successful trading psychology, Focus on your trading strategy and stick to the plan!

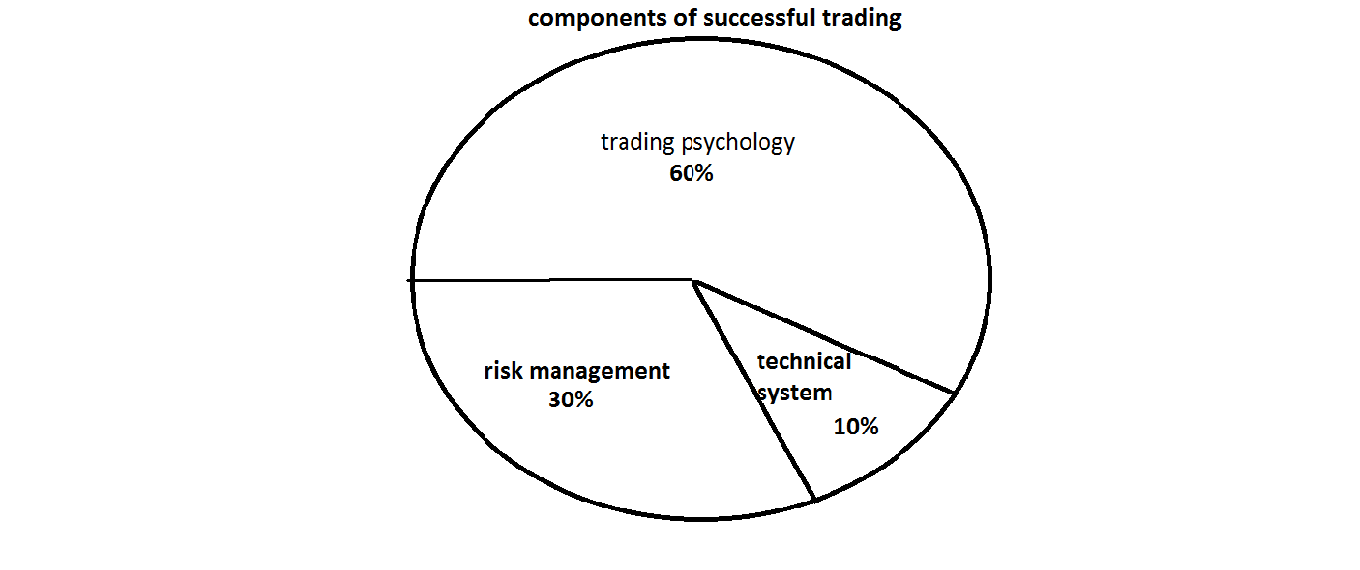

components of successful trading

most of the traders just focus only on there technical system ,this is the big mistake done by the 95% of traders.that is the main reason 95% traders losing money in trading.traders who want success in their trading they should fallow above equation .

Most novice traders do not understand that their trading mistakes are not unique. Trading mistakes are peculiar to all beginners and even to professional traders, most often they have psychological roots, and are part of human nature and psyche. Professionals and experienced traders differ from beginners in the ability to identify mistakes and thus minimize their influence. Mistakes in trading can be divided into two large sections: mistakes that originate from the trading strategy and a more serious ones - neglecting working trading strategy or emotional, intuitive trading or discipline failure. If the first kind may be eliminated by studying the market and bringing the strategy to perfection, then the second type always leads to overtrading, and is eliminated by working on oneself. However, these types are interrelated, and in practice, these mistakes always work together.

Today we will consider several reasons why traders deviate from the pre-established course of trading plan and own rules when making trading decisions, and give some idea of how emotions affect trade.

Very often, a trader deviates from his trading strategy during favorable market period or when the market looks "easy". It is emotionally difficult to miss a market setup and not to open a trade when it looks promising even if it is not confirmed by all the strategy settings. Moreover, the longer waiting in front of the chart, the stronger trader wants to open a trade based on intuition. As a rule, such inputs based on intuition turn out to be losing for the second or third time. It all depends on the emotional experience of the trader but sooner or later it will lead to losses. Again, it always leads to overtrading.

It is important to realize that this is a common phenomenon in trading and such emotional failures are common for human being nature. It is very important to check the volume of your trades. If the trader began to exceed his average daily number of trades, it would be a good idea to suspend trading for a period from three to five days. Take a break. Excessive trading based on emotions never brings positive results.

The financial market is known to be governed by two fundamental market emotions, they are greed and fear.

At the level of human relationships and emotional life, greed manifests itself as a propensity or a desire to own or consume material goods. We will leave aside moral issues and consider greed in terms of practical implications for trading. In trading, greed is always the same, the main consequence of greed for trading is the blindness of the objective mind, which leads to trading decisions based on completely or partially ignored objective information, ignored data and analysis, statistics or facts.

In practice, this always happens when a trader has a very strong desire to gain in the market, he only perceives the information that can confirm his specific position and views. On the other hand, all other data, which contradicts the formed expectations is ignored and rejected.

Another factor of the greed in trading is the fixed profit expectations. This happens when the trader rigidly sets the percentage of the desired income from any trade. This deprives him of mental flexibility and binds to a non-existent result.

The professional approach of successful, profitable trading is the ability to avoid trading based on emotions, overcoming misleading intuitive influence. Ability to act strictly in accordance with the trading plan, and not rush to recover losses without taking into account real trading opportunities.

never give up

“Trade What’s Happening…Not What You Think Is Gonna Happen."

Good luck in your trading