General insurers to see higher motor TP sales after Irdai's rate revision

Motor vehicle owners, of the affordable variety, are going to pay lower premiums on their third-party (TP) liability once the Insurance Regulatory and Development Authority of India’s (Irdai’s) latest proposal translates into revised rates from general insurers.

General insurers, in all likelihood, will register higher sales figures in the product category. However, their costs for servicing of customers and their claims will rise.

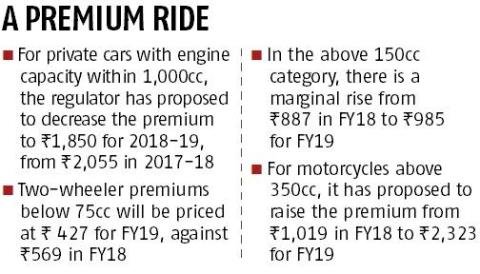

For private cars whose engine capacity does not exceed 1,000cc, the regulator has proposed to decrease the premium to Rs 1,850 for 2018-19, from Rs 2,055 in 2017-18.

Two-wheeler premiums below 75cc will be priced at Rs 427 for FY19, against Rs 569 in FY18. In the above 150cc category, there is a marginal rise from Rs 887 in FY18 to Rs 985 for FY19. For motorcycles above 350cc, it has proposed to raise the premium from Rs 1,019 in FY18 to Rs 2,323 for FY19.

“The reduction in TP premium rates is certainly motivating and acceptable for customers. It is definitely good news for private car owners, two-wheelers and tax owners, as this will reduce the burden on their pockets” says Anurag Rastogi, member, executive management, at HDFC ERGO General Insurance.

The regulator also decided that MTP premium rates for private cars in the 1,000 to 1,500cc category and above 1,500cc, as well as two-wheelers between 75cc and 150cc, will have the same premium rates during the next financial year. Experts say for larger/luxury cars, and high-end motorbikes, the premium is higher.

Yashish Dahyia of Policybazaar.com told Business Standard, “The size and capacity of the car/bike is not that important because motor TP insurance is for protecting the insured against any injury or damage caused to a third person/party (vehicle) in an accident.”

Khushroo Panthaky, director at Grant Thornton Advisory, says; “If you can afford an expensive vehicle, you can pay higher premium. Many a time when premiums are low, companies found it difficult to sustain and this was creating an impact on good customer relationships.”

The earlier time, Irdai had increased the MTP premium for cars in the 1,000cc to 1,500cc and 1,500-plus cc categories by 28 per cent.

Rastogi believes car owners of the below 1,000 cc variety will choose to opt for more comprehensive covers, instead of standalone motor TP products. While the increase in motor TP premiums by Rs 1,300 for high-end and powerful motorcycles isn’t drastic.

The regulator takes into account the ultimate claim costs for each accident year and gross premiums. Then, calculates the Ultimate Loss Ratio (ULR) for each of the accident years. The period this time under analysis was FYs 2011-12 to 2016-17. It analyses the movement of claims (intimations, settlement, settlement time, movement of loss estimates) in the past five years, say experts. “The motor business for insurance companies is not always a profitable one, given that the claims are much higher nowadays to what they used to be” says Panthaky. “With the increase in premiums, there will also be a different way of looking at the payment of claims.”

Motor TP premium income (Gross Direct Premium Income or GDPI) for private players grew 13.1 per cent, and by 17.8 per cent for state-owned companies, for the period up to January 2018 as compared to the previous year.

Motor insurance constitutes 47.6 per cent of private general insurers’ GDPI. Of which, motor TP insurance comprises 22.5 per cent of private players’ GDPI. Motor insurance accounts for 40.3 per cent of public general insurers’ GDPI; 25.3 per cent of their GDPI comes from motor TP sales. “The loss ratio of third-party is on the higher side due to various reasons. It is dependent on industry experience and movement of claims,” says Puneet Sahni, head of product development at SBI General Insurance.

Most cars have a capacity of over 1,000cc, barring a few notable models such as the Maruti Suzuki Alto K10, Renault Kwid, Hyundai Eon and Tata Nano, all priced at Rs 200,000-Rs 500,000.

The majority of motorbikes that are sold are above 100cc, including non-geared ones. By increasing the premium rate for 350cc and above, buyers of motorbikes like the KTM Duke, Royal Enfield Classic 350 or Bullet, and the Kawasaki Ninja, to name a few, will feel a pinch.

New car buyers, especially those looking to buy the compact, hatchback variety, will benefit once Irdai's proposal trickles into new menu prices from the next financial year. The decision to reduce premium rates for bikes under 75cc seems to affect owners of only specific and/or older models of two-wheelers.

“There will be an approximately 10 per cent increase in the premium for insurers, on an overall basis. This also depends on the mix of business one has in their books. Then, again, the inflation of cost of awards and litigation is at 10 per cent. Thereby, we would see a negligible effect on the financials of insurers,” says Sahni.

Asked about possible revenue loss for insurers, or if higher motor vehicle sales would balance out the effect of higher premiums, Panthaky said, “It is a compensatory situation, as premiums go down in some cases and up in others. I think the idea is that this will help people in the longer run, as people use their cars/bikes for three to five or seven years. This move will give them a lower recurring cost.”

Dahiya concurs, saying, “Non-life insurers’ revenues will not be affected by much. The claims ratios tend to be higher for the low cc variety of vehicles; so, I believe the regulator wants to encourage the social need” for having TP motor insurance.

While some vehicle owners will benefit, some will end up paying close to an additional Rs 1,000 on their motor TP insurance cover. For insurers, however, Irdai's move will help increase motor TP sales. However, there will be a proportionate rise in legal and investigative costs related to the servicing and administering of claims.