Crypto Trading for Newbies - Protecting Capital

In my first post I talked about the difference between bullish and bearish markets.

https://steemit.com/crypto/@villagetrading/crypto-trading-for-newbies-bull-vs-bear

In this post I will be discussing probably the most crucial aspect of trading and investing, protecting your capital. Before you invest any money you should not be thinking about how much money can I make, but how much money can I LOSE.

The goal of trading and investing is to increase capital, in fact capital is a pre-requisite for trading and investing in the first place. If you have 1 BTC to invest in a single trade you should ask yourself, how much of that am I willing to lose.

In crypto markets you could lose that entire 1 BTC, for reasons such as an exchange hack, or if the coin turns out to be a scam. You can reduce that risk by investing only in established Exchanges and Markets. The main exchanges I use are Bittrex, Poloniex, Bitfinex, and recently I have started using Bitmex. You will have to use your judgement on which Markets to invest in.

The best tool we have at our disposal for limiting risk is what is called a Sell Stop. This acts like a trigger waiting for price to cross a certain threshold before becoming active. For an example lets assume we bought 100 ETH at 0.016 anticipating a price rise in the coming days, at a total cost of 1.6 BTC (ignoring exchange fees).

The most you want to lose on this trade is 0.1 BTC so if the price drops below 0.015 then you want to sell your position, so you put in sell stop on the exchange. This way if price trades at or below 0.015 the exchange will automatically sell your position at the price you decide, when choosing the price to sell at it should always be 5-10% lower than the Stop price, this is called slippage.

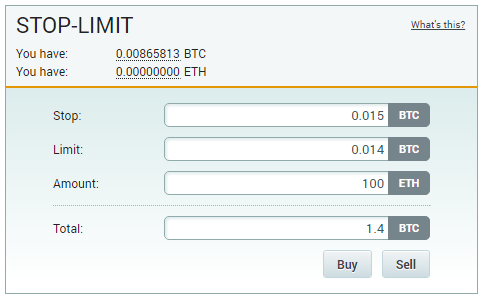

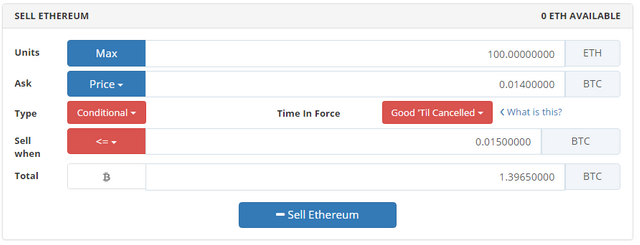

Exchanges have different terminology so I have provided examples for Poloniex and Bittrex

Poloniex - Sell Stop

When you click Sell, Poloniex will put up a helpful summary of what is going to happen before placing your order. Just remember the Limit should always be lower than the Stop.

Bittrex - Conditional Order

Conditional orders in Bittrex are available in the regular Sell box by changing the 'Type' from Limit to Conditional. Remember the Ask should always be lower than 'Sell When'

Remember to always enable 2FA on the exchanges to stop your account getting hacked and never keep too much capital sitting on exchanges. Withdraw to a wallet which you own if you can.

Thanks for reading and if you have any questions ask away!

Very interesting! I like it! Good luck to you!

Thank you. I hope it helps

Great post

Hi, nice post.

With the implementation of stop loss can one still place a take profit order?

No you can only set one or the other. I have a custom altcoin GUI trading bot needs testing. I created it because I wanted more options for buying and selling than what Bittrex currently offers. I wanted to be able to set both stop loss and take profit conditional orders at the same time. As of now you can only set one or the other. My bot will buy at desired price and set a stop loss and a take profit trigger at specified targets. Plus it has a trailing stop to get more profits when coins keep pumping. If anybody is interested in giving feedback and getting a copy message me @ chadsellsall gmail.

I am still confused with the conditional type from bittrex and would appreciate some help.

Lets say I have 10 ether that I want to sell to bitcoin.

The ether buy was as an example 0.05 btc and I would like to sell my ether at a minimum of 0.08, obviously the higher I can get the better.

So how would I set up this trade in bittrex?

Should the ask price be 0.08 and the conditional greater or equal to 0.08?

Hi amaryllis,

I notice your question was not answered ... For a stop loss you would want to select "Less than or equal to" on Bittrex.

keep well :D