UNICAP = The Future of DeFi

#ETF #Ethereum #bitcoin #eth #uniswap #defi #gem #investing #altcoins #exchange #money #cryptocurrency #trading #investment #decentralized.

Introduction

Blockchain technology gives us the true meaning of digital currency which is completely transparent without any manipulation. In Blockchain Space, of course, we need Safe Asset such as Stable Coin for various things that support transaction processes such as trading, swapping or payments. Despite the fact that currently there are various platforms, they still have various drawbacks and weaknesses, that is why the UNICAP platform is different from other platforms in that it has more advantages and unique features, not just an ordinary platform.

Introducing UNICAP

The project was established by the corporate FINEXPO alive since 2002. the most projects of FINEXPO are luxury trade exhibitions and exhibitions held annually round the world. These events were attended by quite 200,000 visitors and 3000 companies worldwide. the corporate is additionally the owner of IQ.cash and Master.Money. The geography of those programs is basically wide and includes the subsequent countries: Thailand, Malaysia, Indonesia, Singapore, Vietnam, India, Egypt, Cyprus, China, Philippines, Kazakhstan, Russia, Ukraine, Slovakia , Latvia, etc.

About UNICAP.Finance

It is a broad Spectrum Decentralized Financial ecosystem which offers varieties of DeFi products and CETF , Crypto Exchange traded Funds. . UNICAP.Finance CETF specialized in holding and trading varieties of cryptocurrencies. The trading takes place at regular intervals , usually 24/7 with advance trading mechanisms which ensures profitability in the trading activities. UNICAP.Finance was established by FINEXPRO an existing and highly reputable Digital Currency platform .

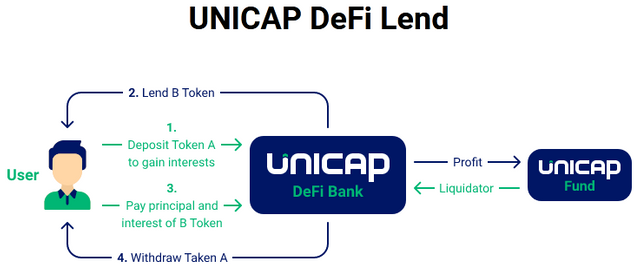

UNICAP.Finance allows users to gain access to varieties of DeFi products in an highly transparent, secured and decentralized environment. Varieties of DeFi instruments can be accessed via the platform such as Staking , Farming , lending , borrowing, liquidity investment pool and many more . The Platform grants opportunities to the users of the platform to earn several additional profits from their inactive crypto assets through creation of a Collective Crypto Investment Fund .

The Crypto Exchange Traded Funds (CETF) are being tokenized into UCAP tokens . This simply means investors Funds are backed up by Real Crypto Assets which are into trading and this funds are tokenized into UCAP tokens allocated to each investors . Literally, each holders of UCAP tokens are the owner of the Investment funds CETF.

This concepts is quite brilliant and highly sustainable . It means UCAP tokens held by each investors are collaterized and backed up by the investment funds (CETF) and in case of any liquidation , investors get compensated . The CETF concepts is quite reliable than to be trading cryptocurrencies individually. The trading system adopted in the management of CETF funds assets is quite advance with high potential of profitability. The success and profitability of the platform reflect in UCAP token , hence increasing the value .

How Does UNICAP.Finance works

UNICAP.Finance is willing to revolutionize investment system and taking to the next level . The platform offers opportunities for anyone to earn passive income . It is a platform designed around varieties of Cryptocurrencies . Users will have access to the most profitable project in the market in which they can even select the project they want to add to their custom CETF .Once they acquire the CETF which meet up with their criteria they they move on with the investment . As explaind earlier, UNICAP protocol works autonomously , which means it tokenized the CETF funds and split ownership. Users are apportioned with UCAP tokens based on the magnitude of their investment . This grant holders of UCAP tokens indrect ownership of funds (CETF) which qualified them receive their share of profit realized from the funds .

UNICAP apart from offering CETF offers large scale DeFi ecosystem where investors can invest in varieties of Financial services . investors can stake , farm , lend and borrow on the platform and earn passive income based on their various investments.

UNICAP.Finance operate a fully decentralized Investment platform which does not allows users to go through any form of complicated KYC procedure before investing their funds .Besides, users can complete control over their funds and can take any form of decision on their assets at any particular point in time.

Сollateralized

You do not buy a token but collectively invest into the fund swapping your funds to UCAP tokens. Your funds are allocated at the fund accounts and all the transactions are transparent. That is why every token UCAP will be initially 90% сollateralized with real cryptocurrency and liquidity tokens which the swap is done for.

Reliability

The project was created by the company FINEXPO existing since 2002. FINEXPO major projects are exhibitions and luxury trade shows organized annually all around the world. These events were attended by more than 200,000 visitors and 3,000 worldwide companies. The company is also the owner of IQ.cash and Master.Money. The geography of these shows is really broad and covers the following countries: Thailand, Malaysia, Indonesia, Singapore, Vietnam, India, Egypt, Cyprus, China, Philippines, Kazakhstan, Russia, Ukraine, Slovakia, Latvia, etc.

Transparency

CETF transparent. CETFs are priced continuously throughout the 24-hour-trading and therefore have price transparency.

Trading

CETF can be bought and sold at current market prices at any time during the 24 hours. Also, investors can execute the same types of trades that they can with a cryptocurrency, such as limit orders, which allow investors to specify the price points at which they are willing to trade, stop-loss orders, margin buying, hedging strategies, and there is no minimum investment requirement. Because CETF can be cheaply acquired, held, and disposed of, some investors buy and hold CETF for asset allocation purposes, while other investors trade CETF shares frequently to hedge risk or implement market timing investment strategies.

Market exposure and diversification

CETF can provide some level of diversification. CETF provides an economical way to rebalance portfolio allocations and to invest cash quickly.

The Problem

Most of the coin and token owners (investors) face:

● Absence of additional passive income.

● Inability of profile creation from several tokens/coins and its professional management.

● Time and resource loss in the process of day trading. Learning and adjusting to artificial intelligence systems.

● Commission losses.

● Constantly following the new tendencies and deciding whether to buy perspective tokens and coins or not.

In a search for profit they start to pay attention to fast-developing DeFI start-ups. However, here they notice that most of DeFi tokens don’t have the actual business but only expectations of how successful the project will be, so they can easily increase and likely easily fall in their price.

Market difference can reach 1-100-1 USD, so only founders get income from it. All projects don’t forward the actual profit to investors, so many of them get into the scam category. We have analyzed the market and created a secure, profitable and transparent project UNICAP.

Finance Fund with DeFi ecosystem for getting additional profit from your inactive crypto assets. Investors can solve these problems, start increasing the profit and getting stable income only by creating a crypto fund (collective investment). We have created secured exchange token UCAP which you are provided with instead of the investment as a part of a fund UNICAP.

You do not buy a token but collectively invest into the fund swapping your funds to UCAP tokens. Your funds are allocated at the fund accounts and all the transactions are transparent. That is why every token UCAP will be initially 90% сollateralized with real cryptocurrency and liquidity tokens which the swap is done for. 10% will be reserved by the company management for control, development, listings at the leading exchanges and project advertisement. The profit of the DeFi ecosystem operation will be forwarded to the fund additionally which is going to increase token cost and cover the initial expenses on fund management as well as market fund cost increase.

Token swap to your funds is planned as multi-leveled (min 90 levels). The price will increase on $0.1 every next level (300,000 – 1,000,000 tokens)! After Pre Public Swap Levels and listing, tokens will swap/sale at the price set by the exchange, but no less than the current level. The starting price $1 will increase up to more $20 by the end of allocation of all tokens which will bring quite a profit to the first fund investors.

The opportunity to swap UCAP tokens to the fund “Buy Back” will be available on further levels (after listing) or you can use the token as a financial instrument of a part of all funds for pools or exchange trading. Swap “Buy Back” UCAP – all tokens to be returned to the fund will be frozen and swap/sale to cryptocurrency in the future after level 90! Swap “Buy Back” 5% OFF commission to fund. Min “Buy Back” swap 10,000 USDT. Swap Price UCAP = Net Worth / Token Circulation

Tokens will be listed on the leading exchanges (Bittrex, OKEX, Huobi, Binance, FTX, BitHumb, UpBit, BitFinex and more) after Pre Public Swap period. Liquidity pools will be created at all leading DeFi platforms.

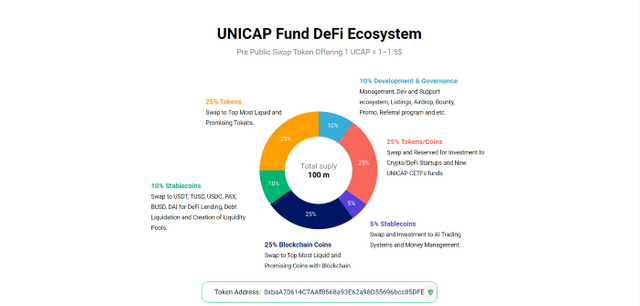

UCAP Supply Allocation 10% / 90%

● 10%: Development & Governance

● 90%: UNICAP project

UNICAP fund Supply Allocation:

● 5% Stablecoins.

Investment AI Trading Systems and Money Management USDT, TUSD, USDC, PAX, BUSD, DAI. Allocation of funds in a form of stable coin for artificial intelligence system trading. Short-term trading – day trading. Futures, options and synthetic instruments trading.

● 25% Reserved for Investment to Crypto/DeFi Startups and new UNICAP CETFs funds.

Promising startup token/coin swap to UCAP token for project development, partnership listing and capitalization multiplication for further profit and fund capitalization increase. It is planned that UCAP token owners will vote for investing in startups.

● 10% Stablecoins.

USDT, TUSD, USDC, PAX, BUSD, DAI for DeFi lending, debt liquidation and creation of liquidity pools.

● 25% Blockchain Coins.

Top most liquid and promising coins with blockchain. Profile management. Fund rotation for liquidity and capitalization increase by swapping inactive or decreasing to more promising in terms of fund policy.

● 25% Tokens (Any Platform).

Top most liquid and promising tokens. Profile management. Fund rotation for liquidity and capitalization increase by swapping inactive or decreasing to more promising in terms of fund policy.

UNICAP Ecosystem

Token Specifications and Sale Allocation

● Token Ticker: UCAP

● Token Type: ERC-20

● Blockchain: Ethereum

● Legal Classification: Utility Token

● Total Supply (No. of Tokens): 100,000,000

● Private Swap: 250,000 UCAP (0.20%) at USD 0.8 per UCAP

● Pre Public Swap Level 1: 300,000 UCAP (0.30%) at USD 0.8 – 1 per UCAP

● Pre Public Swap Level 2: 500,000 UCAP (0.50%) at USD 0.9 – 1.1 per UCAP

● Pre Public Swap Level 3: 500,000 UCAP (0.50%) at USD 1 – 1.2 per UCAP

● Sale Level 4: 500,000 UCAP (1%) at USD 1.1 – 1.3 per UCAP

● Sale Level 5: 500,000 UCAP (1%) at USD 1.2 – 1.4 per UCAP

● Sale Level 6: 1,000,000 UCAP (1%) at USD 1.3 – 1.5 per UCAP

● Sale Level 7-100: 1,000,000 UCAP (1%) each level at USD 1.4 – 20 per UCAP

Roadmap

Roadmap

Q3 2020

Idea Generation. CETF & DeFi product research. Brainstorming. Team forming, Creation of UNICAP.finance

Q4 2020

Site development. Opening of Investor Personal Account (14 languages), Deployment of Smart contract and mining tokens UCAP.

Pre public swap tokens offering. Unicap Global community development. Promo/Airdrop/Bounty.

Q1 2021

DeFi Bank product design and prototype. Swap tokens. Listing token on KuCoin/Bittrex/FTX/Exmo/Lbank. AirDrop for DeFi community. New Funds Develop and Launch. 1st Global community survey.

Q2 2021

UNICAP DeFi Bank v1 Launch, New Funds Development and launch. Swap of tokens. Listing OKEX, HUOBI, BINACE. Acceptance of funding proposals for Crypto/DeFi startups.

Q3 2021

UNICAP DeFi Bank v2 (new protocols) Launch. New Funds Develop and Launch. Listings New Funds.

Q4 2021

UNICAP New Startups Launch. Listings Startups on OKEX/HUOBI/BINANCE.

To get clearer information, please visit the link below:

● Website: https://ucap.finance/

● UNICAP_WP: https://ucap.finance/docs/ucap_wp_v1.pdf

● Telegram: https://t.me/unicap_finance

● Facebook: https://facebook.com/tradersfair

● Twitter: https://twitter.com/unicapfinance

● Linkedin: https://www.linkedin.com/showcase/unicapfinance/

● Discord: https://discord.gg/BJBA4Yb

● ANN: https://bitcointalk.org/index.php?topic=5278941.msg55283491

AUTHOR

Bitcoin talk Username: Nayla cute

Bitcoin talk profile link: https://bitcointalk.org/index.php?action=profile;u=2063413

Telegram Username: @naylacute

ERC-20 Address: 0xff7c46B7aE089EA9957262E58714361ae230964e