Japanese Yen regaining strength after re-electing Abe in landslide

After this weekend's strong election result in Japan for Shinzo Abe, the Yen now looks set to turn around and gain strength.

In this article, I share with you my analyis of the currency markets and tell you which currencies look set to lose out against the Yen. I hope that you enjoy this post and find it useful!

USD vs JPY

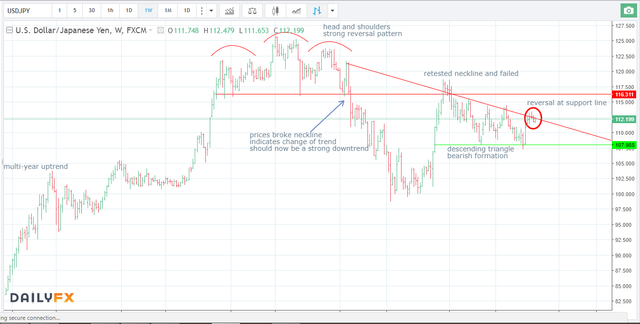

This pair has been trading in a range recently. However, the previous large head and shoulders top and descending triangle have been shaping the longer term direction of this pair. Here is the weekly chart from last week:

Prices shot higher on Friday, above the descending resistance line. However, after today’s big gap higher and close on the low, I believe that this may have been a bull trap, and we may be set for a quick move to the downside. This is known as an exhaustion gap and indicates a change in trend direction. Below is the daily chart:

CHF vs JPY

After a long uptrend, this pair formed an “Adam and Eve” double top in 2015. This is defined as a sudden spike followed by a more rounded top at a similar level. Prices later found support at a multi-year ascending support line, but after retracing to the neckline of the double top, got turned back down. Since then, there have been a number of weekly reversals as the market marks time and edges closer to a break of the multi-year support line:

Consistent with what I believe may be a significant shift in the momentum of the Yen, today we saw a strong reversal after the market initially gapped higher. Given the context and price action, this appears to present a good opportunity to test the downside of CHFJPY.

NZD vs JPY

While I see upcoming strength in the Yen, the New Zealand Dollar continues to look the weakest out of all major currencies at the moment and for the foreseeable future.

After a head and shoulders top, prices have tested that neckline again in this pair, and have already turned much lower. Last week we saw a strong price reversal, closing on the low of the week.

Today prices stayed near the bottom of last week’s large range, but reversed to the low after initially gapping higher and then trading above Friday’s high. This presents us with a good risk:reward opportunity to test the downside.

What do you think?

Thanks for reading, any feedback is much appreciated. If you liked my post don't forget to upvote and resteem ;)

Follow me for more trade ideas and other articles about trading!