Day trading guide: How to start! / Should you?

I'm a moderator on several Reddit financial communities and wrote some wikis there and I'm posting here a few that I wrote entirely for more exposure since they're geared at helping people with trading & investing and some advanced topics. Hopefully it helps someone make the right decisions.

I'll also be tweaking them with the assumption that members of the STEEM community will be reading them especially since crypto and trading have a direct link with each other.

Intro

Day trading is buying or selling a security on the same day to achieve a financial gain, usually on an exchange. It can be done within a few seconds or over hours.

Types of securities can be shares of stock, futures contracts, option contracts, foreign currency, or crypto currencies; this isn't a complete list, however they're what most day traders focus on.

Wait, should you even day trade?

Day trading is not like other self employed or side job activities: As you lose at day trading, you lose money, and eventually you can't day trade any longer.

False sense of security

Paper trading aka simulated trading (even staring at charts) won't make you better either because it doesn't take into account your emotions which most likely are the problem and you won't ever solve it with fake money.

Paper trade only to get used to the software and executing order types like market orders, limit orders etc.

Over trading doesn't work

Again staring at charts doesn't make you better. Either trade in short sessions, typically right after high volume events, see a forex or economic calendar to know when those are. You could also just trade for 30 to 60 minutes before work, during lunch, or after work.

Just keep in mind that if you're losing money that trying to make back your loses doesn't work at all, no mater how much more time you stare at a screen because at this point you're desperate & angry (even more emotional).

You just need to practice with real money in small amounts, best way to do this is by trading forex or crypto which typically have no account minimums and let you do penny trades or sub penny trades respectively.

Solutions to the above are:

- Bank roll (the money you'll use to day trade)

- Savings (this is to cover your living expenses, if you decide to day trade part time w/ a job then this can be skipped)

- Adhere to a strict money management system (see sections below)

- Trade very small, penny trades with forex and/or crypto and work your way up in trade sizes, more on that later

- Trade after high volume events, use an economic calendar; see the news section & when to trade below

Note on quitting your job for trading

If you plan on quitting your job, then your bank roll & savings should be huge: Savings should cover 2 years or more of monthly expenses, and your bank roll should be even bigger.

However if your expenses are paid for because you're a dependent, such as living with your parents or you plan keeping your job & trading part time (morning, lunch, after work), then that's even better since your bank roll can be the minimum:

- $25k for stocks

- 5k to 10k for futures

- Around $100 for forex/crypto (or even less, broker dependent)

Emotions

There are psychologists specifically for dealing with day trader emotions. We can't make recommendations here, but you shouldn't pay more than what a regular psychologist charges, and you should stay away from courses, programs, and retreats offered online.

If you plan on getting a couch for your emotions, don't, seek out a licensed psychologist or a licensed social worker. Think of these people as a doctor for your emotions, so don't seek out a cheap solution or someone who isn't licensed to do this type of work.

If this doesn't sound good to you then don't day trade!

Find something else like swing & long term investing, see Reddit r/stocks & r/investing. But if you're still like "I hate working and I just want to make money my own way" then see r/entrepreneur.

Are you even good at it?

Paper trading, like we said earlier, this isn't going to get you good at trading, don't waste too much time on this.

Paper trade to get good with the software you're going to use before using real money so you know what each order type, button, etc does.

Start with a small account

Forex is highly recommended to every day trader starting out because leverage is high and most forex brokers require no minimums and let you make penny trades. See Reddit's r/forex's wiki.

You can also use crypto except leverage isn't very high and is different for different crypto coins, however that's not the case with crypto futures like at BitMEX.

Money management

In a nut shell, you break up your account in slices and each slice is 1 trade. For example, trading with $100 in a forex account, you would split it by 20, so each trade is $5; while that seems low, you have to consider leverage, forex can have around 50x and some futures products such as treasuries can have over 100x leverage.

But the point to all this is to reduce risk. Think to your self, 1 bad trade = 0 money, so if you want to stay in the game you need more money, so just split your account up. Splitting it in 20 slices means you can make 20 trades. Some traders say only use 1% to 2% of your account, that would mean 100 to 50 trades respectively, but it's more since you're using a percentage, so using 1% of your account for trades.. after 50 trades.. you're left with 61% of your account intact.

See below to continue reading about money & risk management more in depth.

Brokers

List of brokers for day trading:

Traditional:

- Ampfutures

- Interactive Brokers - good but no forex leverage/margin

- Oanda - forex leverage/margin

- Lightspeed

- Robinhood

- TD Ameritrade (Think or Swim aka TOS)

- TradeStation

Crypto:

- Binance

- BitMEX - futures & high leverage

- Coinbase & Coinbase Pro

- Kraken

What to trade

Note that PDT aka Pattern Day Trading rules apply to US stock traders who are trading on margin. See below for more info.

Forex

Best for beginners since most forex brokers require no capital, you can make penny trades, and leverage is high. Also there are no pattern day trading (PDT) rules to stop you from day trading.

Futures

This can be a more interesting market than forex and stocks since you still have high leverage and no PDT rules, but you need more money, around 5k to 10k cash

Options

Again, low capital required and high leverage, however the knowledge required is extremely high so it will take longer to get started on this. Skip it entirely if you're new and stay away from buying just calls and puts.

Stocks

You need over $25k cash to trade this or you get hit with PDT restrictions, unless you use a non margin account (cash account) but that comes with it's own restrictions however you can day trade longer, see PDT terms below.

Crypto

No PDT rules, leverage can be super low unless you trade crypto futures, volume can be low depending on which exchange you use; you still have to pay taxes.

Money management, continued

To quote Reddit's r/forex wiki:

Money management is a form of risk management and is arguably the most important aspect of your trading when it comes to long term survival. You should always enter trades with a stop loss - the distance of the stop allows you to calculate how large of a percent of your account balance will be lost if your trade stops out. You can run a monte carlo simulation to figure out the risk of having a number of trades go against you in a row to drain your account. The general rule is that you should only risk losing 1-4% of your account per trade entered

And links they shared:

- Investopedia's forex management

- A swing trade blog, but the info applies to day trading

But yes it's highly recommend to split your trades, use leverage, and a stop loss + profit taking limit order. You can do this easily with forex since most forex brokers will let you do penny trades.

Some more links:

- daytrading blog; don't take the 2:1 reward to risk ratio to heart, you should focus on identifying good trades with high probability of success and at the same time managing your money/trades

Positive Expectancy

After you've traded for some time, you should be able to calculate how much money your trading strategy brings, this is called expectancy and your strategy should have a positive expectancy. Even if you have more bad trades than good, the good trades should provide enough profit to overcome the losses.

Come back to this in the future.

Terminology

- Technical analysis and terminology. - I wrote this as well

- PDT - Pattern day trading wiki provided by the Stocks community on Reddit

Tools

Type of chart, candle or line chart

Lots of debates on what type of chart you should use, but candle charts show a good amount of info such as the opening price, the closing price, if price went up or down and how far it went (the high & low) for the candle size.

See Stockchart's intro to candles.

Indicators

A lot of day traders use naked charts (no indicators) however most still look at indicators to see how other traders or algos will react. You should be looking at multiple charts of the same security and leave 1 of those charts naked or with very little indicators.

The most useful:

- Volume profile aka volume by price

- Drawing your own support & resistance trendlines

- DOM aka Orderbook - shows you all the limit orders at every price level, this works like an auction + supply & demand, for example if there's a lot of sellers at $35.05 and less buyers at $35.04, then some of those sellers at 35.05 will change their order to meet the low demand below the price before other sellers can do the same. See DOM wiki which I wrote

- ATR - Average true range gives a number that tells you how wide price movements are, great for helping set stops and profit taking limits. ATR of 5 means average price movement of 5 ticks for that given timeframe, typically you would have a stop loss or around 2x ATR so in this case it would be 10 tick wide stop. If a stop loss of around 2x ATR is too high for you or for your given strategy, then trade a different security or change your strategy.

- VWAP - Takes the average price and weighs it by volume, basically you want to be short below VWAP and go long above VWAP; near the VWAP line (or price) there can be lots of whipsaw

- Moving averages - This won't predict anything, but other traders react to them, so it's your job to see if price bounces off these lines or not. Standard moving averages are SMA 20, SMA 50, and SMA 200. Don't clutter your chart with this crap!

- RSI - relative strength index, takes the average gain of the stock price divided by the average loss over a number of periods, default 14; starts to reverse when it points down from 70 (sell signal) and reverses agian when it points up from 30 (buy signal)

- MACD - combines momentum & trend indicators; gives off many trade signals including ovebought/sold and divergence, see link here note that the histogram in the center shows how wide the MACD & Signal line are from each other

- Bollinger Bands (BB) - takes the standard deviation of price times 2 (default); in statistics, 95% of all values are within 2 standard deviations. BB is typically used for resistance and support, more info here.

- Ichimoku clouds - Combines even more indicators, good for beginners, see here

Frontends

Not necessary, but if you don't like your broker's platform you can use the following and connect them to your broker to make trades.

- Tradingview

- cryptowat.ch

- MT4 - Designed with forex in mind and lets you autotrade using an easy to use language they created for people who don't code

- MT5 - same as mt4 except the code is more object oriented targeting actual programmers

News feeds

Typically your broker provides a news feed with some requiring you to pay for faster/better news data.

News doesn't really affect forex or crypto like it does with stocks, but you should be looking at a forex calendar (see forex calendar and fxtreet as examples).

If you trade futures or forex, the calendars above are essential to knowing when a high volume move is coming.

When to trade

I can't list every single high volume event for every security, so in addition to an economic calendar, you can find out on your own:

Look at a chart for the security you're going to trade and take note of the volume spikes.

First format that chart so you're looking at days aka daily timeframe. Look at a weeks or two worth of days and try to find the high volume spike. Then zoom into the 4 hour timeframe and then again with 1 hour and 15 minutes take note of the time and date.

Ask yourself why did that happen, it could be as simple as the US exchange nearing the closing time or when Japan wakes up to trade a specific coin.

Don't take a bet before the event! You want to analyze the results immediately after the event and trade accordingly. Perhaps the event was bad and the security is going to go down from there, maybe it's an over reaction and it'll reverse, take 5 to 15 minutes to see what where the security will go, best to have a separate chart that's broken down by 5 minute candles.

Strategies

First off, keep in mind that algo traders write scripts/bots to deal with these situations and to take the other side of the bet, you'll see lots of whipsaw and generally the opposite effect, however there are big traders waiting for these moments as well, there's also a tug of war occurring and no one can say a strategy will always work 100% of the time:

General strategies

- Patterns - Double tops, head & shoulders, and cup & handle are the most watched for, see here for more, don't get too caught up in patterns because they fail often, but you should be looking for an increase of volume when they work & don't work.

- Channels - very much like fading except you find 2 parallel trend lines that price has been bouncing between, see here

- Breakouts/Breakdowns - while patterns can be attractive, breakouts/breakdowns happen all the time; here's one way to take advantage of them and

Day trading specific strategies

- Fading from yesterday - this involves comparing yesterday's high or low with price movements today: If today's price moves up to yesterday's high and reverses, you short; if it reverses off yesterday's low, you buy.

This doesn't have to be "yesterday" but the last trading session by a specific country like when Chinese traders trade or US traders.

Doji breakout - find a high volume doji candle on daily timeframes, you wait for price to breakout of the high or breakdown of the low before entering your trade

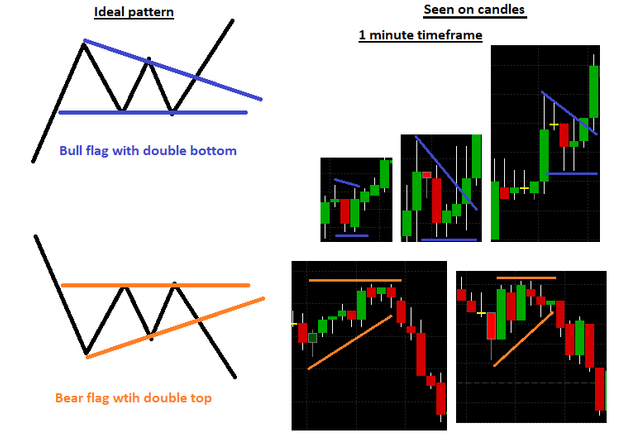

micro patterns - Typically double tops/bottoms and flags, both as small as 1 minute and often can be seen together:

Related communities on Reddit

Terminology

The Reddit version of this guide, that I wrote, can be found here..

Let me know what you think of this guide and ask me any questions you may have.

Congratulations @massivedmg! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPVote for @Steemitboard as a witness to get one more award and increased upvotes!