Valuing Steem Rewards As Taxable Income Is A Vast Overstatement Of Tax Liability - Part 4 - Weaseling Out Of As Many "Standard Income Qualifications" As Possible

It's time to reason our way out of every IRS definition of income that we can. Lets hop to it.

Normally, I keep my disclaimers at the bottom of my post. But today, I want to put one here too: we're getting into theory today. This is the type of reasoning you would use to create a new taxation strategy or defend an audit, not avoid one. The IRS is likely to simply declare that anything coming into your control or sphere of influence in anyway is automatically income until and unless you prove otherwise. Realize that this is what I'm hoping to make some progress on with this post, but that in a very real game-theory sense, you don't want to be the one actually proving that this works in practice unless you have a substantial legal budget. In part 5, I hope to suggest a reasonable course of action for the end user, but realize that anything can happen in the courtroom because we're in uncharted territory here.

We'll look at two main use cases in this post: a user who buys and holds (a simple trading income gain or capital gain), and a user who earns via post rewards and regularly powers down to withdraw Steem.

First, we'll take a quick look at the "buy and hodl'er", a user who buys in for substantual USD value, but doesn't really earn much Steem on the platform.

Hodl'ers are users who have bought their Steem directly with Bitcoin or some other asset. Calculating tax liability for these users is fairly simply and uncontroversial, and you are able to defray the cost until you choose to cash out. You only have taxable income if you make a trading profit in Steem you held for under 1 year.

The IRS clearly states that it expects virtual currency to be taxed as a capital asset (despite a classification as property), when applicable:

Whatever price you paid for your Steem is your cost basis. Let's say you paid $1000 for 1000 Steem. Your cost basis is $1/Steem.

If Steem rises to $2, you have made 100%. Your taxable gain is your selling price minus your cost basis. At $2 Steem, you would owe capital gains taxes on your $1 gain. If you sold when Steem was at 50 cents, you would be able to claim a deduction for a capital loss of 50%, instead. This still applies even though you are likely to be selling your Steem for Bitcoin and not actual cash.

Remember, if you hold an asset for LESS than a year and make a capital gain by selling, you are no longer going to be taxed at the capital gains rate. This is now trading income taxed at the full income tax rate. This is why I strongly suggest that all users only buy in for what they are willing to hold for at least one year.

Tax Reality: You owe capital gains or trading income taxes, depending on whether you held for over 1 year.

Practical Reality: The IRS is years behind technology and has almost zero ability to enforce.

Timmy "Taxation-Is-Theft"'s Audit Risk: Extremely low.

Next, let's look at a user who earns all their Steem Power from posting. This is going to be a complicated question, because we are going to have to determine if Steem Power is income, and if so, when is that income realized?

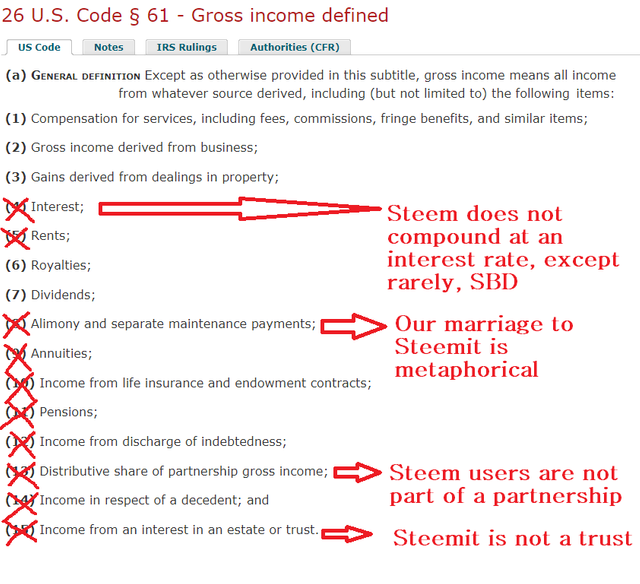

This user seemingly has no capital gains or losses, and therefore we have to carefully look at whether these reward payouts qualify as income. Let's take a look at the IRS' forms of income and see how many we can weasel out of exclude after coming to a reasonable meeting of the minds:

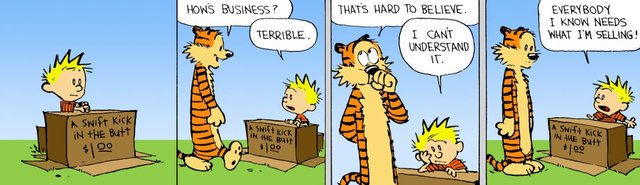

Who is compensating you? (Nobody.) What services are being provided? (None, it is you that are being provided the service, a free platform to share your thoughts.) What fees have you agreed upon? (None) What commissions have you accepted? (None) Any "fringe benefits?" (Magic Internet Points that let me vote other people more Magic Internet Points).

I fully reject that using a platform to share your thoughts becomes "income" simply because an autonomous block chain spits out magic internet points to you every day. If that were true, then any speech could be suppressed and censored simply by the government assigning a value to it. We have no employer and thus no employee, no employment contract, no (legally defined) currency exchanged, and no physical property. Posting on Facebook for Likes does not become income because you can sell likes. Posting on Reddit for Karma does not become income because you can sell Karma. Posting on Steemit does not become income automatically because you can eventually power down Steem Power and get Steem to sell on a market place months later. That is why there are 14 more items on this list, for unusual situation such as Steemit. (Stock options come to mind...)

Unless you have incorporated your own business as a blog-writer and start claiming all your rewards as business income, you do not have any gross income derived from business.

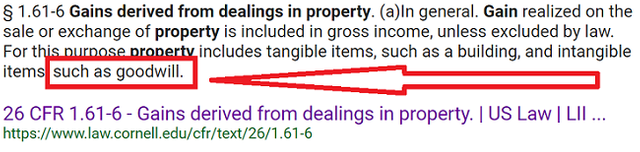

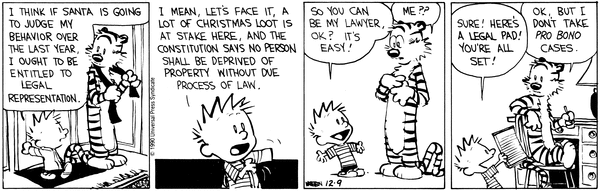

Since the IRS has classified "virtual currency" as property, this particular item does, counter-intuitively, bear some scrutiny. If you have powered down and sold Steem, you may have a capital gain on an item (the Steem property) with cost-basis to be determined. This may not be taxable as income if you have held the asset for over 1 year, or it is similar enough to a stock option to be taxed that way. However, the reality is that if you have not powered down, you have not received anything that can be sold. Therefore, in such a circumstance, you have no gains, not unlike an un-exercised stock option that is only taxed at the time exercise. If you plan to be a long-term investor, you may be able to delay your realized gain, and therefore tax bill, for years.

I only included this one due to the "authoring" nature of posts on Steemit, as some users may think of this as an option. The IRS definition of Royalties rules out Steem Power rewards (no payments, no payments for use, what valuable right - reproducing freely given content?):

"To be a royalty, a payment must relate to the use of a valuable right. Payments for the use of trademarks, trade names, service marks or copyrights,"

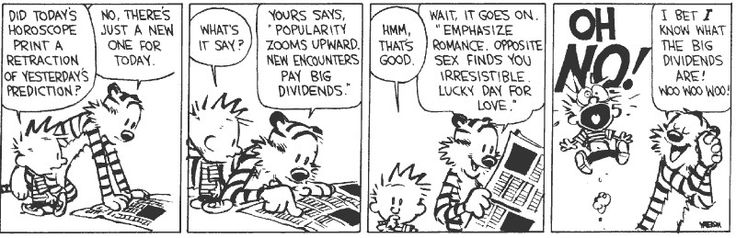

Initially, I thought it might be possible to weasel in a qualified-dividend exception for some users payouts on Steemit. However, the regulations on dividends are, unfortunately for us, not nearly vague enough to allow for advanced-technological interpretations. The IRS has a whole plethora of regulations on dividends here. But, the reality is they define Steem Power rewards out of being dividends pretty thoroughly:

"Dividends are distributions of money, stock, or other property paid to you by a corporation or by a mutual fund. You also may receive dividends through a partnership, an estate, a trust, or an association that is taxed as a corporation."

A autonomous block-chain/computer algorithm is none of these things, and therefore, Steem Power rewards are not a dividend until and unless this definition changes.

OK, so now we know what won't work. What might actually hold up in an audit, and what are our other options? Stay tuned for the 5th and, hopefully, final part where I try to deduce "best of the worst options for paying your federal extortion bill patriotic fair share". If you want a hint, I think Steem Power bears a striking resemblance to certain qualified stock options. If that doesn't titillate you, I don't know what will!

IMPORTANT NOTE: I do not advise making tax decisions based on this post. The IRS is an unconstitutional organization that most closely resembles the authority of a fascist state. You don't want to be a trend-setter in this area. I expect that anyone attempting to justify large amounts of Steem Power earnings using these arguments will be bullied and potentially jailed. You must maintain a consistent tax reporting strategy that is internally logical and consistent if you wish to rely on the "good faith" clause to avoid penalties in the future:

"IRC 6664(c) provides a reasonable cause exception to the penalties under IRC 6662 and IRC 6663 where the taxpayer had reasonable cause and the taxpayer acted in good faith. The reasonable cause exception in IRC 6664(c) applies to all of the components of the accuracy-related penalty on underpayments and the fraud penalty, except for any portion of an underpayment that is attributable to one or more transactions lacking economic substance as described in IRC 6662(b)(6), or that is attributable to a gross valuation overstatement with respect to charitable deduction property. In addition, there are special reasonable cause rules outlined in IRC 6664(c)(3) for certain substantial valuation overstatements."

Tag @exyle, you're it!

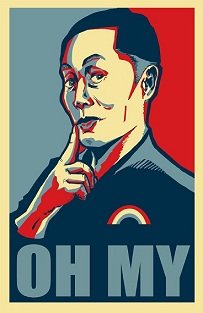

IMPORTANT NOTE AGAIN: I AM NOT (CURRENTLY) A PRACTICING ACCOUNTANT OR ATTORNEY. YOUR TAXING AUTHORITY IS PRACTICALLY ABOVE THE LAW. PROCEED AT YOUR OWN RISK WITH ALL TAX LIABILITY REDUCTION STRATEGIES. DO NOT BE THE PERSON IN JAIL BECAUSE SOME GUY USED CALVIN & HOBBES TO REFUTE IRS REGULATIONS TO YOU LINE-BY-LINE ON SOCIAL MEDIA. XZIBIT HAS NEVER BEEN A LEGITIMATE SOURCE FOR TAXABLE INCOME CALCULATIONS.

Image Sources: bitnote.co, Pinterest, AR15, quickmeme, trollme

Copyright: Calvin and Hobbes, 300, Michael Carny

Ok, what about this? We get free Steem power everyday to give away to other people, how does that tie in to the IRS? We were given that Steem.

I've looked at the gift angle. Unfortunately, it doesn't look good. (This is not an endorsement of the logic.)

There are some technical issues. The main one is that when you vote for someone, you are only flagging someone as having value for a future Steem Power divestment. The Steem Power you are trying to claim is a "gift" doesn't exist yet. You can't give something you don't have legal title to, and you can't have title to something that exists.

Second, you don't directly give the party the rewards. The blockchain does, and since you aren't the blockchain, that does create a technical problem in claiming it as a gift.

Further, the fact that you had to participate to create the rewards generally makes the IRS more likely to want to call it income of some kind rather than a gift. Just a guess, since there's no case on Steem yet.

I continue to look into the gift tax exemption for an option.

I'm glad you are doing this, too complicated for me!

When will this IRS thing end? Even reading a post about it makes me think like a pessimistic.

It's over when we say it is. :)

It’s over.

So I don’t have to file my taxes now...? 🤔

Excellent!!!

I can safely say that I am totally titillated.

I'm chomping at the bit to see how closely what I've been considering as a strategy comes to what you describe.

Unless there's some SP lottery that I can somehow win without entering it, it'll be at least a year before I'd have enough to even consider powering down. I'm also under the impression that limited Power Downs might be a possibility in the future, as opposed to cashing out entirely over a 13 week period.

You can always move to a developing country somewhere in the Caribbean and enjoy your tax-free life, providing that you give up your US papers take up citizenship in that country... or you can be the good citizen you are and remember uncle sam share

Knock, knock...

Not seeing Part 5 anywhere in your feed.... did you end up posting it, or never completed it?

Could you possibly provide a link if you did publish?