The Luna Crypto Crash: What Happened, Why It Mattered, and What's Next

The collapse of the TerraUSD stablecoin wiped out over $15 billion in bitcoin value.

Right now, the bitcoin market isn't looking good. Bitcoin and ether are at their lowest levels since 2020, while altcoins such as dogecoin and cardano are performing much worse. While the drop is distressing for crypto investors, it is not unusual. Cryptocurrencies are notorious for their volatility, and turbulent economic conditions are bringing not just crypto, but also the stock market down.

The collapse of the luna cryptocurrency and its accompanying TerraUSD (UST) stablecoin, on the other hand, is unprecedented. You may not be familiar with UST or what a stablecoin is, but it's a significant thing. Hundreds of millions of dollars in cryptocurrency riches have vanished, sending shockwaves across the market.

There are two connected storylines here: the UST stablecoin and luna, both of which are Terra blockchain projects. The UST coin was meant to always have the same value as a US dollar, but it was depegged last Monday, May 9, and has now dropped to barely 17 cents. Then there's Luna, the ecosystem's beating heart. Its value has plummeted in one of the most spectacular cryptocurrency collapses ever seen.

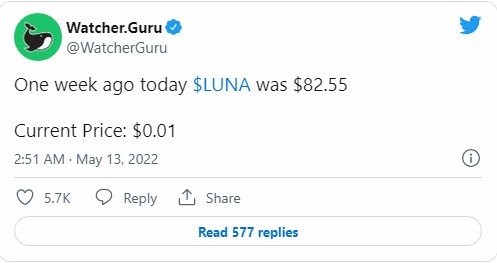

The price of the coin has dropped from $116 in April to less than a cent on Thursday. It has dropped even more, trading for a fraction of a penny over the weekend. Luna has dropped to an eighth of a cent at the time of writing. Small-cap memecoins have witnessed similar collapses before, but never for a currency the scale of moon, which had a market cap of nearly $40 billion just last month.

Mike Boroughs, cofounder of crypto investing firm Fortis Digital, stated, "This is momentous for the crypto markets." "Because of its scale and significance in terms of the number of people who lost significant assets, this is a defining event for the space."

Here's all you need to know about it.

What exactly is a stablecoin?

To comprehend the crypto-crisis, you must first comprehend what a stablecoin is. It's essentially a cryptocurrency tied to a more stable currency. Tether and USDC, the two most popular stablecoins, are both connected to the US dollar, as are other stablecoins. So, if you have 1,000 USDC tokens, you may trade them for $1,000 US dollars at any moment.

Stablecoins are a key component of "DeFi" (decentralised finance), and were created to help investors protect themselves from the volatility of the cryptocurrency market. If the price of ether is $2,000, a trader might buy 2,000 USDC tokens with one ether. If ether decreases 50% to $1,000 tomorrow, the 2,000 USDC tokens are still worth $2,000 and may be exchanged for two ether tokens. When investors anticipate a downturn, they buy in stablecoins such as Tether, USDC, and, until this week, UST.

Stablecoins also allow for bitcoin lending and borrowing, making them an important DeFi technology.

In a significant sense, the Terra UST coin differs from Tether and USDC. Tether and USDC are backed by real US dollars, whereas UST is a "decentralized" or "algorithmic" stablecoin. The notion is that the UST's dollar peg can be maintained without having to rely on actual US dollars thanks to a few smart processes and billions in bitcoin reserves.

"The Holy Grail of DeFi is a decentralised stablecoin," said Cyrus Younessi, former Head of Risk Management at MakerDAO, the firm behind DAI stablecoin. The difficulty for bureaucrats, politicians, and central bankers to control bitcoin and ether is their selling point, but their disadvantage is price volatility. "It would be amazing if you could take those assets, extract stability from them, and productize it," Younessi added.

"However, it isn't particularly viable."

What are Terra, Luna, and UST?

Terra, like ethereum and bitcoin, is a blockchain. While Ethereum's network generates ether tokens, Terra's blockchain generates luna. Luna was trading for $85. before the depeg.

To make UST, you must first burn luna. Last week, for example, you could sell one luna token for 85 UST (since luna was valued $85), but the luna would be destroyed ("burned") in the process. The purpose of this deflationary strategy was to assure Luna's long-term growth. As more individuals invest in UST, more luna will be burnt, increasing the value of the remaining luna supply.

To attract traders to burn luna to generate UST, the Anchor Protocol provided a mind-boggling 19.5 percent yield on staking — which is effectively crypto slang for earning 19.5 percent interest on a loan. Instead of putting your money in a bank where it would earn 0.06 percent interest, the pitch is to put it in a UST where it will yield over 20% interest. Prior to the depegging, this scheme held approximately 70% of UST's circulating supply, or roughly $14 billion.

The following is the key to UST maintaining its peg: A single UST can always be traded for one luna. So, if UST falls to 99 cents, traders might benefit by buying a large quantity of UST and trading it for luna, making a one-cent profit per token. The impact operates in two ways: people buying UST drives up the price, and UST being burnt during its conversion to luna drives down supply.

Finally, there are the reserves. Do Kwon, the creator of Terra, established the Luna Foundation Guard (LFG), a consortium tasked with safeguarding the peg. The LFG now has $2.3 billion in bitcoin reserves, with aspirations to increase this to $10 billion in bitcoin and other digital assets. If UST fell below $1, bitcoin reserves would be liquidated and the money used to purchase UST. If UST rises above $1, its founders will sell it until it falls below $1, then use the proceeds to buy more bitcoin to replenish the reserves.

Everything makes sense. However, UST is now worth 17 cents at the time of writing.

What went wrong, exactly?

On Saturday, May 7, it all began. UST worth over $2 billion was unstaked (taken out of the Anchor Protocol), with hundreds of millions of dollars traded instantly. It's unclear if this was a reaction to a particularly tumultuous moment — rising interest rates have had a significant impact on cryptocurrency pricing — or a more deliberate attack on Terra's infrastructure.

The price dropped to 91 cents as a result of such large sales. Traders attempted to profit from arbitrage by swapping 90 cents of UST for $1 of luna, but a speed bump emerged. Each day, only $100 million worth of UST can be burnt for luna.

It's even worse for lunatics. Luna tokens have almost fully lost their value: Luna's current price is a fraction of a cent lower than its April high of slightly under $120.

Regarding the possibility of a malicious assault. Some suspect that an attacker attempted to breach UST in order to profit from bitcoin shorting, or speculating on its price falling. Depegging UST would require Terra's staff to liquidate chunks of its bitcoin reserve to repeg the stablecoin if would-be attackers built a significant position in UST and then unstaked $2 billion all at once. When investors see that UST has lost its peg, they will unstake and sell their UST, requiring additional bitcoin reserves to be liquidated, increasing sell pressure.

This is, once again, pure guesswork. Younessi is uncertain whether the depeg was the result of a concerted operation, but he believes it is up to crypto engineers to establish better secure solutions.

"As DeFi builders, our objective is to create systems that are resistant to exploitation," he explained. "How would this stand up if a billionaire walked in and attempted to pull it down?"

Younessi described Terra's business as "broken" four years ago when working as a DeFi analyst at Scalar Capital.

Before the accident, he told CNET, "Terra might have expanded to be 10 times as massive." "We should burst that bubble of unsustainable protocols as soon as possible."

What difference does it make?

This is significant for three reasons.

First, luna and UST alone have wiped down approximately $15 billion in crypto worth. Self-harm has been reported by many who had most of their funds invested in UST; while these stories cannot be verified, it is apparent that many people lost a lot of money in the crash. However, as Boroughs of Fortis Digital points out, the devastation isn't limited to Terra's biosphere. Many people who were affected by luna and UST would have sold out large portions of their crypto portfolios to recuperate some of their losses, dragging the market down with them.

It also raises concerns about other stablecoins. UST was unique in that, unlike tether and USDC, it was an algorithmic stablecoin. However, the coins' stability has long been questioned: last year, New York's attorney general accused tether of lying about how much it truly kept in dollar reserves.

Boroughs are concerned that if UST is targeted, similar attacks will be launched against the others.

"The concern in our minds is if what occurred to UST will happen to other stablecoins," he stated. "We're concerned that if huge whales discover a strategy that works to attack UST, they'll apply it to other markets."

Finally, and perhaps most importantly, the demise of UST has piqued the interest of prominent politicians and authorities. UST's depegging, according to Secretary of the Treasury Janet Yellen, "just underscores that this [stablecoins] is a quickly developing product with rapidly growing dangers."

"Stablecoins are one area where we could see some [regulatory] activity," SEC Commissioner Hester Pierce said on Thursday.

What does the future hold for Luna and UST?

Since UST depegged on May 10, Terra developers have had a difficult week. Terra's bitcoin reserves have been questioned by prominent personalities, and the Terra blockchain has gone offline on two occasions. Meanwhile, Terralabs CEO Do Kwon believes he has a strategy to re-peg UST and restore Luna's value.

As previously stated, the Luna Foundation Guard had around $2.3 billion in bitcoin. Those reserves were to be sold in the case of a depegging, with the proceeds used to purchase UST back up to $1. So, what went wrong?

Some have questioned how the money was spent by the LFG. On May 9, about $1.6 billion in bitcoin was transmitted from LFG's wallet to Gemini, a crypto exchange, over the course of a day. Another $875 million was sent to a Binance wallet, the world's largest cryptocurrency exchange. Gemini and Binance have no record of what transpired after that.

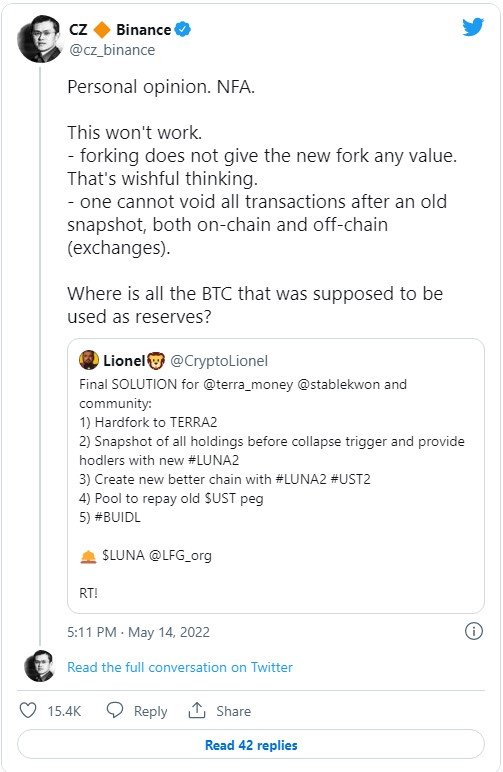

Many people, including Changpeng Zhao, the founder and CEO of Binance, are perplexed by the lack of openness. He tweeted on Saturday, "Where is all the BTC that was meant to be utilised as reserves?" "Shouldn't all of those BTC be utilised to repurchase UST first?"

Terralabs CEO Do Kwon tweeted on Saturday, "We are now working on documenting the utilisation of the LFG BTC reserves during the depegging incident." "Please be patient with us as our teams are working on numerous projects at once."

In a tweet, Kwon stated, "I am sad about the suffering my creation has caused all of you."

Terra's blockchain was blocked the day before Kwon's remark, meaning no transactions of any type were permitted while a plan to "reconstitute" the ecosystem was being developed.

Do Kwon suggested a solution to Luna's problems on Friday. The Terralabs CEO proposed forking Terra, which would result in the creation of a new blockchain. A snapshot of current Luna and UST holders would be obtained, and 900 million Luna tokens would be handed to them, with the remaining 100 million Luna tokens going to a "community pool to support future improvements." In essence, it's an attempt to restore the state of the blockchain before to the depegging.

Many people, including Zhao, doubt that the strategy will succeed.