COTI Universal Payment System (UPS)

Abstract

Online payment platforms have yet to catch up with the times and are restrained by limited functionality and the lack of viable cryptocurrency solutions. PayPal and various other platforms are practical, but do not provide a full feature set designed to address digital payment requirements, inclusive of low FX costs and instant settlements.

The COTI Universal Payment System (UPS) reconciles the functionality of PayPal and other online payment gateways with that of the cryptocurrency world. COTI’s UPS provides a comprehensive payment solution that combines all existing support systems of traditional payment processors with the added value of digital assets.

This includes:

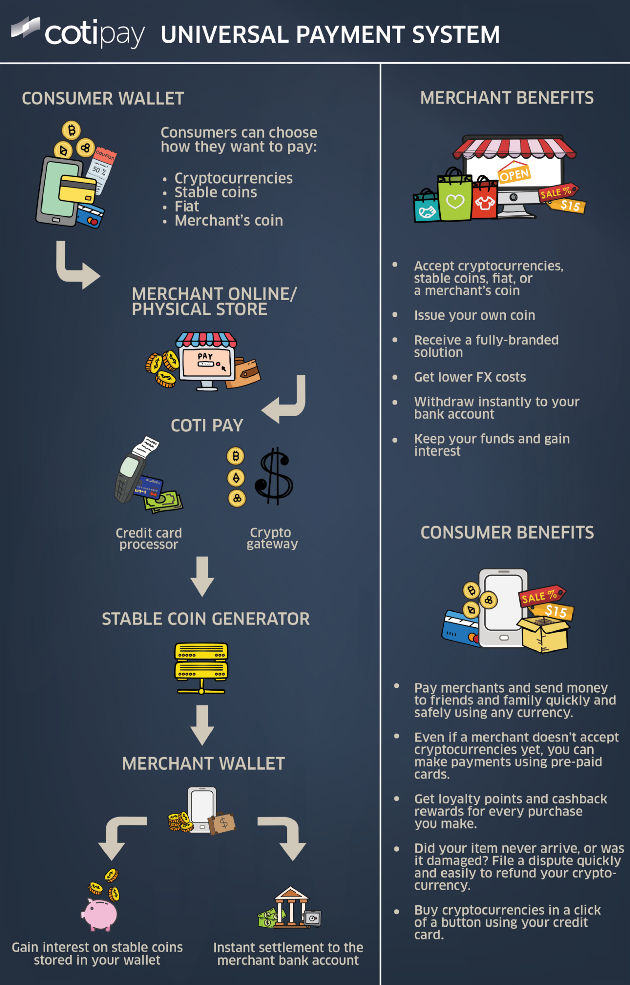

- Instant payments for merchants: funds are credited to the merchant immediately and are backed by stable coins, which reduces friction and high costs for all parties by eliminating price volatility and FX costs.

- Universal processing of fiat and cryptocurrency: COTI’s UPS enables buyers to choose from many popular cryptocurrencies like Bitcoin and Ethereum, as well as fiat.

- COTI-X: allows consumers and businesses to buy, sell and swap crypto to and from fiat in the COTI Pay app.

- Low fees: the COTI UPS eliminates the need for third party processors, which significantly reduces costs.

- Buyer-seller protections: COTI’s Universal Payment Solution covers physical and virtual purchases, as well as crypto and fiat payments.

- COTI Interest: allows merchants to earn interest on stable coin account balances within the COTI Pay app.

- Prepaid cards: virtual debit cards can be used in-store (e.g., NFC Tap and Pay, or QR code payments) and online for merchants not yet accepting crypto.

- COTI Pay Plugins: allow the processing of crypto or fiat payments on any online store (e.g., Shopify, WooCommerce, Magento).

- COTI SDK: allows developers to add retail payment features to any application.

- COTI Whitelabel: enables merchants to issue their own coin and loyalty programs on COTI Pay. Merchant coins and loyalty points will remain internal to the COTI ecosystem.

Introduction

Cryptocurrencies have experienced prolific growth as of late, although Bitcoin’s utility for everyday transactions is severely constrained. While Bitcoin payment gateways are useful for simple peer-to-peer payments, business to consumer (B2C) transactions remain challenging, and the most apparent of these challenges lies in cryptocurrency volatility. This has constricted adoption amongst merchants, as the value of a payment may be worth significantly less just seconds later.

Furthermore, the wide variety of cryptocurrencies has created a network of divergent protocols, which has limited consumer adoption. Transactions are also irreversible, making all sales final with no recourse for buyers or sellers. Finally, regulation is nearly impossible because anonymity is inherent to digital currency protocols.

Shortcomings from both the traditional online payment world and the crypto sphere exacerbate one another, resulting in a vacuum of customary buyer and seller services. COTI’s Universal Payment System can fill this vacuum by introducing trust into the crypto world through buyer-seller protection and efficient crypto-to-fiat and fiat-to-crypto transactions.

For buyers, COTI’s Universal Payment System provides a built-in buyer-seller protection system, which is a first of its kind, and is designed to eliminate transaction risks for buyers transacting in crypto and fiat. Furthermore, by accepting a large number of cryptocurrencies, COTI’s Universal Payment System makes transactions simple and streamlined for buyers and removes the need for multiple wallets. What’s more, the platform enables anyone to pay with crypto, even when merchants don’t yet support crypto transactions.

COTI’s Universal Payment System solves the volatility problem once and for all for both buyers and sellers. By immediately switching crypto payments into stable coins or fiat currency using COTI-X, COTI’s internal settlement layer, merchants are protected from market volatility and enjoy the added benefit of instant settlements.

By reconciling the best features of traditional online payment platforms with the best of cryptocurrencies, the COTI Universal Payment System will be poised to radically change online payments. The platform COTI is creating can maintain trust for all parties by reducing potential risks for both buyers and sellers, while substantially reducing fees due to the platform’s peer-to-peer nature.

We’re Making Cryptocurrency Functional

Digital payment instruments in the United States and around the world consist of complicated financial settlement processes, costing merchants up to 4 percent in processing fees for purchases and involving up to twelve different entities (each a distinct point of failure). Meanwhile, losses from retail fraud in the US alone are continuing to reach all-time highs.

As it stands, the software that moves the vast majority of money around the world today still utilizes legacy systems created during the late 1970s. In the absence of compelling alternatives, consumers have been confined to the status quo. Since the creation of Bitcoin in 2008, blockchain communities have attempted to make cryptocurrencies a useful complement to traditional payment instruments like credit cards, debit cards, and cash. However, fundamental user-experience challenges, such as unintuitive QR code interfaces, complex address strings, new security protocols, and network capacity issues have hindered commercial adoption.

Various scaling solutions, such as multi-layer protocols and Proof of Stake (PoS) consensus algorithms, show considerable promise for improving the speed and utility of blockchain transactions, but create issues of complexity and incompatibility for merchants. A variety of mobile wallets are promoting cryptocurrency payment solutions but unfortunately rely on existing legacy infrastructures.

These wallets utilize virtual Visa and Mastercard debit cards with high fees and require bank accounts, physical cards and multiple tiers of centralization. Digital payments on these platforms are subject to low transaction limits (in some cases, less than $100), as well as Apple’s restrictions for NFC access on iOS devices. Justifiably, these systems have extremely low consumer adoption due to high friction compared to typical payment cards.

It is critical that cryptocurrencies become widely accepted by merchants, as is the case with traditional payments, in order to gain mass adoption. Many companies have recently developed wallets and apps that enable retail blockchain payments, but they are universally dependent on existing payment networks. The promise of cryptocurrency has not been realized due to the need for credit cards, linked accounts, and centralized payment infrastructures to facilitate purchases.

The solution to blockchain payments is to create a cross-network solution that solves merchant and consumer needs, instead of building cryptocurrency acceptance over existing networks.

COTI’s Universal Payment System represents a milestone in cryptocurrency utility for both merchants and consumers. It is the first network specifically designed to support everyday cryptocurrency payments by enabling instant, low fee transactions in-store and online.

Using a simple SDK, the COTI Universal Payment System enables developers to add retail payment features to any app, streamlining cryptocurrency acceptance for merchants and eliminating volatility exposure. It also provides instant settlements backed by a stable coin (interest-based asset), which protects merchants from clearance and settlement overheads.

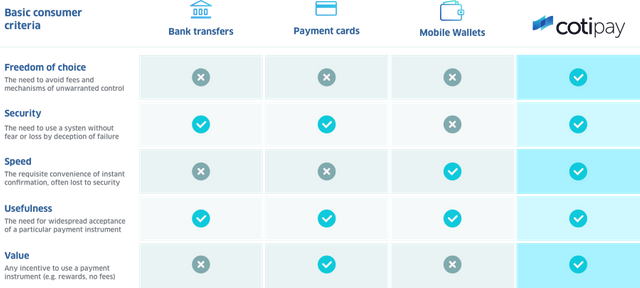

While decades of retail payments confirm the pain points of fraud and processing costs for merchants, we find that consumer needs are distinctly different. Consumers evaluate payment instruments against five basic criteria:

In order for a viable cryptocurrency/fiat payment network to achieve meaningful scale, the following is required:

- Real-time transactions

Merchants and customers should receive successful transaction confirmation within seconds. - No consumer-facing fees

Consumers will not pay a premium to use blockchain cryptocurrencies because such a cost represents negative value in their decision-making process. There should be zero fees on the consumer’s end with competitive spending incentives. - Broad acceptance

Cryptocurrencies should be usable for daily expenditures to encourage consumer adoption. Otherwise, the mindshare required to maintain “front of wallet” utility cannot be attained.

Meeting and dramatically exceeding these expectations will be challenging, but any new payment network must solve both consumer and merchant needs. We believe that COTI’s Universal Payment System satisfies all the core consumer requirements necessary to disrupt the status quo of legacy payment systems.

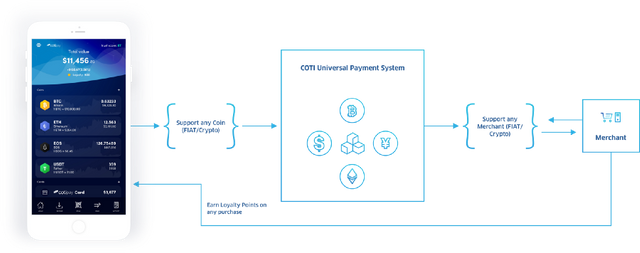

COTI’s Universal Payment System

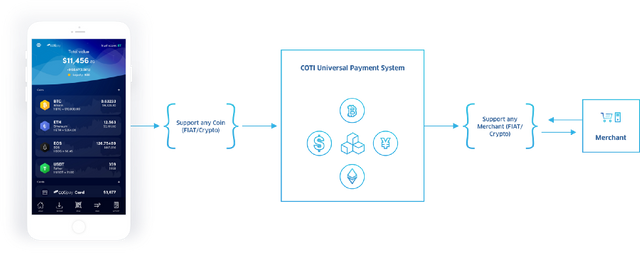

COTI’s Universal Payment System is an open network that enables instant cryptocurrency and fiat payments for both online and in-store transactions.

The COTI Universal Payment System facilitates payments from any wallet, coin and merchant across the globe. The vision for this new universal network is to become an open and seamless standard for cryptocurrency payments in online and offline environments.

COTI’s Universal Payment System enables developers to integrate retail cryptocurrency payment features within their own apps. By creating the most simple and straightforward network, COTI will facilitate widespread cryptocurrency acceptance — no longer requiring multiple payment gateways, processors, associations and financial institutions.

The COTI Universal Payment System Experience

In the COTI Universal Payment System, transactions are designed to be as simple as possible. With just a single tap and scan, the COTI Universal Payment System verifies user cryptocurrency balances against a public index rate and generates a proprietary transaction for any fiat- or crypto-based payment.

The COTI Consumer Ecosystem

- Pay with Crypto

The COTI Universal Payment System solves the deficiencies of both fiat and cryptocurrency payments by making them seamlessly interchangeable. On the one hand, the COTI Universal Payment System unlocks cryptocurrencies from the confines of digital payments and makes them readily convertible into goods and services through supported payment systems and the COTI-X exchange. On the other hand, it creates a definitive liquidity network by freeing cryptocurrency from individual holders, thus making transfers simple, safe and transparent.

With the COTI Universal Payment System, purchases with cryptocurrencies can be significantly cheaper, faster and simpler than existing solutions. In addition to the COTI native token, COTI’s UPS enables buyers to choose from many popular cryptocurrencies like Bitcoin and Ethereum.

- Buyer-Seller Protection

As a well-known service, PayPal relies heavily on is its buyer-seller protection service, although it only covers purchases of tangible goods. BitPay does not cover any purchases, which makes transactions irreversible and leaves buyers exposed to potential fraud. COTI’s Universal Payment System provides buyer protection by covering physical and virtual purchases (when applicable), as well as crypto and fiat transactions.

COTI guarantees buyer-seller protection on all eligible payments made in the COTI Universal Payment System.

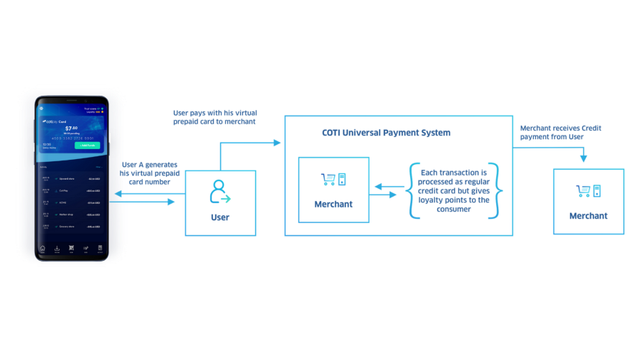

- Virtual Card

To connect the COTI Universal Payment System with other payment rails, the COTI Universal Wallet provides users with access to virtual prepaid cards linked directly to their wallets. These cards enable users to send payments from their COTI wallets when transacting with merchants who do not yet accept cryptocurrencies.

In the COTI Universal Payment System, users will be able to specify their preferred currency any time they create a virtual debit card. When a purchase is made using a card linked to a currency that does not match the transaction currency, COTI-X will automatically convert the currency amount from the prepaid card to the transaction currency, thereby mitigating third-party exchange fees. To this effect, using COTI’s universal prepaid cards will be the simplest and fastest way to cash-out cryptocurrencies.

The COTI virtual debit card can be used to make payments online and anywhere where Visa or Mastercard are accepted offline.

The COTI Universal Payment System’s prepaid cards are issued instantly, so there is no need to wait for a plastic card to arrive.

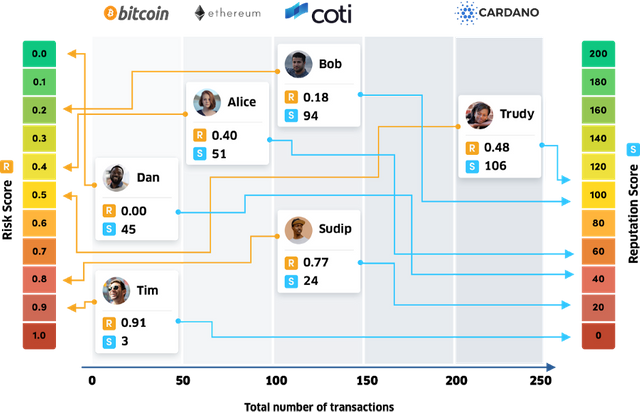

- View the TrustScore of any Merchant

By fully migrating our TrustScore and Ranking mechanism and applying it to any infrastructure, we will empower any network to address the issue of trust between unknown parties. COTI’s ranking mechanism can track the behavioral data of network entities, which is crucial for any service running on any platform, infrastructure or chain.

In the framework of COTI’s Global Trust System (GTS), malicious parties are actively identified and addressed, while reputable behavior is tracked and incentivized. Moreover, the engine is customized per use case, as each industry faces varying levels of risk. By using the reputational scoring system, any infrastructure and chain will be able to leverage efficient behavioral tracking — a data layer that is chiefly missing in the crypto world — in order to maintain trust scores and risk indicators for all consumers and merchants.

The Trust Scoring Algorithm considers the following parameters when determining Trust Scores:

- Account balance — the aggregate value of transactions for each participant over a specific period of time.

- Dispute occurrence — the amount of transaction disputes that the participant has been involved in, if any.

- Disputes won — the amount of disputes that were resolved in favor of the participant.

- Disputes lost — the amount of disputes which were resolved in favor of the counterparty.

- User ratings — the ratings that other transacting parties have assigned to the participant, calibrated according to the Trust Scores of the parties providing the ratings.

- Buy Crypto and Make Swaps Between Crypto/Fiat Using the COTI Wallet

The COTI Universal Payment System supports a variety of currencies, making it an easy-to-use payment solution. COTI’s UPS is backed by the COTI-X currency exchange, which provides network participants with continuous access to liquid markets in a range of digital and fiat currency pairs. Any user who wishes to buy crypto or make swaps between crypto assets will be able to do so instantly using the COTI wallet.

The COTI Universal Payment System abstracts the complexity of currency exchanges from end users. The exchange functions as a foundational layer of the COTI Universal Wallet’s applications and services, operating in the background to ensure that participants’ currency exchange requests are fulfilled immediately. Rather than presenting an orderbook and bid/ask prices on every order, the user is presented with a single fixed rate, inclusive of any fees.

COTI UPS users can make instant and secure transfers to users holding COTI Universal Wallets. Transfers will be instant with low-to-zero fees (depending on the user’s Trust Scores and selected currency). COTI Universal Wallet users will be able to use their wallets as de facto bank accounts for the purpose of holding funds in both digital and fiat currencies. At the start, funds can be deposited into COTI Universal Wallets using cards, bank wires, and several leading digital currencies.

- Loyalty Plans

The COTI Universal Payment System offers unique, cross-platform consumer incentive plans. Consumers earn loyalty points on all their purchases, regardless of their payment method (fiat/crypto). To this effect, COTI’s Universal Payment System is the world’s first reward program that provides crypto payouts for any token. The loyalty plans can be based on COTI’s native coin, stable coin, or any merchant-dedicated token.

- AML and KYC Procedures

The COTI Universal Payment System is adopting appropriate AML and KYC procedures to ensure that its network cannot be used to facilitate money laundering or other illicit activity. COTI’s Universal Payment System is inherently not conducive to money laundering, as any COTI Universal Wallet holder must undergo onboarding procedures.

Notwithstanding its commitment to AML and KYC, the COTI Universal Wallet is similarly committed to protecting user privacy and has appropriate consumer data protection mechanisms in place. The added value of using the COTI Universal Wallet is that consumers only need to go through the KYC process once and have access to any merchant and any cryptocurrency through the COTI wallet and ecosystem.

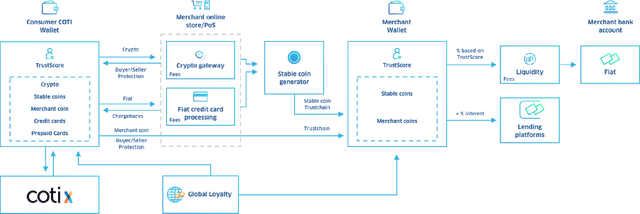

The COTI Merchant Ecosystem

- Crypto Payments On Any Website

COTI strives to expand its range of services with merchant crypto processing solutions. This will enable merchants to receive crypto payments on their website without needing to support crypto transactions on their own, nor to be subjected to volatility risks. This is because COTI enables instant settlements denominated in the merchant’s stable coin, or any other currency of choice. This solution encompasses a ‘Pay with crypto’ button that can be easily integrated into merchant websites.

COTI’s Universal Payment System offers a simple working mechanism, as it integrates with a merchant’s checkout flow and can be added as a payment option in the shopping portal. Any cryptocurrency payment sent by a customer gets credited to the merchant’s wallet account. The merchant benefits by gaining access to a global customer base and a hassle-free mechanism to receive borderless digital currency payments. Both the customers and merchants benefit from low crypto transactional costs, compared to high fees levied by credit card processors. Using such virtual token payments also eliminates high foreign exchange rates.

The COTI Universal Payment System supports payments in Bitcoin, Bitcoin Cash, Ethereum and all other popular cryptocurrencies. It offers easy to use tools for merchants to set up their accounts and begin accepting digital currency payments. COTI’s UPS can be easily integrated with leading e-commerce platforms like WooCommerce (WordPress), Shopify, Magento and more.

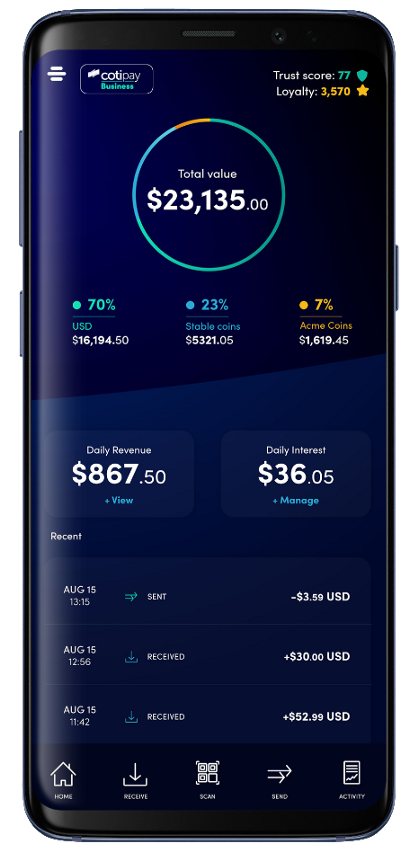

After completing account setup, merchants are granted access to the COTI Universal Payment System dashboard, which enables them to view their cryptocurrency balances, payments, checkouts, and other necessary details.

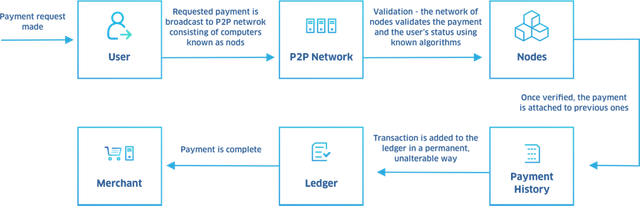

All payments sent through the COTI Universal Payment System are on-chain payments. Transactions are recorded in real-time on the respective cryptocurrency blockchain and rely on blockchain mechanisms for validation, authentication and fraud elimination.

- Traditional Payment Method Support

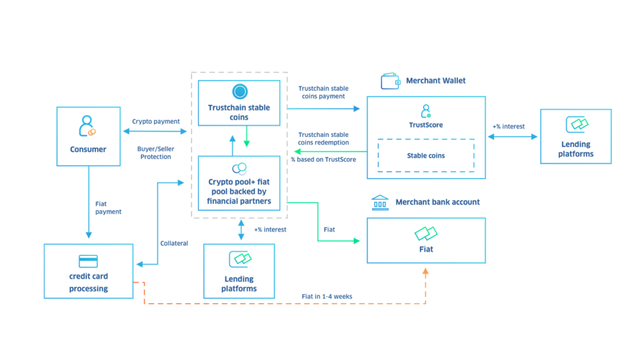

As part of our Universal Payment Solution, COTI removes the barriers of adoption for any merchant by offering both crypto and traditional payment processing. The COTI Universal Payment System also utilizes a payment processing gateway to accept fiat/credit from consumers, while providing the added value of instant settlements utilizing the COTI stable coin, or any other token offered on the platform.

This will assist COTI with generating more adoption by providing the necessary features expected from well-known payment platforms. In subsequent stages, the COTI UPS will enable credit issuers, like banks and e-commerce companies, to issue their own token in the COTI network and benefit from immediate access to network users.

- Buyer-Seller Protections

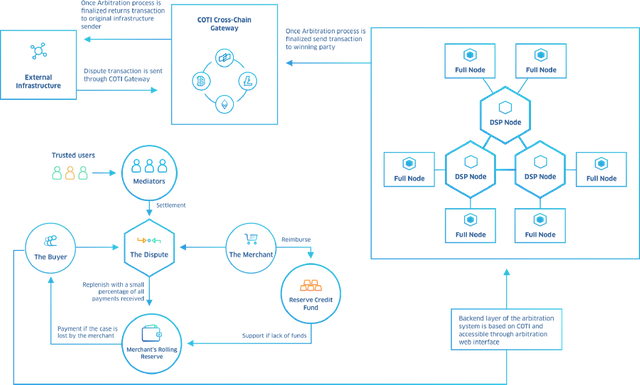

Traditional payment solutions like PayPal have a lengthy dispute resolution process that can take up to several months to be settled. COTI’s unique dispute resolution system consists of a decentralized collective of highly trusted network participants who vote on disputes. This allows the network to offer decentralized human-input services to participants in cases of fraud, error and counterparty abuse. The arbitration service creates a rolling reserve for each merchant to cover possible claims, as well as a system-wide Reserve Credit Fund (RCF) to guarantee it.

- Trust-Based Rolling Reserve

The COTI Universal Payment System employs a performance-based analytics algorithm to evaluate sellers. High merchant performance drives down hold periods, which encourages sellers to perform better over time while increasing buyer confidence. In a best-case scenario, top sellers will see their hold times virtually eliminated and can obtain their funds near instantaneously.

The rolling reserve is a share of a merchant’s transactions that is temporarily set aside to cover potential business risks, such as when a merchant loses a mediated dispute and must compensate the consumer. The arbitration service creates a rolling reserve for each merchant to cover possible claims and a system-wide Reserve Credit Fund (RCF) to guarantee it.

Compared to traditional payment systems, the required size of a merchant’s rolling reserve is calculated based on the merchant’s Trust Score. The rolling reserve is used when a merchant has lost a mediated dispute and is required to compensate the consumer. Merchants that do not meet the rolling reserve requirements will forfeit their ability to sell goods and services in the COTI network.

- Interest on Accrued Balances

Many crypto investors store their digital assets on exchanges or in cold storage for long-term safe keeping. However, this strategy doesn’t contribute to increasing wealth and investment holdings. To this end, merchant accounts are supplemented with interest accounts that enable them to earn interest on their accrued balances.

In the COTI Universal Payment System, merchant accounts can earn interest on accrued balances, which is an easy way to earn supplemental revenues from their balances, instead of being tied to other platforms like PayPal and BitPay.

- Instant Settlements

In COTI’s Universal Payment System, the entire lifecycle of a transaction — authorization, clearing, and settlement — occurs immediately. With digital assets, the cryptographic keys and digital imprint provide trust and security without the need for time-consuming steps.

Funds are credited to the merchant immediately and are backed by stable coins, which reduces friction and high costs for all parties. The entire process is made up of a few simple steps that require a few seconds to complete instead of three days. Instant settlements in COTI are backed by a stable coin generator that ensures the transaction from the merchant’s end and removes all settlement risks and delays.

- CRM

The COTI Universal Payment System provides access to a dashboard that supplies detailed data and reporting functionality on fiat and crypto transactions. Merchants can choose which currencies they wish to accept, as well as their preferred settlement currency. They can also select their preferred settlement time and whether they wish to hold their balance and earn interest, or settle instantly.

The dashboard also provides merchants with wallet-like functionality that enables them to make payments to COTI Universal Wallet holders, to other COTI merchants and to access the COTI-X exchange.

Merchants will have access to a CRM where they can view instant settlement limits and prices and choose the amount they wish to withdraw.

COTI MainNet Ecosystem

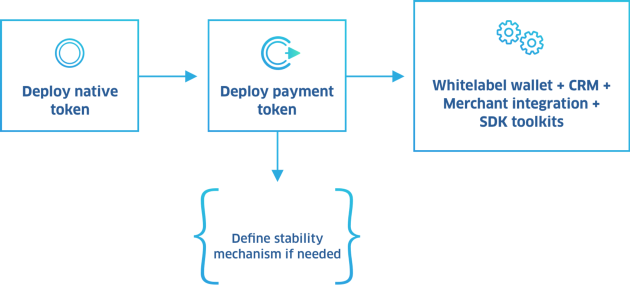

Apart from the COTI MainNet being the catalyst for the COTI Universal Payment System, it will also support third party usage and streamline integrations via:

Whitelabeled and Dedicated Merchant Tokens

COTI’s Universal Payment System supplies a fully customizable and modular solution that supports developers in creating white-labeled payment networks and tokens for specific use cases.

- Instant Settlement Issuers and Marketplaces

As the COTI Universal Payment System expands to support more and more consumers and merchants, a marketplace for instant settlements driven by token and stable coin issuers can be created with a variety of services, inclusive of:

- Credit or factoring products provided to merchants to solve cash flow problems.

- Earning of interest on account balances and crypto transactions

- Managed balance accounts

- Lending platform issuers

- Bank-supported stable coins that can be redeemed to the merchant’s bank account immediately

- Tokens backed by local merchant currencies that can be cashed out instantly

- Existing stable coins with real use cases

- Insurance products for high risk merchants. Acquirers typically do not send funds to merchants due to high CHB ratio, fraud to sale, fraudulent activity, etc.

- Stable coin marketplace that provides merchants with the option to select their preferred settlement currency. Coin issuers, or potential issuers like banks, will also have the opportunity to add their stable coin as a settlement currency.

In the future, we may have geolocalized stable coins to reduce merchant conversion costs. These tokens can be issued on the COTI MainNet for streamlined deployment, price stability, high scalability, and low fees. - Remittances with instant transfers and settlements with minimal fees.

The image is only for illustration purposes and does not represent commercial agreements

Summary

The COTI Universal Payment System provides a gateway to support payments for goods and services and lowers the barriers to entry for merchants aiming to upgrade their payment infrastructure while eliminating intermediary costs. Utilizing COTI’s Universal Payment System as a payment method in online and offline environments opens up new business opportunities, while optimizing traditional payment processes, particularly where instant settlements are concerned.

The COTI Universal Payment System is backed by a network of tools and services that support both crypto and fiat payments and can be seamlessly integrated into any merchant interface. COTI creates a feasible link between merchant economic activity facilitated by fiat and crypto payments and COTI’s UPS as a medium for effectuating all transaction activity.

COTI Resources

Website: https://coti.io

Telegram group: https://t.me/COTInetwork

Github: https://github.com/coti-io

Technical whitepaper: https://coti.io/files/COTI-technical-whitepaper.pdf

I've had many problems with SEPA and SWIFT money transfers, so I decided that I no longer want to work with traditional banks, whose support team cannot even respond and help me in time, because there are a bunch of other personal accounts and so on. Right now I'm working with Silverbird getting the best online business account services. This financial company specializes only in international trade which is important for my business.

Hi everyone, I'm in the process of selecting a payment gateway for my business and I'm finding it a bit overwhelming. Could anyone share their experiences or advice on what key factors to consider? For example, how important is transaction fee structure compared to ease of integration? Also, what are the best practices for ensuring the security of payment transactions? Any recommendations for reliable payment gateways would be greatly appreciated!

Selecting a payment gateway can indeed be challenging with so many options available. It’s crucial to balance transaction fees with the ease of integration; high fees can erode your margins, while a complicated integration process may lead to delays and extra costs. Security should be a top priority as well, so look for gateways that adhere to PCI DSS standards and offer robust fraud protection measures.

For modern payment solutions, you might want to check out Payneteasy(https://payneteasy.com/). Their system offers a comprehensive payment solution with a unified interface for managing multiple providers, enhancing security through their Leads Protection System, and providing flexibility with their global payment platform.