TETHER / BITFINEX | Market Cap More Than Doubled In The 6 weeks After U.S. Regulators Issued Subpoenas. Was This A Modern Day "Operation Mongoose"?

It looks like it's happening guys. A little over 24 hours ago I published a post about Tether after noticing an unusually high jump in its market cap. In the space of just a few minutes during the early hours of Sunday morning (UTC), Tethers market cap rose by 600 million US$, which brought the total amount of Tether in circulation to over 2.3 billion. This is a huge increase considering the market cap for Tether was only 11 million US$ at the beginning of 2017.

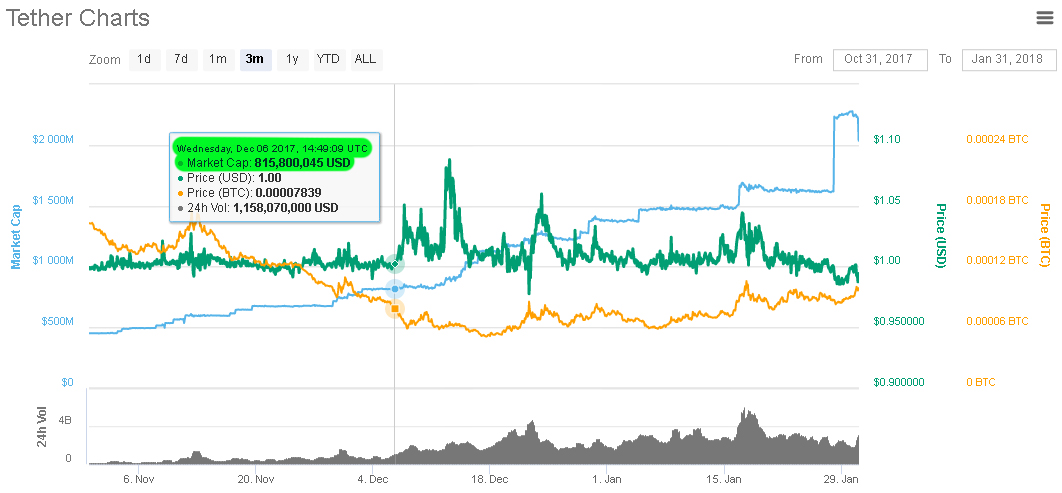

Well, a few hours ago Bloomberg revealed that the Cryptocurrency giants Bitfinex and Tether were subpoenaed by the US Commodity Futures Trading Commission back on December 6th last year. Surprisingly (or unsurprisingly if you've been following the Tether drama), the amount of Tethers in circulation has more than doubled since the subpoenas were issued.

With this recent revelation you can see why the amount of Tethers in circulation has more than doubled since early December. They were probably trying to dump as many of them onto the market before it was over. The first signs that this house of cards was falling came on Friday after Tether parted ways with their auditors Friedman LLP casting further doubts over the credibility of the currency for many.

Tether Confirms Its Relationship With Auditor Has 'Dissolved'- Coin Desk - 01/27/2018

Tether, the issuer of the dollar-pegged cryptocurrency USDT, said its relationship with audit firm Friedman LLP has ended. The statement, provided Saturday evening by a company spokesperson to CoinDesk, confirms the suspicions of online sleuths and is likely to raise new questions about the company's finances.

So, who is behind all of this mess?

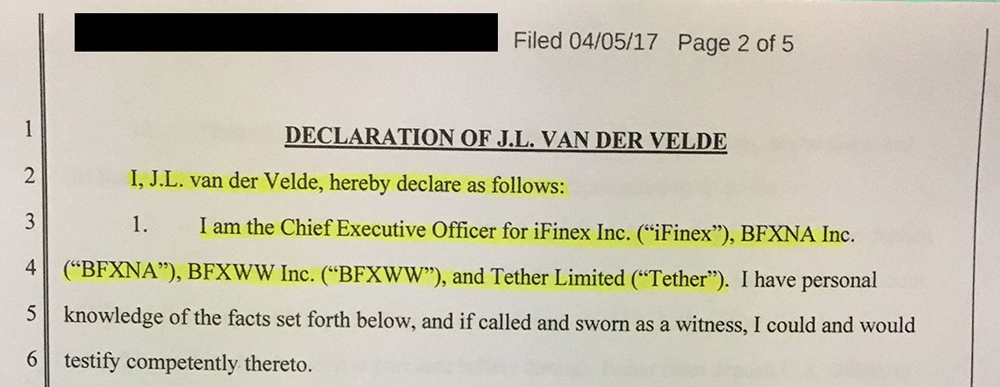

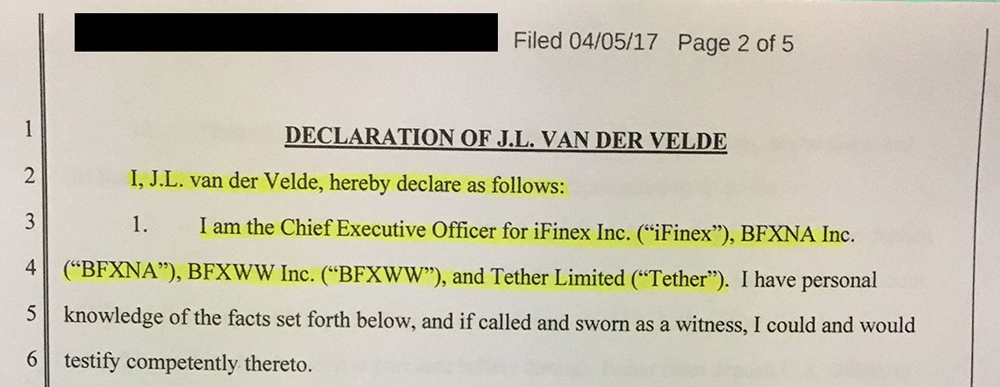

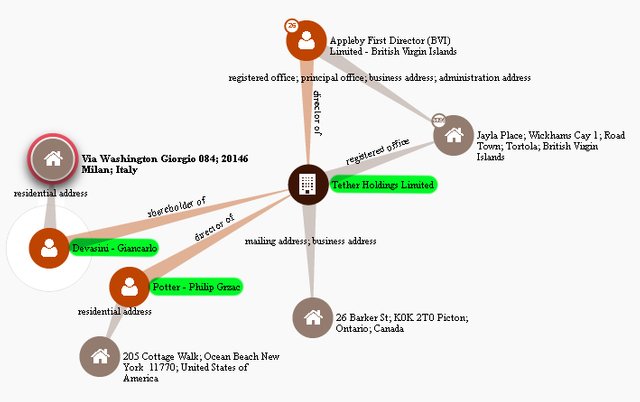

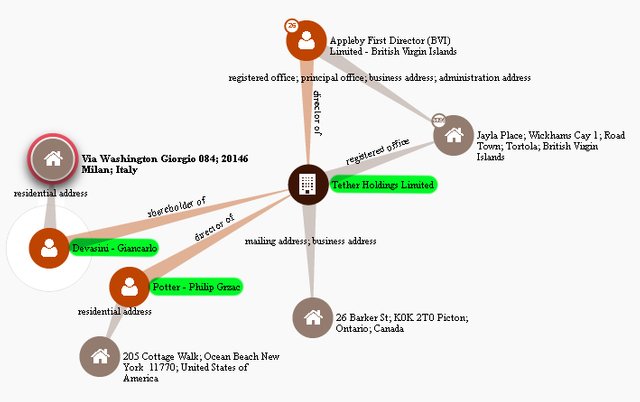

Little is said about who the owners of these companies are on either of their websites. It turns out there are 3 main characters in this story/scam/unfortunate event, Jan Ludovicus van der Velde, Phil Potter, and Giancarlo Devasini.

Source

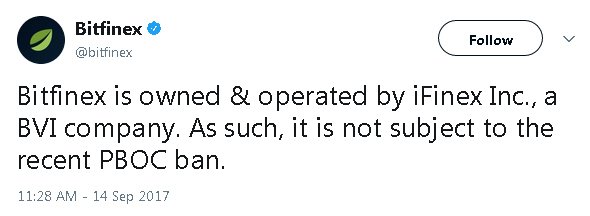

- Jan Ludovicus van der Velde is the CEO of both Bitfinex and Tether.

Source

Phil Potter in the Director at Tether, Chief strategy officer at Bitfinex.

Giancarlo Devasini is a shareholder.

Source

Paradise Papers Reveal Bitfinex’s Devasini and Potter Established Tether Already Back in 2014 - Bitcoin News - 11/23/2017

Philip Potter, Bitfinex’s chief strategy officer, worked for Morgan Stanley in the 1990s, but was fired from the company after Mr. Potter was featured in a 1997 New York Times article that portrayed him as shallow and materialistic. Little is known of Mr. Devasini’s background, other than that he founded a computer hardware company during the 1990’s. Mr. Devasini was fined 100 million Italian lira in 1996 for selling pirated copies of Microsoft software.

The Flow Of Money

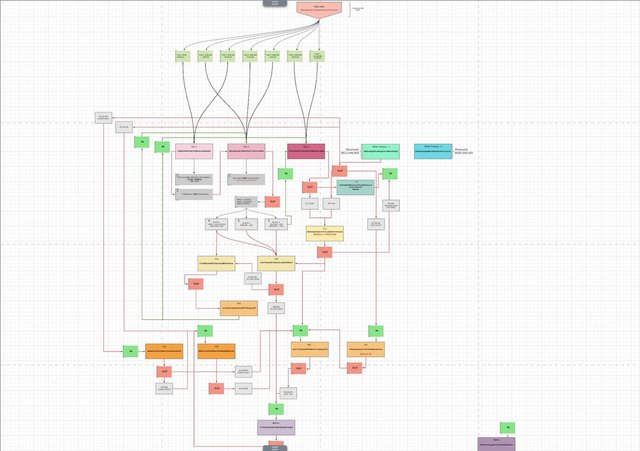

Someone on Twitter has been following the trail of Tethers between the Tether mint, and various exchanges and wallets. As you can see from the map below it's an unbelievably complex network of accounts and transactions. Unfortunately this is the highest resolution Steemit will allow, but the person who made it kindly shared a link to the full interactive version. (Note: You do need to make an account before you can see it)

It may be a coincidence but the price of Bitcoin hasn't stopped dropping since Sunday. If everything that you've heard about this situation over the last few months turns out to be true, and 2.3 billion+ US$ does get wiped from its market cap, then I can't see this ending well for either Tether, Bitcoin, or the rest of the cryptocurrencies. Under normal circumstances the markets would probably cope just fine with losing this amount from it's total, but along with all the negative publicity this will bring to cryptocurrency in general whilst this story plays out it'll undoubtedly have an negative effect throughout the whole of the market. Hopefully we're not heading for a crypto nuclear summer.

Oh, one last thing....

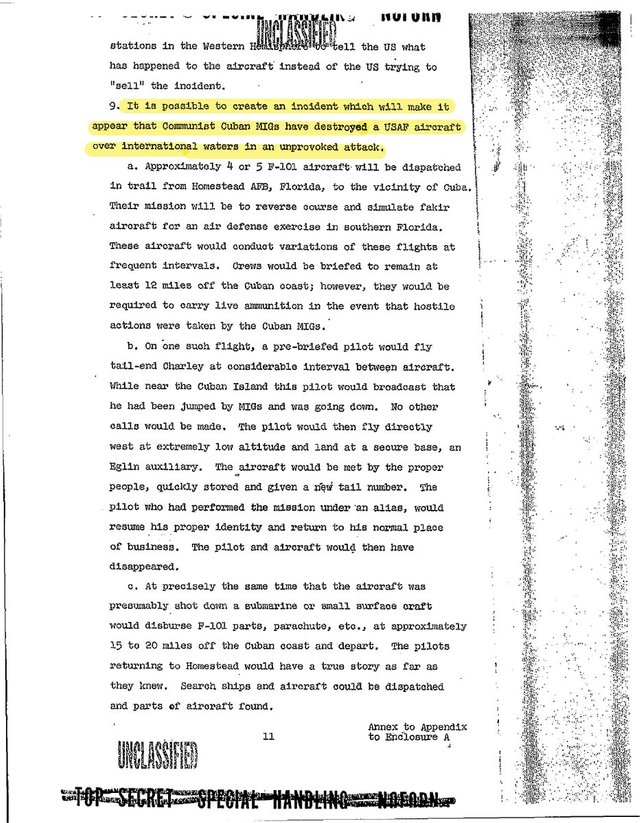

The Pentagon Once Considered False-Flag Attacks To Justify An Invasion Of Cuba | Business Insider - 12/17/2014

The plans were developed under the name "Operation Mongoose," with an emphasis on the namesake animal's speed: The JCS wanted to carry out these operations, thereby legitimizing attacks on Cuba, before Havana and the Soviet Union established bilateral mutual support agreements. The report was released in March, seven months before the start of the Cuban Missile Crisis.

At time of writing Tether stands at US$ 0.994 with 2.3 billion Tethers in circulation, totaling a market cap of US$2 billion.

Curiouser and curiouser eh mate!?

No doubt this is an excersize in manipulation.

I don't think so however I wouldn't put anything past these bastards. They're definitely setting up for a battle.

Nice work as always @fortified

Amazing post and very informational. Thank you!

DUDE! The show is overrr...Great fuckin investigating these last few weeks. I wish i had a fatter upvote to give you.

Also, thank God for JFK cause that false flag would have happened if it were not for him.

"JFK" faked his own death http://mileswmathis.com/barindex2.pdf

This is seemly way worse than I originally thought. His history of criminality does not bode well for Tether.

The greedy stepped out of line, all too human

Thanks! I resteemed, because this is very important information - but I have to admit, that I still don´t understand in detail, what is going on here and why this should have such a devastating influence on all cryptos?

I think it's logical to invest according to its increase. I follow your posts and I can say that.

your post is logical, i get news update. thank you for writing this beautifully.

The whole tether thing has been a shit show but I don't know how much of an impact it will have on crypto overall

Excellent research my friend, and equally great that your previous post is recorded on the blockchain and thus showed that you called this early!

As with all technology there exists an inherant duality. The blockchain is certainly here to stay, equally the fight for it's control has begun. Who wins will shape the future direction of humanity. We live in challenging but exciting times. Thanks for keeping us informed @fortified