Sharing My trading Experiences - From 0 to Her0 #1 - So you want to be a trader?

"The Stock Market is a device which transfer money from the unpatient person to the patience people" - Warrent Buffet

Photo by Jose Francisco Fernandez Saura from Pexels. source

How you been you all Crypt0-Wizards? I hope you may be great, otherwise, I will suggest take some time to reflect on your life, your plans and your actual results. Life is too short to waste it and time is to precious to give it away to some one else's dreams. So get your shit together and just do it.

I have seen a lot of trading videos lately. There is too much information out there. The problem of all of this massive amounts of info are:

- The majority of the actual courses, videos and information are based over and over on the same things: public side of view.

- Many info "posted" by "Real Pro traders" is it being used the wrong way, even the most basic info.

- The amount of money that each of this courses cost is a lot. Many of the best info is free. You just need to look for it and try it by yourself.

- There is many misunderstood concepts. This can make you fall. In example: many people give more priority to the indicators and entry strategies than the psychology. This can lead you to serious mistakes than no one but you can fix.

- While having too many strategies, just too few traders explain to the beginners than the most important thing is understand each strategy has been developed by one trader and may work with his mind and maybe not yours.

Photo by rawpixel.com from Pexels. source

Sharing is caring

I have some time practicing and trying so many things over the future's contracts and I can see that many of the actual approaches of many trader are wrong. When I say wrong I mean that many of them teach about what they know and basically about what they have learned from many professional traders. The "wrong" concept is that if we do not trade as the professionals do we will never have a chance to succeed in this complex world of trading.

My intention is to share with you the whole process I have been doing and also reinforce my knowledge by writing about it. I don't know about you but I am a very visual person so this will help me to write down all this content in my memory. Some of the material we will see in here are:

1. Japanese Candles.

1.1 History & definitions.

2. Candles Patterns.

2.1. Trends. How to confirm a trend - The wrong way and the best way.

2.2. Shall we go with the trend or against it?

2.3. Common Entry points in patterns.

2.4. Common exit points in patterns.

2.5. Resistance levels & Support Levels.

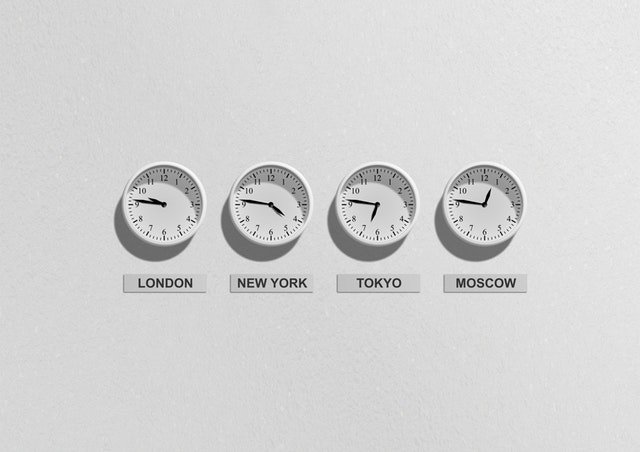

3. The best Hours to trade in the stock markets. Differences between stocks, futures, options & crypto.

3.1. Indicators - Less is More. SMA20 & SMA200.

3.2. Volume of an instrument as indicator of trading opportunities.

3.3. Low Volume = Stuck in the Stock.

4. Volume - A Way to enter and also a way to get out. Climatic Volumes.

4.1. Going long(BUY) - Going short(Sell).

4.2. Different types of orders: Market, Limit & Stop.

5. A trading Plan - What is it? Examples? What is the deep meaning of it?

5.1. The true real indicator of your success of failure.

5.2. Example of a trading plan, parts.

5.3. Making your own. Changing your TradingP as you evolve.

5.4. Cheating you TradingP is cheating yourself.

5.5. Capital, maximum daily lost, maximum trade lost.

6. Trading Psychology - Mark Douglas, books & videos.

6.1. Do I need meditation? Mind Control?

6.2. Sleep well, exercise your brain and your body.

6.3. Do I deserve to make a lot of money? Deep inner beliefs and how to face it/transform it.

6.4. Online Resources: Hypnosis, solfeggios, psychologists, self-observation(_family, friends, longly time_).

6.5. Finding you own routine.

6.6. Unlimited Creative expressions.

6.7. Find your motivation as a trader.

7. Choosing an instrument, why we must stick to it?

7.1. Consistency begins within your choices.

7.2. Plenty of money. No need to jump around instruments.

7.3. Capital of investment vs. Instrument chosen.

7.4. Ticks, pips & points.

8. Fractals & Time Frames.

8.1. Experiencing time frames & fractality.

8.2. Choosing from you "patience level".

8.3. Types of trades: long, swing, intraday, scalping.

9. Brokers & Trading Platforms.

10. Ninja Trader 8, for the win. Installation, getting free market data, creating a chart & using indicators and putting a first operation.

10.1. Analysis and interpretation. Daily Candles, 60 minutes candles and 2 minutes.

10.2. A trading routine.

10.3. How to use the "Market Replay" in Ninja Trader. Use cases.

11. Institutional Traders. The Why, the how. Examples of manipulations.

11.1. Is manipulation bad or needed? Big amounts of money.

11.2. Creating the opposites in order to move the markets.

11.3. How can we benefit from it?

11.4. Examples in charts. Most common types of patterns & candles formations.

12. Shall we buy the news? What to do and what you must not do.

12.1. Operate or not to.

12.2. The important ones. 3 Bulls - Investing.com.

13. Consistency as "the holy grial". Profit, ratio, stops.

14. Thinking as a pro in order to become one. "Pretending to finally make it real".

15. Best Courses I have seen & people I follow in Youtube. (Most of their content is in Spanish but you can use subtitles).

16. After doing lost of practice you can move forward.

16.1. Recommended numbers in your logbook.

16.2. Weekly reviews.

16.3. Share with other traders is needed?

16.4. Trading funds - OneUpTrader, SpeedUptrader, etc.

Stock Market

Photo by Pixabay from Pexels. source

A stock market, equity market or share market is the aggregation of buyers and sellers (a loose network of economic transactions, not a physical facility or discrete entity) of stocks (also called shares), which represent ownership claims on businesses; these may include securities listed on a public stock exchange, as well as stock that is only traded privately. Examples of the latter include shares of private companies which are sold to investors through equity crowdfunding platforms. Stock exchanges list shares of common equity as well as other security types, e.g. corporate bonds and convertible bonds. - source quote

The amount of money moving in the stock market is huge. Around US$79.225 trillion. Which means that there is plenty to all of us but: only if we learn to control ourselves and to play like the "Strong Hands".

Photo by Pixabay from Pexels. source

A Trading Fashion

Each and every person wants to be rich while doing trading? That is one point of view but what if the stock market & each and every company who take benefits from this trading activity are the ones trying to lead all the regular people to get into trading? That is another point of view and maybe, a most precise one. The facts are:

- There is only around 5% - 10% of worldwide traders who are consistently winning each and every month.

- The previous tip left outside of the "winning equation" around 90% - 95% of the whole group of people in the markets, as consisten losers.

- Each trade generate money: in fees, in money that have been "left on the table" or even in money that have been earn.

- Each action within the stock market produces money: fees, market payed data, market insights, market reports, etc.

So we are talking about a multi-trillion dollar company which need public in order to keep making the wheel spin over and over and over and over again. I assume you can make your conclusions for now.

How much time to become a trader?

Photo by Pixabay from Pexels. source

That is a very good question. I recommend you evaluate yourself in order to decide if you have the balls, guts or powers to take yourself into a journey that it will change your life forever. Some other facts we need to consider:

- The best traders have more than 20 years working in the markets.

- Most traders needed more than 1 - 5 years to really start having benefits.

- A trader who knows about the markets can earn from trading or even from teaching others how to do things as he does them.

- Time is always relative but remember that the success it will depend on how much are you willing to make it happen and also in how much time, focus, dedication and effort can you put into this.

- As soon as you get into this you will see this is something that, if you really like it, it can be for life.

With all that being said it may take you more than months. In the process of "becoming a trader" we will need to:

- Decide if this is a hobby or a real life profession.

- Do what it takes to change our attitude about life and money. Trading will reflect your actions, thoughts and reactions the same way you do them in your daily life.

- Assume the responsibility in life and also in trading about: losses, winnings, decisions, reactions, attitudes, self-discipline, honesty(about what you know you do right & wrong) and many more things that will appear as soon as you start doing the hard work.

Photo by rawpixel.com from Pexels. source

C'mon theghost this is not motivating Us

Hell, you are right. The following points may motivate you:

- A consistent trader won't work in regular hours. No more 9 to 5. Imagine yourself doing trading in a nice beach in Cancun.

- A good trader can make more than 5k per month. Can you imagine yourself making that amount of money while working 2 - 3 hours per day?

- While being the most big economic market in the whole world it offers a great opportunity to make money without loosing your life or your life time.

- A great trader can manage hedge funds. This means moving millions daily and getting more than $30,000 - $50,000 per month as "salary".

- As a trader we can and we must control our strategies, time and actions. This is something many people out there won't ever experience because of: bad education, fear, conformity, comfort and maybe because they were taught to do so and they accepted.

So my friends, this is it for now. We will have a very journey ahead of us while doing/reading/commenting or even enjoying this course. I hope you can do the task that I will leave you at the end of each post so you can comment it in the section bellow. I promise I will upvote you as well as I can. Remember: we are not born as professionals, we decide to professionalize our lives and then we become pro in life.

PEACE OUT.

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvoting this reply.

You got a 31.61% upvote from @spydo courtesy of @theghost1980! We offer 100% Payout and Curation. Thank you.

@theghost1980 purchased a 38.28% vote from @promobot on this post.

*If you disagree with the reward or content of this post you can purchase a reversal of this vote by using our curation interface http://promovotes.com