Cryptocurrencies: How to Spot a Winner 80% of the Time

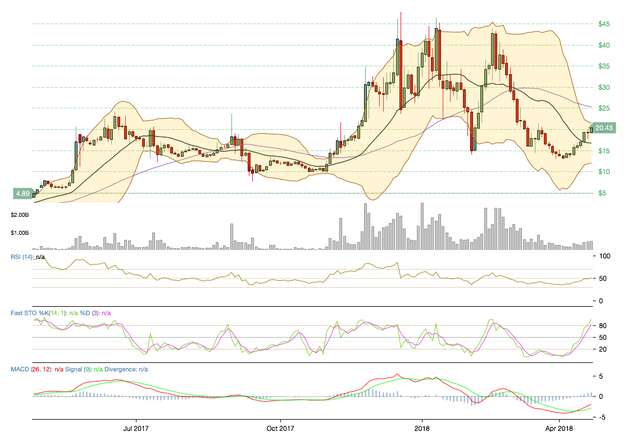

In early April 2018, we argued that if triple-bottom support at $15.77 could hold on Ethereum Classic (ETC), we could make an argument for big upside.

Not only did triple bottom hold, MACD was on the floor.

The Fast Stochastic was at less than 20. RSI was just beginning to pivot from oversold conditions at its 30-line.

Once all of the indicators aligned in oversold territory, it was only a matter of time before we began to see higher highs, which is exactly what happened. A week after the technical set up, ETC rallied from $15.77 to $20.43 with a good deal of bullish momentum at its sails.

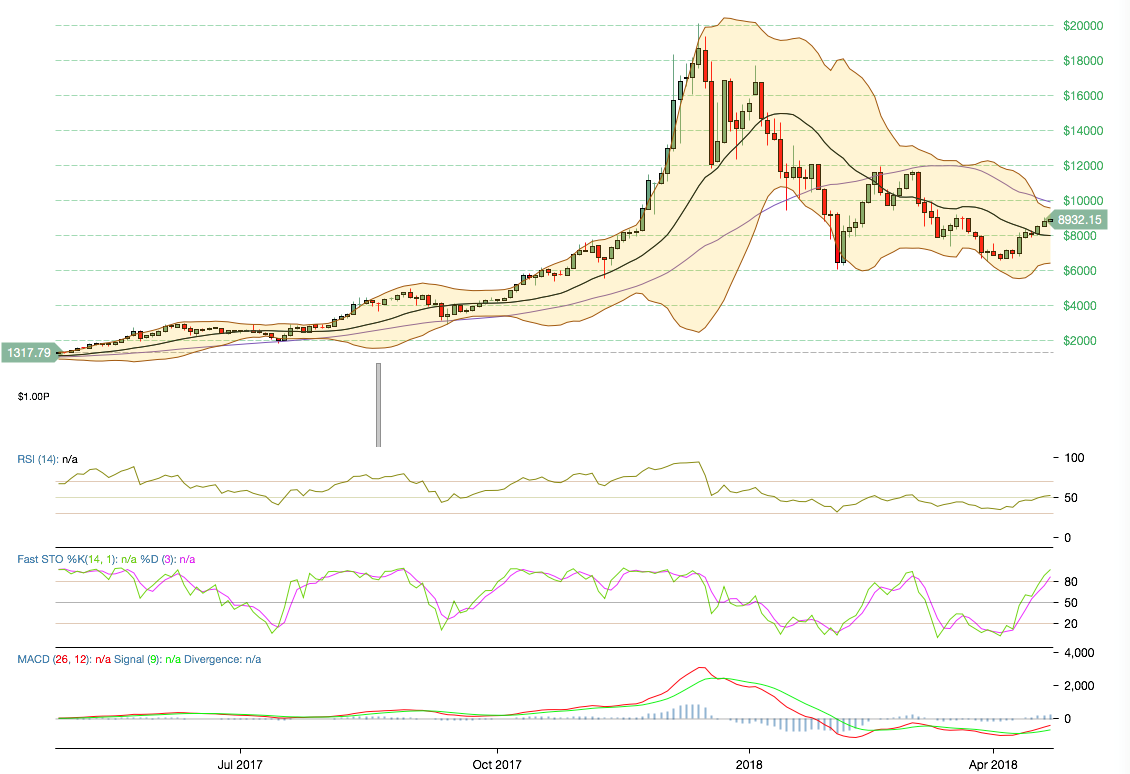

Now, let's take a look at Bitcoin.

In early April 2018, the CEO of Pantera Capital noted that $6,500 was the bottom for the bear market, and sees Bitcoin rallying to at least $20,000 by year-end.

"Something that's growing that fast hardly ever gets below its 200-day moving average," CEO Dan Morehead told CNBC. "When it does, it's a very good time to buy. It's 65 percent below its high, you don't get that opportunity very often."

However, aside from its 200-day, it was incredibly over-extended at its lower Bollinger Band (2,20), as it attempted to break above its 20-day moving average. Plus, each time the coin dropped to or below its 30-line on RSI, coupled with a drop to less than 20 on Fast Stochastic with a severe drop on MACD, we typically saw a rally in the coin not long after.

We saw it happen again at $8,232 on Bitcoin in early April 2018.

Days after the coin would rally to a high of $8,928.

.png)

While technical analysis won’t work 100% of the time with crypto, it gives you a fighting chance to jump into these coins ahead of the herd. Fear kept many traders away from these coins for a brief period. But when things get so out of hand in oversold territory, that’s where you want to buy.

Just as Warren Buffett will tell you with stocks, “Be fearful when others are greedy and greedy when others are fearful.”

The best part – there are hundreds of oversold setups just like these two that can be spotted and profited with just as easily.

Imagine buying a coin at $15.77 and watching it pop to $20.43 in days.