Recession indicators guide + incoming stock & crypto euphoria

Yield Curve

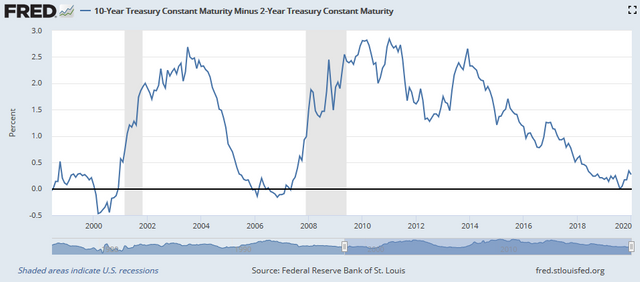

Look at the chart above, it's a slice into the holy yield curve (specifically it's a yield spread between the 10 year yield minus the 2 year yield curve), it's going to be the most important indicator to predicting a recession, more on this later, but in a nut shell when the yield spread dips below zero between a long term & short term treasury, the economy will go through a recession in about 12 to 18 months.

This won't affect just the stock market, but the housing market, jobs market, prices on goods/services, and even crypto (it won't be a safe haven, more on this later).

The yield curve generally is supposed to be upwards sloping where a short term debt contract (bonds) like the 2 year treasury note provides a lower interest rate than a long term debt contract like the 10 year treasury note. But when this curve inverts (2 year note providing a higher yield than than a 10 year note) then it shows how investors are worried about a recession and rush to buy the long term debt contracts. However these long term debt contract investors (who are whales) are always 12 to 18 months early, thus we see the yield curve invert way ahead of a recession.

Yeah the yield curve has gone negative on a variety of debt contracts so we will see a recession in 12 to 18 months but don't panic because we will see short term euphoria and you will want to follow these indicators in the short term to pin point the upcoming recession.

Right before the recession we will see euphoria in stock prices, housing prices, bitcoin prices, and even salaries. Everyone is going to feel rich and it's gonna be great, until the economy burns out and everything crashes. Then whale investors will run for short term debt contracts and gold since it's a world wide staple. Maybe one day bitcoin will be like gold, but it's still very much a speculative investment, which is good during euphoria, and you're going to want to own stocks, bitcoins, and alt coins during this period before you switch it up for gold (more on this in another blog).

Yield curve has gone negative already

Like I said: Whale investors who are worried about the recession are 12 to 18 months early, they buy up long term debt contracts. We see a falling 10 year yield compared to short term debt contracts like the 2 year note & the 3 month bill.

See the charts below and remember the 10y2y spread has gone negative August 2019, and the 10y3m spread on March 2019 & even more negative in September.

Short term recession indicators

Take note of these because when the economy starts to burn out you're going to see unemployment tick up, but not before stock prices become "expensive," and then a drop in stock prices. As whale investors pull money out of stocks, they'll be pulling out of crypto as well and putting their money into gold and bonds.

S&P 500 P/E

P/E is a ratio for the price of a stock over its earnings. As a stock company earns less money, its stock price will seem "expensive" and thus have a higher P/E.

The entire S&P 500 has an average P/E that can be measured. We're not concerned with what that number is, but if that number is growing too fast. A jump from a P/E of 15 to 16 within a month or P/E of 28 to 31 is a dangerous sign.

A company earning way less than they did before means they're going to lay off workers, 100s of 1000s of jobs will be lost and then millions, no one is gonna afford to buy anything let alone crypto.

Bookmark this link for the S&P 500 P/E by month

We're looking for P/E to rise too fast. Something like a 1 point move from the last month's P/E when P/E is already 20 is nothing, but when it's 17 or 18 and it moves to 18 or 19 respectively, then it could be bad sign. Right now s&p p/e is around 23 / 24, so we need to see a 2 or 3 point rise to be concerned of an incoming recession.

Unemployment

All markets depend on a healthy economy and if unemployment rises slightly, that means companies aren't earning enough money and they will lay off people. Unemployment towards the end of 2007 saw a rise of 0.3% and another 0.4% in May 2008, during this time large companies were laying off people in the 10s of 1000s and the stock market responded with falling stock prices.

Bookmark unemployment data table

Bookmark unemployment - longer series data table

What's interesting right now is that unemployment keeps going lower, from 3.6% to 3.5%, but we're looking for a spike up, something like 3.5% to 3.8%. Minimum move of 0.3% is a dangerous sign.

It's always different

While S&P 500 P/E in 2000 & 2001 was extremely high to begin with, we didn't see a P/E & unemployment spike until Jan 2001 when the s&p 500 index was already down by 10%, but in 2001 the s&p 500 index fell another 40% after these indicators were signaling.

Currently the largest tech companies have been hording cash for years and they employ a lot of people, so we might not see mass lay offs if tech companies are willing to spend their cash on retaining employees. Traditional companies won't be able to do the same, so we might see a flat market and a soft recession and the news will call it a slow growth phase.

When to ignore short term indicators

Say stock prices fall and p/e fall in parallel, this shows stocks are becoming cheaper and companies are still earning a lot of money. From Sep 2018 to Dec 2018 the S&P 500 index fell about 15% while P/E dropped 3 points (btw if stock prices drop and p/e drop that's a buying opportunity).

Euphoria

Before the economy burns out, unemployment keeps falling and companies have to attract new workers by raising salaries. Higher salaries means more spending and companies earning more money. This is associated with inflation, but what we're concerned with here is stock prices and crypto prices moving higher.

When everyone you know is making more money from their jobs, they're going to buy more crypto and the price of bitcoin, Steem, and other alt coins will continue to rise. They won't sell until the recession rolls in and they get fired.

How to prepare

Bookmark all the links I posted above and watch them from month to month. Stay in stocks & crypto for as long as possible until you see a spike in short term indicators, for example: A 1.5 point move in p/e and unemployment moving up by 0.3% (x.5% to x.8%). In a situation like that you'll want to short the stock market and buy gold, something I'll be writing in another blog post, so please follow me.

Feel free to suggest how you're preparing for the recession or strategies you know of.

Great post! Welcome to Steemit!

Saw your post on reddit, welcome, nice post here! :)

Congratulations @massivedmg! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Congratulations @massivedmg! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvoting this reply.