"0.04% Of IRS Filers Reporting Bitcoin Gains FUD" - File For An Extension If You Need To

Regulars to my blog will attest to my lack of love for taxes, but I do always advise others that they should default to paying them in legally defensible method and only experiment at their own risk with "creative" accounting methods that the IRS may not be a huge fan of. Though I find US taxes onerous in both amount and form, I don't recommend "tax protest" as a form of political statement for the average bear.

Anyway, preamble aside, you are going to see headlines like this:

I consider this a form of FUD, basically, that's purpose is either click-bait reporting or attempting to paint cryptocurrency as lawless and its users as criminals.

Considering the epic meltdown of the Cryptomarket going into January, all your holds and trades were likely slaughtered unless you had the extreme prescience to know exactly when to cash out. Almost nobody took a 50% loss going into the end of December and then decided to liquidate, double-whammying themselves with a short-term trading income tax to boot. It just doesn't make sense.

These headlines might as well say "Only 0.04% Of Crypto Holders Predicted And Planned For Exact Date Of December Top."

Also, beware of the wash trading rule. It states (from memory...) that if you sell an asset, then buy it back within 30 days, you may not use those trades to set or adjust your cost basis for tax reporting purposes. No painting the tape with a loss and using your market timing skills to dodge the taxes. This is relevant for any crypto user trading into and out of their positions rapidly.

Remember, extensions are free and practically granted automatically. You will still need to pay any taxes owed by tomorrow, but if you are owed a refund, you can safely extend without further immediate action. If you need more time to sort these complexities out (preferably, with a newly motivated accountant with an empty entrance lobby after 4/17), then make sure to take it!

We also have a Radio Station! (click me)

...and a 10,000+ active user Discord Chat Server! (click me)

Sources: Google, IRS.gov, TurboTax, TacAct, Nolo.com, Cornell Tax Law Library

Copyright: SmartSteem, PALNet, SPL, Science Cartoons Plus, ZH, Facebook

I paid my taxes. I'm square!

Nice little intrest free loan given out!

It is expected that only few will pay taxes on their gains of bitcoin esp those individuals who are trading with it. But I think the exchanges will have no escape in paying taxes since they need to register their businesses in the government.

Overall agree with your message. I definitely agree this is fear, uncertainty and doubt - the media is citing a totally unrealistic statistic. A more realistic statistic is Coinbase IRS court case - 6% (800 returns reporting Bitcoin transactions versus 13,000 summoned). And that was before mainstream came into Bitcoin, so how can the number of filers be lower than it was for 2015?

Only tokens treated as securities are subject to wash sale. However it is the most conservative to assume the rule applies to all crypto as the IRS could release more guidance and retroactively apply it.

Also here is more information about extensions and estimating crypto taxes for the extension. Not shilling, this is a long expired post:

https://steemit.com/money/@cryptotax/need-additional-time-to-nail-down-crypto-taxes-file-an-extension

Curious what you mean by this. Isn't fungibility the basic thing you need for wash sale rules to apply? Why does security status (which is only ambiguously defined anyway) have anything to do with it?

Hi @biophil, hope this helps:

The "wash sale" rule applies to stock or securities by design of the Code Section (not just any item of property). Also, there are a certain rules that would apply only to cryptocurrencies that are deemed "securities" for purposes of the Internal Revenue Code. This could all change in the future when more guidance is issued, however I highlighted a few of these nuances in an old article: https://steemit.com/bitcoin/@cryptotax/tax-implications-of-trading-ico-tokens-impacts-to-2017-tax-season

I see, thanks. I'll take a look at the other article!

Come and get it IRS!

xD

The IRS should be abolished... what do they expect? They are purposely making it super hard for crypto hodlers and day traders alike.

Maybe if they just took a modest cut of whatever you cash out to fiat more people would report it? It looks like a nightmare the way they have it set up right now.

Im glad im holding for the long long term...the IRS is a joke! Needs to be torn down and rebuild from the ground up!

taxation on capital/investment gains is pure theft, plain and simple. The invested money has already been taxed when you got it (income tax) then it is being taxed again when gains are made. Not only that but you are taking all the risk and the government is getting a risk-free ride of all profits. And if you lose money, you are on your own, it's not even deductible (only $3000/yr in losses can be deducted). So the government taxes you twice and you do all the work and bear all the risk. And on top of all that, they waste the money left and right & line their pockets & the pockets of their cronies & corrupt friends. Pure theft, no different than the mafia/gangs...but at least gangsters put their life/freedom on the line, these guys are immune, it's all legal.

Oh, in that case feel free to ignore my other comment.

In my opinion, all gifts or other benefits should still pay taxes.

Taxation is theft.

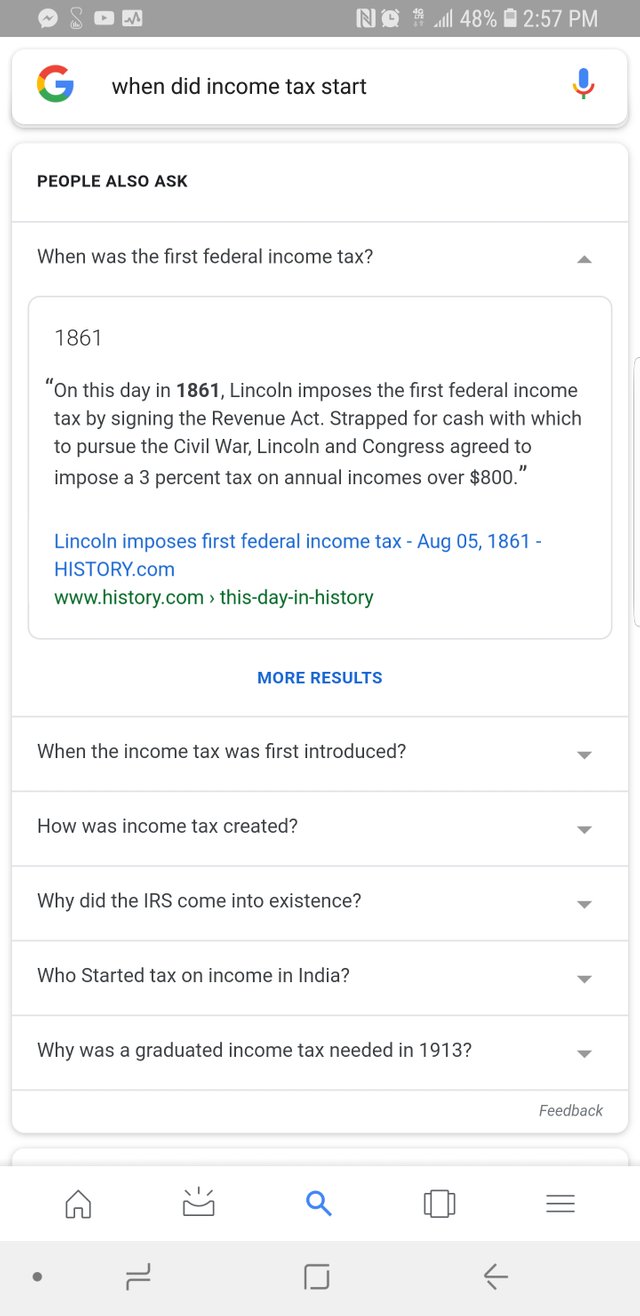

When will they abandon the income tax that was started to fund wars! Wars do no good. When has war benefited the human race??

Unless Coinbase and Binance work together and provide customers with detailed annual reports, I don't see how I could report any gains/losses *but even then, I don't see how its possible). When I covert ETH to an alt coin on Binance, it's not like a stock trade, there is no cash involved, no loss or gain...cash goes into the initial coinbase then goes to Binance and gets traded into various things and mixed together, and back to cash in the end, but I don't see a way to track gains or losses in any manner. What am I missing?

The basic idea, as I understand it and as most people seem to interpret it, is that every single trade is a potentially taxable event, and the basis/gain/loss is computed using the fair market value at the moment of the trade. Whether a transaction is taxable or not has nothing to do with whether the transaction involved fiat.

You sell 1 ETH for 1 TOKEN on Binance: you're exiting an ETH position and entering a TOKEN position. If you bought that 1 ETH for $50 and then it's worth $500 at the time you traded it for the 1 TOKEN, then you have a (roughly) $450 taxable gain.

Of course, I'm not a tax adviser and this isn't tax advice. Just trying to be a friendly helpful person.

Well, If you are cashing out then I see how you would have to play a little bit of cover-your-assets, but if you aren't cashing out, isn't it currently untraceable? I mean crypto is all about the values and anonymity, so if you are just collecting and storing, is it an honor based thing?