The Sweetbridge vision is to provide liquidity to all the 'locked-up' assets in the world of global commerce. Most people don't realize that global commerce is about $54 trillion Global GDP, or roughly 2/3rds of the world economy. Blockchain has forwarded humanity a surreal opportunity to capitalize on these locked up assets, a concept which I believe will have tremendous network effects throughout the global economy. As it stands today, there is only about $60-70 trillion in liquid currency v.s. over some $700 trillion in total assets. We used to have a solution for this problem, both a "hard" and "soft" form of currency, but in recent past have all but abandoned the idea. Sweetbridge aims to digitize assets via union of law and code, a.k.a smart contracts, a concept which CEO Scott Nelson was acting upon before 'smart contract' was even a coined term. Sweetbridge's goal does not stop at simply bringing all assets onto the chain via zero interest loans - an easily marketable, borrow against yourself model. They also aim to revolutionize the law industry, shifting the power structure from a work your way up partnered pyramid scheme to a value brought; value earned model - An idea I see sweeping through my army of lawyer associates and peers.

Together with their alliance, Sweetbridge is one of if not the biggest blockchain project on the planet. In order to legally tip toe around regulations, they have their home base set in Switzerland (main US office in Phoenix), and are currently have licenses in the MSB (Money Services Business) space. This allows them to become a sort of "on-ramp" for other projects that wish to join their alliance in order to avoid the excess of legal fees they had to trudge through. The Sweetbridge vision starts to get really interesting when you think about the applying the idea to depressed economic environments and 3rd world countries, which are really the roots of the supply chain. Financing and interest rates are very high in these areas, often reaching a breath-taking 25%. This effectively dissuades competition and at the same time subsidizes inefficiency within the existing structures, a sort of "double-tax" model (which is technically illegal). When you apply this crypto-economic concept to areas that are effected by this, it eliminates the need to do things like credit checks (because the asset can be locked up on the block chain), and in turn leads to a whole realm of competitive yet cooperative spirit. I think you can start to visualize how this could make a huge difference.

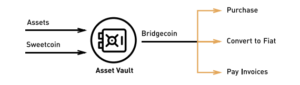

Sweetbridge is truly a first of its kind in the crypto-sphere. The value of most projects today are driven by pure sentiment via social force. This allows all kinds of instability and bad-acting to sweep in and create negative feedback loops. Sweetbridge aims to implement a redemption mechanism that will allow their 'asset vault' to remain relatively stable. The technological backing of the Sweetbridge system organically inflates and deflates the cryptocurrency based on the flow of assets in and out of the vault. The organic price manipulation is not done by people, but rather programatically. This means the deflationary/inflationary effect is not done by any person, not even Sweetbridge themselves, and therefore is not subject to corruption.

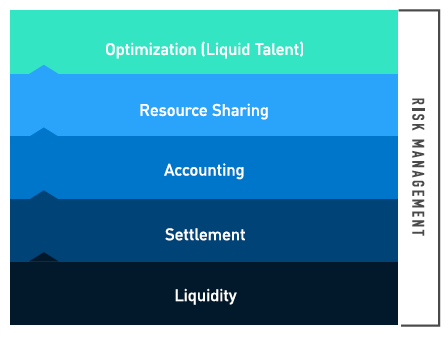

Stack

Sweetbridge is a technology stack and project alliance that solves four basic problems:

1. Lack of liquidity in supply chains, by creating an innovative collateralized liquidity economy

2. Resource underutilization, by enabling asset sharing across organizational boundaries

3. Suboptimal supply chain operations, by providing access to liquid professional talent and

creating incentives for supply chain professionals to provide services based on objective

measurements of outcomes

4. Accelerating pace and scale of change, by creating more flexible and adaptive supply chains.

To address these problems, Sweetbridge proposes to create a layered blockchain-based protocol

stack in the service of a broad ecosystem of supply chain projects. The Sweetbridge project is a

combination of bottom-up technologies together with a consortium of project alliances managed by a

nonprofit foundation.

The Sweetbridge protocol stack will be composed of five layers for (1) liquidity, (2) settlement, (3) accounting, (4) resource-sharing, and (5) optimization.

There are some of the greatest minds on the planet behind this project and alliance such as Scott Nelson, Vinay Gupta and Imogen Heap. Seeing the length to which Scott brought his last company (over 7B in revenue), I believe in his leadership, as well as most of the advisory board. You can check them out in the link below (although that is an incomplete list)!

Potential 'Tappable' Asset Classes

This includes but is not limited to:

- Inventory

- Invoices - ~$27 trillion is locked up in invoices around the world at any given time

- Factory Equipment - For example, trucks, planes, manufacturing equipment, etc.

- Intellectual Property

- And even......Talent - Sweetbridge sees a future where even talent, yes you, are fluid and not bound to any entity like an old fashioned company.

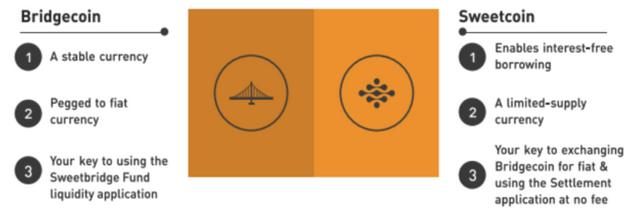

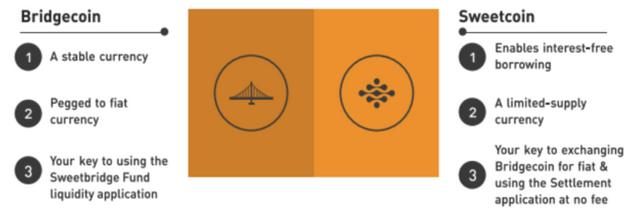

Sweetcoin v.s. Bridgecoin

I thought I would cover this in as simple language as I could, because I see a bit of confusion generated when people are first introduced to the concept.

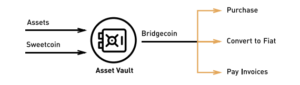

Bridgecoin will exist in many denominations. One for each major fiat currency as well as one for key commodities. This is a token that is designed specifically for liquidity, to forward you the value of a locked-up asset, say your house, interest free. This works because you can lock up the value/title of that house onto the blockchain in a smart contract and get bridgecoin in return. This effectively allows you to borrow against the value of that house for whatever reason you had in mind. The bridgecoin can then be used as a...dare I say..."bridge," to any resource you seek! After the Bridgecoin is repaid to the smart contract (a.k.a Asset Vault), the Bridgecoin is "burned". Burning a coin removes it from circulation and thus reduces the number of Bridgecoins in the market, which maintains a balance between collateral and Bridgecoin.

Sweetcoin is a sort of 'membership token' that allows you to become a "citizen" in the Sweetbridge economic environment. Depending on how much Sweetcoin you buy, you are forwarded opportunities that "foreigners" dont have. You demonstrate how vested you are in the system based on the amount of Sweetcoin you have. If you use it by putting it into vaults with other assets (in a proper ratio), then you get access to the different protocols such as interest free loans and settlement

processes. The value in this system isnt driven by social understanding, its intrinsic. In other words, it has demonstrable value. And better yet it even maintains the main benefit of all other cryptocurrencies...That is, as the ecosystem grows the amount of Sweetcoin you need to do things goes down.

Useful References: