome write up, simple info a lot of people might miss.

In general it's also high risk to invest in cryptos, and i bet as long as bitcoin and other cryptos are going for the moon - then some people are willing to take a chance with GBTC . Buying cryptos and stock can never be guaranteed - so my advice is, don't ever invest more than you are willing to loose.. :) High risk, potential high reward :P. But anyways great article, and it good with some insight - thanks.