BTCUSDT - US Federal Reserve Meeting

Hi all!

Another publication of an idea on the topic of alerting / reminding how the cryptocurrency market behaves in general, and bitcoin in particular on the eve / after the FOMC.

So, today, July 27 at 21.00 Moscow time, the decision on the interest rate of the US Federal Reserve will be published, and 30 minutes later - a press conference at which further plans for monetary policy will be announced ( perhaps the more important component, since it is precisely the expectations " the market lives ).

Let's restore the chronology of events:

March 16 - the first rate increase over the past few years, by a symbolic 0.25% to 0.5%, by that time the market had already completely laid this outcome, as a result, in fact, we saw a local wave of growth until the end of March.

May 4 - the rate was raised by 0.5% to 1%, inflationary risks began to prevail, it became obvious that the monetary authorities would take the necessary measures to contain the accelerating inflation. The next day, all risky assets were under pressure, bitcoin did not stand aside, in a short period of decline by more than 30%.

June 16 - the rate increased to 1.75%, and the step increased from 0.5 to 0.75%. It was on the fact of the previous meeting, two days later, that the minimum of the current year was formed.

This month, we are seeing modest attempts to restore demand for risky assets, market participants are gradually developing the opinion that the peak of inflation has passed or is just around the corner, respectively, and the cycle of tightening the monetary policy of the US Federal Reserve will soon come to its final stage. Like it or not, we have yet to find out, in connection with this, the special attention of market participants will be paid to the press conference, at which Jerome Powell will outline the position of the US Federal Reserve in terms of future prospects.

The market has already fully priced in the rate increase by 0.75%, if confirmed, it is likely that we will see a similar picture to what was observed in March, however, by the time of this writing, the opening of the trading session on the US stock market indicates this, almost + 2% add indices.

From the point of view of technology, there is an ascending structure for bitcoin on the presented timeframe, within which local lows and highs rise, scrapping is possible only if it goes below $18,900.

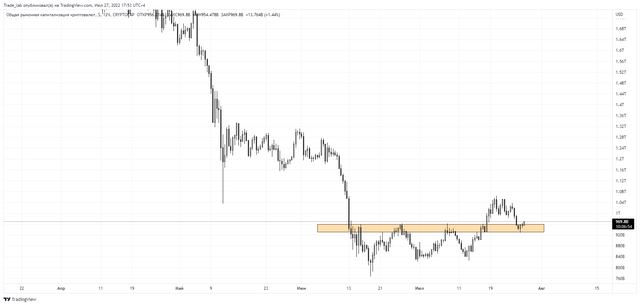

The dynamics of the total capitalization of cryptocurrencies maintains the growth scenario by retesting the level that was previously resistance

Summing up the above, the relevance of a possible growth in the region of $ 28,000-32,000 remains.

If you like our ideas and reviews, please put 👍 and leave a comment, and don't forget to subscribe! 😉