Steem Taxes

I felt this information might be useful for other users.

Taxes

I've been freaking out about taxes for the past week after reading @jerrybanfield's article Steemit Tax Calculation and Payment System. The method Jerry describes in the post is fairly straightforward and easy to implement and I will be doing so from this point on, but...

- What about past rewards?

- Will I need to amend my 2016 filing?

- How the heck can I even calculate my past earnings?

At first I thought about writing a script that would fetch all of my rewards and historical price data to have this information automatically calculated. However, after glancing at the SteemJS API and searching for an easily parsable source for price data, I quickly realized that this was going to take much more effort than I was willing to put into it.

There had to be an easier way. Well, thanks to @jesta's SteemDB I found a method that provides a decent estimate of the value of your past earnings in a "fairly" short amount of time.

Method

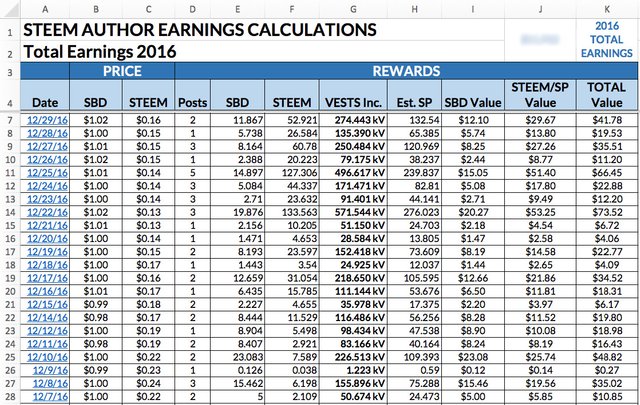

I joined Steemit in July of 2016 and I was able to create a table containing all of my author earnings with their approximated USD value at the time they were redeemed in a little over an hour. Here is how I did it...

Step 1 (SteemDB):

Visit: https://steemdb.com/@your-username-goes-here/authoring

It will contain a table with ALL of your steem rewards to date. Copy the entire table.

Step 2 (Excel):

Paste the table copied from SteemDB into a blank spreadsheet. The cells for SBD, STEEM, and SP contain some text that will need to be stripped so that you can apply formulas to these values. A simple Find and Replace applied to these cells takes care of that in a matter of seconds.

Next add columns for the price of STEEM and SBD. For each date that you received rewards, manually enter the STEEM and SBD price on that date. I did this using coinmarketcap.com which was a simple tool to use for this purpose. Now I realize that manually fetching price data is an inelegant solution, but keep in mind that my goal was to create this table in the shortest time possible. In this instance, manual data entry was faster than developing an automated solution.

So now you have a table with your Steem rewards and price data. All that is left to do is calculate your earnings. I added 3 columns: SBD USD Value, STEEM/SP USD Value, and TOTAL USD Value. A few seconds later I had added my formulas and my approximated total Steem earnings in USD had been calculated.

Step 3 (Repeat):

If you are a big time curator, it is probably best to repeat this process with your curation rewards as well.

Conclusion

Depending on where you live, you probably should be paying taxes on your Steem rewards. Hopefully the method described above proves useful for someone.

OR...

I can just not worry about all of that and pay on whatever I cash out into Dollars?

Yeah...I like that plan a lot better. It's hard to claim earnings or assets when they're not "real" and the "value" constantly fluctuates. If I don't have to pay taxes on my stocks until I sell them for a profit, then I don't know why I should feel obligated to pay taxes on fake digital money that can be worth $0.00 tomorrow.

Not happening.

Good job on the post though.

Technically, you are required to pay taxes on the value of what you earn. Example, if you work for a publicly traded company and get stocks as a bonus, you have to pay tax on that even if you don't sell the stocks. Usually companies will actually take the tax out before they even give you the stocks. I'm not a tax professional and I don't like it either!

Technically, I don't even care. I don't work for a publicly-traded company and my rewards on this platform aren't stock. The government has been very clear about how they don't classify this stuff. So, if I decide to pay them anything, it'll be as if it were income or capital gains. I'm not interested in their absurd calculations and other political douchebaggery. They can't exactly tax me on holdings that they cannot prove that I own.

I suppose they can try...

Do you playa!

Hi, I am clearly very late to this thread but I just want to clarify. "get stocks as a bonus" In the US tax world:

If employee is awarded straight stock free of all restrictions for a bonus I would agree there is immediate taxation, however this is usually not how it works with public companies - you would get a restricted award or options. So, for equity based comp that has a vesting, there are three key event dates - the grant date and the vest date (and third exercise date for options), the taxation at each point in time depends on the very specific facts/circumstances. I might write an article just on different options/awards, so that it gets people thinking about how taxation of steemit currencies works.

I'm sure you just meant eventually there is taxes and I am over-killing here, but I was dying to just add that point in.

This is not tax advice to any one individual and shouldn't be used to attempt to avoid taxes/penalties.

I completely agree and the IRS leaves us all confused about this. I mean people in Second Life, how do they pay taxes for their trades of in game items? How about people in other online games? What if it is baseball cards and people trade them?

I realize we are supposed to pay taxes on all of these trades but it's unrealistic to expect any human to calculate every trade they ever made for their entire existence. I will make my best effort to pay what I understand I owe, and if they give more clarity then I can better direct my effort. As things are now, I have no idea if I paid the tax the right way, or if I got the right amounts, and using magic values on Steem websites which don't reflect what it is when it reaches my bank account is even more confusing.

By the time it's translated into fiat (real currency) it's usually not whatever is reflected on these sites. It might be more in some cases, but often it is less, and it would be easier on all of us and possibly better for the IRS (they can collect more tax) if we were allowed to simply capture everything going into our bank account, or at least onto the regulated exchanges like Poloniex and Coinbase. I can handle exporting my Coinbase transactions and paying tax on that, along with Poloniex, Bittrex, etc, if that is the case, but not the amount Steem is worth at any given day doesn't seem to reflect what a person will actually get for the Steem after multiple trades.

First you have to send the Steem to Poloniex or Bittrex as SBD. This SBD then gets traded into Bitcoin. Bitcoin can actually be sold for fiat so it's at least convertible. Steem isn't that popular and SBD isn't really used outside of Steem ecosystem.

Exactly! There is no point in calculating taxes on cryptos that have not been cashed out. If it's not already in your pocket, you don't actually have anything but hope. Last time I checked, they weren't taxing HOPE - yet!

Agreed. I'm no accountant but you shouldn't have to pay or factor in taxes except on gains.

Yeah as I understood you only tax it as capital gains if you cash out for a profit. There's a difference in percentages for short term and long term gains. So just hodl.

For US citizens, this is very accurate. The estimated value of a Steemit account is not what is taxed. The dollars derived from the account are taxed as a capital gain. Last I heard, that was something like 20%.

I've also done some reading on Bitcoin taxation and the like from a few different sources and found a fair amount of consensus. If you cash out your investment, you will be taxed on the gain, not on the value of the security.

Yea. Paying taxes based on the usd value when received has the potential to fuck you. Since Steem could be ZERO after Hardfork ## implodes the system. I'm gonna run it by a tax attorney anyway.

I'm going to run it by my tax cat-torney and see what she thinks.

Like... You are going to ask your cat?

@ats-david

Cat

@ats-david

Cat

licks ass

Anyway

(cat will probably be more knowledgeable than actual tax attorney)

hahahhaha

I actually just asked her. She said...

Your tax attorney is a pussy.

Hahaha!

Finally, someone laughed. :)

Plus you don't have to pay the cat! Well, maybe give it a treat, which costs money. Plus you have to feed them every day, and pay for flea and worming treatments, and pay vet bills when they get hurt....... I'll take the attorney :D

Yeah...but if you're petting an attorney while it sits on your lap, people are going to think you're weird.

That look pretty much says it all :-)

most eye opening response to that. Tax laws change all the time. Do you pay tax on something that was $3000 one day and then 0$ then next?

@ats-david, its always easy and good thing to pay government money when investments are going well, what of when someone enter a scam crypto? I rather reinvest my gains till am sure that I can relax and live well with them and then I will pay taxes on the profits...good post though @mynameisbrain . Following both of you for more posts, lets stay in touch

This reply alone got you a new follower. LOL!

The fine print on SteemDB:

"* All Steem Power & VEST calculations are done using the current conversion rate, not a historical rate. This may cause some calculations to be incorrect."

This is useless to just copy the table when it doesn't provide you with any historical rates. Where would those rates even be pulled from? Poloniex? Coinmarketcap?

In any case, we need the historical rates. This process needs to be automated. Also there probably aren't enough accountants for everyone on Steem to call.

I'm sorry but you're wrong @ats-david, you DO have to pay taxes on your stocks if you received them as income -- and the same is true of Steem, SBD and Steem Power.

STEEM isn't received "as income" and it's not classified as currency.

In any case, I don't even care - as I stated multiple times. I'll just report my Dollar earnings however I choose to report them. I'll let the bureaucrats figure out how to proceed after that. I'm not going to fret over it. I have better things to do.

The IRS clearly states that it considers receiving anything of value in return for performing tasks (aka work) as income. As I've said before, think "stocks".

Does this include receiving food for work performed?

IRS Virtual Currency Guidance : Virtual Currency Is Treated as Property for U.S. Federal Tax Purposes; General Rules for Property Transactions Apply

https://www.irs.gov/uac/newsroom/irs-virtual-currency-guidance

Exactly

Hm. Donations from abroad are tax-free in The Netherlands. Consider this I must.

If you're from the Netherlands then check out dereunie.info on how to avoid tax all together. Tried it myself.

Or, you could just stop paying tribute to the thieving SOB guv'mnt henchmen.

Unless you are a government employee or are exercising some other "privileged activity," there is no statutory requirement to pay a tax. And, there is certainly no moral requirement.

😄😇😄

The logic of taxing Steemit currently displayed here, if implemented officially, is ridiculous. Their only argument for taxing it is apparently Steem has a price. Facebook likes can be bought from click farms, so everyone who gets free likes better start filing. Same with tweets and Reddit karma. I hear you can buy gold in World of Warcraft. I guess everyone who ever looted a mob now has a taxable gain. Doesn't matter that it's locked into a game (or Steem Power is locked into a platform). We say it is taxable, so it must be.

Prostitutes still charge, right? Lord, I must have a huge taxable gain of un-purchased sex I need to start auditing. I knew buying that ButtCoin (patent pending) would come back to bite me eventually.

Don't even get me started on market depth. You couldn't sell 1 million (or some other arbitrary number, depending on the order book) Steem without tanking the price, so 1 million Steem @ a current "price of $1" is not worth anywhere near $1 million. Under this logic, they'd try to tax you on that though. You're totally screwed if they tax you on it @ $2 and the market tanks before you can even physically remove it to pay the taxes they are demanding. If price tanks far enough, you could be in the hole.

It would make more sense to consider it a capital gain, but then you have to set a cost-basis. However, income tax rates, for self-employed, are ludicrous, and IMO make no sense given the other issues.

Oh, and I guarantee you the "elite" would be funneling all this through a trust or LLC and paying 10% or less on all of it, minus expenses. The only reason @jerrybanfield and @mynameisbrian have to worry about paying it this way, is because they are the "little guy", relatively speaking, and will be threatened and potentially crushed otherwise. Regardless of the legality or constitutionality of any of it.

Lets not forget about those wonderful CS:GO weapon skins worth thousands of dollars! All those 8-16 year olds playing the game should be in jail for tax evasion!!

This is why non-crazy tax law usually doesn't tax things until you actually realize a cash gain. Thus, you would only owe tax on your CS:GO skins if you started selling them for profit and made money money, annually, than the minimum taxable level. You would also be open to a lot of deductions, and could form an LLC to pay yourself hourly for the work and deduct that too.

In other words, while it might be crappy, it would be a whole lot less crappy than this insanity.

Yeah this makes the most sense I think. The problem is that if everyone accepts crypto then a lot of people simply wont go back to using cash. And an even larger number of people probably wont even have bank accounts anyway.

But what do the lawyers and tax professionals say? Do they say we owe taxes on our CS:GO skins? I mean I don't know how to interpret the law. Is the IRS going to crack down on gamers?

Yes, we do owe money on CS skins and WoW Gold, if we allow them to change the tax law to tax us at the point of non-monetary gain. If we allow Steem to be taxed, before we actually make a cash gain on it, then that exact same logic will justify jailing anyone who receives anything that is convertible via the free market to money (so, every item in the history of existence) and does not voluntarily pay about 35% self-employment taxes. That will include every online game's currency in history, and any other salable items.

I bet even Reddit Karma has a price you can purchase it for for astro-turfing purposes. That would make every "I can haz cheezburger" post an unrecorded taxable gain.

That's the law you are legitimizing when you pay taxes when you receive Steem.

Yeah exactly, so what is the situation? The IRS needs to clarify or at least tell us where the line is. Their 2014 guidance was good for 2014 when it was only Bitcoin and only cryptocurrency, but the situation has evolved.

This is the exact confusion I have with regard to how to deal with Steemit taxes. I know we must pay something but don't know the best way to calculate it. So why is Steem different if it's not directly traded for fiat? As you said, you can buy Facebook likes or really any account with fiat or Bitcoin, but you cannot directly cash out your Steem dollars into the USD and your Steem Power cannot be purchased with fiat.

LOL, epic.

wasn't there a ruling recently about BTC not being treated as a currency?

It's in a pretty heavy state of legal flux atm. You've got the new proposed bill to more or less try and criminalize it. You've got past federal judges calling it both currency and property in loosely-related cases (theft, etc.). And no doubt all sorts of stuff I personally missed and can't recall here.

The exact legal status is still jurisdiction dependent and subject to interpretation. I wouldn't want to have to work any cases on it. There's not much precedent to look at, relatively speaking, and most if it is open to interpretation.

the more money is involved the more likely taken on. I'm sure a federal ruling will come within the decade.

Not paying taxes isn't really an option. People posting as if it's an option to just ignore the IRS are setting people p to get arrested. Don't listen to these posts.

So, is this how you "promote a more secure, free, and happy society?"

And what does the risk of getting arrested have to do with promoting freedom?

Is your "security" worth the chains you apparently willingly wear?

I agree with you completely that it is not an option to "just ignore the IRS." The reality is that one must vigilantly defend themselves against that terrorist organization.

"Not paying taxes" is really an option for anyone with the courage and intelligence to investigate the matter. I'm reminded of this famous quote:

If you don't mind getting arrested, and having your life savings confiscated, go ahead and be an activist against the IRS. I'm interested in promoting a more secure, free, and happy society, but also in an intelligent way. It's not very smart to take unnecessary risks which can and likely will destroy your life unless you don't want a secure, free, and happy future for yourself.

Do you expect everyone to be self sacrificing?

In my opinion the smartest course of action for us to take is to do it similar to Bill Gates, and make and keep as much money as we can in our field whilst simultaneously writing and calling our congressmen to push them to change certain lines in the tax code. There is a right way to solve these problems and it doesn't involve breaking or ignoring the laws or the enforcers of those laws.

The best way to make and keep your money is to comply with the IRS. By being a taxpayer you also have the right to contact your representatives and I would suggest that by keeping your taxpayer/citizenship status you can do more to promote the ideals and better world than by alienating or criminalizing yourself.

Thank you for a thoughtful and gracious response.

However, it is clear that we obviously disagree, possibly irreconcilably. I do admire men like Simon Black who seem to have managed great success while "avoiding" taxation for the most part.

Self sacrificing or not, I do expect everyone to be moral, not to rob me, and not to support those who do. In my considered opinion, the tax code is an irredeemable monstrosity. However, for those who have studied it, it does have significant and considerable loopholes that are exploited by the wealthy and wise.

At the most fundamental level, "tax codes" and the crooks - call them congressmen or whatever you care to - who promulgate them - bear no relationship to "law" whatsoever. "Legalizing" evil is an oxymoron. I don't care how many "legislators" sign a document purporting to legalize theft, or how many judges and cops "enforce" such theft, it is still immoral robbery. The entire lot of them "just doing their jobs" are the criminals. I also find it difficult to respect those who empower them with their tacit approval.

The driving force behind the development of Bitcoin, other cryptocurrencies, and blockchain based distributed organizations, is the hope of wresting immoral power out of the hands of governments. Devising ways to tax these developments is like fastening boat anchors to jet aircraft. Go ahead and do so for yourself if you must, but I'll be leaving those impediments off of mine...

Idealist vs realist perspective

I cannot argue on the basis of moral and immoral. I can only argue on the grounds of risk reduction, safety, smart decisions which have a higher probability of predictable outcomes. This is no different than with investing where some people are willing to bet their life savings on a particular cryptocurrency and let the chips fall while others choose to never take such a crazy risk.

Neither of these individuals are wrong. Each individual has to decide for themselves which risks are worth taking, which investment strategy they believe is likely to work for them and to achieve their goals. The only thing I state in my comment is that if your goal is to keep your money and avoid jail then compliance is really the only behavior pattern which leads to predictable desired behavior from the law enforcers. It's possible to go the route of non-compliance but then the behavior of the law enforces can become unpredictable and uncertainties can arise. If the goal is to be happy and enjoy your wealth, if you manage to acquire property, then having to look over your shoulder and be paranoid is not aligned with that for most people.

Taxes are unavoidable

Taxes cannot be avoided no matter how we feel about the entities taxing us. If the US government did not exist there would still be taxes and the only difference would be who you're paying the taxes to. In what part of the world are there no taxes at all? Even in Afghanistan the Taliban taxes the farmers, and in any civilization, society, or large group, there is a strong tendency for there to emerge a system of taxes also known as fees for protection. The shop owner would be paying the local gang if not the IRS. If it has to be paid (even Jesus Christ admitted that), then paying gives peace of mind.

I posted in my blog just recently that the smartest tactic is to contact our congressmen and let's get our representatives to reduce the risks on Steemit account holders. To start we could reduce the complexity of the tax code so that only exchange into fiat is a taxable event and all crypto to crypto trades non-taxable. This would allow the industry to thrive and go mainstream (compliance is required for mainstream adoption), and you can promote a lot of security, freedom, and happiness, if you have adoption. If you take a hard line radical approach you never get mainstream adoption and the majority of people will never benefit from your toy, and just think about how the Internet would have been if it never made it out of the university level of awareness?

For the record, I think a lot of the laws are unfair, I think the tax code is impossible for an ordinary human to understand, but I recognize that the laws are real, they can effect my life, the tax code is real and can effect my life, and these are risks to be mitigated and compliance is the cheapest option for the vast majority of people (myself included).

References

Thank you again for your interesting, comprehensive, and gracious responses. :)

😄😇😄

You don't stop the mafia by paying them. The more you pay them, the more they have to use against you. It's people who bend over and spread their cheeks every time they are told to who are the problems in this world.

Control freaks and thieves can't win unless the majority volunteer to be slaves.

so glad we don't have those issues here in the UK. I don't even think they have written crypto into tax yet.

There is tax on crypto in the UK and initial tax documentation back in 2014

arrrrrrr...................fuck

If you pay taxes by converting crypto into cash then its super unfair because the value of the crypto might crash to almost nothing a day later. So now I am out a huge chunk of cash and my crypto also dropped to nothing.

Yes that is exactly the case, but based on what I have read online mining rewards and crypto income are taxable (per irs guidance). Any additional losses and or gains are then declared at the time your crypto is converted to usd. I'll be meeting with the accountant next week to discuss.

so what happens if we over pay the IRS? Suppose we find out layer we paid more than we had to? If the radical interpretation is followed then cryptocurrency is effectively suppressed by tax complexity. No one will be able to say for sure that they didn't miss some transaction or that their calculations are correct.

I'm in total agreement.

Please let us know what your accountant says if possible.

Will do

Well, my bot owns my account...so

Well he doesn't like that term since he thinks I'm his strawman;)

You scripted him! lol

So... that means your bot has to pay taxes to skynet!

LOL that's in the future..In the present they are called the IRS

How about the developers make life easier for all of us ordinary humans and give us an export button so we don't have to manually do all this?

Hahaha haha haha haha ha Ha

How bout that?

Ok, thanks for all that information. I was hoping they would just give us a 1099. I better bookmark this page.

1099 LOL. Priceless

hey @mynaneisbrian

i dnt think i should pay taxes if i havent cashed it out..if i am putting it in as investment on steem power..

when i do decide to take it out i will be taxed on it again.

so i think ill just keep om investing and not worry about it..

i could be wrong though cuz these things are wy too complicated all the time..

thanks for the post though..!

I agree 1000%

Well, I can appreciate people's concern... but it seems to me there are some dependencies here.

First depends on the tax authorities of any Steemian's country of residence. How does the IRS (for example) classify cryptocurrencies? As I recall, they don't give Bitcoin "currency" status, it's actually an "asset class."

That being true, UNTIL you actually "have dollars in your hand" all you technically have is what's called an "unrealized gain." Now, when you DO get actual fiat, there are two kinds of income. If you originally used dollars to INVEST in Steem, you end up with a capital gain. You get to subtract your original cost from your gross receipts and pay a somewhat reduced tax rate on the difference. Anything you were PAID for authoring/curating will probably be considered "ordinary income" BUT... you're not an "employee," you're an "independent contractor," so you'd probably have to complete a Schedule C if you're in the US.

By all means, run it by a tax attorney. Alternately... if you actually receive your earnings as ATM withdrawals on a largely anonymous BTC debit card? You have to figure out your own formula for sleeping well at night!

Hi, I'm late to the party, but it is never to late for me to address my favorite topic. I believe, assuming Steemit user is a US citizen - when the Steem currency (any of the three but there is some debate on Steem Power) is credited to his/her account for posting/curating, it is treated as property they received and is taxable at that point in time). See Notice 2014-21 Q-3, 5,10. He/She will then begin a holding period and if they convert to USD after a year, will be taxed long-term capital gains (or a loss) on the difference between the USD proceeds and the value when he/she received the crypto. The good news is, he/she may have also potential expenses that are now business expenses. This will be the subject of one of the many topics I am covering in my tax blog, and I am going to have examples and helpful suggestions for the filing season that is upcoming.

PS: I will research whether it is appropriate to classify the Steem Power as restricted property, or that it falls outside scope of cryptocurrency from the perspective of the Notice, but I will have more in depth analysis later on.

This is not tax advice to any one individual and shouldn't be used to attempt to avoid taxes/penalties.

Thanks! Taxes are the one thing I'm worried about when it comes to cryptos

In Canada, I believe, we have to pay taxes on all revenues. However, it is an income when it appears in a BTC-> CAD exchange. But we have an advantage, there are no taxes on lottery winnings and donations! So, transfer the Steems to someone you trust who will give you a donation!