Black Stone Minerals: Trouble Ahead by Michael A. Gayed

Summary

- Black Stone drops in a bullish stock market.

- Despite a strong financial situation, the price dipped below the 2015 IPO price.

- Terminal impulsive move calls for even lower prices ahead.

- Looking for a helping hand in the market? Members of The Lead-Lag Report get exclusive ideas and guidance to navigate any climate. Get started today »

The extraction of oil, coal, and minerals brought, and still brings, a cost to the environment. - Bono

Bono's words have nothing to do with Black Stone Minerals (BSM), except to highlight some of the risks a company with a focus on the minerals and royalty business faces. Many other ones exist, contributing to the bearish article you're about to read.

From 1876, when it was established as a lumber company, to 2015, when it went public to become the largest publicly-traded mineral and royalty company in the United States, Black Stone evolved into a conglomerate owning properties and mineral rights in forty-one states in the continental USA. Since becoming public, its share price reached a high this 2019 of a little over $17 and now retraced well below the $19 IPO price in 2015 when it raised over $400 million at the low end of the range of $19 to $21.

Black Stone is very active in the acquisition and leasing of properties - only in the Q3 of 2019, it acquired $2.3 million of property in East Texas in an all-cash transaction. This is nothing compared with the $335 million acquisition of mineral and royalty assets from affiliates of Noble Energy (NYSE:NBL) in 2017. It used a combination of private placement (about $300 million) and cash to finance the acquisitions.

Black Stone knows very well that sometimes what lies underground is more valuable than lies on the ground. The term "mineral rights" refers to resources to extract from the subsurface of land, such as ore, oil, metal, and gas, but not limited to these ones.

What options does it have for its properties as a company owning oil, natural gas, and mineral interests? A few, we might say. One would be to exploit the properties on its own. Another is to sell the rights to someone else or sell the surface rights but retain the mineral rights. Finally, another option is to lease the mineral rights for royalties (profit shares from the mineral extracted). Black Stone's business takes advantage of all these options.

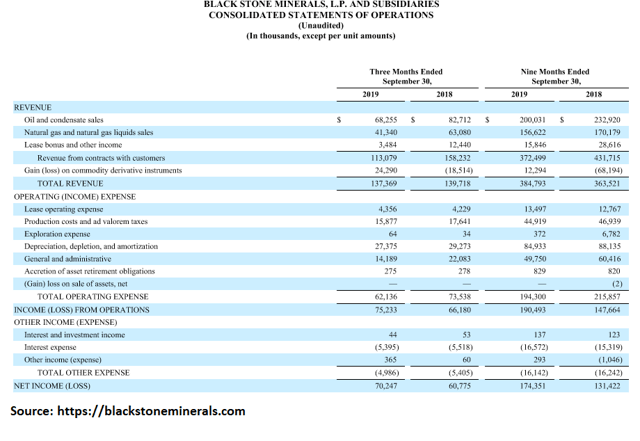

The company reported an adjusted EBITDA of $96.2 million for Q3 2019 and a net income of $70.2 million for the quarter, beating the 3 months and 9 months ended September 30, 2018.

...Read the Full Article On Michael A. Gayed's Blog on Seeking Alpha

Author Bio:

This article was written by Michael A. Gayed. An author on Seeking Alpha and founder of the Lead Lag Report.

Steem Account: @leadlagreport

Twitter Account: leadlagreport

Learn more about Michael A. Gayed on Seeking Alpha

Steem Account Status: Unclaimed

Are you Michael A. Gayed (a.k.a. leadlagreport)? If so, you have a Steem account that is unclaimed with pending cryptocurrency rewards sitting in it from your content. Your account was reserved by the Steemleo team and is receiving the rewards of all posts syndicated from your content on other sites.

If you want to claim this account and the rewards that it has been collecting, please contact the Steemleo team via twitter or discord to claim the account. You can also view the rewards currently sitting in the account by visiting the wallet page for this account.

What is Steemleo Content Syndication?

The Steemleo community is syndicating high-quality financial content from across the internet. We're also creating free Steem accounts for the authors of that content who have not yet discovered the Steem blockchain as a means to monetizing their content and we're listing those accounts as the 100% beneficiaries to all the rewards. If you want to learn more about Steemleo's content syndication strategy, click here.