The Ultimate guide to becoming an INVESTOR

You don't need qualifications, a planet-sized-brain or even investing experience. All an investor ever does is invest in something that consistently makes money.

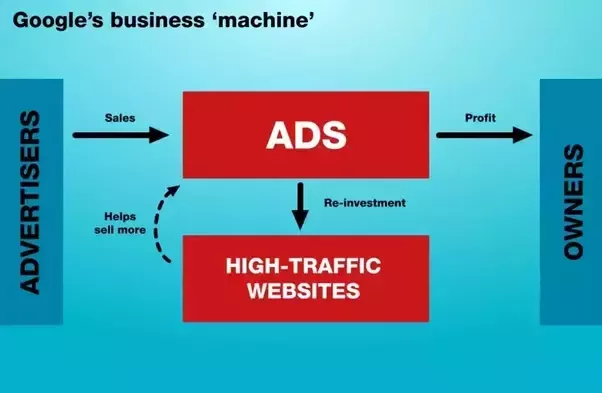

Think of a company as a machine you in which you would invest.The ‘machine’ always has certain parts. It sells something to someone and re-invests some of that to help make more sales in future. What’s left over is profit for the owners. Here’s Google:

If you can invest in such a machine, at the right time you can become very rich indeed. That doesn’t mean it’s easy, but most of the barriers that you think will stop you won’t. Interested?

Let’s talk about you

Are you young, poor, unqualified – a student, or hating your job? Maybe a touch rebellious?

Perfect.

You have no bad habits and will work until your fingernails fall out and your eyeballs roll onto the desk. The world awaits you.

Older, wiser, bit of money saved, experienced with a stable job? Maybe a mortgage and kids? Your job is much harder. It can be done, but it might feel like you’re trying to dance backward through quicksand.

The most important qualities of a good investor are he should be proactive learnerandpatience. It doesn't hurt to be persuasive, but this can be learned. I started as a shy uber-nerd aged 19; I soon learned how to invest when it was the only way.

Enough preamble. Let's make you a billionaire investor.

Certification

Please forget all of the terribly deluded nonsense you’ve heard about the value of certification. It is nothing but a very costly joke ; by itself, a certification is worth less than a half-eaten sandwich. At least you can eat the sandwich.

You do need a certification of course. But understand that even the most successful investors did not become successful because of those costly certifications. Remember Michael burry of the movie “The Big Short” he was a doctor by education and made his firm over a billion dollars in just one trade.

Certifications are overrated. What isn’t overrated is timing. Dr burry chose to short the real estate industry at the time it was the backbone of the economy – good luck trying to do that now .What you want, therefore, is an astute awareness of an investment that is currently underrepresented in the market. It’s usually easier to refine an existing strategy that isn’t fully realized than to create a wholly original one.

People fear to start to invest wherever the market is down, but market being low can be a good thing. The best time to invest the money is when the market is low. Many successful investors have ridden to success on the coattails of another – it is usually better to have some to look up to. You just need to learn fast.

I personally recommend trying to invest in something that you understand. You’ll know more about your field, you’ll understand the business, and you’ll be knowing the risk associated with the business. If you can make your investments about a why– not a what – you’ll inspire yourself and those around you. And to survive the next step, you need a fair sprinkle of inspiration:

Starting

Starting to invest is a bit like parenting; everyone assumes you know what you're doing, but investing don't come with instruction manuals. You stumble through it, learning as you go.

It's at the start where you're most likely to fail. Your aim is to be the next buffet, but you probably don't have all the parts and the ones that you need may cost more than you have. Your investment is probably at least half wrong too, but you won't know which half yet. All of this is normal.

Warren Buffett's first-ever stock purchase illustrates two very important principles of successful investing strategies: patience and the importance of timing,

At the ripe old age of 11, Warren Buffett went into the stock trading business with his sister, Doris, buying six shares of Cities Service, an oil service company, at $38 a share. Buffett had identified Cities as an undervalued stock and was confident of making a nice profit for himself and his sister. Unfortunately, the stock lost almost a third of its value within just a few weeks of Buffet purchasing it. Despite his sister haranguing him continually about their dwindling fortune, Warren held onto the stock until it rebounded to $40 a share when he closed the trade for a $2 per share profit. He then had the unpleasant experience of watching the stock rise to over $200 a share without him.

Patience is indeed a virtue for investors. Buffett exercised patience well in waiting for the market to come back in his favor, but he failed to be patient enough to take full advantage of the stock's profit potential. Having successfully weathered the storm, he failed to observe the adage, "Let profits run." Still, he did make a profit on his very first stock trade.

Why Most People Fail ?![]

( )

)

#1 Reason for failure ->Lack of knowledge

I constantly see people rise in life who are not the smartest, sometimes not even the most diligent, but they are learning machines.

They go to bed every night a little wiser than they were when they got up and boy does that help, particularly when you have a long run ahead of you

As I said at first , you don't need qualifications, a planet-sized-brain but what you will need and will help you is knowledge. Knowledge is what will make you truly a successful investor.

Where to get it ?

Want to know one habit ultra-successful people have in common?

They read. A lot.

#1 Resource for knowledge -> Books

Whether reading is already a way of life for you, or you’re just getting started, here are some book lists to consider:

Rich Dad Poor Dad - http://amzn.to/28ZHC2D

"Rich Dad, Poor Dad" is a must read for those looking to change their attitude about money and wealth also Rich gets richer and Poor gets poorer , want to know why ? This book will answer that.

THE INTELLIGENT INVESTOR - http://amzn.to/295jala

According to Buffett, reading The Intelligent Investor was the best decision he ever made in his career. No Doubt his net worth is close to $70 Billion

VALUE INVESTING AND BEHAVIORAL FINANCE - http://amzn.to/295jlgf

Parag Parikh is the master of investing, and he’s written a comprehensive book on how to be a successful value investor

SECURITY ANALYSIS - http://amzn.to/294pwTq

Security Analysis is an all-time best seller, and Warren Buffett has repeatedly praised his investment success and valuation skills to this book. This book is difficult to understand and highly recommended for advanced investors.

COMMON STOCKS AND UNCOMMON PROFITS - http://amzn.to/292fFw9

My investment philosophy evolved through the years - to be more quality based - this book was one of the main reasons that occurred.

THE 4-HOUR WORK WEEK: ESCAPE 9-5, LIVE ANYWHERE, AND JOIN THE NEW RICH - http://amzn.to/28ZHMai

This book has been a source of inspiration for me, as I know it has been for thousands of other entrepreneurs.

Some really important things to do

1)Don't invest emotionally

This is one of the hardest pieces of investment advice to follow. Many investors have the urge sell stocks when the market is down. Great Investors doesn’t, and that’s why they are great investors. To invest like them you have to ignore stock market cycles and put your emotions aside.

2)Never ever take a broker's advice

Investors want to believe in someone. Forecasters want to earn a nice living. One of those groups is going to get suckered. I think you know who.

And finally

It's never been easier to start to invest. You can become a killer investor, doesn't matter your student - that was enough for Me

I think Investing is a game of playing with the risk.Knowledge and patience are big factors, but luck plays a big part. However, as long as you can keep picking yourself up when you get knocked down, try different things and keep learning, the odds are in your favor. You just have to dare to chance them.

(By the way, did you enjoy this answer? If so, upvote alright? and don't forget to follow me)

Here are my other articles on cryptocurrencies users might be interested in-

https://steemit.com/steemit/@yash2212/what-s-the-best-cryptocurrency-to-invest-in-long-term-why

If you like the post don't forget to comment and follow me

Thank you, I enjoyed the read! :)

You're welcome. If you have any queries related to investing feel free to ask I'd be happy to help

Ready with the cart loaded, gonna buy them on Amazon Great Indian Sale.Thank You!