Much Support - So Resistance - Cryptocurrency Trading Explained

Theoretically, if you could learn how to read trends, analyze past price data, and learn all you can about coins you're interested in, then you could earn a nice profit by day trading. But for us mere mortals who can't grasp the technical nature of cryptocurrency trading, there are Crays (experts) in our midst who perform the due diligence, research, and technical analysis needed to make logical bets.

Thanks to one of our top Crays (who asked to remain anonymous) here is a lesson in support / resistance in charts.

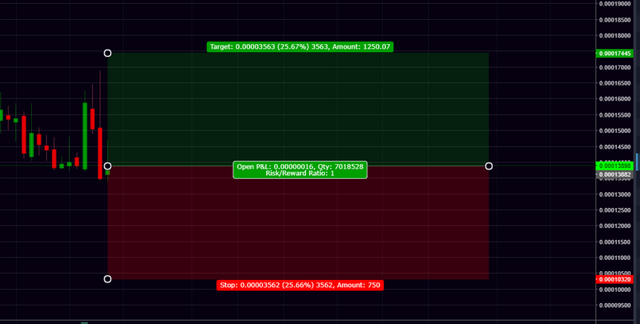

The middle between the red and green highlighted areas is your entry (where you buy in). The area below in red is how far you will take a loss with your stoploss at the bottom of the red. The green is your expected profit with your target being the very top.

The bottom is your Risk, the top is your Reward, the difference is the Ratio.

All your trades should have some sort of Risk/Reward thought process or calculation. The following chart is an RR plot in trading view, its set to an r/r of 1. this means that you are willing to risk one unit while expecting to win one unit (not a good trade btw):

This is a little more like it, here you are willing to lose up to 1 unit to win 2 the middle line is where you entered your trade. The bottom is where you set your stop. And the top is where you exit the trade (take profit). You should know all three of these things for every single trade you make or you shouldn't be trading.

Hodling is just trading on a different time frame.

It's why you keep looking back at January 2018 in disgust because you didn't set your r/r back when you bought the coins in 2016/2017. So you should learn how to work with time frames.

This is a pretty simple chart to trade. You certainly would not look at this chart and say, time to buy massive! Why? Because it's repeating a pattern, its trending down, we're in an uncertain market, the fundamentals are being questioned, and a number of other reasons, but it's a weekly chart. So you might then extrapolate and say we're looking for a higher low this time.

We're not worried about the upswing at this point, so stay focused. We're trying to figure out when is a good time to buy. For example, where do you see support below the current price and above that diagonal blue line? Draw a horizontal line on the chart where you think there might be support. And why do you think there is support there?

When a move reaches a point and goes the other way, we call that either resistance (up) or support (down).

So back in April 2017, we went up to 6000ish Satoshis, got rejected and came all the way back to 2500. We later blew thru 6k and came back through it and then again. We are now approaching that level again. What happens is once you go beyond a level, it flips and becomes the opposite of what it was.

6k was once resistance, it now becomes support. I would expect it might hit 6K heading down and stop for a spell. Except it's probably not strong support. Can you guess why? Because the original resistance was further in the past and we have since plowed through it a couple of times. This means, it's been tested and failed. And it's done it both directions.

If you learn nothing else, this is key to trading.

All the cray indicators, the clouds, all the other nonsense is nothing compared to simple price action. Suppose the next move down hits 6K, then reverses and heads up for the next several months. What does it tell us if we hit the support then reverse and move higher? What does it mean if we bounce of the first yellow line? it means that our theory that 6k is support is validated, because 6k support the price and rejected it upwards.

If you can buy around suspected support levels, while trying to sell around suspected resistance levels, you are ahead of 90% of traders. Support levels are never set in stone and they aren't really best drawn as lines. They are really zones of support. It's simple. Just look for where price reverses.

These are the places that create potential support/resistance. If current price is above one of these lines, it is potential support. If below, then resistance. In other words, if we are above one of these lines, it is more likely that if we drop to that level in the future, it might hold for us (or support us).

If price is dropping we want it to find some kind of floor to keep it from dropping further, we need something to "support" the price.

Otherwise it goes to zero.

When prices go up, there are all kinds of forces that prevent them from just going to infinity; people selling at a profit, etc. So there are natural ceilings for where the price can go. We call this resistance. So once we look at a chart and identify possible support/resistance is next.

Which do you think is stronger support/resistance? A level that has been touched a single time or one that has multiple touches? So with these multiple lines we can start to think about support/resistance areas for buys and sells. You can typically eyeball and be okay. I've started to use magic boxes to assist my view. We're not considering anything else but support resistance now you can trade a chart naked, just on price action alone, even if you don't know what you are trading or why.

A final calculation and example.

Lets say you make a bet 4 times for $100 each time. One time you expect to lose $100. Three times you expect to win $100, so a profit of $300.

$300 minus $100 = $200

$200 / 4 = $50

This bet has a positive expectation of $50 each time it's made.

Good luck and look for much support and so resistance!

Doge_homemade_meme

@jsherm, I'm interested in the same topic as you, let's spin it together. I signed on to you, I hope you'll sign up for me. Always glad to meet new people!