Trade Ideas : Gold, $'s, SPX, and Fitbit

Dollar should pop soon in a dead cat bounce and send gold and silver lower—gold perhaps testing the 1180-1190 area of support. I think this bear market in rally in the US dollar will eventually provide a good set up for buying the pullback in precious metals.

Even though everyone is bearish on the dollar—as am I—I think the countertrend rally could be sudden and vicious given the extremes in sentiment and how far and fast the dollar has fallen recently.

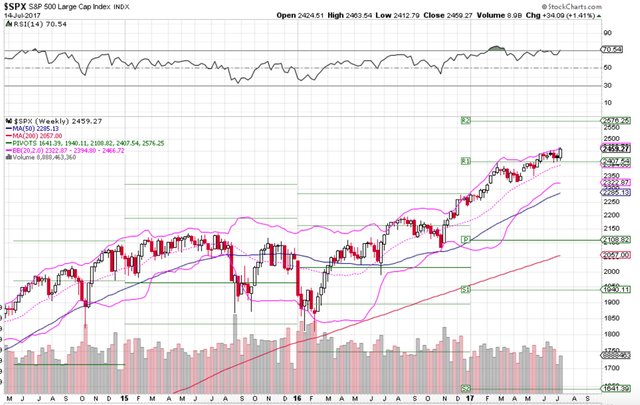

I don’t think the S&P 500 is done going up, so I have no intention of shorting the market right now. As overdone as it is, many indicators show that it could could go up even more. I don’t like blatant irrationality, but I have to trade what I see and what is actually happening. Therefore, shorting just doesn’t seem to present a good risk to reward ratio at this time.

I know a lot of people—including me—are anxious to short at least a short term market top, but this doesn't seem like a good place to go on a heroic put buying spree! The market doesn't care what we think!

My best idea for trading the market this week is to look to go long on a pullback of Fitbit (FIT). I got long last week via $6 call options, but I think the target could be $6 + plus, and possibly up to $7 over the next few weeks.

Fitbit is a shady company (IMO), and as of now, I still don’t care for the fundamentals. That said, the technicals look very good.

If you enter, make sure you know where you plan to exit and lock in profits. FIT is a trade, not an investment.

Current Positions :

Long FIT, GILD, AG, JD

These are swing trades, most of which will be closed out by Friday.

I'm unsettled by the weather

It's getting stranger

Should it be this good right now?

Are we in some kind of danger?

Is this atmosphere just me-

Or is the sky too blue?

It's too perfect

Something's got to give

-Ride “Weather Diaries”