How I travel between Colombia and Europe for free (Euros and Colombian pesos arbitrage opportunity)

Colombia is a beautiful and welcoming country with already very affordable prices, and there's a way to make your trip to Colombia cost even less.

The situation with the currency exchange rates in Colombia is quite irregular.

To be short, the cash euros are cheaper than the "electronic" euros (dollars as well, but the price difference is much smaller). So this opens an arbitrage opportunity – opportunity to get free money, to be exact. It's not just theory, I checked it myself and it really does work.

How to get the free money?

So, the thing is – when you take out money from the ATM using a credit or debit card connected to a foreign (non-Colombian) bank account, you get more Colombian pesos (COP) for 1 EUR (or 1 USD) than you would get exchanging that 1 EUR (or 1 USD) in cash to COPs.

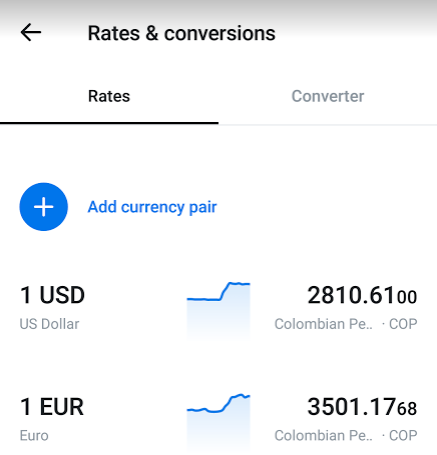

As of writing this article, for example, the currency exchange rate of my Revolut card is 3501,18 COP for 1 EUR:

!

!

And the exchange rate of an exemplar currency exchange bureau (casa de cambio), SurCambios.com in Medellin, Colombia is 3.290 COP to buy 1 EUR (500 EUR banknotes, but some other casas de cambio offer the beneficial rate also for 200 EUR banknotes), and 3.380 COP to buy 1 EUR (smaller banknotes):

So you basically just do two steps:

- Take out 7500 EUR worth of COPs from an ATM (today, using Revolut you'd get 26.258.850 COPs)

- Take those COPs to the currency exchange bureau (casa de cambio) and exchange them to EUR (200 EUR or 500 denominations, preferably). In the exemplar SurCambios bureau, you'd get 26.258.850 / 3280 = 8.005,75 EUR.

That's it – you just got 505,75 EUR for free! Of course, there's no use of cash euros in Colombia, so just do this before you fly back to Europe, to take that cash with you.

Some things to take into consideration:

- Use credit or debit cards that charge no ATM withdrawal and no currency exchange fee. I use, for Example, Revolut premium and N26 Black. If you have to pay these commission fees, then check out how much you'll have to pay before doing this.

- Use ATMs that don't charge a withdrawal fee. BBVA and Colpatria (Scotiabank) usually don't charge any fees, although they notify you that your transaction might be charged a fee.

- Most ATMs have withdrawal limits in Colombia. Usually it's 600.000 COP/withdrawal, and max 3 withdrawals a day with one card. So it helps having more than one duplicate card. Also, BBVA ATMs have a smaller withdrawal limit (300.000 COP), but they seem to have no daily limit of withdrawals with one card.

- Why 7500 EUR? Because that 8.005,75 EUR is, as of writing this article, equivalent to 10.000 USD, which is the maximum limit of cash you can take out of Colombia without declaring it.

Congratulations @linas.lekavicius! You received a personal award!

Click here to view your Board

Congratulations @linas.lekavicius! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!