Centralized Cryptocurrency Exchanges, Explained

Centralized Cryptocurrency Exchanges, Explained

1.What is a Centralized Cryptocurrency Exchange?

It is an online platform and most common way to trade cryptocurrencies.

This includes buying/selling cryptocurrencies with fiat (fiat/crypto paring) as well as buying/selling cryptocurrencies with other cryptocurrencies (crypto/crypto pairing). They can be viewed as an online marketplace for the entire cryptocurrency network.

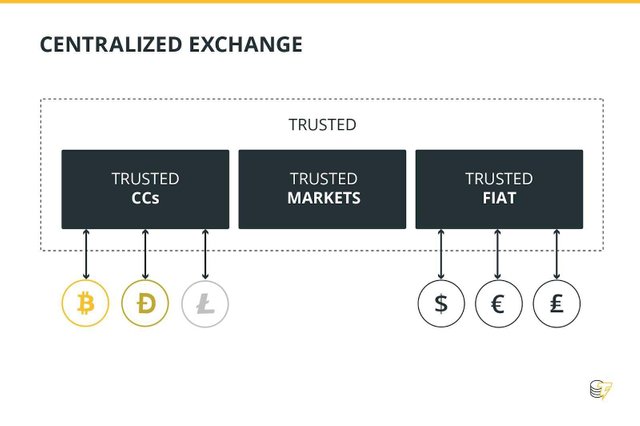

2.What does it mean for an exchange to be centralized?

To be centralized means to trust somebody else to handle your money.

In the past, the word “centralized” was a given for all institutions that managed finances.

To be centralized means that there is a trusted middleman to handle whatever asset may be in a trade. In a bank, for example, a customer gives their money over to the bank to hold for them. This one institution is now in complete control of the customer’s money.

In many cases, this is much safer than a person finding some way to manage themselves. Banks have many securities and a team to watch over their customers’ money. The bank can also offer a variety of services, such as loans, because the bank has a large amount of money and has created a trust relationship with the customer.

Centralized cryptocurrency exchanges are no different. A user can store their money on the exchange. The currency is now in the hands of the exchange, but the trust of the middleman makes it easy for a customer to recover a lost password or 2FA because that customer has given the exchange full access to their account. This can also take the pressure off of the customer of being 100% in control of their money. There are many stories of investors losing hundreds of thousands of dollars because they lost the private keys to their hardware wallet. If their money were in a centralized exchange, they wouldn’t have to worry about that; recovering would be as easy as showing a passport or verifying identification.

3.How does centralized exchange differ from a decentralized one?

Cryptocurrencies and blockchain are decentralized by nature, so this allows for the exchanges to also be decentralized.

In simple terms, a decentralized cryptocurrency exchange (DEX) cuts out the middleman by creating a highly intelligent “trustless environment.” Deals are made through smart contracts and atomic swaps so that currency never passes through the hands of an escrow service - it’s just peer-to-peer. DEXs are still in infancy and not very popular just yet, but 2018 might see a lot of progress with decentralized exchanges.

4.Do all centralized exchanges provide fiat/crypto pairings?

No.

All exchanges have crypto/crypto pairing (i.e., trading 1 BTC for 9 ETH), but not all have fiat/crypto pairings (i.e., trading $900 for 1 ETH). One of the most popular exchanges that provide fiat/crypto pairings are:

Coinbase - most popular in the world- supports Bitcoin, Bitcoin Cash, Litecoin, and Ethereum

Gemini - Based out of New York and high regulation standards for the US. Supports Bitcoin and Ethereum

Kraken - Kraken has a variety of crypto/fiat pairings with more than just USD and EUR, which can be viewed on their site.

Robinhood - a popular trading app provides fiat pairings to Bitcoin and Ethereum.

5.Is volume important for exchanges?

The more volume there is on an exchange, the less volatility and market manipulation there will be.

If Alice is trying to buy 1 BTC for the exchange’s current price of $10,000 and the volume on the site is extremely high, chances are she will buy the 1 BTC almost instantly. If the market price is $10,000 on a very low volume site, she may eat up all of the sell orders that are at $10,000 before she can buy her whole Bitcoin. Then Alice would need to buy the higher sell orders to satisfy her order, losing money and also making the price of Bitcoin go up on that exchange.

6.Are centralized cryptocurrency exchanges safe?

No centralized exchange is immune to hacks.

Many hacks have occurred throughout the course of cryptocurrency history, but in many cases, the exchange went out-of-pocket to pay customers back for the stolen money. DEXs are impossible to hack, but users are much more vulnerable to locking themselves out of their money. Popular centralized exchanges are safe in the way that banks are safe.

7.Is verification required to open an account on an exchange?

The regulations of each country are still fuzzy, but exchanges around the world require minimum verification to authenticate the account.

Many exchanges allow users to open an account without an identity check, but those accounts will have extremely small withdrawal/deposit limits. Basic verification normally requires a picture of the user’s passport/ID, and 2 Factor Authentication enabled. 2FA is a secret password that regenerates every thirty seconds or so that is needed every time a user logs into their account. 2FA is normally kept on the user’s phone.

8.Which exchanges have the most volume and crypto pairings?

While exchanges are still new and growing more and more popular each day, there have been some over the past 2017 year that have stood out in volume and amount of coins to trade.

Binance. While Binance has only launched in 2017, it has already begun trading the highest volume of any exchange. This exchange is based out of China and is so popular that most altcoins first move to this major exchange after their ICO. Level two verification allows 100 Bitcoin withdrawal while Level one allows under 2 Bitcoin withdrawal/day.

Bittrex. Bittrex has been a long-standing cryptocurrency exchange based out of the United States. While the most popular coins traded are BTC and ETH, Bittrex holds over 250 trading pairs. It is known for its easy interface for crypto beginners.

Bitfinex. Located in Hong Kong, Bitfinex is another long-standing cryptocurrency exchange which still lies in the top ten for trade volume.

Upbit. While many South Korean crypto exchanges have suffered during the crackdown on crypto in the country, UpBit stayed on top and even broke a record back in January of 2018 for highest trading volume ever.

GDAX. The Global Digital Asset Exchange is an extension of CoinBase, one of the most popular exchanges in the world. GDAX is not suitable for beginners but is very useful for margin trading as well as trading crypto/fiat and crypto/crypto. Users are also insured up to $250,000 by the Federal Deposit Insurance Corporation (USA). While offering many more options and features than its sister company Coinbase, Vice President Adam White of Coinbase noted: “Coinbase is designed for retail customers while GDAX is focused on serving sophisticated and professional traders.”

Source:@cointelegraph.com

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://cointelegraph.com/explained/centralized-cryptocurrency-exchanges-explained