OneLuckyFlip’s Crypto Trading Tips and Tricks: Trading on a BTC Price Rise

INTRODUCTION

With the sudden rise in Bitcoin price today, it seems that Quickfinger Luc traders were overwhelmed with the many alerts that went off on different altcoin price drops. With relatively slow base trading in the past couple of weeks, this makes for a very busy day. A trader can be overwhelmed with the amount of choices of altcoins to trade and may even exhaust all their bitcoins buying up altcoins. Here I have outlined some trading tips during a BTC price rise.

1. Consider selling BTCs to your country’s currency and not take any trades

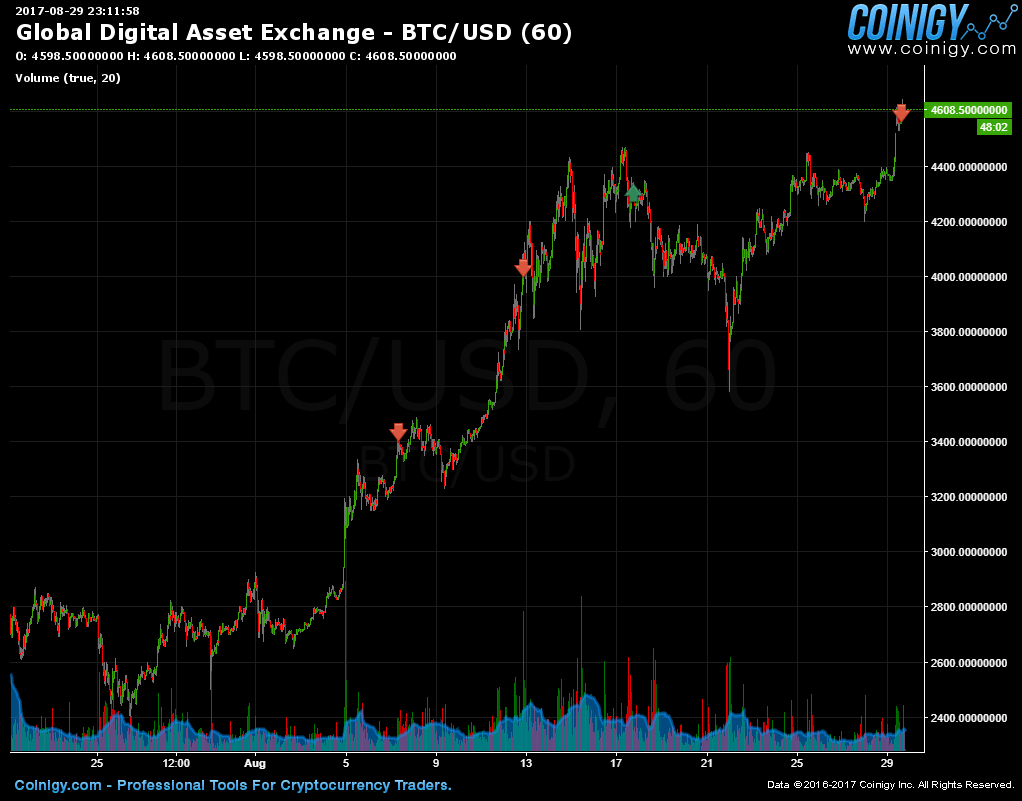

BTC/USD CHART IN REVERSE

If there was a USD/BTC chart, it would look like the one up top which is just the reverse of BTC/USD. The point is selling off your BTCs is like buying up USD, and a trader can use the same base trading method Luc teaches by simply reversing the BTC/USD chart.

In addition, traders can take the opportunity to go ahead and cash in any BTC profits earned from prior trades as BTC buyers are giving sellers a very good deal.

Pros to trading in cash: No volatility, good time to cash out to pay expenses, liquid (could be used to buy ETH for example).

Cons: Limited returns, boring (c’mon we are QuickFinger’s Luc traders)

2. Choose buying altcoins with big drops

CRYPTOMARKET SCREEN

By choosing to buy altcoins with big drops, the returns will likely be bigger. Here from examining chart above courtesy of coinmarketcap.com, NEO and Monero(10+% drop) would be good coins to consider buying up while avoid Ripple and ZCash(5% or less). My typical aim is to get returns of at least 10% and buying when coins take a significant drop will present the greatest chance.

3. Choose altcoins with good history charts

ETH/BTC CHART

BURST/BTC CHART

This is a fundamental of Luc's trading method. Coins with good history charts will show constant quick returns back to base like Ethereum while an inconsistent return to base will keep you stuck holding the coin for a long time or maybe even lose money like BURST.

NOTE: *The above charts in this section are just examples and does not reflect if this coin should or should not be bought now during this BTC price hike.

4. Choose altcoins you’ve traded successfully in the past

Buy coins you have had success with in the past. You have a better understanding of the coin and it’s trading behavior. Also taking a position with a coin you’ve had success would make you feel comfortable. Make sure to get that coin at a cheap price.

Trades I Took

NEO/BTC

Reason: Safe trade to base with good return, dropped 14% (BTC value) in past day

NEOS/BTC

Reason: High success to return to base, familiar with coin, dropped 11% (BTC value) in past day

EDIT: I want to emphasize this is a "nibble" trade about half of my regular buy as the drop is only 3-4% from regular base. I wanted to get a little action as coin tends to spike 20%+ in next few days. If you are only familiar with Luc's base trading strategy, a new trader, or are not familiar with trading this coin, I would recommend buying 10% below base minimum.

ADT/ETH

Reason: Familiar with trading this coin.

*NOTE: Although this is ethereum chart, the coin is offering me a good deal.

EDIT: I don't use Luc's base trading strategy on this coin because of the low volume activity

BTC/USD

Reason: Pay bills

DISCLAIMER AND CREDIT

Nothing here is meant as financial advice. This is just a strategy that I'm using as a cryptocurrency day trader. Please seek a duly licensed professional for any financial advice. Never forget, cryptocurrency trading is extremely risky and never invest more than you can afford to lose!

I'd like to give a special thanks to Luc for his selfless contribution in teaching cryptocurrency trading. Please visit his blog at: https://steemit.com/@quickfingersluc

Thanks for visiting my blog and happy trading everyone. Let me know if there are any other tips you'd like to share from your experience, or some other thoughts.

I don't understand your NEOS buy. I have the base at .000875. Plz explain.

Same situation with the ADT/ETH buy. I have the base at .0001475.

Am I missing something? Were you trading on 5 min charts but showed us a 60 min chart?

Hi @tizzle. You have some valid questions from my trades in terms of Luc's position trading strategy.

For NEOS, this is just a nibble, about half my original buys. I took the "nibble" because I'm familiar with the history of the coin(as I stated in my reason under my chart) as it presents 20%+ returns every few days. It's a risk/reward factor. If it goes lower, then I plan to add more up to my regular buys. But to your point, 87,500 would be the base in Luc's position trading strategy. I did buy at mid 84s about 3-4% below the base. This is an important point for new traders or traders only familiar with luc's strategy, and I will put an edit in my blog that this is a nibble.

For ADT/ETH, I don't usually put emphasis on position trades because this is a low volume coin. The coin has dropped and given me the opportunity to buy low so I can sell off high on these spikes and pumps that happen almost everyday. I'm very familiar in trading this coin which points to bullet 4 of my post. Out of all altcoins, this is the coin I have made the most money off of so I will always take a position on this when I think it's low.

In this post, I just wanted to emphasize some different things to consider when taking trades on altcoins because alot of them are going to drop when bitcoin rises. Keep in mind, you are doing something right by just taking trades with altcoins in general because

However, if you only follow Luc's base trading strategy, you should never go wrong on ALMOST ANY trade.

So would you advise that we get in on altcoins right now since it is currently discounted? I've been holding some coins that I thought were good buys because they broke strong bases and never quite came back to the base and I'm debating whether or not to let it go.

It's been weeks since Bitcoin and ETH's continuous climb and altcoins seem to not be recovering. I'm holding most my position in STEEM and I'm wondering if I should let it go at a loss...

I got in at the first dramatic drop with ETH/STEEM at around 452 and right now its at 350 (Poloniex Chart).

With regards to your question about buying altcoins, it's up to you :) With BTC being at an all time high price, the best advice is to just sell SOME off. The amount you want to sell is up to you. If you want to sell cash or buy up altcoins is also up to you. What I did, was sell 10% of my current btc holdings in cash, and started buying up altcoins with about 3-5% trades.

Now you mention you have a big position in Steem. I'm not sure how much, but try to limit position to no more than 20% of btc account (that's even big). It prevents events like what you're experiencing from happening where being stuck on a trade because a bounce failed will prevent one from taking more trades. Of course, this is dependent on account size; smaller account sizes, tend to hold bigger position so you can grow your account faster, and bigger account sizes, start using smaller positions relative to size for diversification.

In your STEEM trade situation, the best approach when the coin keeps dropping is to buy more and sell on the next bounce. A buy of 10% below your initial buy at 400s would put your position at an average of 425 but your position has now doubled. If you sell everything at the next bounce close to 450s which is your first buying point, you would get a TOTAL profit of 5-6% which would be the same as 10%-12% profit on 1 unit position. Now I know I'm seeing the results on chart and easy to say, but that is the strategy I take regardless if I have a position and the coin keeps dropping. Hope this helps.

You're a BEAST @oneluckyflip!!!

Great post :) thank you for this!

What did you use to reverse the chart like that?

Appreciate the kind words! Saved chart as png, and used Microsoft Photo app on Windows 10 to edit. 1. Rotate 180 degrees. 2. Flip

That's an awesome post. Thanks for sharing your knowledge.

Just a question about finding a new base, When do you move onto a new base, are there set rules ie a certain percentage change in price?

Hi @pgapro. Luc's latest video explains some important considerations in determining latest base and if it should be used once a panic drop ensues. Go to his explanation during the Neo chart, that should help.

https://dtube.video/#!/v/quickfingersluc/873zxkot

Thanks man!!

Thanks for this post. Happy to see your thoughts on ADT/ETH as I found this pair looking for account building trades today and grabbed some.

ADT has been good to me! That's a coin I have been trading for a month or more. Although, I am prepared to move to a different account building chart once the audience starts to diminish....always be prepared. Good luck in your trading ventures

Very nice post, a bit of a mind flip!

And ouch at your ETH purchase on the 17th ish of July.

Ive made a few of those :D

Hi @howcrazyisbob. I was wondering if someone would catch that! I intentionally keep a history of all my trades to show some of the mistakes I have made. They are good easter eggs. Two attempts at breakout trades on ETH, two failures!