Valuing Steem Rewards As Taxable Income Is A Vast Overstatement Of Tax Liability - Part 3 - Powering Down - "Steem Power" Is Not a Tradeable Asset, It's a Proxy For Value Like A Stock Option

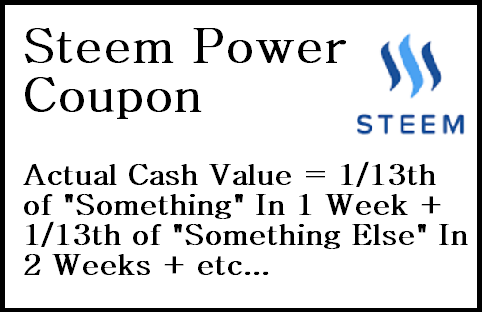

Steem Power literally has no immediate cash value. It can't be liquidated instantly. It's technically restricted such that you can only liquidate 1/13th, or about 7.6%, each week, starting with week 2. It's more like an unvested stock share or a coupon with no immediate cash value. You must wait 1 week to receive 1/13th of it, then 2 weeks to receive the second 1/13th, etc.

Therefore, Steem Power has no immediate liquidation price, and it is 100% incorrect to value it as income at the time of receipt at the current free market price. The IRS' own guidelines on employee stock options make that clear as well: "Taxation begins at the time of exercise." I would argue that for Steem Power, the "time of exercise" is Powering Down, and there are at least 13 "times of exercise", and that even if one wants to pay full income tax and maximize their tax liability on all their Steem Power earnings, they are likely still regularly overpaying their taxes.

This makes Steem Power different from most every stocks, bonds, physical assets and other forms of cryptocurrency. Even if we set aside the realities of the order book we discussed in part two here, and price Steem Power at the current Steem price, it simply is factually and mathematically not worth what the rewards payout says it is "at time of acquiring".

With Steem Power, I'd say the "time of exercise" is very clearly the moment at which your power down activates each week, resulting in you having an actual liquid and tradeable asset. This creates a situation whereby the burden of even correctly reporting ones taxes is almost too much to bear. When the bar for reporting one's taxes correctly becomes "You must be a Tax Lawyer, Accountant, Block-chain Technology Expert, Mathematician, and Logical Philosopher," we've reached the zone where compliance is ludicrous and almost any internally consistent reporting strategy will result in "good faith" clause protection.

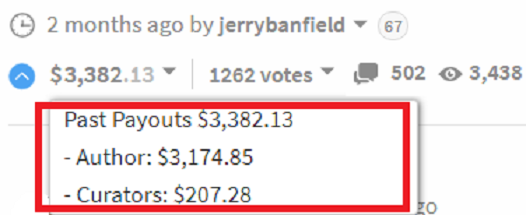

To illustrate the burdensome nature of attempting to value Steem Power, regardless of whether one intends to file it as income or not, I will calculate a hypothetical payout using a post from our positive friend, @jerrybanfield, whom is responsible for yours truly arriving here in the first place. We will be using the (soon to be shown fallacious) method of "valuing the reward payout at time of acquiring", thus temporarily conceding all arguments from part 1 and part 2.

For the sake of this post, we will assume this post was 100% powered-up (this actually simplifies the calculation process), but do note that this applies to all Steem Power rewards since half of the payout, at minimum, is always in Steem Power. Furthermore, I will be ignoring the curation cut, as this again simplifies our calculations.

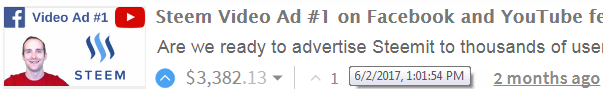

Here's our guinea pig post:

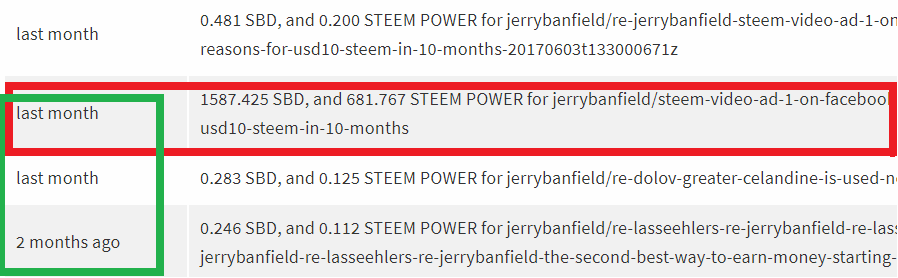

And the rewards:

And here's what Jerry is probably thinking of me right about now:

Jerry's post paid out rewards on approximately 6/9/17, as near as I can tell (without digging into the blockchain). That makes the approximate date of posting 6/2/17:

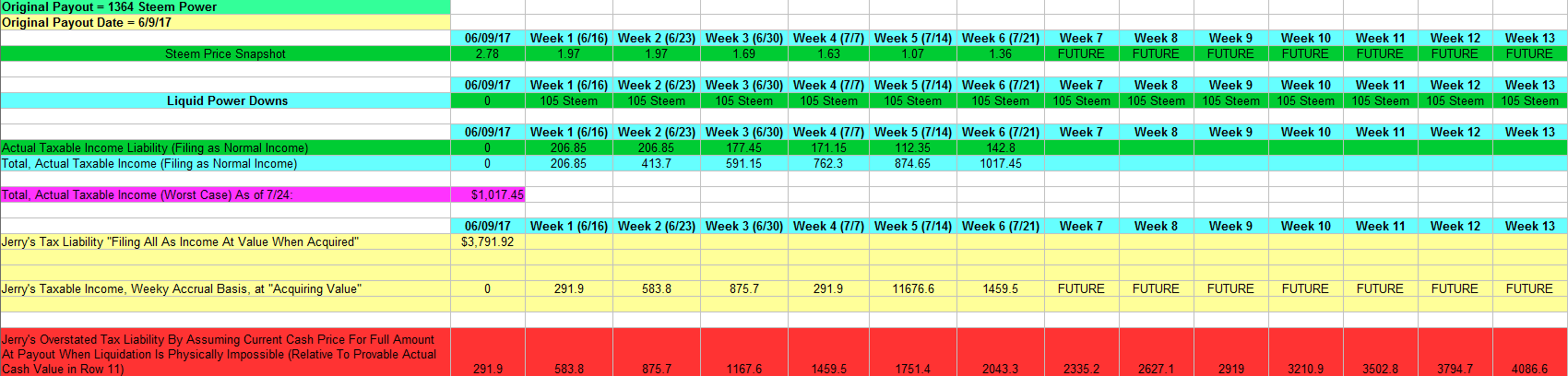

I doubled the Steem Power reward for this post and ignored the SBD, so we could assume a 100% powered up post (as noted above). This results in a payout of 1364 Steem. Using a Steem price from that day of $2.78, that results in a total payout of $3791.92. That's higher than the post tool-tip shows by $617 (+curation), likely due to different price snapshots on a volatile day, but the math will all work out. At the end, we will reduce our estimate of Jerry's overstated tax liability by 19.4% to account for this discrepancy. For the record, it's still possible after these adjustments that we will overestimate Jerry's over-payment. That's fine, we're not doing the man's 1040 here, we're illustrating overall concepts.

I will provide my work below, but for the sake of brevity, I will cut to the chase right now:

Using IRS-acceptable methods of determining tax liability that I believe would hold up to scrutiny, I was able to show that @JerryBanfield substantially overstated his tax liability. Further, this was done ignoring the arguments I put forth in parts 1 and 2 of this article series, and simply stipulating to a fact (that I do not agree with) that Steem Power rewards are regular taxable income. In other words, we deliberately avoided reducing our tax liability here and paid the maximum possible amount, like a "good tax-payer", and we STILL came in way lower than Jerry's (well-intentioned) math.

In his attempt to remain an upstanding citizen (and on the pain of the fear of imprisonment), Jerry's filing strategy under our assumptions came up with a taxable liability for this post totaling $3791.92 (less curation; post value discrepancy noted above). Since we can't hop in a DeLorean and get future price data, we are forced to look only up to the present time on an accrual basis. Jerry's strategy came up with a (pro-rated) taxable liability of $2043.3 (through week 6).

My strategy of accounting for the actual liquid value of the rewards once exercised (or even, exercisable), which I believe would pass IRS audit (except I didn't use 24h Steem price averages, just pulled snapshots), came up with a (pro-rated) taxable liability of $1017.5. That would mean that Jerry's accounting method overstated his tax liability by $2043.3 - $1017.5 = $1025.8.

Adjusting for that 19.4% overage we noted above, and I suspect that Jerry's accounting method has overstated his tax liability by slightly less than $825 so far, and we are less than halfway through his theoretical power-down period! This number could still double.

That's an 81.25% liability overstatement, an absolutely mammoth number! Some of that differential comes from valuing the rewards in the first week where they are not liquid, but even ignoring that, we are well over 50% overstated tax liability! Without knowing his tax bracket, Jerry could be paying upwards of 50% income tax on this post using his method, and I guarantee you the IRS isn't going to point out his error.

Further, I think you will all agree that this is an absolutely huge burden of tax calculation and no person can be expected to spend this kind of time attempting to determine their tax liability on every last post or comment they receive an award on. In fact, the reason I started constructing this series of posts in the first place was I watched 90 seconds of Jerry's tax filing video and immediately thought "Jesus, expecting anyone, but particularly creative types, to deal with this mess is a gross misuse of time and human resources."

I mean, look what I had to do to calculate half of one of Jerry's post's liability. This is half my day, shot, and it's not even totally accurate or been triple-checked yet:

@JerryBanfield , I hope some of this is useful to you going forward. You have 2 years from the time you have paid your taxes to file an amendment, so clearly every single Steemian still has over a year to figure this out for themselves. Everyone should find a tech-savvy accountant to run these suggestions by unless they are one themselves.

Stay tuned for part 4, where I hope to give my own take on a fair way to file one's Steemit taxes. Those that I haven't yet bored to tears will hear all about the excitement of "qualified dividends being taxed at the capital gains rate" and other potential filing options.

In a bonus part five, I hope to take questions and cover a few potential outside-the-box ideas for reducing tax liability that may not make it into part four. Island vacations and trust divulgments, oh my!

PS - The clever will have noticed that this phenomenon can work in reverse selling into a strong bull market. This is just one advantage that stock options have - you do not value them until they are exercised, and therefore, you choose when they become taxable by your own actions. That's why you don't pay the value of the stock options right when you get them, but when you exercise them.

IMPORTANT NOTE: I do not advise making tax decisions based on this post. The IRS is an unconstitutional organization that most closely resembles the authority of a fascist state. You don't want to be a trend-setter in this area. I expect that anyone attempting to justify large amounts of Steem Power earnings using these arguments will be bullied and potentially jailed. You must maintain a consistent tax reporting strategy that is internally logical and consistent if you wish to rely on the "good faith" clause to avoid penalties in the future:

"IRC 6664(c) provides a reasonable cause exception to the penalties under IRC 6662 and IRC 6663 where the taxpayer had reasonable cause and the taxpayer acted in good faith. The reasonable cause exception in IRC 6664(c) applies to all of the components of the accuracy-related penalty on underpayments and the fraud penalty, except for any portion of an underpayment that is attributable to one or more transactions lacking economic substance as described in IRC 6662(b)(6), or that is attributable to a gross valuation overstatement with respect to charitable deduction property. In addition, there are special reasonable cause rules outlined in IRC 6664(c)(3) for certain substantial valuation overstatements."

Tag @exyle, you're it!

IMPORTANT NOTE AGAIN: I AM NOT (CURRENTLY) A PRACTICING ACCOUNTANT OR ATTORNEY. YOUR TAXING AUTHORITY IS PRACTICALLY ABOVE THE LAW. PROCEED AT YOUR OWN RISK WITH ALL TAX LIABILITY REDUCTION STRATEGIES. DO NOT BE THE GUY IN JAIL BECAUSE SOME DUDE WHO PHOTOSHOPPED A POSTER OF MICHAEL J. FOX'S ONLY CLAIM TO FAME RANTED ABOUT TAXES TO YOU ON SOCIAL MEDIA. GEORGE TAKEI IS (STILL) NOT A LEGITIMATE SOURCE FOR TAXABLE INCOME CALCULATIONS.

Apologies for any math errors.

Copyright: Parker Brothers, Back To The Future, Jerry Banfield, UK NHS, 3rd Rock From The Sun

Sources: IRS Site, Wikipedia, Investopedia, Imgflip, A Bunch Of Education(tm)

Amazing series. Its been very fascinating trying to consider the tax implications.

Do you imagine SBD payouts were need to be considered income? What would you consider if they are used to buy Steem, which is then powered in to Steem Power?

Would that be a series of like-kind transfers after the initial SBD 'income'?

Followup question - want to help build a tool that tells any Steemian their tax liability given their blockchain data and the pricing of that time? At the surfae, it looks like a few lookups + IRS math.

fascinating, that criminal agency known as the IRS... #feelsGoodToSayThisWithoutOrwellianConcerns

Wow, great questions. I hope to delve into these more thoroughly in part 4.

"Do you imagine SBD payouts were need to be considered income?"

SBD payouts may be technically different enough to trigger different liability requirements. I personally buy SP not Steem via Blocktrades when I add to my Steemit account, because if that turns out to be an issue, I want to be on the right side of it. For those same reasons, I have considered moving all my posts to 100% power-up too, but haven't pulled the trigger there yet. I need to refresh myself on the exact wording of certain IRS regulations and do additional research before I forego the gambling on an SBD price increase.

"What would you consider if they are used to buy Steem, which is then powered in to Steem Power?"

Again, I fear the technical existence of this additional step (relative to powering up directly) may very well create a different legal reality.

I think the source of your SBD payout may be important in determining what type of income it is. Did your SBD payout come from hard work authoring, which may be arguably a form of income? Did your SBD payout come from self-voting, possibly making it some form of capital dividend paid to yourself?

I'm not entirely sure myself, and I am working on the research for these questions for part 4 now.

I think your tool is a great idea, however my programming is quite rusty so, technically speaking, I am not of much use. I don't think we could create a tool that would, for example, differentiate the two SBD situations I highlighted above. That would require subjective analysis or self-reporting. Correct me if I am wrong?

This would be a great idea to revisit if we have produced a viable tax reporting strategy by the end of part 5.

IF SteemIt is viewed as an Alternate Reality Game, then tax liability may arise when there's a Capital Asset Gain (Losses are another story). The only thing the tax payer really has to decide is if SteemIt usage is for business or a hobby.

https://www.irs.gov/businesses/small-businesses-self-employed/tax-consequences-of-virtual-world-transactions

https://www.irs.gov/uac/is-your-hobby-a-for-profit-endeavor

So here's my non math view on the taxes. :) Since it is a de-centralized currency, it should not be taxable by any means, unless and until it is exchanged for a centralized currency, such as cash. At this point, you deduct the total original cash investment for the tax period (which the bank used will have a record of as well) and any additional crypto being cashed out would be taxable as income.

To be either calculated once per quarter, just like all other taxes, or once per year for non business.

Steem, should not be taxable at all. One cannot directly exchange steem for dollars, it has to go through an exchange into a second crypto, and then be exchanged again for dollars.

The Fed should only concern themselves with the last exchange that can directly be measured, money in, money out.

“Should” is rather irrelevant, when it comes down to the matter of what regulations are. I agree with you 100% that such would be ideal, though doubt the “should” argument would ever hold up in an audit.

Haha, you are right of course...'should' making it my opinion, not fact...but I do believe that is how it Should work... :)

I appreciate your comment, and I think you are mostly on the right track.

"To be either calculated once per quarter, just like all other taxes, or once per year for non business."

This is an important point. Currently, in the US, if you hold an asset under a year, it's regular income - like a day trader. You pay income tax in your normal bracket.

If you hold it more than a year, then it is capital gains. This is taxed at a substantially lower rate.

Generally speaking, there may need to be some allowance for different time horizons in whatever final taxing strategy is employed.

"The Fed "

I know you probably mean .gov here, but I'm still going to take this opportunity to say "Boo non-Federal-Federal Reserve, Boo".

I missed your reply before :O

Ahh, I didn't know that about capitol gains. I am a little person who has done retail for years and never owned anything, traded, or held assets. I think you are correct about different time horizons though. I can see where it could get messy.

I just feel like it is not an asset until you hold it in your hand...until then it is a promise of an asset, and should only be taxed at the point of entry into tangible asset. They way it is done, all forms of currency are taxed over and over and over...and then when you die they tax it again.

Yes, I meant Gov... :) (though it all goes to the Fed in the end...we should Tax them on that..does the Fed Reserve even pay tax on the money that they create, and all they collect?)

@lexiconical you're getting better and better at these tax descriptions.

I was 100% conscious all the way through and don't even need to summarize to see if I understood it.

I bet it warms the cockles of your heart to hear that.

I'm almost inspired to start a chorus of "Yes we have a friend in

JesusJerry".Jerry makes a great example because he's so transparent with his earnings and tax strategy, and also because he is earning a lot of what looks closer to arguable income, as opposed to being more of a capital investor only. I've never actually spoken with him outside Steemit.

He also works hard to reply to everyone that he can and is a friendly guy, though. I don't mind trying to help him, but I think the real value is in helping all of Steemit by proxy. Jerry is just an example of the worst victim of some current potential interpretations of the tax code. He's hit harder by this due to his reward sizes and lack of other day job to pay the bills (to avoid powering down). He's exactly the type of target the IRS will try to bully into overpaying, and most in need of a rock-solid tax strategy.

Which, to be clear, we have not arrived anywhere near to yet.

I've seen lots of internet marketing types over the last 7 or 8 years. I understand that kind of persona is what sells informational products, but I don't really pay attention to Jerry.

I've got a strategy in mind & I think it's along the same lines you seem to be heading towards with Capital gains & value at time of exercise.

I think you could get different answers right now depending on who you ask at the IRS too so them being 10 years behind doesn't help either. I will admit that in the past when I've had interactions with IRS & ATF people, they've been really helpful in answering questions and offering advice on how to address situations. Then again, I was the one who contacted them and I was very polite & courteous.

Thank goodness for the "Good Faith" clause.

"I've seen lots of internet marketing types over the last 7 or 8 years."

I can't say that this is my area of expertise. I came across Jerry's video explaining Steem and Steemit on Youtube while looking up unrelated cryptocurrency videos.

I have a lot more I could say on the topic, but I'd veer far afield.

Honestly, with something like Steem Power, I doubt anyone at the IRS could give you an accurate answer without stopping to do their own research - which is, ultimately, what I'm trying to do in these posts.

I think your research is putting anyone who reads it light years ahead of the IRS.

This is a great point. I appreciate the reminder.

I’ve been super stressed regarding these matters. Though as I just moved back to Canada this year - I had to call the CRA (Canadian IRS equivalent) to notify them I was back after 5 years as a non-resident, and despite the stress I had about even just making the call, the guy I spoke to seemed very nice and helpful.

I’m grateful for your pointing this out in the midst of all the antagonism towards the government to refocus on the fact that the actual people working at the CRA/IRS may not be bad guys after all - relieves some of the worry about possible audits, knowing it could happen with employees who are there to serve pleasantly as that guy on the phone did. :-)

Excellent posts. I would like to hear your explanation of a Steem to Bitcoin to Fiat currency. Are two tax liabilities incurred?

Well, with taxes, it always "depends".

But the short answer is yes. You have a taxable gain on capital assets you hold (if you hold them over 1 year). Your cost basis is the value when you bought it, and the price when you sell it will hopefully be more. You will owe capital gains tax on the difference.

Technically, a 3 part trade like you mentioned usually takes place well in under 1 year-per-step, and would be subject to regular income tax like day-trading. However, you probably bought and sold at almost the same price, and have little to no taxable gain. Thus, though it is a taxable event, it probably only generated a few pennies worth of liability. Nobody monitors this sort of thing, and you are protected under the good faith clause from this sort of under-reporting.

Now, if you made a substantial gain at any point in the process, you probably have a taxable gain of some sort. However, this is the wild west for now, and we're all sort of guessing a bit. The IRS has been asked to clarify some of its crypto stances, but I suspect they don't have the requisite research or understanding to do so yet. Plus, not all crypto are the same (Steem Power is noticeably different), so a one-size-fits-all strategy is not a great idea.

Thanks. You are a great asset to this community.

@lexiconical I am honored you used my top paying post as an example on here! Yes the Facebook and Google ads I am running for this post are all tax deductible meaning the income from this really ends up being about $0 net with what I got paid and what I spent.

Even after reading your post, I still am sticking with calculating the full liability because as long as I am based in the US, the most conservative approach is the wisest for me to face an audit successfully. A conservative approach of just putting in the reward value on the day I redeem them is also easy to do while what you shared here appears to take more effort to actually keep track of.

You are right that Steem Power received is not immediately tradable but receiving a stock might fit the same conditions. For example, I might get stocks given to me that I technically could not trade until several days later because of weekends and or holidays. As far as I know I would still have to put in the value on the day I received it and then I would be well within my rights to sell that for a different value and make up any difference with capital gains or losses.

If I want to minimize my tax liability, I think the best way would be for me to move to another country. Without doing that, I might as well pay the most I can stand to and then live free of the fear of any audit!

@Jerrybanfield

This is part of why I wrote this post:

"As far as I know I would still have to put in the value on the day I received it and then I would be well within my rights to sell that for a different value and make up any difference with capital gains or losses."

This is not correct. That was the point of me writing this post about (to) you.

"Taxation begins at the time of exercise."

Steem Power and Steem Rewards are not valued until the time of exercise.

Everything I suggested in this post comes directly from the IRS guidelines for valuing stock and asset options.

The whole point of this post was that I recalculated your tax liability using the IRS own guidelines and found it to be much lower.

"I might as well pay the most I can stand to and then live free of the fear of any audit"

You are voluntarily overpaying your taxes. This is a fear-based strategy.

I am not suggesting anything that (should) get you audited, but anyone can be audited.

This, I assume, you are meaning at the time of Power Down - in the case of receiving a 100% Powerup of rewards...

So essentially, you’d need a method of tracking every single rewards payout in Steem Power - and then a protocol to determine what fraction of that are “exercised” as a Power Down, each week after for the next 3 months (if your Power Down is on the 3-month setting, versus older ones like my account got initiated on a 2-year breakdown) - adding up those weekly fractions for all 13 weeks, get the actual figure to be calculated as “income?”

kick ass post... i need to learn how to format like this,,, peace

If it makes you feel any better, it's a ton of work to do the formatting! And I'm not sure I'm even good at it.

Thank you!

Looks good to me, i'll try to improve my skills sometime... but I'm havin' fun being a little ragged too, (-: , ty

WOW! That was a lot of information. What a great friend you are to Jerry.

Upvoting, resteeming, and following you now.

Thank you for all your support!

@lexiconical I'm new here, so I had no idea Steem wasn't immediately convertible to cash. Very interesting! That first paragraph was the most valuable thing I've read about the mechanics of Steem so far! Thank you!

I'm happy you found it useful! In order to cash out Steem Power for Steem, you have to power down over 13 weeks. It used to be 52! That got changed some time ago, however, and I suppose that means it could change again in the future.

Many people are confused with steem and steem power, in this post are the differences explained very clear, good post.

Thank you for your compliment.

100% agree with you that Steem Power is not taxable while it is in your account. That would be like taxing for the number of YouTube subscribers you have...no value until you actually monetize it.