Learn Trading How to stop loss. get margin trading and landing On Poloniex

The previous tutorial we learned how to use Poloniex in basic form, but it is time to raise the level. We previously mentioned that this platform goes much further than the basic purchase / sale of crypto-assets, offering us advantages like Stop Limit orders , which allow us to increase profits or reduce losses depending on how we implement it or work in the format of Margin Tranding , which is basically working with borrowed money.

Remember that if you have not read the first tutorial we recommend you do this link so you know the basics before moving on to this second step.

Let's start.

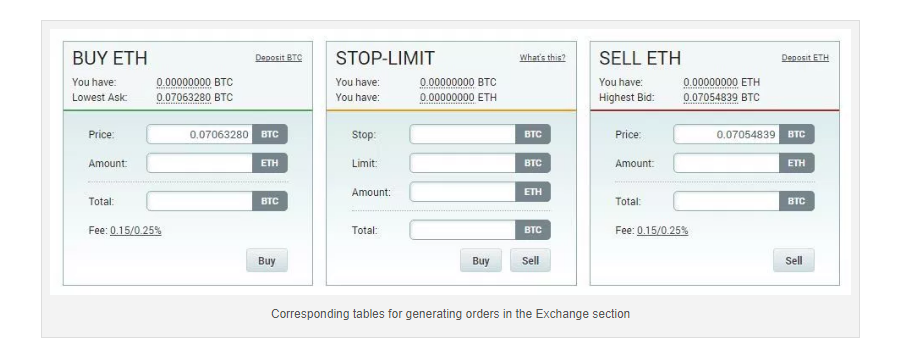

If we noticed in the previous tutorial, between the boxes of purchase and sale of the exchange is a box called " Stop Limit ". But what does he do? Well, in a basic way, it is used to buy and sell, but more intelligently.

To explain it better remember that the market for cryptomonedas works 24 hours a day and has no holidays, that is; never stops. This means that we can not always be aware of changing markets , in which we miss generating juicy profits or avoiding many losses. To do this, enter Stop Limit.

In the previous tutorial we learned how to create normal orders, which at the time of purchase set a price and a quantity, and executed the order when someone seemed right our price; but what if we buy many crypto-currencies and the price goes down? or if a criptomoneda is having a significant rise and we want to enter, but all this happens when we are not? Let's play a little with Stop limit.

Stop Limit are orders that allow you to set a "limit" to generate a new order, that is, the purchase order is not going to be performed until certain requirements that we set will be met . Some of these are the Stop or virtual limit for generating the order, and the Limit, which is the price that will be placed in the order after the limit is exceeded. To see this in more detail we will see the Stop Limit box.

In the middle box we see the section of Stop Limit, which exists for each of the crypto-currencies that are traded in Poloniex . We will understand it little by little, before generating an order.

Stop : refers to the virtual limit that we are going to paste, that is, when the price of the crypto-currency touches this limit will execute the order according to the price we place.

Limit : refers to the price of the order that will be generated once the Stop has been exceeded.

Amount : here will be placed the amount of CryptoDivisas that you want to buy or sell on the order.

Total : is the total price of the transaction.

To generate a Stop Limit type order, you only have to enter the corresponding data in each box, and click Buy or Sell, depending on the order that we want to generate. When you create these orders, you can display them either in the table at the bottom of the My Open Orders page or in the top menu, clicking on Orders and then in My open orders .

Poloniex offers a quick guide to what Stop Limit is all about. You can view it here .

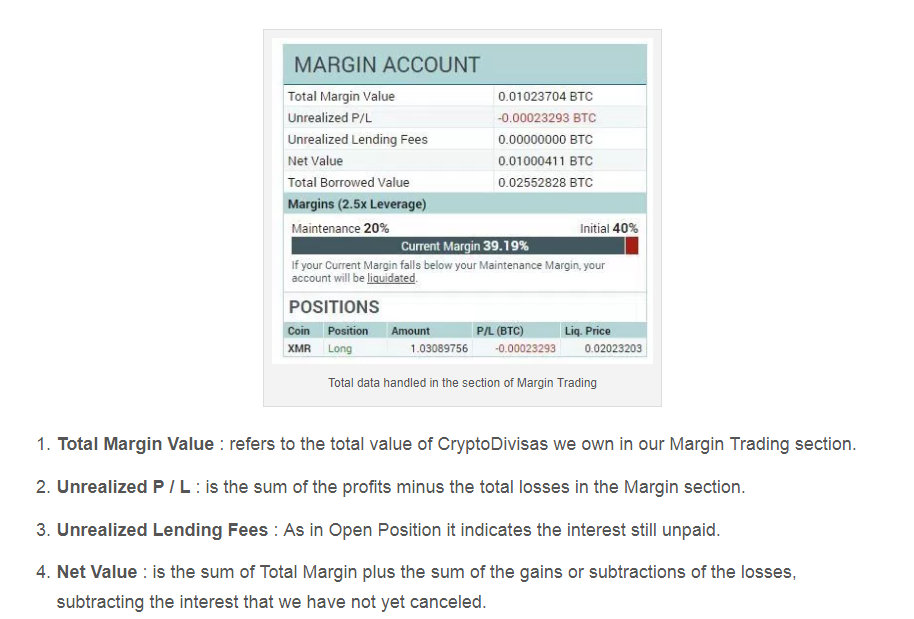

In the basic exchange, we will risk and generate profits from our own funds, but with this section we can generate even more profits by asking for a loan , this means that other users will lend us their funds so that we can trade with them and pay them a percentage by the time we have used these funds.

That is why Margin Trading becomes a very attractive option, since obviously more funds are greater profits, but beware, also may be greater losses, so before moving on to this section we recommend that you have good practice in the basic exchange.

Similarly, something to take into consideration is that we are not going to work with 100% of the money borrowed, since we are going to work leveraged to 2.5, which means that of 100% of the money in Margin Trading, 40% of that money must be from our personal funds. This is to protect the loans in case someone does not want to respond.

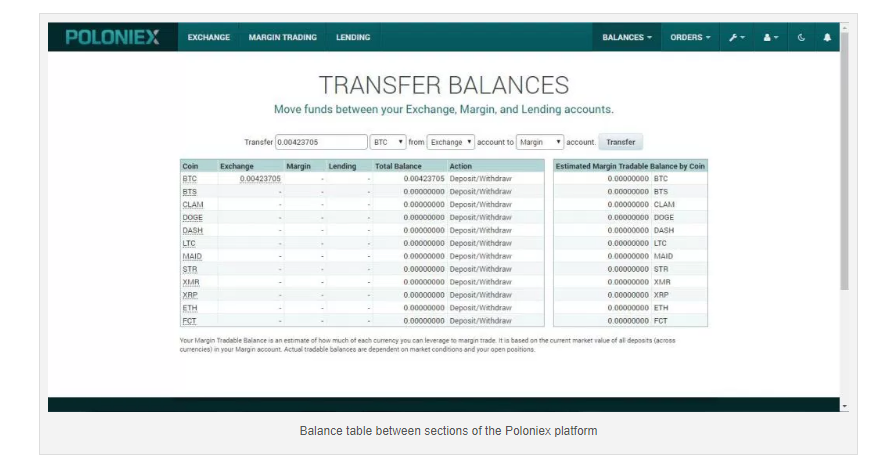

But before starting with Margin Trading we will take a little detour and learn about the section of Transfer Balances . To go to this section we will click on the top menu in Balances, and then on Transfer Balances .

Here we are going to find the different balances of each section of Poloniex, that is to say, the balances that we have currently in the section Exchange . In order to transfer them, we will go to the box above the table that is on screen and in the text box ( Amount ) we will place the amount that we wish to transfer.

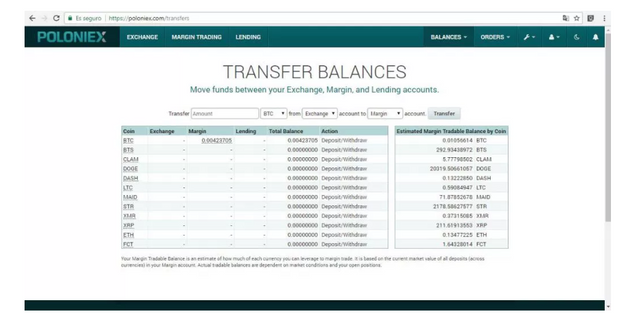

Then we will select the unit ( BTC , ETH, XMR, ETC) to then select the destination and the origin of the transaction, which in our case would be from Exchange to Margin Tranding . Once this is done, we will click on the Transfer button , and we will have transferred our funds. These operations can be done as many times as we like, since no commission is charged. At the end we can see our funds as shown below.

It may seem strange to see so few cryptones available for transfer between the different sections (Exchange, Margin Trading, Lending) but here is one of the disadvantages of both Margin Trading and Lending, because you can only work with these few crypto-currencies; contrary to Exchange, which does possess a much greater amount than these two.

Already with balance in Margin Trading we can start this type of exchange.

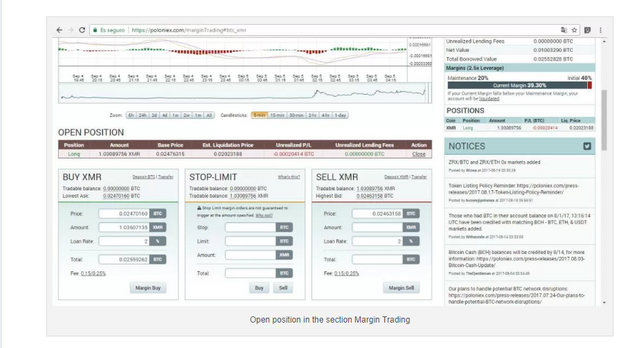

Let's go to the section by clicking on the top menu, in Margin Trading. Once here we will see something very similar to Exchange, but with a particularity: at the top of the Buy, Stop Limit and Sell boxes is a section called Open Position, where we will see our open order with a series of data that we will analyze later.

As we mentioned at the beginning, in Margin Trading we work at 2.5, that is, the total number of coins we have in this section will multiply by 2.5, which will give us the total currencies we will have available. But where do these extra currencies come from? Well, in the section Lending we can borrow or lend our funds (later we will see in depth this). Now, when creating an order from Margin Trading, the platform will automatically take a loan depending on the percentage amount that we are willing to pay for it.

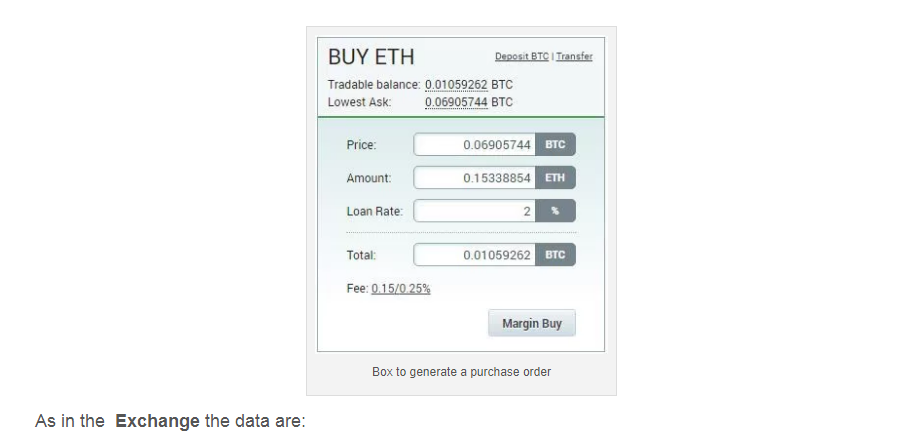

We will create a new order, in our case of purchase, and for this we will go to the purchase box " Buy " and we will fill in the following information.

Price: is the price we want to pay per unit

Amount: amount we want to buy from the cryptonnet

Loan Rate: Refers to the maximum interest rate we are willing to pay for the loan we are going to request , ie if we do not currently have a Lending Loan, the system will automatically take the lowest loan, depending on of the interest rate that we place.

Total: is the total cost of the operation.

These operations cost between 0.15 and 0.25 depending on the volume of crypto-currencies to be moved in the transaction. Before creating the order we have to remember that the minimum amount to create an order in this trading mode is 0.02 BTC per order.

To create it, we will click on Margin Buy, and the following will be automatically generated.

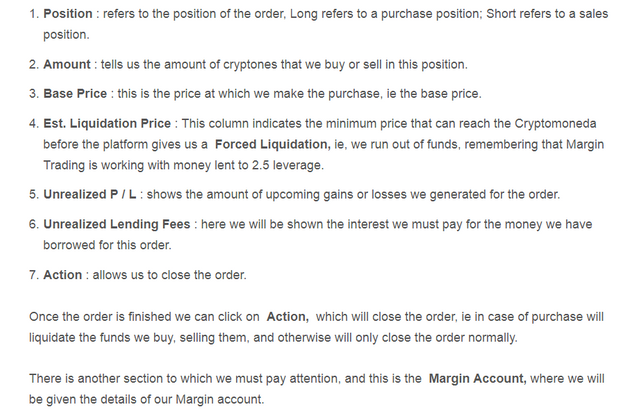

As we can see, a bar or a "position" is opened in the Open Position section, which we will study in detail.

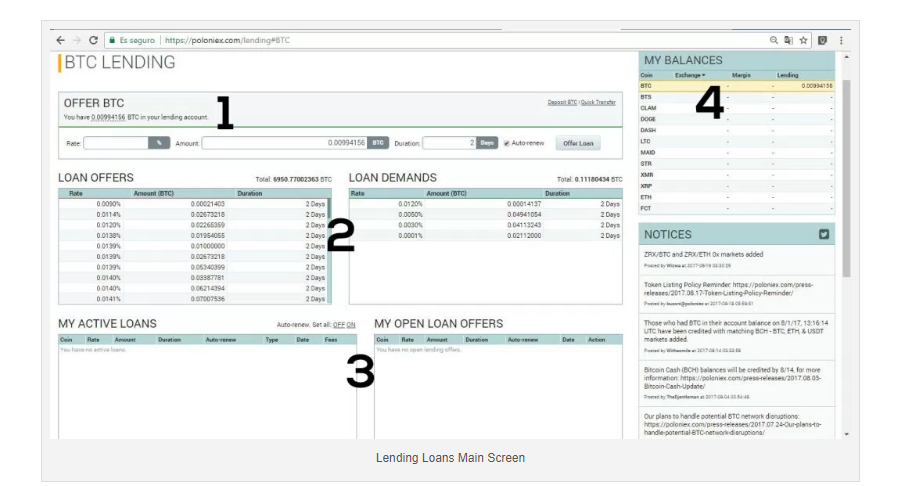

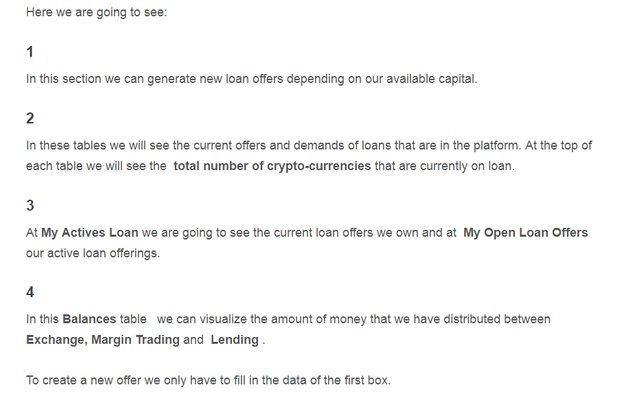

Rate : Let's place the interest rate we want to receive per day.

Amount : The loan amount is entered.

Duration : we will set the duration in days.

Auto-renew : Upon selecting this option, the loan once returned will be renewed and will automatically appear on the offer orders again.

Once the data is filled, we will click on the offer loan button that will generate the new list order, and will be reflected in the table below. It should be remembered that the minimum bid for a loan is 0.01 BTC.

The tools we saw in this advanced tutorial are far more powerful than the basic tools we saw earlier. With Stop Limit we can increase profits or reduce losses if we use it wisely, but you should also be careful because the risk of losses can be high; perhaps not so much in Lending, since the system is in charge of protecting our money liquidating the user in case of price drop , but in Margin Trading because we can make very good profits, but in his view we can find ourselves involved in difficulties if we do not do a good market study and force the platform to give us a forced liquidation that is the same to leave us without funds. So you have to be very careful when experimenting with this section.

It remains for us to take great advantage of this platform and always remember the maxim of "practice makes perfect". That's why we recommend practicing first on basic Exchange before moving on to this level.

Source: https://criptonoticias.com/tutoriales/tutorial-trading-avanzado-poloniex-stop-limit-margin-trading-lending/

Not indicating that the content you copy/paste is not your original work could be seen as plagiarism.

Some tips to share content and add value:

Repeated plagiarized posts are considered spam. Spam is discouraged by the community, and may result in action from the cheetah bot.

Creative Commons: If you are posting content under a Creative Commons license, please attribute and link according to the specific license. If you are posting content under CC0 or Public Domain please consider noting that at the end of your post.

If you are actually the original author, please do reply to let us know!

Thank You!

@hamzayousaf got you a $1.43 @minnowbooster upgoat, nice! (Image: pixabay.com)

Want a boost? Click here to read more!

thanks for sharing this is help full

This post recieved an upvote from minnowpond. If you would like to recieve upvotes from minnowpond on all your posts, simply FOLLOW @minnowpond

This post has received a 2.66 % upvote from @booster thanks to: @hamzayousaf.

!cheetah ban

Plagiarism

Okay, I have banned @hamzayousaf.