Is trading getting harder every day?

Its very common to see discussions or authors of articles pointing that trading is getting harder every day, and if you want to stick with this article i can explain you why this is just a tunnel vision, and in fact trading is getting easier day by day. Yes it is true that low competition is allowing one to perform with better results, but what it matters is if certain historical approaches are today easier to execute, more profitable and getting more flexible day by day. Without the doubt there are niches in trading, very specific methods that are getting extinct, but my point here should be aimed towards 99% of total retail traders out there, since their trading method fit to the area of more general approach of trading, that in fact is getting better, faster and easier to achieve each day that it goes by.

Retail trader in 1985 / retailer trader today

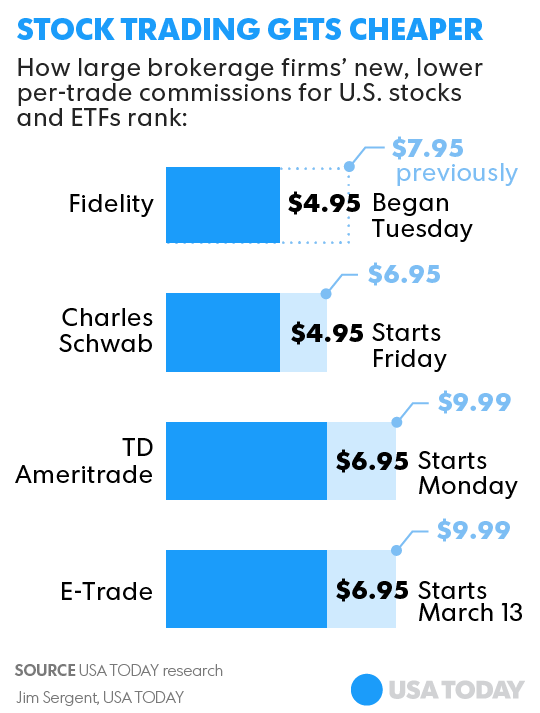

Commission costs are decreasing

Overall brokers, exchanges and providers are decreasing commissions year by year, simply due to competition. Retail trader 15 years ago had to pay much more for fees, simply becouse brokers could charge much more due to low competition as that trader had barely any other direction to go to. Today competition between brokers is harsh, which leads to decrease in cost of fees, and on other hand blockchain based decentralized platforms are pushing this trend even faster, as the fees are severely lower compared to other centralized providers. Trend is very clear and obvious, fees per trade are going lower and lower, thus allowing retail trader to increase frequency of trades and to move to ever lower time frames.

Lately there have been few brokers across stock and FX trading already allowing 0 fee cost trading which clearly points to which way trend of commission cost is moving. It simply allows trader to have more room to when it comes for shaping trading strategy and time frame execution.

Speed of execution

Increased technological ability of computers is allowing ever faster executions in regards to client based platforms and also the overall internet speed is allowing information to pass quicker to trader than ever before. Today trader is able to receive much larger amount of information than decades ago, and receive them within single second. Increased speed of information receiving and trade execution simply allows trader to develop much broader spectre of trading strategies, allowing much more flexibility and freedom to trader today than ever before.

A lot of traders approach this the wrong way, they bombard themselves with ton of information simply becouse its free and easy to access, creating mass confusion especially without properly formed trading strategy. The key is to use increase of speed, but only to gather and use only specific information that are applicable to trading strategy that trader uses.

This means trader has to know ahead what exactly he/she is trading to know for which information one has to look for, and how the execution speed of trade is relevant to that strategy.

20 years ago trader could complain becouse simply one could not access certain information that would be required to build and execute certain strategy of, today there is no excuse for that.

Ability to find profitable traders and learn from them

Global connectivity is making much easier to find specific person that one is willing to learn from, decades ago that was much much harder. Trader 20 years ago had to dig really hard, spend probably a lot of money in order to call, travel, find, and judge whether that person is legit to learn from it. It took much more dedication, resources and harshness on initial judgment failure than it does today when it comes to finding person to learn from.

Trading is very performance based science, where it is extremely important that one learns from person that actually does perform okay, as opose to just learn from someone who is able to provide theories and data.

With social media, websites, google research its possible to find much easier a mentor, the only problem that still exits (which existed as well few decades ago) is how to judge whether that person is legit to learn from. That is something that still takes strategic approach on judgment or /and experiance at least some overall.

Trading communities

Trading community is double edged sword. It has positives, providing quick to access learning data and answers for beginners, space to find like minded people, but also large disadvantage which is a lot of different trading ideas and strategies which build bad foundation to majority of participants. The way to go for trader should be to focus on single pattern and strategy and perfect that. But lets leave that aside.

Communities are increasing in size and value every year, it enables now beginners to gather initial required data to start trading much easier than it was ever before, and social platforms based around trading are improving in terms of technology every year, it is by no means going downwards, quite the oposite, softwares and forums today are far more efficient than the ones just 5 years ago.

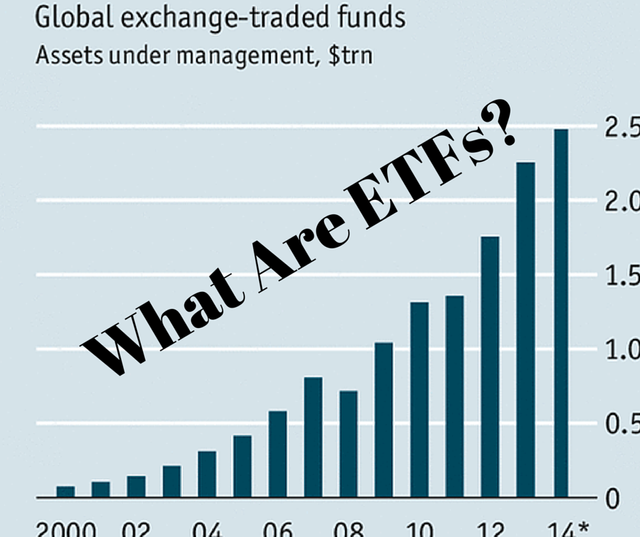

Number of instruments and liquidity

Liquidity was major obstracle preventing traders to enter into lower time frame trading, simply becouse there was noone to buy/sell to or becouse the spread was too large compared to structure/info that trader was trading. As the participants in markets are increasing each year, the capital size is increasing, this creates more liquidity, now enabling traders to dig deeper and deeper into micro details to trade. Just to make this clear, this is judging the overall market, if one would judge specific instrument or market then liquidity could be flat, increasing or decreasing. Overall however across markets in general especially due to easy access the liquidity is increasing. Accessing marketed instrument today via internet and quick platform is much faster than 20 or 30 years by physical accessing the correct brokerage or exchange, or even making phone call. On other hand number of instruments is increasing as well. Especially with crypto decentralized exchanges opening in next 2 years this will balloon number of traded assets into exponential numbers from today onwards.