10 Good Reasons To Buy BITCOIN now!

This was first posted on medium by Henry Brade. Which is a Bitcoin user since 2011 and a Bitcoin entrepreneur since 2012. He have been living and breathing bitcoin every day for the last five years and I am an expert in the field. This article focuses on bitcoin investing. In this write-up I give 10 good reasons to buy bitcoin now.

.

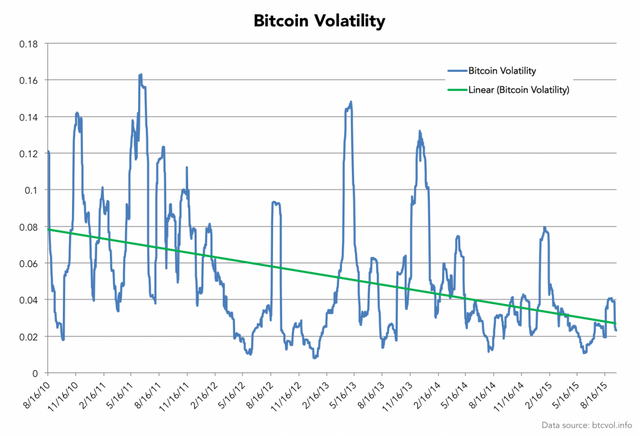

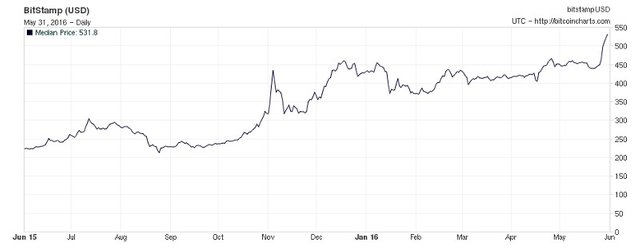

1. Price of bitcoin has been more stable than ever before

In the last 1,5 years bitcoin has shown unprecedented stability as a financial instrument. It has been more stable than ever before which has increased trust in the currency. Historically large price increases have always been preceded by a stable period and now we’ve experienced the most stable period so far.

The volatility of bitcoin price has been decreasing

During this stable period there have been times when bitcoin has been more stable than the US stock index, japanese yen or even gold. This is totally unprecedented for something like bitcoin and it is a strong indicator. It means that bitcoin is growing up as a currency and is ready for the next stage of growth.

.

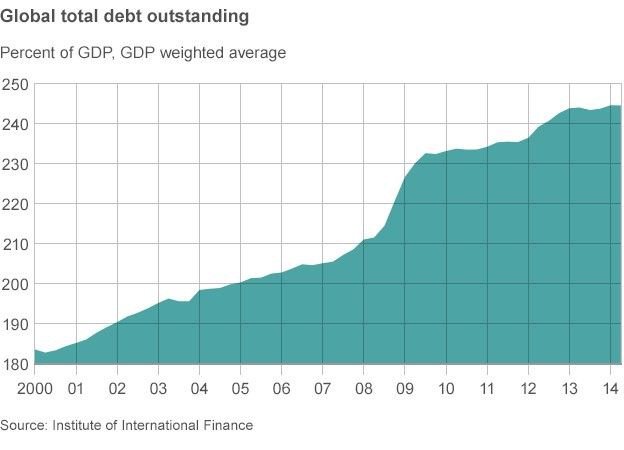

2. Global economy is unstable

The economic situation is unstable all over the world but the value of bitcoin is not strongly correlated neither with the stock market nor national currencies. Bitcoin may in fact benefit from the collapse of the traditional economy which means that it is smart to diversify some funds into bitcoin.

In 2008 the economy collapsed due to unsustainable debt structures but what many people don’t understand is that debt has only increased since. It is possible that in this decade we will see an even larger collapse.

The world is acquiring more and more debt

In that type of situation traditional safe havens such as physical gold will likely rise in value but this time bitcoin will have a significant role. Bitcoin as a currency is similar to gold, it is scarce and can’t be created from nothing . However the features of Bitcoin are more advanced as it can be moved effortlessly to anywhere in the world.

Weak national currencies are already a great source of demand for bitcoin. The growth of bitcoin trading volume is high in countries such as China, Latin America, South Africa and based on recent reports, also in India. Due to the weak valuation of local currencies people want to exchange increasing amounts of traditional currency into bitcoin.

The worse the traditional economy gets, the better it is for bitcoin. This is why it makes sense for anyone to diversify a portion of their investment portfolio or savings budget into bitcoin.

.

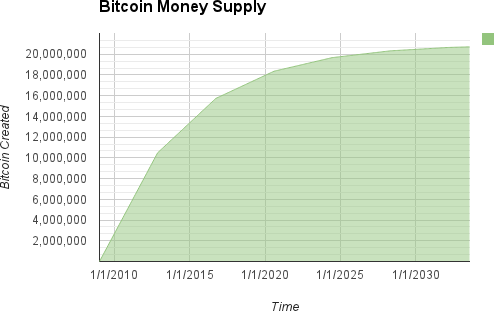

3. The creation rate of new bitcoins is halving

In July the daily amount of new bitcoins created will halve from 3 600 bitcoins to 1 800 bitcoins. This is a fixed rule set in the Bitcoin protocol since the beginning and it activates approximately every 4 years. The next halving is estimated to happen on July 10th and in addition to the actual reduction in new bitcoins created, it is expected to have significant speculative meaning.

As you can see from the picture, most bitcoins have already been created

As a currency bitcoin is very different to national currencies such as the dollar or the euro. Bitcoins can’t be created out of nothing and the amount of bitcoins is predetermined and strictly regulated by the protocol itself. The maximum amount of bitcoins is 21 million and there will simply be no more. To this date 15,5 million bitcoins have been created.

This absolute scarcity of bitcoins is one of the biggest reasons why they are such a good investment. As the user count of Bitcoin increases, we can assume that the price of bitcoin also increases. This causes no problems for the use of Bitcoin since a single bitcoin is divisible to very small pieces. Euros or dollars are divisible to one hundredths (cents) while the smallest bitcoin unit is 0.00000001 bitcoins, which is also called a satoshi.

The halving is one of the most significant Bitcoin events of 2016 and it is accompanied by a lot of price speculation. Now is a good time to stay updated on the events of the Bitcoin world.

.

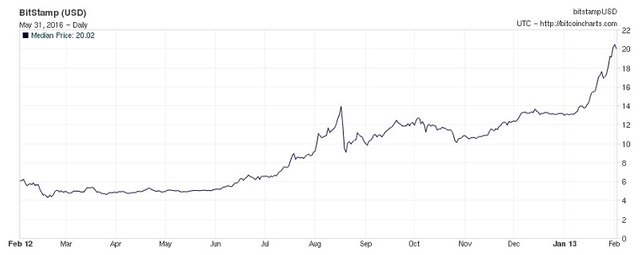

4. From a historic perspective the price graph looks very tempting

The current price graph of bitcoin resembles the situation preceding the great price increase of 2013 a great deal. Bitcoin had recovered from the first price bubble of 2011 and stabilized. Then we saw the largest price increase to date when bitcoin increased from 13.5 dollars in the beginning of 2013 to an impressive high of over 1 100 dollars in December 2013.

Price of bitcoin from February 2012 to February 2013

Price of bitcoin for the last 12 months

The price development of bitcoin has repeated a similar pattern many times. That does not prove the same pattern will repeat in the future but it does increase the likelihood of it happening again. The price graph now is very similar to what it has been right before the large price increases in the past. That is quite interesting.

.

5. Plans to get rid of cash are a gold mine for bitcoin

At least in some parts of Europe there seems to be an increasing movement to get rid of cash. The trend is increasing in many developed countries where digital payment methods have high adoption. However, from a privacy perspective cash is an important payment method and traditional digital payments methods leave a lot to be desired in that sense. Bitcoin is digital cash and any attempts to remove actual cash will increase the demand of bitcoin.

Plans to abolish the 500 € bill is only the beginning

The digital revolution of money brings significant enhancements in ease of use but it causes problems for privacy. We are in danger of moving into a police state where everything people do can be monitored. In the era of digital money and payments Bitcoin is an alternative that retains the features of cash.

It is almost certain that all attempts to remove cash will increase the demand of cryptocurrencies and right now Bitcoin is the king of cryptocurrencies.

.

6. The usage of Bitcoin is increasing rapidly all over the world

The amount of transactions in the Bitcoin network is increasing rapidly. More goods and services are bought with bitcoin every day. Even here in Finland there have been multiple Tesla’s sold with bitcoin. In Latin America and South Africa the growth numbers of Bitcoin usage are impressive. In China bitcoin is used increasingly to move funds out of the country. And based on recent reports the use of Bitcoin is also increasing rapidly in India.

The growth in the amount of Bitcoin transactions during the last 2 years

In the real world Bitcoin is used much more than any other blockchain project. Other projects such as Ethereum are mainly in development stage and they are not used in the real world for almost anything. The increasing real world use of Bitcoin is a great strength and the meaning of that will only get bigger. Bitcoin is the first universal currency and that reality is getting more real day by day.

7. The solutions to the scaling issues of Bitcoin exist and are progressing

Bitcoin has been so popular that it is reaching the technical limitations of transaction processing. The Bitcoin network can only process a few transactions per second and the limit is almost up. This is a positive problem since it is a sign of the great growth of Bitcoin. The problem has caused a lot of public discussion though and it has questioned Bitcoin’s ability to evolve.

The solutions however do exist and are constantly being developed. In the coming months Bitcoin will be upgraded with an update called Segregated Witness which will increase the capacity of the Bitcoin network by approximately 80 %. This is a significant improvement but it is only a temporary fix. The long term solutions are also in development.

So called lightning network is being built on top of the Bitcoin network and already multiple different implementations exist. The lightning network will eventually increase Bitcoin transaction capacity to thousandfold. Additionally so called sidechains have been thought of as a potential method of scaling Bitcoin and sidechains are also in active development.

From an investment perspective it is smart to buy bitcoin before these upgrades are enabled since the price could rise very quickly once they are enabled.

.

8. New use cases for Bitcoin are found constantly

People seem to often have the wrong idea about Bitcoin. For example, people ask can I pay in the local store using Bitcoin? That is actually irrelevant. What is relevant then? Bitcoin technology enables whole new ways of trade that were not possible without Bitcoin. In this part I will go through 3 new Bitcoin developments that enable whole new ways of trade.

OpenBazaar

OpenBazaar is a decentralized store platform that enables opening your own internet shop easily and reliably. It is a competitor to platforms such as eBay and Alibaba and the engine of the platform is Bitcoin. All trade in OpenBazaar is done with bitcoin.

The advantages of OpenBazaar are diverse. The fee structure is radically cheaper than in eBay where the merchant could be forced to pay as much as 10 % every time someone buys their product. OpenBazaar is free. Additionally OpenBazaar is a free (as in freedom) platform with less restrictions than centralized platforms. Through OpenBazaar the merchants can also be found easily which makes it a great advertising platform for small merchants.

OpenBazaar has been in existence for only a short while but it already has tens of thousands of users and the merchants have been reporting that their sales have increased significantly since opening their shop in OpenBazaar.

21 API marketplace

Known for the first Bitcoin computer, 21 Inc has launched a revolutionary API marketplace. The idea is automated payments between computers. Computers can buy and sell different API’s in the API marketplace. This is a new and revolutionary way of trade.

The Bitcoin Computer developed by 21

One example of what can be done with the 21 marketplace is the paywalls of news sites. Currently paywalls are a pain in the ass, passing them requires complicated registrations, card payments and so on. Using the 21 model the user’s browser could automatically send small microtransactions to the news site which gives access to a specific article. Micropayments are difficult for traditional payment methods due to the fees but with Bitcoin this is actually possible to implement.

This is just one of the countless possibilities for buying and selling API access. Time will tell what kind of applications will come out of it.

Opendime

Opendime, which was recently published, is the world’s first physical Bitcoin payment stick. It is a USB stick with bitcoin value in it and it is designed for re-use. The balance of the stick can be checked at any time to verify that it holds a certain amount of bitcoins. It can be given to other parties as payment. The bitcoins can be extracted from the stick at any time but after it is done, it can no longer be given to other people as payment. This is an innovative way of using digital currency like bitcoin and it has great potential.

Three OpenDime sticks that can be loaded with bitcoin value

.

9. Bitcoin is getting smarter smart contracts than Ethereum

In the near future the Bitcoin blockchain will be linked with so called sidechains which allow Bitcoin to achieve much more than just monetary payments. One of these use cases is smart contracts which are believed to change the world. Ethereum is a blockchain project focused on smart contracts but what many people don’t know is that Bitcoin is getting even smarter smart contracts.

Rootstock is a blockchain project independent of Ethereum and the purpose is to copy the Ethereum model of smart contracts and improve upon it. The plan for Rootstock is to become a sidechain of Bitcoin since Bitcoin is the largest and most secure blockchain. This would be a significant improvement for Bitcoin and from an investment perspective it is smart to buy bitcoin before the official release of Rootstock is out.

.

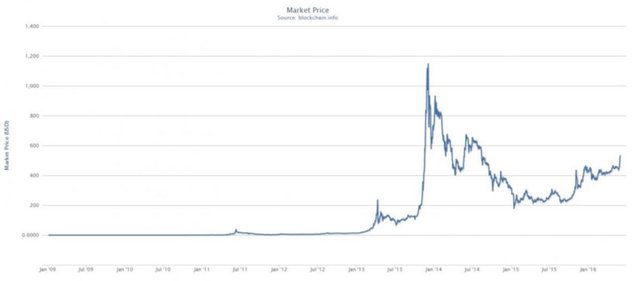

10. Bitcoin market sentiment is becoming positive

The trade of bitcoins in official exchanges started in 2010 and ever since the price of bitcoin has been quite a rollercoaster ride. Trading started at approximately 0.1 dollars per bitcoin and ever since there have been multiple price “bubbles”.

The all-time price graph of bitcoin (2009–2016)

The first great bubble started in the spring of 2011 when bitcoin broke the $1 price barrier and reached a high of $32 during the summer. After that the price crashed to a fall low of around 2 dollars. It is important to note that even after the crash the value was significantly higher than in early 2011.

The next bubble, which was the largest to date, happened in 2013. In that year there were actually 2 consecutive bubbles. The value of bitcoin was approximately 13.5 dollars in the beginning of the year and in the spring it rose to over $250. After that it crashed to a low around $60 and stabilized to around 100 dollars.

In the fall of 2013 we experienced the largest bubble in Bitcoin history. The price rose in a few months from 100 dollars to a high of over 1 100 dollars per bitcoin. After the high of December 2013 the price crashed and we had to suffer a whole 1,5 years from the price correction that followed. As before though, the price stabilized to a higher level than before the bubble.

The market sentiment cycle

This type of development is natural and it is part of the so called market sentiment cycle. When the price was at 1 000 dollars, bitcoin was in the so called euphoria phase. Everyone was very emotional and super excited about the continuous price increase and more and more people wanted to put all their money in to get rich with everyone else. This is a highly dangerous time to invest though, as has been seen.

The best time to invest is when a financial instrument is in its cycle either in the bottom or rising from the bottom. Investing at the bottom is very difficult since it is hard to find faith in that particular instrument at that time but it is already much easier to invest in something that is rising from the bottom.

Bitcoin price for the last 6 months

After that 2013 bubble and the ensuing price correction bitcoin stabilized to around 200 dollars per bitcoin. The price was at the 200 dollar range for a long time, around a year. Now in the last 12 months bitcoin has more than doubled to over 500 dollars and Bitcoin is being thought of more positively even in the media. At this time in the cycle we are between relief and optimism. I think this is a good time to invest as it is not as risky as a euphoria phase investment nor is it as difficult as trying to catch the bottom.

My view of the situation is that in the next 6 months or so bitcoin is going to start a new phase of massive price increase which could lead to an increase in the price to around 10x. It is also likely that after this rise the price will go down again but I believe it will stabilize higher than it is now. It is important to understand that even though bitcoin has a lot of volatility, it has been increasing in the long term.

I wish you were right :-)

It's always a good time for buying bitcoin!

Upvoted you

Upvoted you