Trading liquid rotations/bottoms

Market bottom

Every trader with a year of trading experiance has probably heard a phrase "you cannot know where the bottom is, you can only guess", it is probably one of the most wide spread false information in trading. It is in fact possible to have edge on finding the bottoms and tops in markets, however it does require thousands of hours in front of charts in order to spot the patterns. My aim in this article is for reader to learn those patterns without spending such required time.

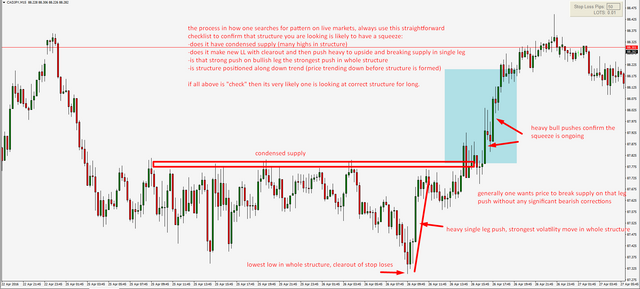

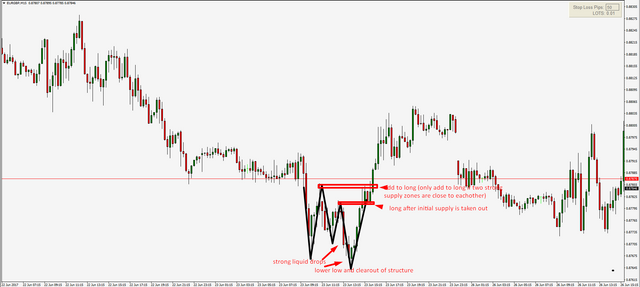

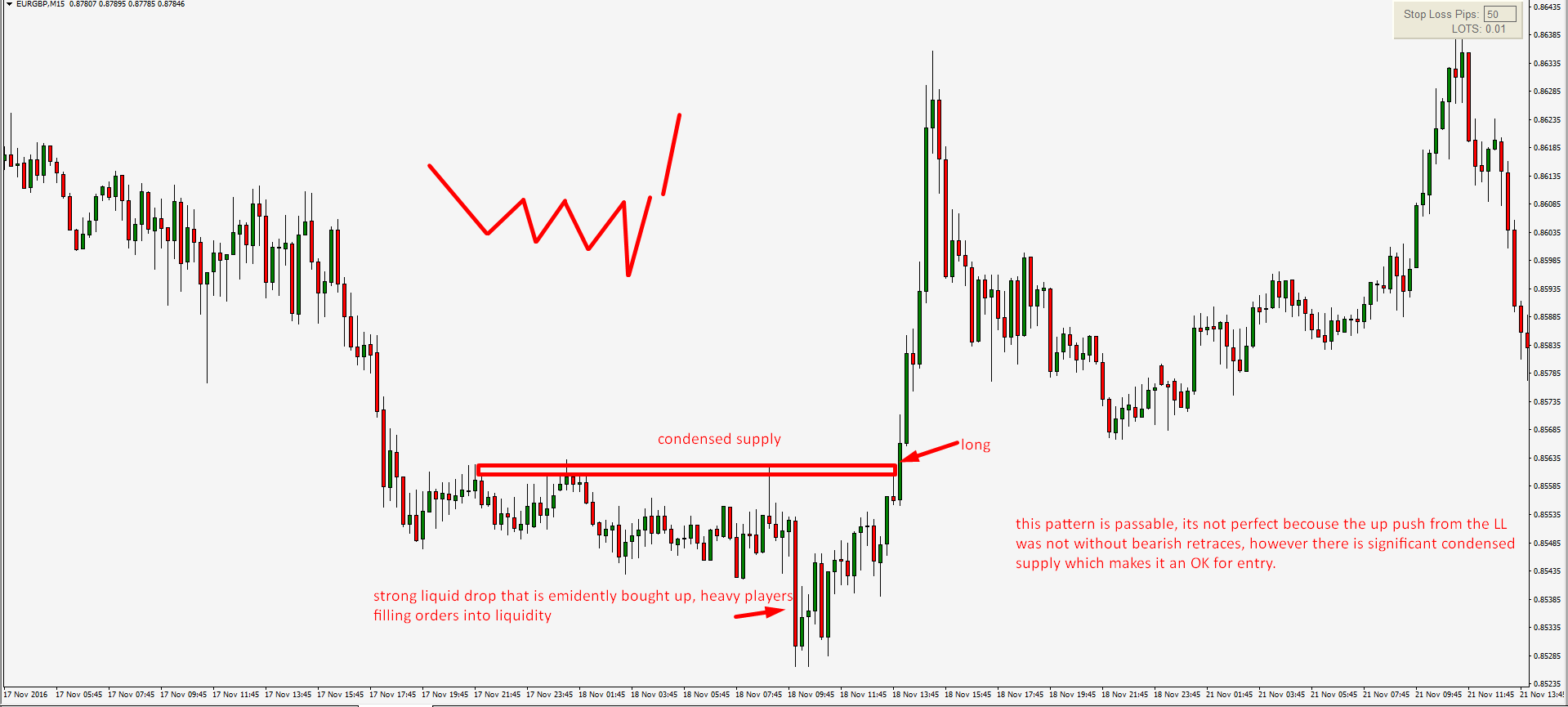

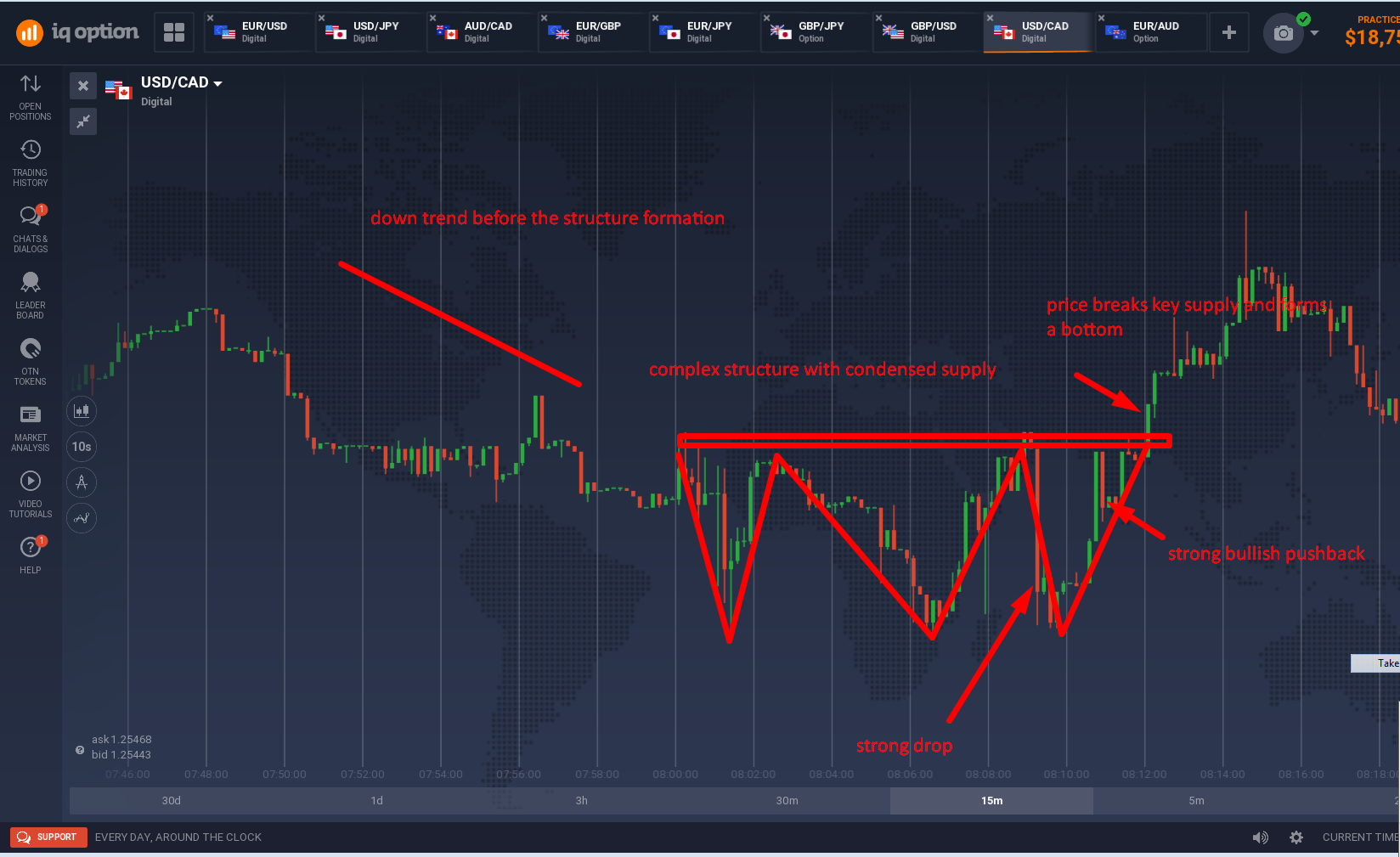

Strongest bottoming attempts will usually come from condensed price structures with a lot of activity and liquidity in them, best thing for a trader when it comes to finding bottoms is to not focus on double bottom pattern, but rather look for more complex and larger structures. The pattern which is my prefference when it comes to trading the rotations and bottoms is clearout. The name comes from the process that happens in such structure, beginning with few or several highs/lows that are made within structure, a liquid strong drop which clears all the stop loses from the participants in structure and following with strong bullish push above key highs in the structure. Basically a 3 step process that generally confirms such pattern is taking a place. For a beginner trader this might be difficult to understand so it is best to focus on key characteristics in order to find such patterns, which i will list bellow.

Characteristics of clearout pattern:

-complex structure with at least 2 highs and lows

-strong drop bellow lows of the structure

-strong rotation and bullish push above the highs of structure

Example setup:

Entry is always made once the key supply of structure has been taken out by buyers, handling the stop loss is however up to a trader. In most cases if squeeze and bottoming process is taking place the price will hold the flipped supply and keep moving upwards, leaving trader with a choice to use very tight stop loss.

Trading rotations could be difficult to some traders at beginning since it requires different mentality that most traders have when it comes to trading, meaning that most traders will think to short instrument once the price is trading around the previous highs and thinking of long if asset is trading around the lows, eg- buy low sell high. Rotation trading is completly oposite, it is waiting for highs to be broken to establish the strenght on buyers, and then buying price around and above the nearby highs. In most cases shorts will get squeezed out of the participants who were short in such structures.

When it comes to searching of bottoming clearout patterns, it is best to stick to assets that have down trend since it is more likely that bottom will be formed on such asset, rather than seeking them on up trending assets and looking to find pattern in retracement legs.

Those patterns are persistent and appear in all markets including forex, equities, bonds, cryptocurrencies and others.

The only difference is the time frame that one can trade depending on market, in forex markets any time frame can be traded since markets are liquid and fees are low, however cryptocurrencies for example have to be traded on charts 15 minute and above in order to have enough liquidity to enter and exit position quickly and to cover the fees on most exchanges.

Still, you can only guess where the bottom will be, even with your "1000 of hours of chart studying". You will never know for sure!

Its not about knowing for sure, technically there is no such thing as sure thing for anything in universe, however that doesnt mean that one cannot execute process with positive outcome over long run just becouse the outcome is never 100% sure. Therefore it is important to have an edge where one is able to find pattern that has 70-80% statistical reliability and execute based on that, it is totally doable executing such pattern with positive outcome / profits even if it is not 100% guarantee that bottom will trully be formed. This is core basis of any profitable strategy.