Short-term Thoughts on AAPL

This analysis is based on the assumptions that the market is currently in a downward trend approaching a possible correction territory. As of December 13, 2018, the market is experiencing about a 12% drop from the all time high of the S&P 500 at 2940 points. This can be related to mid-February of 2018 in which the market dropped near 12% from then all-time highs from the news of tariff talks between the US and China. The current situation is similar in that the lack of tariff negotiation along with the running out of company Earning beats are putting downward pressure on the market once again. Overall, we should still see earnings beats till the end of 2018 and into mid-2019, and with the help of tariff negotiations panning out I believe that we will come to a short-term correction zone. It is my opinion that the US markets still have room to go down with the likelihood of a squeeze upward once the S&P reaches 2530 points (based on Fibonacci retracements).

The outlook for this analysis is a 1-3-month trade on AAPL not investment. It is my opinion that the S&P is near the distribution phase (consolidation at the top) of the market cycle and will retest its previous high and possibly make a new all-time high near SPX approaching 3000 points. From there on it is my opinion that the market will enter a bear market, timing assumption is that this will occur near the middle of 2019.

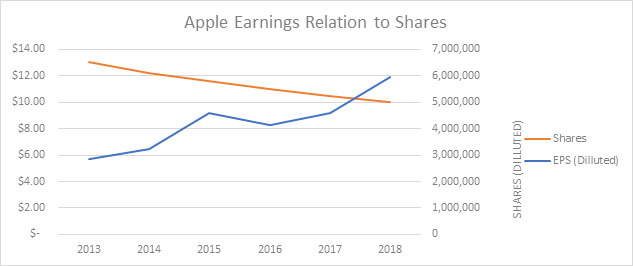

Why I am interested in current Apple Stock is that over the period of 5 years the company has been repurchasing stock partially enabled by the tax-cuts given to corporations and this provides artificial inflation of its Earnings. Apple is not the only company which has done this. Overall many Stocks have been beating earnings through the decreasing of shares outstanding, which is due to the increase in stock repurchases in the past two years. I believe in a trading aspect (not investing) there is opportunity for short term swing trades. A wait and see (or buy put options) till AAPL reaches a target price of $145 (based on a 61.8% Fibonacci retracement from all time high of $233 and prior P/E ratios of the past 5 years).

Closer look at Apple:

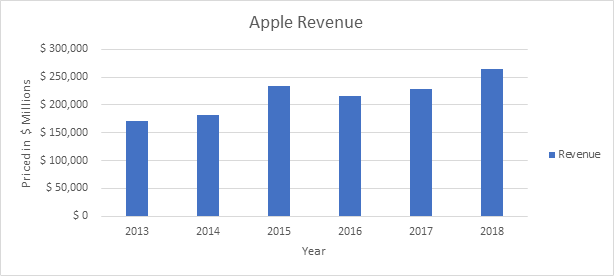

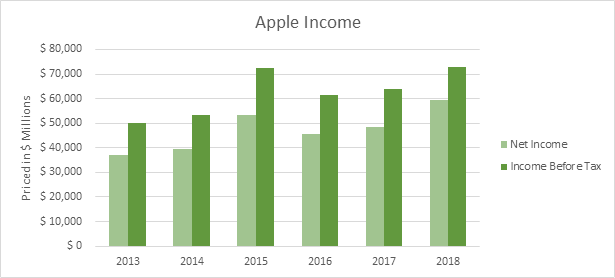

Apple has gone through a transformation over the recent years in how it is looked at in terms of investing. What once used to be considered a high growth tech stock now looks like a traditional blue-chip stock (still having room for growth). Dividends is expected, and the company takes up near 4% of the S&P 500. Below is a couple of graphs which show Apples revenue along with income before and after tax.

The graphs above show that Apple over the past 5 years have a solid uptrend in revenue making for larger net income as well. What stands out is the increase in retained net income due to larger tax cuts provided by the Trump administration. The outlier of the data is the year 2015 in which the overall market had some disruption primarily caused by China’s Shanghai composite market collapsing near 50%. After the global markets were able to gain traction again Apple continued it’s growth. Something to take note is the closing of the gap in between net income before and after taxes. Because of tax-cuts that went into play near beginning of 2018 large corporations were able to retain more of their earnings. Below is a graph which shows how the tax-cuts have impacted Apples net income.

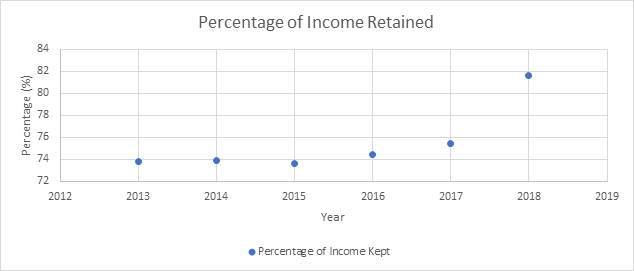

The figure above shows that Apple having a near constant income after tax from 2013-2017 hovering around 74% of its total income. In the year 2018 Apple was able to retain a little over 81% of its net income, saving near $4 billion in taxes. Along with this savings Apple has aggressively increased its stock repurchasing program. The graph below shows the affect of stock repurchases related to the drastic increase in Earnings per share.

The graph above shows the increase in EPS (Diluted) along with the decrease in shares outstanding (Diluted) for the time-frame of 2013-2018 (based on 10-K forms). The graph shows that Apple has been diligent in repurchasing its shares back which has a correlation to the earnings reports increasing over the years. The outlier in this graph is in the years 2015-2016 which can be related to the mini recession which China faced and had effect on Apples revenue since it does business in China. What can be seen from this trend is that due to stock repurchases shares are likely to see continuing growth once investors find that the stock is valued correctly, which my target is at $145 a share.

Why $145?

The reasoning for the price target of $145 is based on overall market conditions having downward pressure, Fibonacci retracement from all-time highs, and retracement to historical P/E ratios in which Apple showed consistent growth.

Fibonacci:

The graph above shows a potential 62% Fibonacci retracement looking over daily pricing data spanning from July 2016 till present. There looks to be strong support at $162 or 50% retracement, but I believe in the current market conditions it will break past that and approach the 62% retracement. It is my opinion this will occur mainly due to the current downward pressure in the overall US markets. Reasons for this pressure are due to the 3 expected interest rate hikes by the fed in 2019, the continuing bleeding of many global markets (China, Japan, Canada, Australia all down over 12% for 2018), and the plateau of earnings beats for 2018 coming to an end.

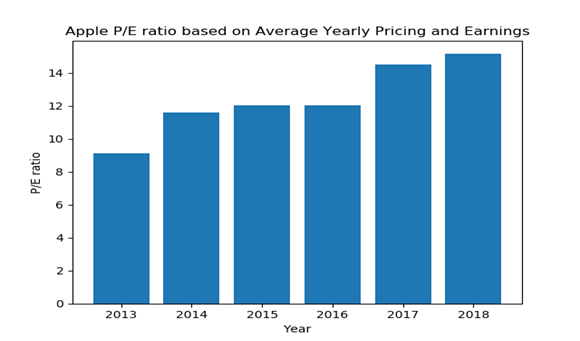

Historical P/E ratios:

Over the past 2 years Apple has had a drastic increase in P/E ratio ranging near 14 and has room to deflate a tad more to a point in which investors will see value in terms of investing (P/E multiple of 12). Since 2017 Apple has deviated from its average yearly P/E ratio of about 12 disregarding the year 2013. In the past 2 years alone, it has been overvalued at around 14-15 range when compared to the prior years when it was valued at a P/E multiple near 12 and had strong consistent growth. When calculating for a price at which Apple would have to be trading at to have a P/E multiple of 12 using the 2018 Earnings of $11.91, it shows that the price per share would be about $143. This strengthens the argument that investors are waiting to dive back into Apple when valued at a reasonable price, around $145.

Conclusion:

Overall, this is based on my opinion and analysis of Apple under current market conditions. I believe that the US markets will continue in its downtrend for a while longer (till end of 2018 at least) and have a nice bounce which will cause it to go into one more correction zone before it hits a bear market. I believe that Apple is in a good position to approach a price target of $145 in the near future where investors will find it to be a good value and are willing to buy.

Disclaimer:

(This analysis is all based on my opinion and is not meant for you to take action on, please do your own research and use this as material to support or deny your own analysis)

I currently have no positions in AAPL.

Works Cited:

All data obtained from AAPL 10-k forms filed to SEC and Yahoo Finance Pricing data

Congratulations @roobear541! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!