How to perform assets under management in a safe way

It’s not a secret for anyone, that assets under management market in cryptocurrencies is a very young and can be characterized with the following problems:

- Direct fraud of investor or trader;

- Loss the control over the funds;

- Lack of transparency.

Let’s look at how different services approach these problems.

Trading groups and personal managers

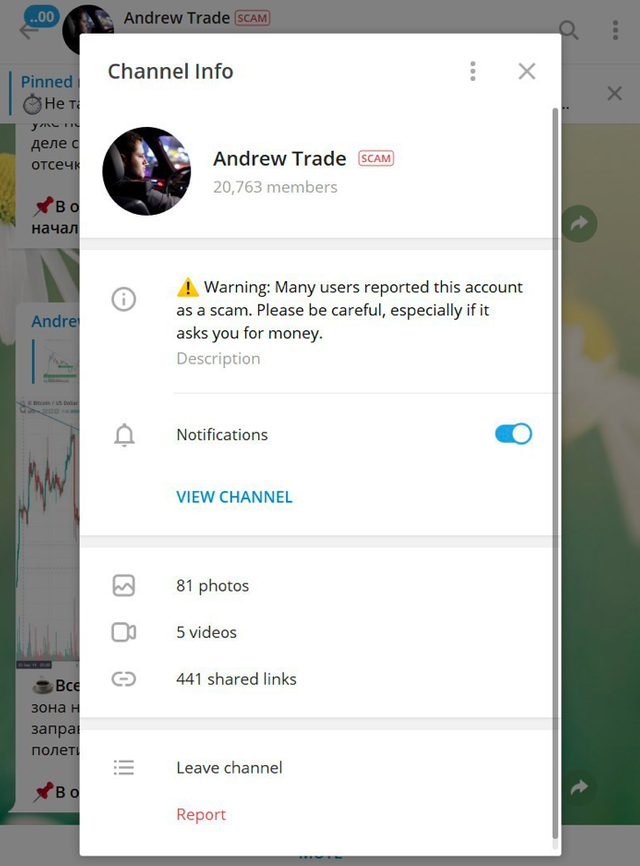

This type of asset management is a perfect example of a direct fraud and is common for swindlers with some kind of signal groups, some of them even with paid entrance. On the channel, they publish profitable deals to create a FOMO effect. Sometimes the authors of such channels use Photoshop to change the balances or the trade results to encourage their followers to sends them assets for management. At this stage, investors do lose control over their deposit and most likely they won't get their money back. One of many examples is a telegram group with 20k members — Andrew Trade (currently deleted):

Trading through direct API access

Another popular way of trusting the assets to a manager is by giving direct access to your exchange API key. With this method, the investor basically loses access to his funds and puts a huge risk on himself.

This is what happens: when providing your API key to a trader, the investor can seriously harm his balance because of the absence of any risk management tools and uncareful trader’s actions. There are lots of cases when traders do not use any stop-orders and market swing can cost the investor a big portion of his balance.

Moreover, unavailability to put any restriction on the trader and allowed trading pairs can cause loss of a full deposit. Using the client’s assets trader can buy his own sell orders on low-liquidity pars, washing away the money. We have such example from the private telegram chat.

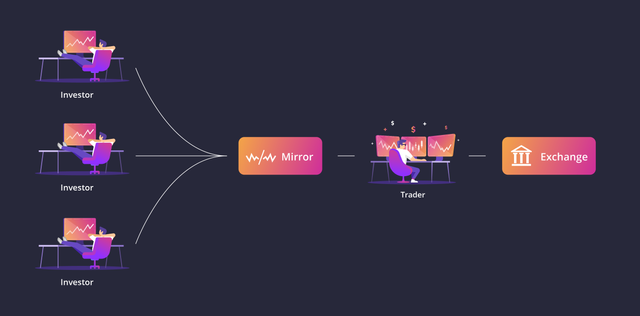

Copy-trading

The most popular service out there is copy-trading or social trading. The idea is that you choose a trader and automatically follow his activity. That way you can follow a human trader, trading algorithm or even a chat with signals.

This kind of service lacks a risk-management system and with no restriction on the trader, it has similar risks to providing access to direct API. As you already know that puts a huge risk on the investor and can cost him his deposit.

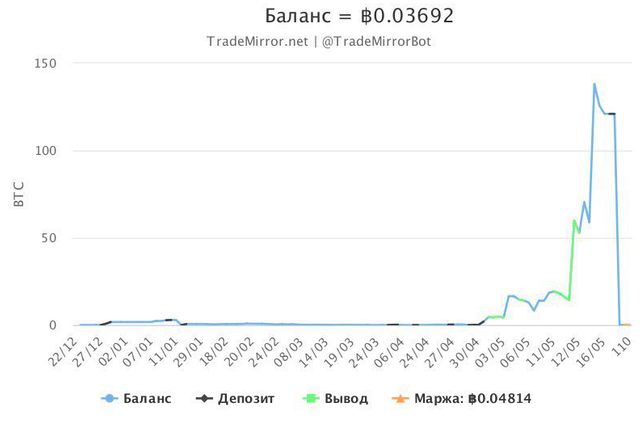

Here is an example of an investor losing his deposit on a copy-trading service:

Source: Private telegram chat

Another huge problem of copy-trading platforms is that it puts restrictions on the investor itself. You can’t trade on this account by yourself, cos it will interrupt the trader's activity. And if you want to work with several traders, you would need to create multiple accounts on exchange, which is impossible in most of the cases.

How Membrana solve these problems

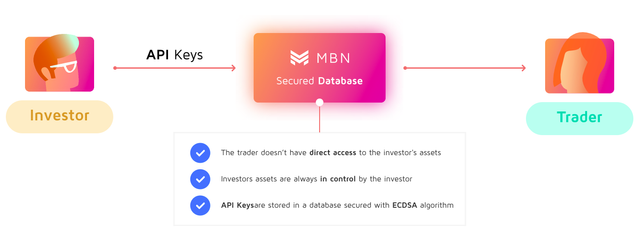

Membrana uses another approach to provide safety for investors— p2p contracts for asset management, which uses the best of the API protocol and Ethereum Smart-Contracts.

Investor’s security and p2p asset management:

With the help of API protocol, investor’s funds are always on his exchange account. Investor connects his exchange account to the Membrana platform through API keys which are stored in a database. The trader doesn’t have direct access to investor’s API, they trade through inner MBN protocol that has all the restrictions put on top. Additionally, it allows the investor to be working with multiple traders and trading himself at the same time using only one exchange API connection.

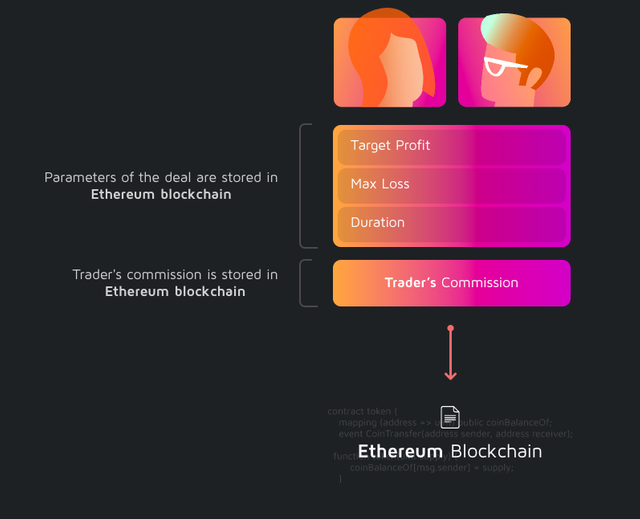

Another main advantage of the Membrana platform is the usage of Ethereum Smart-Contracts. It solves multiple safety issues protecting the interest of the investor and the trader.

When concluding an asset under management contract — all of the conditions and the risk-management limitations are deployed in the smart contract. That guarantees the investor, that he would not lose more than he counts as acceptable when concluding the contract.

Let's see the example of the contract conditions:

The investor is trusting a trader 1 BTC for management. The contract is concluded for 30 days with a target profit of 30% and a maximum loss of 10%.

Upon reaching one of these conditions the contract will automatically finish, the access for trading will be closed for the trader and he would receive his commission based on his performance. You can watch a short video of how Membrana helps investors and traders: How membrana.io helps traders!

And what about the data transparency?

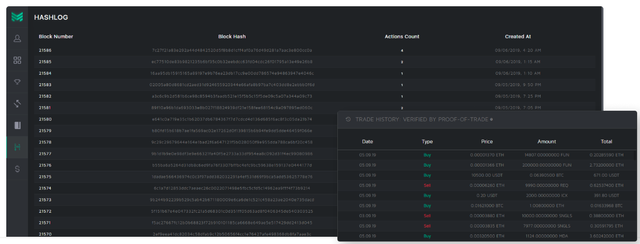

On a regular platform, the ROI and profitability of the trader are backed only by its reputation. You cannot be sure, that the presented ROI is real or fake. We, on our end, brought a Proof-of-Trade system to the table, which verifies and commits all of the trading activity into blockchain as a hash sum. That way all of the trading data and ROI are unchangeable and transparent.

Protecting the trader

One thing that was totally missed by other platforms — is protecting the interest of the trader. When concluding the contract, the investor sends the trader’s commission fee to the smart contract. Upon finishing the contract, the trader receives it is based on his performance and the rest is sent back to the investor.

If the trader reached the target profit, he receives the commission fee in full size. That way both parties are safe, investors have his assets in full control and under the protection of the smart-contract and trader has his payout guaranteed.

In this article, we don't aim to harm the reputation of other platforms or trading groups. Our goal is to educate the audience with problems of the asset management market and to share the technological difference in solving them.

Know more:

Website Twitter Telegram Telegram Korean Telegram Indonesian BitcoinTalk Reddit LinkedIn Facebook Youtube