Art Vandelay's - The Daily Vandelay - Vandelay Industries' Total Di©k Move #1

Here at Vandelay Industries, we've really started to embrace these cryptocurrencies that seem to be coming from nowhere. It's an exciting time for us, but sometimes we've noticed that in order to really make some decent profits, you have to be kind of a di©k. The internet is full of di©ks just waiting to rip YOU off, but God Forbid you return the favor! Sometimes you have to play a little dirty to get what you want.

Here's a nifty little trick I commonly refer to as a "di©k move" that can really pay dividends on occasion. It involves trading and lending at Poloniex and using another site's homepage to tip yourself off to good investment moves.

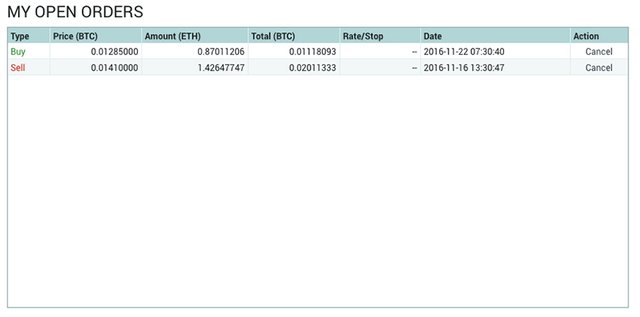

Let's take Ethereum for example from early this morning 11-22-16. ETH was in a good place right then, up a little. The first part of the di©k move is to have an IN position, as well as an OUT position for Ethereum. As you can see in the next image. Notice the ETH price @ .0134.

Now notice I have a SELL order set @ .0141, and at the same time also have a BUY order set @ .0128. Essentially what I'm doing is to putting myself in a decent position regardless of which direction ETH decides to go. SELL at a profit, or BUY at a good price.

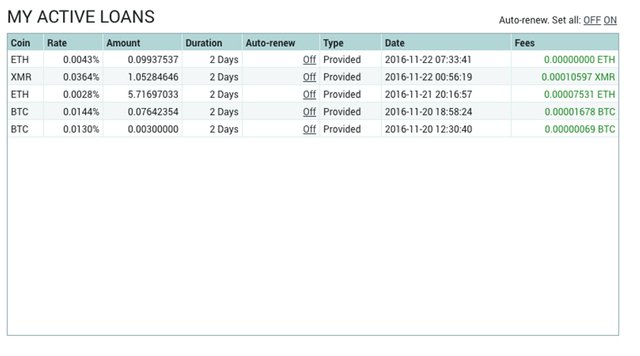

Now that was the IN and OUT part of the di©k move. The Middle of the Road part involves Poloniex Lending. Polo lending is comprised of nefarious little creatures that are playing the crypto market on the margin and attempting to use other people's coin to scrounge out a profit. You don't want to concern yourself with them other than getting paid your cut of their pie in the form of short term interest. The reason you want to be in this market is simple: if you're going to be in Ethereum , for instance, then you might as well get paid some interest for holding onto it.

Never put everything you have in lending though. You'll be stuck in the loan for a minimum of two days and regardless of what your coin does, you can't back out. This is the reason for the IN, OUT and LEND at the same time. It's a gas when it works like clockwork, trust me.

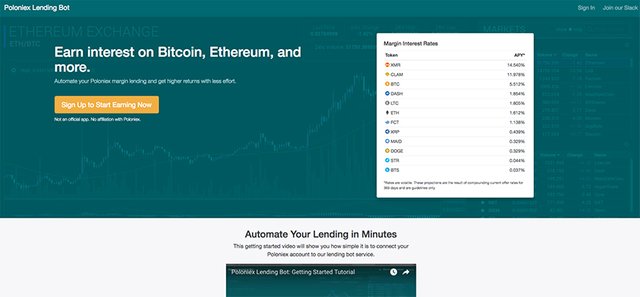

The final piece of the di©k move is to watch the Poloniex Lending Markets via a website called The Poloniex Lending Bot. What this site does is for a fee, swaps you into Polo Lends on your behalf. The bot's purpose is simple: you lose money if you're not in a loan, so better get in at whatever the lowest price is. This usually has you bought in at very ridiculously low interest levels and will piss you off big time when you watch it happen before your eyes!

If you watch Polo Lending enough, you'll spot average loans at say, .015% for example. Then you'll see these idiots offering loans at stupidly low rates like .00895, for the same loan. They're the nefarious creatures I mentioned before that know there are bots out there that will snatch the lowest possible rate and they try to get loaned coin for much less than the market rate. Do yourself a favor and manually do your Polo Lending rather than use a bot. You'll be much better off.

Mainly with Poloniex Lending Bot, you're using the good information on their homepage to tip you off as to good lending opportunities. Also, high loan percentages usually means something's afoot in the Polo Margin World. A rate that keeps going up can mean a lot oof shorts are at play and the coin might take a dump. It also could be the other way, but Poloniex Lending Bot can be a good first warning to start watching a coin closer.

Di©k Move complete.

Anyway, this has been your friend, Art Vandelay with The Daily Vandelay.

It makes me laugh how people are willing to loan out their coin to people betting against it at these tiny dust rates. Botting it just reinforces the race to the bottom. Most of the time on Poloniex, borrowing may as well be free.

If it's just sitting an exchange, you're getting nothing from it. That's why you cover your a$$ with positions in case it goes up or goes down. Monero currently lends at 14% annually. That's not too bad. But you could let the exchange have it for 0% if that's what you prefer.

The risk of letting the coins sit on the exchange isn't worth the dust in return, I'd say. And then there's the time spent setting up, managing, and monitoring the bot as well! If you have coins sitting on Poloniex, I suggest setting an optimisticly high rate on the lending page. Once in a while, a big short hits and the 1-2% daily rate you can get more than covers whatever you might've made at 0.001% in the mean time. Very low maintenance that way as well.

I prefer to play it long myself. There were lots of 1%+ rates back when BTC took off. I don't have a bot doing things for me. I just pointed out the site that displays the lending rates like Poloniex should be doing themselves, but don't for some reason. When you notice a lending rate increasing though, it's been my experience that somethings about to happen. Might be a tip to sell as shorts outweigh the longs in the margin arena usually.